Islamic Investor: Islamic Investor: - Islamic Finance News

Islamic Investor: Islamic Investor: - Islamic Finance News

Islamic Investor: Islamic Investor: - Islamic Finance News

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CASE STUDY<br />

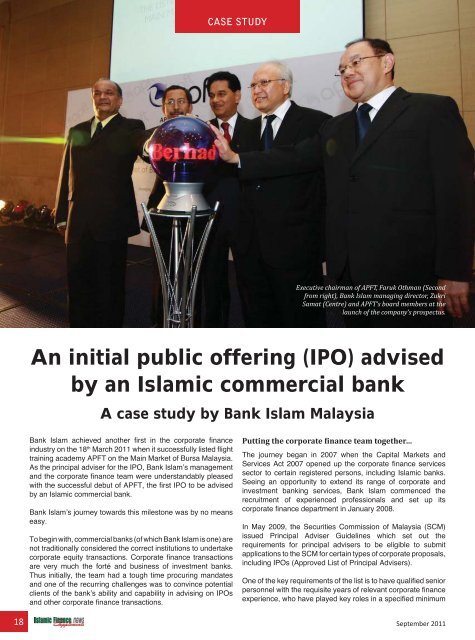

Executive chairman of APFT, Faruk Othman (Second<br />

from right), Bank Islam managing director, Zukri<br />

Samat (Centre) and APFT’s board members at the<br />

launch of the company’s prospectus.<br />

An initial public offering (IPO) advised<br />

by an <strong>Islamic</strong> commercial bank<br />

A case study by Bank Islam Malaysia<br />

Bank Islam achieved another fi rst in the corporate fi nance<br />

industry on the 18 th March 2011 when it successfully listed fl ight<br />

training academy APFT on the Main Market of Bursa Malaysia.<br />

As the principal adviser for the IPO, Bank Islam’s management<br />

and the corporate fi nance team were understandably pleased<br />

with the successful debut of APFT, the fi rst IPO to be advised<br />

by an <strong>Islamic</strong> commercial bank.<br />

Bank Islam’s journey towards this milestone was by no means<br />

easy.<br />

To begin with, commercial banks (of which Bank Islam is one) are<br />

not traditionally considered the correct institutions to undertake<br />

corporate equity transactions. Corporate fi nance transactions<br />

are very much the forté and business of investment banks.<br />

Thus initially, the team had a tough time procuring mandates<br />

and one of the recurring challenges was to convince potential<br />

clients of the bank’s ability and capability in advising on IPOs<br />

and other corporate fi nance transactions.<br />

Putting the corporate finance team together…<br />

The journey began in 2007 when the Capital Markets and<br />

Services Act 2007 opened up the corporate fi nance services<br />

sector to certain registered persons, including <strong>Islamic</strong> banks.<br />

Seeing an opportunity to extend its range of corporate and<br />

investment banking services, Bank Islam commenced the<br />

recruitment of experienced professionals and set up its<br />

corporate fi nance department in January 2008.<br />

In May 2009, the Securities Commission of Malaysia (SCM)<br />

issued Principal Adviser Guidelines which set out the<br />

requirements for principal advisers to be eligible to submit<br />

applications to the SCM for certain types of corporate proposals,<br />

including IPOs (Approved List of Principal Advisers).<br />

One of the key requirements of the list is to have qualifi ed senior<br />

personnel with the requisite years of relevant corporate fi nance<br />

experience, who have played key roles in a specifi ed minimum<br />

18 September 2011