As of 30 June 2006

As of 30 June 2006

As of 30 June 2006

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

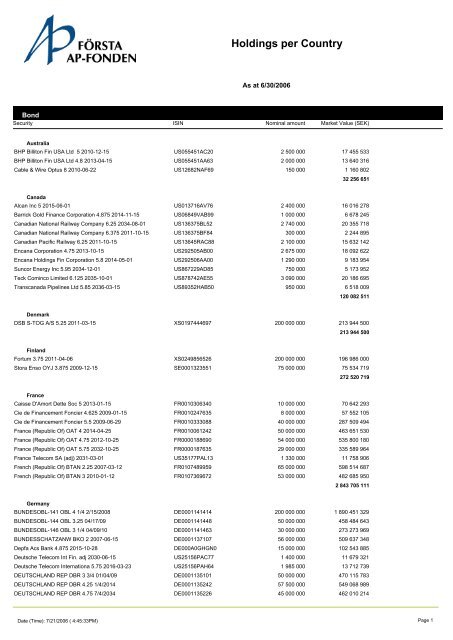

Holdings per Country<br />

<strong>As</strong> at 6/<strong>30</strong>/<strong>2006</strong><br />

Bond<br />

Security<br />

ISIN<br />

Nominal amount<br />

Market Value (SEK)<br />

Australia<br />

BHP Billiton Fin USA Ltd 5 2010-12-15 US055451AC20<br />

2 500 000 17 455 533<br />

BHP Billiton Fin USA Ltd 4.8 2013-04-15 US055451AA63<br />

2 000 000 13 640 316<br />

Cable & Wire Optus 8 2010-06-22 US12682NAF69<br />

150 000 1 160 802<br />

32 256 651<br />

Canada<br />

Alcan Inc 5 2015-06-01 US013716AV76<br />

2 400 000 16 016 278<br />

Barrick Gold Finance Corporation 4.875 2014-11-15 US06849VAB99<br />

1 000 000 6 678 245<br />

Canadian National Railway Company 6.25 2034-08-01 US136375BL52<br />

2 740 000 20 355 718<br />

Canadian National Railway Company 6.375 2011-10-15 US136375BF84<br />

<strong>30</strong>0 000 2 244 895<br />

Canadian Pacific Railway 6.25 2011-10-15 US13645RAC88<br />

2 100 000 15 632 142<br />

Encana Corporation 4.75 2013-10-15 US292505AB00<br />

2 675 000 18 092 622<br />

Encana Holdings Fin Corporation 5.8 2014-05-01 US292506AA00<br />

1 290 000 9 183 954<br />

Suncor Energy Inc 5.95 2034-12-01 US867229AD85<br />

750 000 5 173 952<br />

Teck Cominco Limited 6.125 2035-10-01 US878742AE55<br />

3 090 000 20 186 695<br />

Transcanada Pipelines Ltd 5.85 2036-03-15 US89352HAB50<br />

950 000 6 518 009<br />

120 082 511<br />

Denmark<br />

DSB S-TOG A/S 5.25 2011-03-15 XS0197444697<br />

200 000 000 213 944 500<br />

213 944 500<br />

Finland<br />

Fortum 3.75 2011-04-06 XS0249856526<br />

200 000 000 196 986 000<br />

Stora Enso OYJ 3.875 2009-12-15 SE0001323551<br />

75 000 000 75 534 719<br />

272 520 719<br />

France<br />

Caisse D'Amort Dette Soc 5 2013-01-15 FR0010<strong>30</strong>6340<br />

10 000 000 70 642 293<br />

Cie de Financement Foncier 4.625 2009-01-15 FR0010247635<br />

8 000 000 57 552 105<br />

Cie de Financement Foncier 5.5 2009-06-29 FR001033<strong>30</strong>88<br />

40 000 000 287 509 494<br />

France (Republic Of) OAT 4 2014-04-25 FR0010061242<br />

50 000 000 463 651 5<strong>30</strong><br />

France (Republic Of) OAT 4.75 2012-10-25 FR0000188690<br />

54 000 000 535 800 180<br />

France (Republic Of) OAT 5.75 2032-10-25 FR0000187635<br />

29 000 000 335 589 964<br />

France Telecom SA (adj) 2031-03-01 US35177PAL13<br />

1 3<strong>30</strong> 000 11 758 906<br />

French (Republic Of) BTAN 2.25 2007-03-12 FR0107489959<br />

65 000 000 598 514 687<br />

French (Republic Of) BTAN 3 2010-01-12 FR0107369672<br />

53 000 000 482 685 950<br />

2 843 705 111<br />

Germany<br />

BUNDESOBL-141 OBL 4 1/4 2/15/2008 DE0001141414<br />

200 000 000 1 890 451 329<br />

BUNDESOBL-144 OBL 3.25 04/17/09 DE0001141448<br />

50 000 000 458 484 643<br />

BUNDESOBL-146 OBL 3 1/4 04/09/10 DE0001141463<br />

<strong>30</strong> 000 000 273 273 969<br />

BUNDESSCHATZANW BKO 2 2007-06-15 DE0001137107<br />

56 000 000 509 637 348<br />

Depfa Acs Bank 4.875 2015-10-28 DE000A0GHGN0<br />

15 000 000 102 543 885<br />

Deutsche Telecom Int Fin. adj 20<strong>30</strong>-06-15 US25156PAC77<br />

1 400 000 11 679 321<br />

Deutsche Telecom Internationa 5.75 2016-03-23 US25156PAH64<br />

1 985 000 13 712 739<br />

DEUTSCHLAND REP DBR 3 3/4 01/04/09 DE0001135101<br />

50 000 000 470 115 783<br />

DEUTSCHLAND REP DBR 4.25 1/4/2014 DE0001135242<br />

57 500 000 549 068 989<br />

DEUTSCHLAND REP DBR 4.75 7/4/2034 DE0001135226<br />

45 000 000 462 010 214<br />

Date (Time): 7/21/<strong>2006</strong> ( 4:45:33PM) Page 1

Holdings per Country<br />

<strong>As</strong> at 6/<strong>30</strong>/<strong>2006</strong><br />

Bond<br />

Security<br />

ISIN<br />

Nominal amount<br />

Market Value (SEK)<br />

Germany continued...<br />

DEUTSCHLAND REP DBR 5 1/4 01/04/08 DE0001135051<br />

