Achmea Hypotheekbank N.V. annual report 2011

Achmea Hypotheekbank N.V. annual report 2011

Achmea Hypotheekbank N.V. annual report 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

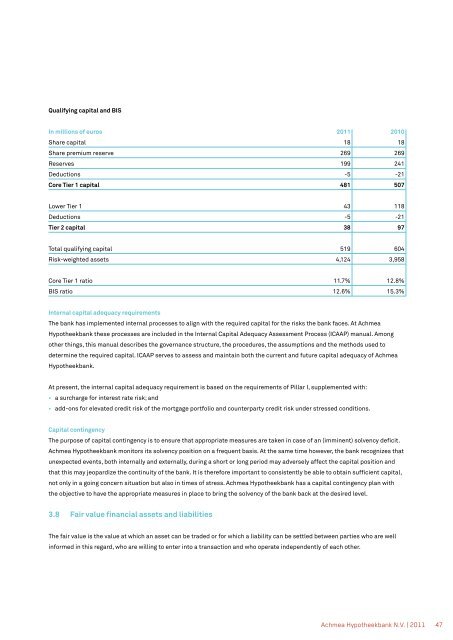

Qualifying capital and BIS<br />

In millions of euros <strong>2011</strong> 2010<br />

Share capital 18 18<br />

Share premium reserve 269 269<br />

Reserves 199 241<br />

Deductions -5 -21<br />

Core Tier 1 capital 481 507<br />

Lower Tier 1 43 118<br />

Deductions -5 -21<br />

Tier 2 capital 38 97<br />

Total qualifying capital 519 604<br />

Risk-weighted assets 4,124 3,958<br />

Core Tier 1 ratio 11.7% 12.8%<br />

BIS ratio 12.6% 15.3%<br />

Internal capital adequacy requirements<br />

The bank has implemented internal processes to align with the required capital for the risks the bank faces. At <strong>Achmea</strong><br />

<strong>Hypotheekbank</strong> these processes are included in the Internal Capital Adequacy Assessment Process (ICAAP) manual. Among<br />

other things, this manual describes the governance structure, the procedures, the assumptions and the methods used to<br />

determine the required capital. ICAAP serves to assess and maintain both the current and future capital adequacy of <strong>Achmea</strong><br />

<strong>Hypotheekbank</strong>.<br />

At present, the internal capital adequacy requirement is based on the requirements of Pillar I, supplemented with:<br />

• a surcharge for interest rate risk; and<br />

• add-ons for elevated credit risk of the mortgage portfolio and counterparty credit risk under stressed conditions.<br />

Capital contingency<br />

The purpose of capital contingency is to ensure that appropriate measures are taken in case of an (imminent) solvency deficit.<br />

<strong>Achmea</strong> <strong>Hypotheekbank</strong> monitors its solvency position on a frequent basis. At the same time however, the bank recognizes that<br />

unexpected events, both internally and externally, during a short or long period may adversely affect the capital position and<br />

that this may jeopardize the continuity of the bank. It is therefore important to consistently be able to obtain sufficient capital,<br />

not only in a going concern situation but also in times of stress. <strong>Achmea</strong> <strong>Hypotheekbank</strong> has a capital contingency plan with<br />

the objective to have the appropriate measures in place to bring the solvency of the bank back at the desired level.<br />

3.8 Fair value financial assets and liabilities<br />

The fair value is the value at which an asset can be traded or for which a liability can be settled between parties who are well<br />

informed in this regard, who are willing to enter into a transaction and who operate independently of each other.<br />

<strong>Achmea</strong> <strong>Hypotheekbank</strong> N.V. | <strong>2011</strong><br />

47