Islamic Investor: Islamic Investor: - Islamic Finance News

Islamic Investor: Islamic Investor: - Islamic Finance News

Islamic Investor: Islamic Investor: - Islamic Finance News

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FEATURE<br />

Source: Eurekahedge<br />

conducive environment for growth in the industry. In the last two<br />

years Malaysia has further strengthened its place by issuing<br />

more licenses to foreign banks; a policy that is set to continue.<br />

As such, the country looks set to maintain its position as the<br />

leading <strong>Islamic</strong> fund center in the coming years.<br />

Geographic mandates<br />

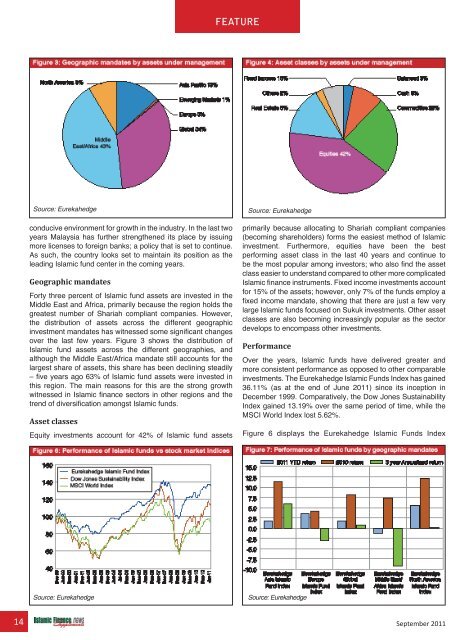

Forty three percent of <strong>Islamic</strong> fund assets are invested in the<br />

Middle East and Africa, primarily because the region holds the<br />

greatest number of Shariah compliant companies. However,<br />

the distribution of assets across the different geographic<br />

investment mandates has witnessed some significant changes<br />

over the last few years. Figure 3 shows the distribution of<br />

<strong>Islamic</strong> fund assets across the different geographies, and<br />

although the Middle East/Africa mandate still accounts for the<br />

largest share of assets, this share has been declining steadily<br />

– fi ve years ago 63% of <strong>Islamic</strong> fund assets were invested in<br />

this region. The main reasons for this are the strong growth<br />

witnessed in <strong>Islamic</strong> fi nance sectors in other regions and the<br />

trend of diversifi cation amongst <strong>Islamic</strong> funds.<br />

Asset classes<br />

Equity investments account for 42% of <strong>Islamic</strong> fund assets<br />

Source: Eurekahedge<br />

primarily because allocating to Shariah compliant companies<br />

(becoming shareholders) forms the easiest method of <strong>Islamic</strong><br />

investment. Furthermore, equities have been the best<br />

performing asset class in the last 40 years and continue to<br />

be the most popular among investors; who also fi nd the asset<br />

class easier to understand compared to other more complicated<br />

<strong>Islamic</strong> fi nance instruments. Fixed income investments account<br />

for 15% of the assets; however, only 7% of the funds employ a<br />

fi xed income mandate, showing that there are just a few very<br />

large <strong>Islamic</strong> funds focused on Sukuk investments. Other asset<br />

classes are also becoming increasingly popular as the sector<br />

develops to encompass other investments.<br />

Performance<br />

Over the years, <strong>Islamic</strong> funds have delivered greater and<br />

more consistent performance as opposed to other comparable<br />

investments. The Eurekahedge <strong>Islamic</strong> Funds Index has gained<br />

36.11% (as at the end of June 2011) since its inception in<br />

December 1999. Comparatively, the Dow Jones Sustainability<br />

Index gained 13.19% over the same period of time, while the<br />

MSCI World Index lost 5.62%.<br />

Figure 6 displays the Eurekahedge <strong>Islamic</strong> Funds Index<br />

Source: Eurekahedge<br />

Source: Eurekahedge<br />

14 September 2011