Guide to Financial Issues relating to FP7 Indirect Actions - KoWi

Guide to Financial Issues relating to FP7 Indirect Actions - KoWi

Guide to Financial Issues relating to FP7 Indirect Actions - KoWi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

• The system applied and the costs declared according <strong>to</strong> it should follow the normal<br />

accounting principles and practices of the beneficiary. Therefore, if the system used by<br />

a beneficiary is more "refined" than the "minimum" requirements mentioned above, it<br />

is that system which should be used when declaring costs:<br />

Example: if a beneficiary's accounting system distinguishes between different overheads rates<br />

according <strong>to</strong> the type of activity (research, teaching...), then the overheads declared in an <strong>FP7</strong> ECGA<br />

should follow this practice and refer only <strong>to</strong> the concerned activities (research, demonstration...)<br />

Does the simplified method need <strong>to</strong> be certified by the Commission?<br />

The simplified method does not require previous registration or certification by the<br />

Commission. Consequently, there is no specific certification of the simplified method used by<br />

a beneficiary. The beneficiary has the responsibility <strong>to</strong> ensure that the simplified method used<br />

is compliant with the requirements. However, the certification on the methodology - described<br />

in Article II.4 of ECGA – may cover the methodology of calculation of indirect costs<br />

(including the simplified method) for those beneficiaries who are allowed <strong>to</strong> use the<br />

certification on the methodology.<br />

When a Certificate on the <strong>Financial</strong> Statement is submitted the audi<strong>to</strong>r will describe the<br />

(simplified) accounting system certifying these points. It is important <strong>to</strong> remember that this<br />

option refers <strong>to</strong> the possibility for a beneficiary <strong>to</strong> use a simplified method of declaring<br />

indirect costs. There is therefore no "standard model" - only different simplified methods used<br />

by beneficiaries complying with the requirements mentioned above.<br />

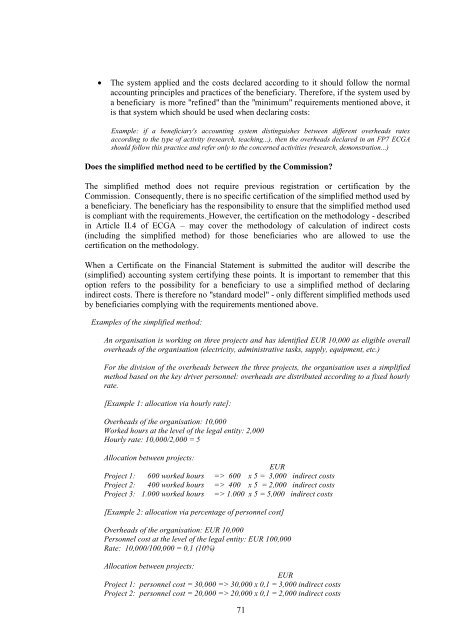

Examples of the simplified method:<br />

An organisation is working on three projects and has identified EUR 10,000 as eligible overall<br />

overheads of the organisation (electricity, administrative tasks, supply, equipment, etc.)<br />

For the division of the overheads between the three projects, the organisation uses a simplified<br />

method based on the key driver personnel: overheads are distributed according <strong>to</strong> a fixed hourly<br />

rate.<br />

[Example 1: allocation via hourly rate]:<br />

Overheads of the organisation: 10,000<br />

Worked hours at the level of the legal entity: 2,000<br />

Hourly rate: 10,000/2,000 = 5<br />

Allocation between projects:<br />

EUR<br />

Project 1: 600 worked hours => 600 x 5 = 3,000 indirect costs<br />

Project 2: 400 worked hours => 400 x 5 = 2,000 indirect costs<br />

Project 3: 1.000 worked hours => 1.000 x 5 = 5,000 indirect costs<br />

[Example 2: allocation via percentage of personnel cost]<br />

Overheads of the organisation: EUR 10,000<br />

Personnel cost at the level of the legal entity: EUR 100,000<br />

Rate: 10,000/100,000 = 0,1 (10%)<br />

Allocation between projects:<br />

EUR<br />

Project 1: personnel cost = 30,000 => 30,000 x 0,1 = 3,000 indirect costs<br />

Project 2: personnel cost = 20,000 => 20,000 x 0,1 = 2,000 indirect costs<br />

71