Size Effect

Size Effect

Size Effect

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Size</strong> <strong>Effect</strong><br />

Collaborative Effort by:<br />

Brian T. Allman<br />

Patrick Hu<br />

Josh Jones<br />

Yann Ling-Barnes<br />

John Nunn

<strong>Size</strong> <strong>Effect</strong><br />

Outline<br />

•CAPM<br />

•EMH<br />

•Testing CAPM & EMH<br />

• Abnormal Returns in Small Firm Portfolios<br />

• Portfolio Strategies based on Market Capitalization<br />

•Results<br />

•Conclusion<br />

•Real-world Application

CAPM<br />

Capital Asset Pricing Model<br />

• All Expected Stock Returns are a function<br />

of:<br />

– Risk free borrowing Rate (R(<br />

f )<br />

– Riskiness of stock, as measured by Beta (B i )<br />

– Excess return on Market Portfolio [E(R[<br />

m )-R f ]<br />

E(R i ) = R f +B i [E(R m )-R f ]

CAPM<br />

Capital Asset Pricing Model<br />

• Holding the Market Risk Premium constant, each<br />

% increase of Risk should provide equivalent %<br />

increase in Return.<br />

[E(R m )-R f ] = ΔE(R<br />

)/ΔB i i<br />

• As Beta increases, Expected Return increases<br />

equivalently.

• Weak-Form EMH<br />

EMH<br />

Efficient Market Hypothesis<br />

– Prices on traded assets (stocks, bonds, or property)<br />

already reflect all past publicly available information.<br />

– Disproves Technical Analysis.<br />

WF EMH

EMH<br />

Efficient Market Hypothesis<br />

• Semi-Strong Strong Form EMH<br />

– Prices reflect all publicly available information and prices<br />

instantly change to reflect new public information.<br />

– Disproves Fundamental & Technical Analysis.<br />

S-SF EMH<br />

WF EMH

EMH<br />

Efficient Market Hypothesis<br />

• Strong Form EMH<br />

– Privately available information is instantly reflected<br />

within prices.<br />

– Disproves Insider Trading & Fundamental Technical<br />

Analysis.<br />

S-F EMH<br />

S-SF EMH<br />

WF EMH

• Purpose:<br />

Abnormal Returns in<br />

Small Firm Portfolios<br />

– To test the performance of small caps vs. large caps.<br />

– To test whether abnormal returns that are not explained<br />

by beta exist.

• The Test:<br />

Abnormal Returns in<br />

Small Firm Portfolios<br />

1. Collected NYSE & AMEX stock prices from 1962-1975.<br />

1975.<br />

• Daily returns<br />

• Common shares<br />

2. Ranked all stocks by market value and divided into 10<br />

equally-weighted portfolios.<br />

3. Beta estimates for the portfolios were close to 1.<br />

4. Combined daily returns to obtain portfolio returns.<br />

5. Re-balanced portfolio by repeating step 2 at the end of<br />

each year.<br />

6. Calculated abnormal returns.<br />

• Daily return of portfolio – Daily return of NYSE-AMEX index.

• Hypothesis:<br />

Abnormal Returns in<br />

Small Firm Portfolios<br />

– CAPM implies that any two assets with the same beta<br />

will have the same expected return.<br />

– Mean abnormal returns are zero.<br />

– According to CAPM, mean abnormal returns should be<br />

zero because all the portfolios have betas near one,<br />

which should approximate the return of the market as a<br />

whole.

Abnormal Returns in<br />

Small Firm Portfolios<br />

Results:<br />

– Portfolio with smallest firm on average experienced<br />

returns >20% a year higher than portfolio with largest<br />

firms.<br />

– Investors can form portfolios that systematically earn<br />

abnormal returns based on firm size.<br />

– Persistence of small firm abnormal returns reduces the<br />

chance that the results are due to market inefficiencies.<br />

– CAPM does not adequately describe stock return<br />

behavior.

• Purpose:<br />

Portfolio strategies based<br />

on market capitalization<br />

No matter how you slice it, small caps win out.<br />

– To determine if small firms, on average, earn higher<br />

rates of return than large firms.<br />

– To determine if actively managed portfolios out perform<br />

passively managed portfolios.

