Islamic Investor: Islamic Investor: - Islamic Finance News

Islamic Investor: Islamic Investor: - Islamic Finance News

Islamic Investor: Islamic Investor: - Islamic Finance News

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHAPTER<br />

World <strong>Islamic</strong> Index’s outperformance of the other two indices is<br />

clearly evident over the period of the abovementioned downturn<br />

while the MSCI World ESG trails that of the conventional MSCI<br />

World along an almost identical path. This is despite the fact<br />

that more than 50% of index constituents in the MSCI World<br />

<strong>Islamic</strong> Index are also constituents of the MSCI World ESG<br />

Index.<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

The MSCI World ESG and MSCI World SRI indices’<br />

constituents overlap a fair amount with those in the MSCI World<br />

<strong>Islamic</strong> index: Out of 630 <strong>Islamic</strong> constituents, 356 are found<br />

in the MSCI World ESG index and approximately half of the<br />

market weighting of the MSCI World SRI index corresponds<br />

to constituents found in the <strong>Islamic</strong> index (Source: MSCI,<br />

September 2011).<br />

Despite MSCI’s ethical indices having a similar industry<br />

screening methodology between MSCI’s ethical and Shariah<br />

indices, the latter has clearly proven to be not only more<br />

resilient during a down trending market, but also less volatile.<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Source: MSCI, August 2011<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

While naysayers may argue that <strong>Islamic</strong> indices only build<br />

alpha during a downturn, the graph clearly continues to show<br />

outperformance by the <strong>Islamic</strong> index compared to the ESG and<br />

mainstream world indices during the period of April 2009 up to<br />

August 2011. The comparative returns of all four indices have<br />

proven that the <strong>Islamic</strong> index is more resilient and continues to<br />

build alpha even after the markets have stabilized.<br />

We believe that the two major factors that could contribute to<br />

this outcome are:<br />

1) Minimal country weightings for the debt-ridden PIIGS<br />

(Portugal, Italy, Ireland, Greece, Spain). These Eurozone<br />

countries were on the verge of fi nancial ruin by the beginning of<br />

2010 and greatly contributed to the European sovereign debt<br />

crisis. The MSCI World <strong>Islamic</strong> index weighted these countries<br />

at only 1.1%; the conventional World weighted them at 3.0%<br />

and the ethical indices weighted them at approximately 4.0%.<br />

(See Exhibit 2)<br />

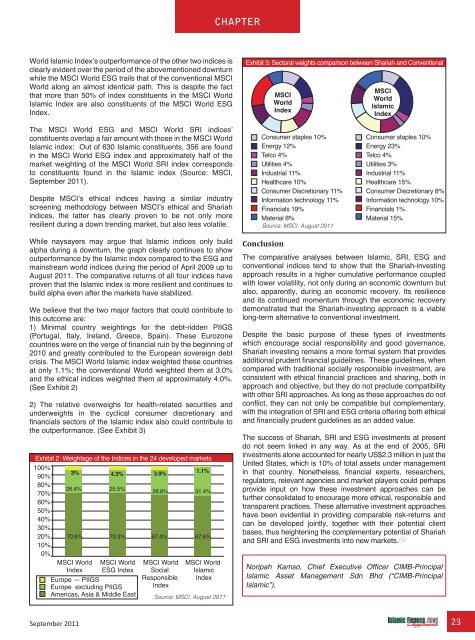

2) The relative overweighs for health-related securities and<br />

underweights in the cyclical consumer discretionary and<br />

fi nancials sectors of the <strong>Islamic</strong> index also could contribute to<br />

the outperformance. (See Exhibit 3)<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Source: MSCI, August 2011<br />

Conclusion<br />

The comparative analyses between <strong>Islamic</strong>, SRI, ESG and<br />

conventional indices tend to show that the Shariah-investing<br />

approach results in a higher cumulative performance coupled<br />

with lower volatility, not only during an economic downturn but<br />

also, apparently, during an economic recovery. Its resilience<br />

and its continued momentum through the economic recovery<br />

demonstrated that the Shariah-investing approach is a viable<br />

long-term alternative to conventional investment.<br />

Despite the basic purpose of these types of investments<br />

which encourage social responsibility and good governance,<br />

Shariah investing remains a more formal system that provides<br />

additional prudent fi nancial guidelines. These guidelines, when<br />

compared with traditional socially responsible investment, are<br />

consistent with ethical fi nancial practices and sharing, both in<br />

approach and objective, but they do not preclude compatibility<br />

with other SRI approaches. As long as these approaches do not<br />

conflict, they can not only be compatible but complementary,<br />

with the integration of SRI and ESG criteria offering both ethical<br />

and financially prudent guidelines as an added value.<br />

The success of Shariah, SRI and ESG investments at present<br />

do not seem linked in any way. As at the end of 2005, SRI<br />

investments alone accounted for nearly US$2.3 million in just the<br />

United States, which is 10% of total assets under management<br />

in that country. Nonetheless, financial experts, researchers,<br />

regulators, relevant agencies and market players could perhaps<br />

provide input on how these investment approaches can be<br />

further consolidated to encourage more ethical, responsible and<br />

transparent practices. These alternative investment approaches<br />

have been evidential in providing comparable risk-returns and<br />

can be developed jointly, together with their potential client<br />

bases, thus heightening the complementary potential of Shariah<br />

and SRI and ESG investments into new markets.<br />

Noripah Kamso, Chief Executive Offi cer CIMB-Principal<br />

<strong>Islamic</strong> Asset Management Sdn Bhd (“CIMB-Principal<br />

<strong>Islamic</strong>”).<br />

September 2011 23