Achmea Hypotheekbank N.V. annual report 2011

Achmea Hypotheekbank N.V. annual report 2011

Achmea Hypotheekbank N.V. annual report 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

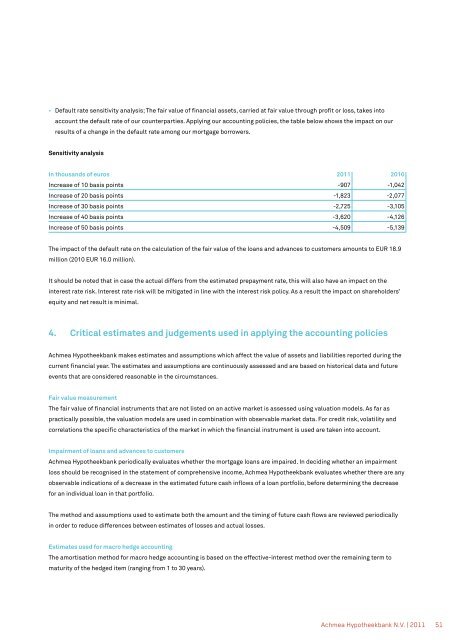

• Default rate sensitivity analysis; The fair value of financial assets, carried at fair value through profit or loss, takes into<br />

account the default rate of our counterparties. Applying our accounting policies, the table below shows the impact on our<br />

results of a change in the default rate among our mortgage borrowers.<br />

Sensitivity analysis<br />

In thousands of euros <strong>2011</strong> 2010<br />

Increase of 10 basis points -907 -1,042<br />

Increase of 20 basis points -1,823 -2,077<br />

Increase of 30 basis points -2,725 -3,105<br />

Increase of 40 basis points -3,620 -4,126<br />

Increase of 50 basis points -4,509 -5,139<br />

The impact of the default rate on the calculation of the fair value of the loans and advances to customers amounts to EUR 18.9<br />

million (2010 EUR 16.0 million).<br />

It should be noted that in case the actual differs from the estimated prepayment rate, this will also have an impact on the<br />

interest rate risk. Interest rate risk will be mitigated in line with the interest risk policy. As a result the impact on shareholders’<br />

equity and net result is minimal.<br />

4. Critical estimates and judgements used in applying the accounting policies<br />

<strong>Achmea</strong> <strong>Hypotheekbank</strong> makes estimates and assumptions which affect the value of assets and liabilities <strong>report</strong>ed during the<br />

current financial year. The estimates and assumptions are continuously assessed and are based on historical data and future<br />

events that are considered reasonable in the circumstances.<br />

Fair value measurement<br />

The fair value of financial instruments that are not listed on an active market is assessed using valuation models. As far as<br />

practically possible, the valuation models are used in combination with observable market data. For credit risk, volatility and<br />

correlations the specific characteristics of the market in which the financial instrument is used are taken into account.<br />

Impairment of loans and advances to customers<br />

<strong>Achmea</strong> <strong>Hypotheekbank</strong> periodically evaluates whether the mortgage loans are impaired. In deciding whether an impairment<br />

loss should be recognised in the statement of comprehensive income, <strong>Achmea</strong> <strong>Hypotheekbank</strong> evaluates whether there are any<br />

observable indications of a decrease in the estimated future cash inflows of a loan portfolio, before determining the decrease<br />

for an individual loan in that portfolio.<br />

The method and assumptions used to estimate both the amount and the timing of future cash flows are reviewed periodically<br />

in order to reduce differences between estimates of losses and actual losses.<br />

Estimates used for macro hedge accounting<br />

The amortisation method for macro hedge accounting is based on the effective-interest method over the remaining term to<br />

maturity of the hedged item (ranging from 1 to 30 years).<br />

<strong>Achmea</strong> <strong>Hypotheekbank</strong> N.V. | <strong>2011</strong><br />

51