44 000 000 425 471 873<br />

DEUTSCHLAND REP DBR 5 1/4 07/04/10 DE0001135150<br />

<strong>30</strong> 000 000 <strong>30</strong>5 298 6<strong>30</strong><br />

DEUTSCHLAND REP DBR 5 5/8 01/04/28 DE0001135069<br />

60 000 000 667 221 762<br />

DEUTSCHLAND REP DBR 6 1/4 01/04/24 DE0001134922<br />

55 000 000 644 839 184<br />

Kreditanstalt fuer Wiederaufbau 3.5 2009-07-15 DE000A0JRLV6<br />

20 000 000 182 932 398<br />

Kreditanstalt fuer Wiederaufbau 5 2009-01-04 DE0002760782<br />

20 000 000 194 342 356<br />

7 161 084 423<br />

Great Britain<br />

Bradford & Bingley Plc 3.875 2011-05-04 XS0252901359<br />

20 000 000 184 011 154<br />

British Sky Broadcasting 6.875 2009-02-23 US111013AB49<br />

2 000 000 15 079 061<br />

British Telecommunications PLC 8.875 20<strong>30</strong>-12-15 US111021AE12<br />

1 375 000 12 210 934<br />

HBOS Treasury Services Plc 3.250 2013-01-25 XS0241851764<br />

<strong>30</strong> 000 000 265 824 329<br />

HSBC Finance Corp 4.625 2010-09-15 US40429CCV28<br />

5 000 000 34 919 574<br />

HSBC Holdings Plc 6.500 2036-05-02 US404280AG49<br />

2 600 000 18 466 596<br />

Royal Bank Of Scotland 5 2013-11-12 US780097AN12<br />

3 750 000 25 812 878<br />

Scottish Power 4.91 2010-03-15 US81013TAA97<br />

5 200 000 36 800 222<br />

Scottish Power 5.375 2015-03-15 US81013TAB70<br />

1 000 000 6 937 736<br />

United Kingdom Gilt 4.000 2016-09-07 GB00B0V3WX43<br />

60 000 000 764 687 660<br />

United Kingdom Government 4.25 2032-06-07 GB000489<strong>30</strong>86<br />

10 000 000 1<strong>30</strong> 709 182<br />

United Kingdom Government 5 2025-03-07 GB00<strong>30</strong>880693<br />

6 000 000 85 739 579<br />

United Kingdom Government 8 2015-12-07 GB0008881541<br />

27 000 000 450 537 846<br />

United Kingdom Government 8 2021-06-07 GB0009997999<br />

23 000 000 417 040 757<br />

United Kingdom Government 8.5 2007-07-16 GB0009126557<br />

38 500 000 552 145 570<br />

United Kingdom Government 9 2011-07-12 GB0002215225<br />

1<strong>30</strong> 000 000 2 126 648 166<br />

United Kingdom Government Gilt 4.75 2010-06-07 GB00B03<strong>30</strong>274<br />

15 200 000 202 694 955<br />

United Kingdom Government Gilt 4.75 2015-09-07 GB0033280339<br />

32 000 000 433 373 820<br />

United Kingdom Government Treasury STOC 5 20080<strong>30</strong>7 GB0031734154<br />

180 000 000 2 444 274 977<br />

United Kingdom Government Treasury STOC 5 20120<strong>30</strong>7 GB00<strong>30</strong>468747<br />

19 000 000 259 975 403<br />

United Kingdom GovernmentTreasurySTOC4.25 20360<strong>30</strong>7 GB0032452392<br />

4 000 000 53 236 702<br />

Vodafone Airtouch Plc 7.75 2010-02-15 US92857TAG22<br />

1 940 000 15 161 335<br />

Vodafone Group Plc 5 2013-12-16 US92857WAF77<br />

1 000 000 6 649 <strong>30</strong>1<br />

Vodafone Group Plc 5 2015-09-15 US92857WAG50<br />

1 110 000 7 345 863<br />

Vodafone Group Plc 5.750 2016-03-15 US92857WAK62<br />

2 400 000 16 707 671<br />

8 566 991 270<br />

Italy<br />

Italy Buoni Poliennali Del Tesoro 4.25 2009-11-01 IT0001338612<br />

50 000 000 470 347 969<br />

Italy Buoni Poliennali Del Tesoro 4.25 2019-02-01 IT0003493258<br />

<strong>30</strong> 000 000 276 856 887<br />

Italy Buoni Poliennali Del Tesoro 4.75 2013-02-01 IT0003357982<br />

25 000 000 243 794 443<br />

Italy Buoni Poliennali Del Tesoro 5.5 2010-11-01 IT0001448619<br />

35 000 000 345 664 553<br />

Italy Buoni Poliennali Del Tesoro 5.75 2033-02-01 IT0003256820<br />

38 000 000 415 859 757<br />

Telocom Italia Capital 4.95 2014-09-<strong>30</strong> US87927VAL27<br />

1 920 000 12 597 012<br />

Telocom Italia Capital 5.25 2015-10-01 US87927VAQ14<br />

3 565 000 23 585 242<br />

Telocom Italia Capital 6 2034-09-<strong>30</strong> US87927VAM00<br />

1 500 000 9 457 239<br />

1 798 163 102<br />

Japan<br />

Japan Government 2.500 2036-03-20 #22 (<strong>30</strong> Year) JP1<strong>30</strong>0221643<br />

