Islamic Investor: Islamic Investor: - Islamic Finance News

Islamic Investor: Islamic Investor: - Islamic Finance News

Islamic Investor: Islamic Investor: - Islamic Finance News

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CHAPTER<br />

Benefitting from Responsible Investment<br />

Interfacing Shariah Investing with Socially Responsible<br />

Investments (SRI) and Environmental, Social & Governance (ESG)<br />

In June 2006, legendary investor Warren Buffet, announced he<br />

was giving most of his wealth to the foundation set up by Bill<br />

Gates and his wife. The total assets of the Bill & Melinda Gates<br />

Foundation are expected to reach US$100 billion before the<br />

end of the decade.<br />

As societies become more affl uent, they experience a migration<br />

of values. There appears to be a shift away from “materialist”<br />

values, which emphasize economic and physical security<br />

and towards “post-materialist” values, which emphasize selfexpression<br />

and quality-of-life.<br />

Data shows that the top 2% of the world’s population owns<br />

more than half the world’s wealth, and the top 10% owns<br />

85% (Source: World Institution of Development Economics<br />

Research, 2000). The future of the social-issues movement<br />

hinges on the desire of the wealthiest individuals of the planet<br />

to use their investments to improve the world. The good news<br />

is that this desire exists.<br />

Even the smaller “Average Joe” investors believe that the small<br />

gestures they make to avoid harming the environment makes<br />

them feel better. They are able to see concretely what their<br />

savings are used for: which companies get their money and<br />

what they do with it.<br />

This new breed of investors consist of people who care deeply<br />

about ecology and saving the planet; about relationships;<br />

about peace and social justice; and about self-actualization,<br />

spirituality and self-expression.<br />

The concept of assimilating ethical components into<br />

investment portfolios has always been the core of Shariah<br />

investing. Shariah investing can be considered a form of<br />

socially responsible investing (SRI) because it also excludes<br />

investment in businesses that are deemed unethical, such as<br />

those involved in gambling, alcohol, tobacco and weapons.<br />

Interestingly, Shariah investing then goes beyond the traditional<br />

ethical investment screening approach to further integrate an<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

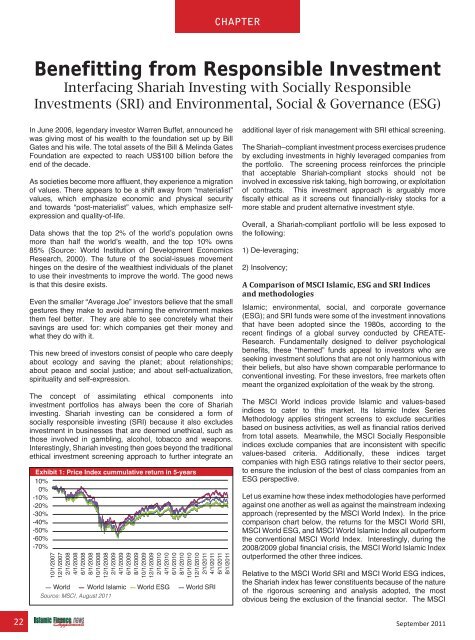

Source: MSCI, August 2011<br />

additional layer of risk management with SRI ethical screening.<br />

The Shariah–compliant investment process exercises prudence<br />

by excluding investments in highly leveraged companies from<br />

the portfolio. The screening process reinforces the principle<br />

that acceptable Shariah-compliant stocks should not be<br />

involved in excessive risk taking, high borrowing, or exploitation<br />

of contracts. This investment approach is arguably more<br />

fi scally ethical as it screens out fi nancially-risky stocks for a<br />

more stable and prudent alternative investment style.<br />

Overall, a Shariah-compliant portfolio will be less exposed to<br />

the following:<br />

1) De-leveraging;<br />

2) Insolvency;<br />

A Comparison of MSCI <strong>Islamic</strong>, ESG and SRI Indices<br />

and methodologies<br />

<strong>Islamic</strong>; environmental, social, and corporate governance<br />

(ESG); and SRI funds were some of the investment innovations<br />

that have been adopted since the 1980s, according to the<br />

recent fi ndings of a global survey conducted by CREATE-<br />

Research. Fundamentally designed to deliver psychological<br />

benefi ts, these “themed” funds appeal to investors who are<br />

seeking investment solutions that are not only harmonious with<br />

their beliefs, but also have shown comparable performance to<br />

conventional investing. For these investors, free markets often<br />

meant the organized exploitation of the weak by the strong.<br />

The MSCI World indices provide <strong>Islamic</strong> and values-based<br />

indices to cater to this market. Its <strong>Islamic</strong> Index Series<br />

Methodology applies stringent screens to exclude securities<br />

based on business activities, as well as fi nancial ratios derived<br />

from total assets. Meanwhile, the MSCI Socially Responsible<br />

indices exclude companies that are inconsistent with specifi c<br />

values-based criteria. Additionally, these indices target<br />

companies with high ESG ratings relative to their sector peers,<br />

to ensure the inclusion of the best of class companies from an<br />

ESG perspective.<br />

Let us examine how these index methodologies have performed<br />

against one another as well as against the mainstream indexing<br />

approach (represented by the MSCI World Index). In the price<br />

comparison chart below, the returns for the MSCI World SRI,<br />

MSCI World ESG, and MSCI World <strong>Islamic</strong> Index all outperform<br />

the conventional MSCI World Index. Interestingly, during the<br />

2008/2009 global fi nancial crisis, the MSCI World <strong>Islamic</strong> Index<br />

outperformed the other three indices.<br />

Relative to the MSCI World SRI and MSCI World ESG indices,<br />

the Shariah index has fewer constituents because of the nature<br />

of the rigorous screening and analysis adopted, the most<br />

obvious being the exclusion of the fi nancial sector. The MSCI<br />

22 September 2011