Guide to Financial Issues relating to FP7 Indirect Actions - KoWi

Guide to Financial Issues relating to FP7 Indirect Actions - KoWi

Guide to Financial Issues relating to FP7 Indirect Actions - KoWi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

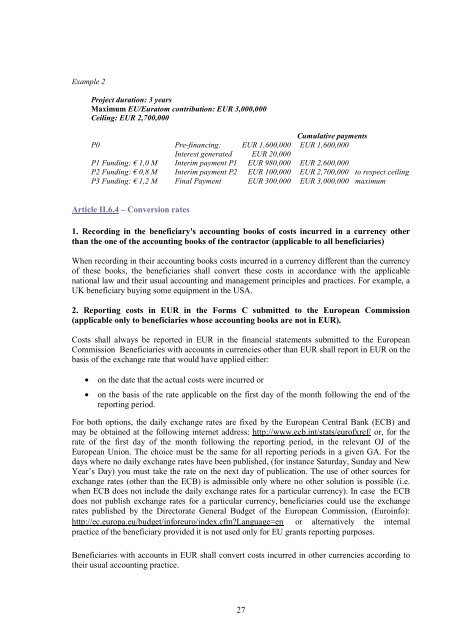

Example 2<br />

Project duration: 3 years<br />

Maximum EU/Eura<strong>to</strong>m contribution: EUR 3,000,000<br />

Ceiling: EUR 2,700,000<br />

Cumulative payments<br />

P0 Pre-financing: EUR 1,600,000 EUR 1,600,000<br />

Interest generated EUR 20,000<br />

P1 Funding: € 1,0 M Interim payment P1 EUR 980,000 EUR 2,600,000<br />

P2 Funding: € 0,8 M Interim payment P2 EUR 100,000 EUR 2,700,000 <strong>to</strong> respect ceiling<br />

P3 Funding: € 1,2 M Final Payment EUR 300,000 EUR 3,000,000 maximum<br />

Article II.6.4 – Conversion rates<br />

1. Recording in the beneficiary's accounting books of costs incurred in a currency other<br />

than the one of the accounting books of the contrac<strong>to</strong>r (applicable <strong>to</strong> all beneficiaries)<br />

When recording in their accounting books costs incurred in a currency different than the currency<br />

of these books, the beneficiaries shall convert these costs in accordance with the applicable<br />

national law and their usual accounting and management principles and practices. For example, a<br />

UK beneficiary buying some equipment in the USA.<br />

2. Reporting costs in EUR in the Forms C submitted <strong>to</strong> the European Commission<br />

(applicable only <strong>to</strong> beneficiaries whose accounting books are not in EUR).<br />

Costs shall always be reported in EUR in the financial statements submitted <strong>to</strong> the European<br />

Commission Beneficiaries with accounts in currencies other than EUR shall report in EUR on the<br />

basis of the exchange rate that would have applied either:<br />

• on the date that the actual costs were incurred or<br />

• on the basis of the rate applicable on the first day of the month following the end of the<br />

reporting period.<br />

For both options, the daily exchange rates are fixed by the European Central Bank (ECB) and<br />

may be obtained at the following internet address: http://www.ecb.int/stats/eurofxref/ or, for the<br />

rate of the first day of the month following the reporting period, in the relevant OJ of the<br />

European Union. The choice must be the same for all reporting periods in a given GA. For the<br />

days where no daily exchange rates have been published, (for instance Saturday, Sunday and New<br />

Year’s Day) you must take the rate on the next day of publication. The use of other sources for<br />

exchange rates (other than the ECB) is admissible only where no other solution is possible (i.e.<br />

when ECB does not include the daily exchange rates for a particular currency). In case the ECB<br />

does not publish exchange rates for a particular currency, beneficiaries could use the exchange<br />

rates published by the Direc<strong>to</strong>rate General Budget of the European Commission, (Euroinfo):<br />

http://ec.europa.eu/budget/inforeuro/index.cfm?Language=en or alternatively the internal<br />

practice of the beneficiary provided it is not used only for EU grants reporting purposes.<br />

Beneficiaries with accounts in EUR shall convert costs incurred in other currencies according <strong>to</strong><br />

their usual accounting practice.<br />

27