8 500 000 000 536 636 779<br />

Toyota Motor Credit Corporation 4.35 2010-12-15 US892332AM94<br />

1 500 000 10 271 528<br />

Date (Time): 7/21/<strong>2006</strong> ( 4:45:33PM) Page 2

Holdings per Country<br />

<strong>As</strong> at 6/<strong>30</strong>/<strong>2006</strong><br />

Bond<br />

Security<br />

ISIN<br />

Nominal amount<br />

Market Value (SEK)<br />

546 908 <strong>30</strong>7<br />

Luxembourg<br />

Tyco International Group Ltd 6 2013-11-15 US902118BK35<br />

750 000 5 397 269<br />

Tyco International Group Ltd 6.125 2008-11-01 US902118AM00<br />

2 865 000 21 008 095<br />

Tyco International Group Ltd 6.375% 2011-10-15 US902118BC19<br />

2 310 000 17 156 936<br />

43 562 <strong>30</strong>0<br />

Netherlands<br />

ABN Amro Bank NV 4.65 2018-06-04 Serie US00080QAB14<br />

500 000 3 189 206<br />

Diageo Finance Bv 3.875 2011-04-01 US25244SAB79<br />

900 000 6 051 940<br />

9 241 147<br />

Norway<br />

Eksportfinans 4.75 2008-12-15 US28264QBB95<br />

4 000 000 28 386 166<br />

28 386 166<br />

Puerto Rico<br />

Telecomunicaciones De Puerto Rico 6.8 2009-05-15 US87929DAJ54<br />

125 000 911 661<br />

911 661<br />

Spain<br />

Ayt Cedulas Cajas Global 3.500 2011-03-14 ES0312298047<br />

40 000 000 363 597 354<br />

Ayt Cedulas Cajas Global 4.000 2021-03-24 ES0312298054<br />

20 000 000 175 115 058<br />

BSCH Issuance Ltd 7.625 2009-11-03 US055654AA50<br />

750 000 5 759 209<br />

Im Cedulas #9 4.25 2016-06-09 ES0347785000<br />

20 000 000 182 848 097<br />

La Caja De Ahorros Y Pensiones 4.25 2017-01-269 ES0414970295<br />

<strong>30</strong> 000 000 272 810 353<br />

Telefonica Emisones Sau 7.045 2036-06-20 US87938WAC73<br />

3 875 000 28 025 054<br />

Telefonica Europe BV 7.75 2010-09-15 US879385AC65<br />

2 875 000 22 436 417<br />

1 050 591 542<br />

Supra National<br />

<strong>As</strong>ian Development Bank/pasig 5.5 2016-06-27 US045167BN22<br />

20 000 000 144 000 395<br />

European Investment Bank 4.125 2010-09-15 US298785DP82<br />

15 000 000 104 076 208<br />

European Investment Bank 4.875 2016-02-16 US298785DU77<br />

10 000 000 70 046 998<br />

International Finance Corp 5.125 2011-05-02 US45950KAP57<br />

10 000 000 71 770 373<br />

Nordic Investment Bank 4.75 2007-10-09 SE0000510158<br />

24 000 000 25 281 780<br />

Nordic Investment Bank 5.2 2008-09-03 SE0000496036<br />

35 000 000 37 678 550<br />

452 854 <strong>30</strong>3<br />

Sweden<br />

E.On Sverige AB 3.41 2010-11-24 SE0001577552<br />

75 000 000 74 221 500<br />

E.On Sverige AB 3.9 2010-06-16 SE0001758186<br />

100 000 000 99 360 667<br />

Investor 5.28 2007-04-10 SE0001061060<br />

50 000 000 51 451 167<br />

Investor 5.5 2008-04-07 SE0001032988<br />

100 000 000 105 560 167<br />

Landshypotek 4.85 2008-09-22 SE000111<strong>30</strong>77<br />

200 000 000 212 268 556<br />

Landshypotek 5 2009-12-21 SE0001334657<br />

400 000 000 424 148 000<br />

Länsförsäkringar Bank 2.9 2010-09-<strong>30</strong> SE0001514449<br />

200 000 000 194 502 000<br />

Mellansvensk Kraft 5.7 <strong>2006</strong>-07-05 AP0016002966<br />

10 000 000 9 994 617<br />

NB Hypotek 3 2009-06-17 #5522 SE0001571985<br />

290 000 000 284 154 567<br />

NB Hypotek 3.25 2010-06-16 #5519 SE0001426438<br />

860 000 000 838 735 544<br />

NB Hypotek 4.5 2008-09-17 #5518 SE0001040718<br />

1 508 000 000 1 588 896 660<br />

Date (Time): 7/21/<strong>2006</strong> ( 4:45:33PM) Page 3

Holdings per Country<br />

<strong>As</strong> at 6/<strong>30</strong>/<strong>2006</strong><br />

Bond<br />

Security<br />

ISIN<br />

Nominal amount<br />

Market Value (SEK)<br />

Sweden continued...<br />

Sandvik AB 5.7 # 103 2007-01-25 SE0000894214<br />

100 000 000 103 990 167<br />

Scania CV 6.27 2007-02-12 #150 SE0000900078<br />

80 000 000 83 505 200<br />

SEB Bolån 4 2011-06-15 SE0001572082<br />

760 000 000 759 518 667<br />

SEB Bolån 4.75 2008-06-18 SE0001033192<br />

1 400 000 000 1 435 018 667<br />

Specialfastigheter AB 2.9 2010-09-02 #131 SE0001514480<br />

200 000 000 196 435 111<br />

Spintab AB 3.5 2010-06-16 #SPI 174 SE0001426164<br />

200 000 000 196 796 222<br />

Spintab Swedmortgage AB 5 2008-06-18 #173 SE0001018433<br />

340 000 000 349 862 267<br />

Spintab Swedmortgage AB 6 2009-04-20 #SPI 168 SE0000454803<br />

<strong>30</strong>0 000 000 320 984 000<br />

Stadshypotek 6 2007-09-19 SE0000894917<br />

