Annual Report 2006 - Komatsu

Annual Report 2006 - Komatsu

Annual Report 2006 - Komatsu

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

Other investment securities primarily include non-marketable<br />

equity securities.<br />

Unrealized holding gains and losses deemed to be temporary<br />

are included as a component of accumulated other comprehensive<br />

income (loss) until realized.<br />

Proceeds from the sales of marketable securities and investment<br />

securities available for sale were ¥4,112 million ($35,145<br />

thousand), ¥2,593 million and ¥14,056 million for the years<br />

ended March 31, <strong>2006</strong>, 2005 and 2004, respectively.<br />

Net realized gains on sale of investment securities available<br />

for sale during the years ended March 31, <strong>2006</strong>, 2005 and<br />

2004, amounted to gains of ¥2,505 million ($21,410 thousand),<br />

gains of ¥162 million and gains of ¥211 million, respectively.<br />

They were included in “interest and other income” in the<br />

accompanying consolidated statements of income. The cost<br />

of the marketable securities and investment securities sold<br />

was computed based on the average-cost method.<br />

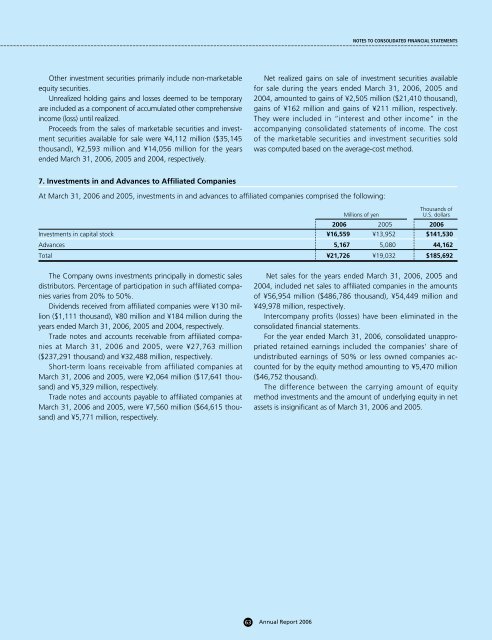

7. Investments in and Advances to Affiliated Companies<br />

At March 31, <strong>2006</strong> and 2005, investments in and advances to affiliated companies comprised the following:<br />

Thousands of<br />

Millions of yen<br />

U.S. dollars<br />

<strong>2006</strong> 2005 <strong>2006</strong><br />

Investments in capital stock ¥16,559 ¥13,952 $141,530<br />

Advances 5,167 5,080 44,162<br />

Total ¥21,726 ¥19,032 $185,692<br />

The Company owns investments principally in domestic sales<br />

distributors. Percentage of participation in such affiliated companies<br />

varies from 20% to 50%.<br />

Dividends received from affiliated companies were ¥130 million<br />

($1,111 thousand), ¥80 million and ¥184 million during the<br />

years ended March 31, <strong>2006</strong>, 2005 and 2004, respectively.<br />

Trade notes and accounts receivable from affiliated companies<br />

at March 31, <strong>2006</strong> and 2005, were ¥27,763 million<br />

($237,291 thousand) and ¥32,488 million, respectively.<br />

Short-term loans receivable from affiliated companies at<br />

March 31, <strong>2006</strong> and 2005, were ¥2,064 million ($17,641 thousand)<br />

and ¥5,329 million, respectively.<br />

Trade notes and accounts payable to affiliated companies at<br />

March 31, <strong>2006</strong> and 2005, were ¥7,560 million ($64,615 thousand)<br />

and ¥5,771 million, respectively.<br />

Net sales for the years ended March 31, <strong>2006</strong>, 2005 and<br />

2004, included net sales to affiliated companies in the amounts<br />

of ¥56,954 million ($486,786 thousand), ¥54,449 million and<br />

¥49,978 million, respectively.<br />

Intercompany profits (losses) have been eliminated in the<br />

consolidated financial statements.<br />

For the year ended March 31, <strong>2006</strong>, consolidated unappropriated<br />

retained earnings included the companies’ share of<br />

undistributed earnings of 50% or less owned companies accounted<br />

for by the equity method amounting to ¥5,470 million<br />

($46,752 thousand).<br />

The difference between the carrying amount of equity<br />

method investments and the amount of underlying equity in net<br />

assets is insignificant as of March 31, <strong>2006</strong> and 2005.<br />

63 <strong>Annual</strong> <strong>Report</strong> <strong>2006</strong>