BALANCE SHEET as at 31 December 2009 - Joseph Rowntree ...

BALANCE SHEET as at 31 December 2009 - Joseph Rowntree ...

BALANCE SHEET as at 31 December 2009 - Joseph Rowntree ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

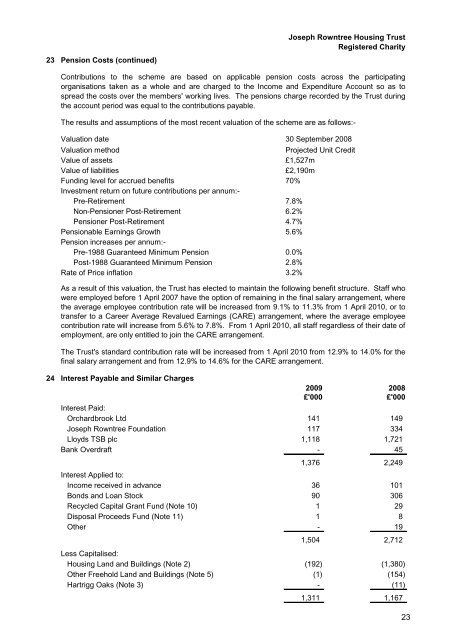

23 Pension Costs (continued)<br />

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

Contributions to the scheme are b<strong>as</strong>ed on applicable pension costs across the particip<strong>at</strong>ing<br />

organis<strong>at</strong>ions taken <strong>as</strong> a whole and are charged to the Income and Expenditure Account so <strong>as</strong> to<br />

spread the costs over the members' working lives. The pensions charge recorded by the Trust during<br />

the account period w<strong>as</strong> equal to the contributions payable.<br />

The results and <strong>as</strong>sumptions of the most recent valu<strong>at</strong>ion of the scheme are <strong>as</strong> follows:-<br />

Valu<strong>at</strong>ion d<strong>at</strong>e 30 September 2008<br />

Valu<strong>at</strong>ion method<br />

Projected Unit Credit<br />

Value of <strong>as</strong>sets<br />

£1,527m<br />

Value of liabilities<br />

Funding level for accrued benefits<br />

£2,190m<br />

70%<br />

Investment return on future contributions per annum:-<br />

Pre-Retirement 7.8%<br />

Non-Pensioner Post-Retirement 6.2%<br />

Pensioner Post-Retirement 4.7%<br />

Pensionable Earnings Growth 5.6%<br />

Pension incre<strong>as</strong>es per annum:-<br />

Pre-1988 Guaranteed Minimum Pension 0.0%<br />

Post-1988 Guaranteed Minimum Pension 2.8%<br />

R<strong>at</strong>e of Price infl<strong>at</strong>ion 3.2%<br />

As a result of this valu<strong>at</strong>ion, the Trust h<strong>as</strong> elected to maintain the following benefit structure. Staff who<br />

were employed before 1 April 2007 have the option of remaining in the final salary arrangement, where<br />

the average employee contribution r<strong>at</strong>e will be incre<strong>as</strong>ed from 9.1% to 11.3% from 1 April 2010, or to<br />

transfer to a Career Average Revalued Earnings (CARE) arrangement, where the average employee<br />

contribution r<strong>at</strong>e will incre<strong>as</strong>e from 5.6% to 7.8%. From 1 April 2010, all staff regardless of their d<strong>at</strong>e of<br />

employment, are only entitled to join the CARE arrangement.<br />

The Trust's standard contribution r<strong>at</strong>e will be incre<strong>as</strong>ed from 1 April 2010 from 12.9% to 14.0% for the<br />

final salary arrangement and from 12.9% to 14.6% for the CARE arrangement.<br />

24<br />

Interest Payable and Similar Charges<br />

<strong>2009</strong> 2008<br />

£'000<br />

£'000<br />

Interest Paid:<br />

Orchardbrook Ltd 141 149<br />

<strong>Joseph</strong> <strong>Rowntree</strong> Found<strong>at</strong>ion 117 334<br />

Lloyds TSB plc 1,118 1,721<br />

Bank Overdraft - 45<br />

1,376 2,249<br />

Interest Applied to:<br />

Income received in advance 36 101<br />

Bonds and Loan Stock 90 306<br />

Recycled Capital Grant Fund (Note 10) 1 29<br />

Disposal Proceeds Fund (Note 11) 1 8<br />

Other - 19<br />

1,504 2,712<br />

Less Capitalised:<br />

Housing Land and Buildings (Note 2) (192) (1,380)<br />

Other Freehold Land and Buildings (Note 5) (1) (154)<br />

Hartrigg Oaks (Note 3) - (11)<br />

1,<strong>31</strong>1 1,167<br />

23