387 000 000 417 349 8<strong>30</strong><br />

Stadshypotek 6 2009-03-18 SE0001078064<br />

200 000 000 214 816 000<br />

Stadshypotek 6 2010-09-15 SE0001292897<br />

878 000 000 984 905 280<br />

Statshypotek 6 2011-06-15 #1571 SE0001384769<br />

1 600 000 000 1 737 760 000<br />

Svenska Handelsbanken 6.9 2008-01-02 #526 SE0000431256<br />

100 000 000 108 437 667<br />

Swedish Coverd Bond 5.5 2008-12-17 #SBAB 118 SE0001721077<br />

1 143 000 000 1 225 120 105<br />

Swedish Government 4 2009-12-01 #1048 SE0001173709<br />

633 000 000 654 346 167<br />

Swedish Government 3 2016-12-07 #1050 SE0001517699<br />

2 075 000 000 1 962 327 500<br />

Swedish Government 4.5 2015-08-12 #1049 SE0001250135<br />

254 000 000 273 316 700<br />

Swedish Government 5 2009-01-28 #1043 SE0000460297<br />

2 000 000 2 114 422<br />

Swedish Government 5.0 2020-12-01 #1047 SE0001149311<br />

10 000 000 11 275 278<br />

Swedish Government 5.25 2011-03-15 #1045 SE0000722852<br />

310 000 000 333 625 875<br />

Swedish Government 5.5 2012-10-08 #1046 SE0000909640<br />

1 539 000 000 1 733 880 150<br />

Swedish Government 6.5 2008-05-05 #1040 SE0000412397<br />

64 000 000 68 257 956<br />

Swedish Government 6.75 2014-05-05 #1041 SE0000412389<br />

667 000 000 796 806 538<br />

Swedish Government 8 2007-08-15 # 1037 SE0000<strong>30</strong>4149<br />

17 000 000 19 116 500<br />

Swedish Match 5.35 2008-03-19 SE0001031006<br />

50 000 000 52 183 125<br />

17 925 042 839<br />

USA<br />

Abbott Laboratories 5.600 2011-05-15 US002824AS99<br />

4 600 000 33 178 007<br />

Aetna Inc 6.625 2036-06-15 US00817YAF51<br />

2 640 000 19 007 791<br />

AIG Sunamerica Glob Fin 5.85 2008-08-01 US008739AA25<br />

405 000 2 997 188<br />

Allstate Corp/the 4.5 2009-05-29 US02003MAA27<br />

1 800 000 12 603 523<br />

Allstate Corp/the 5.55 2035-05-09 US020002AS04<br />

1 775 000 11 137 156<br />

American Express Centurion 4.375 2009-07-<strong>30</strong> US02581FVU01<br />

6 175 000 43 7<strong>30</strong> 873<br />

American International Group 4.25 2013-05-15 US026874AT47<br />

5 000 000 32 901 126<br />

AOL Time Warner Inc 7.625 2031-04-15 US00184AAC99<br />

750 000 5 903 377<br />

Archstone Smith Trust 5 2007-08-15 US039583AA76<br />

175 000 1 273 893<br />

Archstone Smith Trust 5.625 2014-08-15 US03958QAC24<br />

1 700 000 12 140 325<br />

ASIF Global Funding BND/Corporation 3.85 20071126 US045180AA47<br />

945 000 6 665 651<br />

<strong>As</strong>surant Inc 6.75 2034-02-15 US04621XAD03<br />

1 500 000 10 880 874<br />

AT&T Broadband Corporation 8.375 2013-03-15 US00209TAA34<br />

3 760 000 <strong>30</strong> 709 058<br />

AT&T Wireless Group 7.875 2011-03-01 US00209AAE64<br />

2 200 000 17 487 928<br />

Avalonbay Comm 6.625 2011-09-15 US05348EAE95<br />

750 000 5 663 827<br />

Bank <strong>of</strong> America Corp 4.5 2010-08-01 US060505BU72<br />

4 855 000 34 153 583<br />

Bank <strong>of</strong> America Corp 4.875 2012-09-15 US060505AR52<br />

1 015 000 7 061 476<br />

Bank <strong>of</strong> America Corp 5.875 2009-02-15 US066050CV50<br />

5 700 000 42 200 659<br />

Bank <strong>of</strong> America Corp 7.4 2011-01-15 US060505AG97<br />

4 675 000 37 000 767<br />

Bank <strong>of</strong> America Corp 7.8 2010-02-15 US060505AD66<br />

470 000 3 713 139<br />

Bank Of New York 5.2 2007-07-01 US064057BB79<br />

440 000 3 237 393<br />

Bank One NA 3.7 2008-01-15 US06423EPM11<br />

6 475 000 46 108 141<br />

Date (Time): 7/21/<strong>2006</strong> ( 4:45:33PM) Page 4

Holdings per Country<br />

<strong>As</strong> at 6/<strong>30</strong>/<strong>2006</strong><br />

Bond<br />

Security<br />

ISIN<br />

Nominal amount<br />

Market Value (SEK)<br />

USA continued...<br />

Bank One Corporation (Texas) 6.25 2008-02-15 US06422KAA07<br />

3 650 000 27 123 014<br />

Bear Stearns Companies Inc 4.55 2010-06-23 US073902KD90<br />

7 000 000 48 315 007<br />

Bellsouth Capital Funding 7.75 2010-02-15 US079857AG34<br />

750 000 5 881 109<br />

Bellsouth Capital Funding 7.875 20<strong>30</strong>-02-15 US079857AH17<br />

2 000 000 16 120 496<br />

Bellsouth Corporation Gloabal 6.55 2034-06-15 US079860AE23<br />

675 000 4 637 969<br />

Bellsouth Corporation Gloabal 6.875 2031-10-15 US079860AD40<br />

900 000 6 518 741<br />

Berkshire Hathaway Finance Corp 4.125 2010-01-15 US084664AR26<br />

6 <strong>30</strong>0 000 44 063 843<br />

