Size Effect

Size Effect

Size Effect

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

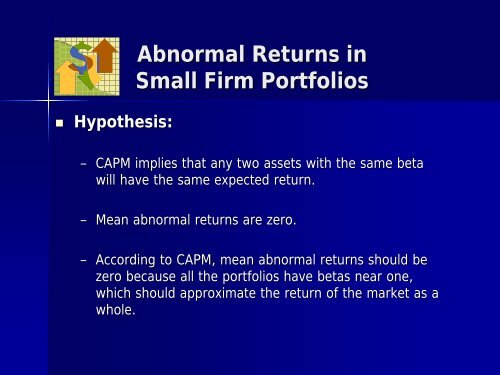

• Hypothesis:<br />

Abnormal Returns in<br />

Small Firm Portfolios<br />

– CAPM implies that any two assets with the same beta<br />

will have the same expected return.<br />

– Mean abnormal returns are zero.<br />

– According to CAPM, mean abnormal returns should be<br />

zero because all the portfolios have betas near one,<br />

which should approximate the return of the market as a<br />

whole.