• The Test:<br />

Portfolio strategies based<br />

on market capitalization<br />

No matter how you slice it, small caps win out.<br />

– Collected NYSE & AMEX stock prices from 1963-1980.<br />

1980.<br />

• Daily returns<br />

• Common shares<br />

– Ranked all stocks by market value and divided into 10<br />

equally-weighted portfolios.<br />

– Active vs. Passive portfolio strategy.<br />

• Active – annual portfolio rebalancing<br />

• Passive – hold till 1980 without rebalancing<br />

• Placed any proceeds after delisting in an S&P 500 Index fund

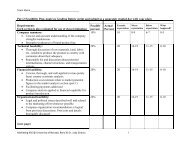

Portfolio strategies based<br />

on market capitalization<br />

No matter how you slice it, small caps win out.<br />

• Investment Characteristics of The Market Value<br />

Portfolio<br />

Portfolio<br />

Average Annual<br />

Return<br />

Average Percent<br />

on AMEX<br />

Average Median<br />

Value ($M)<br />

Average Share<br />

Price<br />

Median Share<br />

Price<br />

Estimated<br />

Portfolio Beta<br />

MV1 32.77% 92.19% $92.19 $4.60 $5.24 1.58<br />

MV2 23.51% 77.33% $77.33 $10.80 $9.52 1.57<br />

MV3 22.98% 52.09% $52.09 $19.30 $12.89 1.50<br />

MV4 20.24% 34.05% $34.05 $30.70 $16.19 1.46<br />

MV5 19.08% 21.33% $21.33 $47.20 $19.22 1.43<br />

MV6 18.30% 12.73% $12.73 $74.20 $22.59 1.36<br />

MV7 15.64% 8.37% $8.37 $119.10 $26.44 1.28<br />

MV8 14.24% 4.73% $4.73 $209.70 $30.83 1.22<br />

MV9 13.00% 3.39% $3.39 $434.60 $34.43 1.11<br />

MV10 9.47% 2.25% $2.25 $1,102.60 $44.94 0.96

Portfolio strategies based<br />

on market capitalization<br />

No matter how you slice it, small caps win out.<br />

• Investment Characteristics of The Market Value<br />

Portfolio (cont’d)

• Results:<br />

Portfolio strategies based<br />

on market capitalization<br />

No matter how you slice it, small caps win out.<br />

Cumulative Increase, 1963‐1980<br />

Portfolio <strong>Size</strong> Active Strategy Passive Strategy Difference<br />

Smallest 4528% 1026% 3502%<br />

Largest 312% 328% ‐16%

• Results (cont’d):<br />

Portfolio strategies based<br />

on market capitalization<br />

No matter how you slice it, small caps win out.<br />

• Very small firms can generate large gains over long periods of<br />

time, even with passive strategy.<br />

• Small firms with

Portfolio strategies based<br />

on market capitalization<br />

• Transaction Cost:<br />

*Considering Transaction Costs<br />

– Estimated average of 950 stocks used per year,<br />

95 stocks per portfolio<br />

– Used Current costs of $10 per trade<br />

• Cumulative transaction costs:<br />

– $32,300 for actively managed portfolio<br />

– $1,900 for passively managed portfolio<br />

• Transaction costs in 1960’s s & 1970’s s >> today’s

CONCLUSION<br />

• What have we learned from these 2 papers?<br />

– Using a CAPM Market Risk Premium of 9% to compare a<br />

Large Cap Stock with a Small Cap Stock:<br />

– Reinganum disproved CAPM.<br />

– Small Cap stocks out perform Large Cap stocks even<br />

after additional Risk is considered.<br />

Portfolio Type: *Beta: E(R i<br />

) CAPM: *R i<br />

: Observed:<br />

Small Cap<br />

Portfolio<br />

Large Cap<br />

Portfolio<br />

1.58 16.22% 32.77%<br />

0.96 10.64% 9.47%

CONCLUSION<br />

• Reinganum disproved Semi-Strong Strong Form EMH.<br />

– Market Capitalization can be used to systematically<br />

construct a portfolio that out performs and generates<br />

consistent abnormal returns.<br />

S-SF EMH<br />

WF EMH

NEXT STEP<br />

• Real-World Application<br />

– Select security exchange<br />

• Nasdaq<br />

• NYSE<br />

– Determine firm size for inclusion<br />

– Fine tune portfolio criteria

NEXT STEP

NEXT STEP

NEXT STEP

NEXT STEP<br />

• Recent Returns of Small Cap Stocks<br />

– Total Returns from Morningstar Small Cap, Mid Cap &<br />

Large Cap Indexes<br />

YTD 1 Yr 3 Yr Avg 5 Yr Avg 10 Yr Avg<br />

Small Cap 6.50% 30.33% 10.16% 5.11% 8.23%<br />

Mid Cap 6.82% 28.35% 6.52% 4.67% 7.19%<br />

Large Cap 5.24% 18.83% 1.60% 2.63% 1.94%

<strong>Size</strong> <strong>Effect</strong><br />

QUESTIONS?