Boeing Capital Corporation 4.75 2008-08-25 US097014AJ33<br />

2 000 000 14 374 470<br />

Boeing Capital Corporation 6.1 2011-03-01 US097014AD62<br />

2 295 000 17 080 113<br />

Bristol Myers Squibb Corporation 5.75 2011-10-01 US110122AG36<br />

5 625 000 41 045 628<br />

Burlington Northern Santa Fe Corp 7.125 2010-12-15 US12189TAS33<br />

2 000 000 15 197 096<br />

Burlington Northern Santa Fe Corp 7.875 2007-04-15 US12189TAP93<br />

750 000 5 565 708<br />

Capital One Bank MTN BE 4.875 2008-05-15 US14040EHF25<br />

1 000 000 7 134 094<br />

Carolina Power and Light Company 5.25 2015-12-15 US144141CX47<br />

1 000 000 6 812 434<br />

CenterPoint Energy Houston 6.95 2033-03-15 #K2 US15189XAD03<br />

475 000 3 640 685<br />

CenterPoint Energy Resources 7.875 2013-04-01 US15189YAB20<br />

1 500 000 11 960 288<br />

Centex Corporation 5.25 2015-06-15 US152312AQ77<br />

1 105 000 7 123 735<br />

ChevronTexaco Capital co 3.5 2007-09-17 US166760AA64<br />

3 000 000 21 321 485<br />

Cisco Systems 5.25 2001-02-22 US17275RAB87<br />

2 200 000 15 838 591<br />

Citicorp 6.375 2008-11-15 US17<strong>30</strong>3MJC47<br />

2 000 000 14 734 623<br />

Citigroup Inc 4.625 2010-08-03 US172967DA60<br />

6 000 000 42 412 <strong>30</strong>3<br />

Citigroup Inc Global 6 2033-10-31 US172967CC36<br />

525 000 3 602 776<br />

Citigroup Inc Global 5.125 2014-05-05 US172967CK51<br />

5 500 000 38 036 853<br />

Citigroup Inc Global 5.85 2034-12-11 US172967CT60<br />

1 485 000 10 072 192<br />

Citigroup Inc Global 5.875 2033-02-22 US172967BU43<br />

2 853 000 19 537 810<br />

Citigroup Inc Global 6.2 2009-03-15 US172967AX90<br />

7 875 000 58 545 249<br />

Comcast Cable Communications 7.125 2013-06-15 US20029PAN96<br />

1 820 000 13 762 514<br />

Comcast Corp 5.9 2016-03-15 US200<strong>30</strong>NAL55<br />

3 200 000 22 569 508<br />

Conoco Funding Co 6.35 2011-10-15 US20825UAB08<br />

4 440 000 33 172 263<br />

Consolidated Natural Gas Co 6.85 2011-04-15 US209615BV48<br />

1 690 000 12 901 937<br />

Costco Wholesale Cost Corporation 5.5 2007-03-15 US22160KAA34<br />

3<strong>30</strong> 000 2 412 208<br />

Cox Communications Inc 4.625 2010-01-15 US224044BP12<br />

1 765 000 12 406 918<br />

Cox Communications Inc 5.5 2015-10-01 US224044BH95<br />

1 500 000 10 107 819<br />

Credit Suisse First Boston USA 6.5 2012-01-15 US22541LAC72<br />

5 000 000 38 088 985<br />

CRH America Inc 6.4 2033-10-15 US12626PAF09<br />

<strong>30</strong>0 000 2 109 290<br />

CSX Corporation 5.5 2013-08-01 US126408GD91<br />

1 050 000 7 543 7<strong>30</strong><br />

CVS Corporation 3.875 2007-11-01 US126650AJ96<br />

150 000 1 062 268<br />

CVS Corporation 4 2009-09-15 US126650AU42<br />

865 000 5 972 422<br />

Daimler Chrysler North America Hldg 7.45 20270<strong>30</strong>1 US171196AP38<br />

3 765 000 28 512 218<br />

Devon Energy Corportion 7.875 2031-09-<strong>30</strong> US25179SAD27<br />

860 000 7 214 510<br />

Dominion Resources Inc 8.125 2010-06-15 US25746UAA79<br />

1 505 000 11 754 203<br />

DTE Energy Co 6.35 2016-06-01 US233331AM92<br />

1 400 000 10 062 373<br />

Eop Operating Limited Partnership 6.8 2009-01-15 US268766BF82<br />

1 500 000 11 369 498<br />

Eop Operating Limited Partnership 6.95 2011-03-02 US26884AAM53<br />

335 000 2 568 364<br />

ERP Oper Ltd Partnership 5.2 2013-04-01 US26884AAQ67<br />

1 750 000 12 164 459<br />

ERP Oper Ltd Partnership 6.625 2012-03-15 US26884AAN37<br />

400 000 3 016 416<br />

Fannie Mae 5.125 2011-04-15 US31359MM268<br />

<strong>30</strong> 000 000 214 917 051<br />

Fannie Mae 7.25 2010-01-15 US31359MFG33<br />

<strong>30</strong> 000 000 235 289 002<br />

Federal Home Loan Bank System 3.875 2013-06-14 US31339X2M59<br />

20 000 000 1<strong>30</strong> 910 250<br />

Federal Home Loan Bank System 5.375 2009-07-17 US3133XFYK63<br />

40 000 000 288 042 877<br />

Date (Time): 7/21/<strong>2006</strong> ( 4:45:33PM) Page 5

Holdings per Country<br />

<strong>As</strong> at 6/<strong>30</strong>/<strong>2006</strong><br />

Bond<br />

Security<br />

ISIN<br />

Nominal amount<br />

Market Value (SEK)<br />

USA continued...<br />

Federated Dept Stores Inc Del 6.625 2008-09-01 US31410HAT86<br />

3 040 000 22 754 358<br />

First Union Corporation 7.8 2010-08-18 US33738MAE12<br />

2 250 000 17 883 903<br />

Fleet Boston Finl Corporation 3.85 2008-02-15 US3390<strong>30</strong>AG32<br />

