Achmea Hypotheekbank N.V. annual report 2011

Achmea Hypotheekbank N.V. annual report 2011

Achmea Hypotheekbank N.V. annual report 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

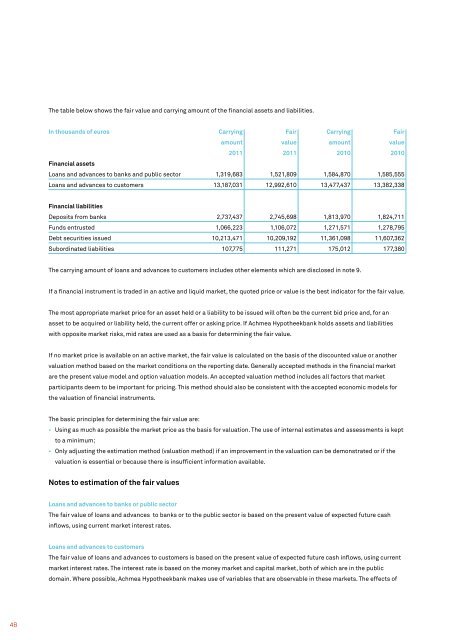

The table below shows the fair value and carrying amount of the financial assets and liabilities.<br />

In thousands of euros Carrying Fair Carrying Fair<br />

amount value amount value<br />

<strong>2011</strong> <strong>2011</strong> 2010 2010<br />

Financial assets<br />

Loans and advances to banks and public sector 1,319,683 1,521,809 1,584,870 1,585,555<br />

Loans and advances to customers 13,187,031 12,992,610 13,477,437 13,382,338<br />

Financial liabilities<br />

Deposits from banks 2,737,437 2,745,698 1,813,970 1,824,711<br />

Funds entrusted 1,066,223 1,106,072 1,271,571 1,278,795<br />

Debt securities issued 10,213,471 10,209,192 11,361,098 11,607,362<br />

Subordinated liabilities 107,775 111,271 175,012 177,380<br />

The carrying amount of loans and advances to customers includes other elements which are disclosed in note 9.<br />

If a financial instrument is traded in an active and liquid market, the quoted price or value is the best indicator for the fair value.<br />

The most appropriate market price for an asset held or a liability to be issued will often be the current bid price and, for an<br />

asset to be acquired or liability held, the current offer or asking price. If <strong>Achmea</strong> <strong>Hypotheekbank</strong> holds assets and liabilities<br />

with opposite market risks, mid rates are used as a basis for determining the fair value.<br />

If no market price is available on an active market, the fair value is calculated on the basis of the discounted value or another<br />

valuation method based on the market conditions on the <strong>report</strong>ing date. Generally accepted methods in the financial market<br />

are the present value model and option valuation models. An accepted valuation method includes all factors that market<br />

participants deem to be important for pricing. This method should also be consistent with the accepted economic models for<br />

the valuation of financial instruments.<br />

The basic principles for determining the fair value are:<br />

• Using as much as possible the market price as the basis for valuation. The use of internal estimates and assessments is kept<br />

to a minimum;<br />

• Only adjusting the estimation method (valuation method) if an improvement in the valuation can be demonstrated or if the<br />

valuation is essential or because there is insufficient information available.<br />

Notes to estimation of the fair values<br />

Loans and advances to banks or public sector<br />

The fair value of loans and advances to banks or to the public sector is based on the present value of expected future cash<br />

inflows, using current market interest rates.<br />

Loans and advances to customers<br />

The fair value of loans and advances to customers is based on the present value of expected future cash inflows, using current<br />

market interest rates. The interest rate is based on the money market and capital market, both of which are in the public<br />

domain. Where possible, <strong>Achmea</strong> <strong>Hypotheekbank</strong> makes use of variables that are observable in these markets. The effects of<br />

48