3 750 000 26 644 932<br />

Fleet National Bank 5.75 2009-01-15 US33901LAA26<br />

1 660 000 12 288 378<br />

Florida Power & Lt Co 5.4 2035-09-01 US341081EU75<br />

4 400 000 28 670 905<br />

Florida Power Corporation 4.8 2013-03-01 US341099CC12<br />

525 000 3 572 820<br />

Freddie Mac 5.125 2011-04-18 US3137EAAB58<br />

<strong>30</strong> 000 000 214 979 073<br />

Freddie Mac 5.250 2016-04-18 US3137EAAD15<br />

20 000 000 142 417 647<br />

Freddie Mac 5.5 2011-09-15 US3134A4HF43<br />

40 000 000 293 106 102<br />

General Electric Capital Corp 3.75 2009-12-15 US36962GM274<br />

2 775 000 18 837 460<br />

General Electric Capital Corp 4.875 2010-10-21 US36962GS628<br />

2 980 000 21 032 122<br />

General Electric Capital Corp 5.45 2013-01-15 US36962GZY33<br />

2 000 000 14 492 229<br />

General Electric Capital Corp 6.75 2032-03-15 US36962GXZ26<br />

6 050 000 47 271 245<br />

General Electric Capital Corp Float 2008-01-15 US36962GN751<br />

11 400 000 83 326 784<br />

Golden West Finl Corp Del 4.125 2007-08-15 US381317AP11<br />

3 785 000 27 233 551<br />

Goldman Sachs Group Inc 5.7 2012-09-01 US38141GCG73<br />

8 250 000 59 712 866<br />

Goldman Sachs Group Inc 5 2011-01-15 US38141GEF72<br />

4 150 000 29 574 666<br />

Goldman Sachs Group Inc 5.25 2013-04-01 US38141GDB77<br />

1 <strong>30</strong>0 000 9 103 145<br />

Goldman Sachs Group Inc 5.35 2016-01+15 US38141GEE08<br />

5 080 000 35 408 926<br />

Goldman Sachs Group Inc 6.6 2012-01-15 US38141GBU76<br />

675 000 5 153 039<br />

Halliburton Co 5.5 2010-10-15 US406216AR24<br />

5 000 000 36 039 706<br />

Harrah's Operation Inc 8 2011-02-01 US413627AH33<br />

250 000 2 001 595<br />

Household Finance Corporation 4.125 2009-11-16 US441812KH60<br />

3 210 000 22 087 155<br />

Household Finance Corporation 5.75 2007-01-<strong>30</strong> US441812JX<strong>30</strong><br />

700 000 5 165 635<br />

Household Finance Corporation 6.375 2010-08-01 US441812GA63<br />

600 000 4 517 678<br />

Household Finance Corporation 6.4 2008-06-17 US441812FY58<br />

750 000 5 482 288<br />

Household Finance Corporation 6.5 2008-11-15 US441812GD03<br />

575 000 4 250 267<br />

Household Finance Corporation 7.875 2007-03-01 US441812GK46<br />

2 875 000 21 549 603<br />

HSBC Bank USA 5.875 2034-11-01 US4042Q1AA55<br />

3 000 000 19 823 981<br />

IBM Corporation 5.875 2032-11-29 US459200BB69<br />

2 750 000 19 007 518<br />

Jersey Central Power & Light 5.625 2016-05-01 US476556CM51<br />

2 000 000 14 076 847<br />

John Hancock 5.625 2008-12-01 US41014SAA42<br />

275 000 1 987 240<br />

Johnson Controls Inc 4.875 2013-09-15 US478366AM91<br />

200 000 1 363 886<br />

Johnson Controls Inc 5.5 2016-01-15 US478366AR88<br />

3 220 000 22 660 106<br />

JP Morgan & Co Inc 6.625 2012-03-15 US46625HAN08<br />

1 575 000 11 959 935<br />

JP Morgan Chase & Co 5.600 2011-06-01 US46625HGG92<br />

4 500 000 32 393 482<br />

JP Morgan Chase & Co Inc 4 2008-02-01 US46625HAV24<br />

6 265 000 44 754 283<br />

JP Morgan Chase & Co Inc. 5.25 2007-05-<strong>30</strong> US46625HAP55<br />

2 250 000 16 207 9<strong>30</strong><br />

Kellogg Co 2.875 2008-06-01 US487836AY41<br />

2 500 000 17 139 620<br />

Kraft Foods Inc 4 2008-10-01 US50075NAK00<br />

4 000 000 28 026 665<br />

Kraft Foods Inc 5.25 2007-06-01 US50075NAG97<br />

2 000 000 14 394 146<br />

Kraft Foods Inc 5.625 2011-11-01 US50075NAB01<br />

980 000 7 006 056<br />

Lasmo USA Inc 6.75 2007-12-15 US51808BAF94<br />

750 000 5 486 022<br />

Lehman Brothers Holdings Inc 5.5 2016-04-04 US52517PF635<br />

2 375 000 16 594 720<br />

Lehman Brothers Holdings Inc 5.75 2011-04-25 US52517PG963<br />

4 415 000 31 873 092<br />

Lehman Brothers Holdings MTN 6.625 2012-01-18 US52517PSC67<br />

700 000 5 359 734<br />

Lehman Brothers Holdings PLC 8.25 2007-06-15 US524908CK48<br />

4 000 000 29 595 089<br />

Lincoln National Corp 6.150 2036-04-07 US534187AR02<br />

975 000 6 715 <strong>30</strong>4<br />

Lockheed Martin Corporation 8.5 2029-12-01 US5398<strong>30</strong>AK58<br />

1 914 000 17 432 066<br />

Marsh & McLennan Cos Inc 5.375 2007-03-15 US571748AD44<br />

1 425 000 10 403 067<br />

Date (Time): 7/21/<strong>2006</strong> ( 4:45:33PM) Page 6

Holdings per Country<br />

<strong>As</strong> at 6/<strong>30</strong>/<strong>2006</strong><br />

Bond<br />

Security<br />

ISIN<br />

Nominal amount<br />

Market Value (SEK)<br />

USA continued...<br />

Marsh & McLennan Cos Inc 5.375 2014-07-15 US571748AM43<br />

3 335 000 22 952 861<br />

Marsh & McLennan Cos Inc 5.75 2015-09-15 US571748AP73<br />

2 440 000 16 859 261<br />

May Department Stores Co 5.75 2014-07-15 US577778BS12<br />

950 000 6 808 452<br />

May Department Stores Co 6.7 2034-07-15 US577778CE17<br />

35 000 253 382<br />

Merck & Company Inc 4.375 2013-02-15 US589331AH03<br />

1 095 000 7 351 495<br />

Merck & Company Inc 6.4 2028-03-01 US589331AD98<br />

3 345 000 24 384 144<br />

Merrill Lynch & Co Inc 4 2007-11-15 US59018YNZ06<br />

3 000 000 21 248 595<br />

Merrill Lynch & Co Inc 4.25 2010-02-08 US59018YUZ23<br />

9 260 000 64 609 320<br />

Metlife Inc 5 2013-11-24 US59156RAG39<br />

2 900 000 19 768 016<br />

Metlife Inc 6,125 2011-12-01 US59156RAC25<br />

2 800 000 20 526 952<br />

Midamerican Energy Holdings Co 6.125 2036-04-01 US59562VAL18<br />

1 375 000 9 494 494<br />

Morgan Stanley Dean Witter & Co 5.05 2011-01-21 US61746SBS77<br />

15 500 000 112 034 607<br />

Morgan Stanley Dean Witter & Co 6.75 2011-04-15 US617446GM50<br />

3 000 000 22 699 371<br />

National City Corporation 3.2 2008-04-01 US635405AN31<br />

6 025 000 41 951 458<br />

News America Inc 6.2 2034-12-15 US652482BJ86<br />

3 180 000 20 904 067<br />

News America Inc 6.400 2035-12-15 US652482BL33<br />

1 100 000 7 402 970<br />

Nisource Finance Corporation 5.40 2014-07-15 US65473QAL77<br />

1 575 000 11 014 869<br />

Nisource Finance Corporation 7.875 2010-11-15 US65473QAJ22<br />

2 325 000 18 218 733<br />

Noble Corporation 5.875 2013-06-01 USG65422AA86<br />

1 650 000 11 838 567<br />

Norfolk Southern Corporation 5.257 2014-09-17 US655844AU21<br />

2 500 000 17 574 852<br />

Norfolk Southern Corporation 5.64 2029-05-17 US655844AX69<br />

1 203 000 8 017 321<br />

Norfolk Southern Corporation 7.8 2027-05-15 US655844AJ75<br />

47 000 401 288<br />

Northrop Corporation 7.125 2011-02-15 US666807AT91<br />

350 000 2 719 379<br />

Northrop Corporation 7.75 2031-02-15 US666807AW21<br />

2 003 000 17 <strong>30</strong>7 734<br />

Northrop Corporation 7.875 2026-03-01 US666807AQ52<br />

1 3<strong>30</strong> 000 11 434 255<br />

Nuveen Investments 5.5 2015-09-15 US67090FAB22<br />

2 000 000 13 752 105<br />

Ocean Energy Inc 4.375 2007-10-01 US67481EAB20<br />

5<strong>30</strong> 000 3 783 521<br />

Ohio Edison Co 6.875 2036-07-15 US677347CE41<br />

975 000 7 151 288<br />

Oracle Corp And Ozark Holding 5.250 2016-01-15 US68402LAC81<br />

5 975 000 41 345 705<br />

Pfizer Inc 4.65 2018-03-01 US717081AQ68<br />

2 925 000 19 190 672<br />

Philip Morris Companies Inc 7.75 2027-01-15 US718154CF28<br />

200 000 1 668 162<br />

Phillips Petroleum Co 8.75 2010-05-25 US718507BQ87<br />

4 000 000 32 051 327<br />

Principal Life Global 3.2 2009-04-01 US74254PAA03<br />

3 000 000 20 427 227<br />

Procter & Gamble Co 6.875 2009-09-15 US742718BM03<br />

2 475 000 18 852 807<br />

Progress Energy Inc 7.1 2011-03-01 US743263AD77<br />

2 000 000 15 358 706<br />

Progress Energy Inc 7.75 2031-03-01 US743263AE50<br />

1 250 000 10 286 642<br />

Progressive Corporation 6.25 2032-12-01 US743315AL75<br />

500 000 3 574 576<br />

Prologis 5.25 2010-11-15 US743410AF93<br />

1 235 000 8 688 662<br />

Protective Life Secured Trust 3.7 2008-11-24 US74367FAA66<br />

1 225 000 8 473 257<br />

Prudential Financial INC 3.75 2008-05-01 US74432QAA31<br />

1 500 000 10 496 464<br />

Prudential Financial INC 5.4 2035-06-13 US74432QAH83<br />

975 000 6 016 327<br />

Public Service Elec & Gas Co 5.375 2013-09-01 US74456QAL05<br />

825 000 5 853 091<br />

Pulte Corporation 6.375 2033-05-15 US745867AP60<br />

390 000 2 483 313<br />

Quest Diagnostics Inc 5.125 2010-11-01 US74834LAK61<br />

1 400 000 9 878 802<br />

Raytheon Corporation 4.85 2011-01-15 US755111BQ38<br />

2 505 000 17 786 398<br />

Raytheon Corporation 6.75 2007-08-15 US755111AE17<br />

2 278 000 16 999 176<br />

Residential Capital Corp 6.500 2013-04-17 US76113BAR06<br />

1 850 000 13 219 347<br />

Rio Tinto Finance Ltd 2.625 2008-09-<strong>30</strong> US767201AB24<br />

645 000 4 373 188<br />

Rohm & Haas Co 7.85 2029-07-15 US775371AU10<br />

500 000 4 332 539<br />

SBC Communications 6.15 2034-09-15 US78387GAQ64<br />

2 600 000 17 525 842<br />

Date (Time): 7/21/<strong>2006</strong> ( 4:45:33PM) Page 7

Holdings per Country<br />

<strong>As</strong> at 6/<strong>30</strong>/<strong>2006</strong><br />

Bond<br />

Security<br />

ISIN<br />

Nominal amount<br />

Market Value (SEK)<br />

USA continued...<br />

Schering-Plough Corporation adj 2033-12-01 US806605AG68<br />

1 780 000 13 235 061<br />

Slm Corp 3.625 2008-03-17 US78442FAN87<br />

1 600 000 11 255 863<br />

Slm Corp 4 2010-01-15 US78442FDE51<br />

4 175 000 28 954 411<br />

Southwest Airlines Co 5.125 2017-03-01 US844741AX63<br />

1 000 000 6 616 437<br />

Sovereign Bank 5.125 2013-03-15 US84603MEX02<br />

275 000 1 902 908<br />

Sprint Capital Corporation 6.875 2028-11-15 US852060AD48<br />

4 060 000 29 682 499<br />

Sprint Capital Corporation 7.625 2011-01-<strong>30</strong> US852060AJ18<br />

2 450 000 19 329 804<br />

Sprint Capital Corporation 8.75 2032-03-15 US852060AT99<br />

725 000 6 446 026<br />

St Paul Travelers Cos Inc 6.75 2036-06-20 US792860AK49<br />

2 100 000 15 024 112<br />

State Street Corporation 7.65 2010-06-15 US857477AB95<br />

485 000 3 740 720<br />

Suntrust Bankings Inc 4.25 2009-10-15 US867914AY98<br />

5 000 000 34 766 349<br />

TCI Communications Inc 7.125 2028-02-15 US872287AL19<br />

2 225 000 16 588 871<br />

TCI Communications Inc 7.875 2026-02-15 US872287AF41<br />

2 380 000 19 141 742<br />

Teva Pharmaceutical Finance LL 5.55 2016-01-02 US88163VAC37<br />

2 825 000 19 549 218<br />

Texaco Capital Inc 5.5 2009-01-15 US881685BJ94<br />

1 725 000 12 735 066<br />

Texas Eastn Transmission Corporation 5.25 20070715 US882389CB31<br />

2 500 000 18 378 378<br />

Tiaa Global Markets 3.875 2008-01-22 US87244HAF29<br />

350 000 2 496 235<br />

Tiaa Global Markets 4.125 2007-11-15 US87244HAB15<br />

175 000 1 241 425<br />

Time Warner Inc 6.625 2029-05-15 US887315BN85<br />

725 000 5 078 853<br />

Time Warner Inc 6.95 2028-01-15 US887315BM03<br />

990 000 7 359 338<br />

Time Warner Inc 7.57 2024-02-01 US887315BH18<br />

4 675 000 36 761 894<br />

Toyota Motor Credit Corporation 2.875 2008-08-01 US892332AL12<br />

650 000 4 477 240<br />

Travelers Property Casualty Corp 5 2013-03-15 US89420GAH20<br />

1 100 000 7 599 160<br />

Union Pacific Corporation 5.75 2007-10-15 US907818CM83<br />

2 400 000 17 494 375<br />

Union Pacific Corporation 6.625 2029-02-01 US907818CF33<br />

1 000 000 7 620 234<br />

United States Bancorp 3.95 2007-08-23 US91159HGD61<br />

3 858 000 27 648 385<br />

United States Bancorp 4.4 2008-08-15 US90331HKW24<br />

2 325 000 16 604 453<br />

United States Treasury Note/bo 4.5 2016-02-15 US912828EW61<br />

8 515 000 59 375 575<br />

United States Treasury Note/bo 5.125 2016-05-15 US912828FF20<br />

11 535 000 83 509 760<br />

United Technologies Corporation 4.875 <strong>2006</strong>-11-01 US91<strong>30</strong>17BE81<br />

800 000 5 794 071<br />

United Technologies Corporation 7.5 2029-0915 US91<strong>30</strong>17BA69<br />

700 000 5 954 028<br />

UnitedHealth Group Inc 5.2 2007-01-17 US91324PAD42<br />

4 005 000 29 458 080<br />

Unitedhealth Group Inc 5.800 2036-03-15 US91324PAR38<br />

1 925 000 12 694 778<br />

US Bank National <strong>As</strong>sociation 2.87 2007-02-01 US90331HJA23<br />

1 800 000 12 918 429<br />

US Central Credit Union 2.75 2008-05-<strong>30</strong> US90335GAA94<br />

450 000 3 077 891<br />

US Govt Bonds 5.25 2029-02-15 US912810FG86<br />

100 000 000 731 4<strong>30</strong> 880<br />

US Govt Bonds 5.375 2031-02-15 US912810FP85<br />

73 240 000 547 317 246<br />

US Govt Bonds 7.125 2023-02-15 US912810EP94<br />

90 000 000 792 762 532<br />

US Govt Bonds 7.5 2016-11-15 US912810DX38<br />

140 000 000 1 202 087 214<br />

US Govt Bonds 8.75 2020-08-15 US912810EG95<br />

100 000 000 988 227 393<br />

US Govt Notes 4.25 2013-11-15 US912828BR04<br />

20 000 000 137 079 009<br />

US Govt Notes 4.75 2014-05-15 US912828CJ78<br />

66 000 000 466 517 314<br />

US Govt Notes 2.375 <strong>2006</strong>-08-15 US912828BF65<br />

73 000 000 528 754 976<br />

US Govt Notes 2.625 <strong>2006</strong>-11-15 US912828BP48<br />

102 000 000 729 864 681<br />

US Govt Notes 2.625 2008-05-15 US912828AZ39<br />

182 500 000 1 259 <strong>30</strong>8 120<br />

US Govt Notes 3.25 2007-08-15 US912828AH31<br />

164 000 000 1 169 786 394<br />

US Govt Notes 3.375 2008-11-15 US912828BQ21<br />

179 000 000 1 243 919 327<br />

US Govt Notes 3.5 2009-08-15 US912828CS77<br />

145 000 000 1 009 517 172<br />

US Govt Notes 3.5 2009-11-15 US912828DB34<br />

124 000 000 852 651 377<br />

US Govt Notes 4 2012-11-15 US912828AP56<br />

<strong>30</strong> 000 000 204 261 2<strong>30</strong><br />

Date (Time): 7/21/<strong>2006</strong> ( 4:45:33PM) Page 8

Holdings per Country<br />

<strong>As</strong> at 6/<strong>30</strong>/<strong>2006</strong><br />

Bond<br />

Security<br />

ISIN<br />

Nominal amount<br />

Market Value (SEK)<br />

USA continued...<br />

US Govt Notes 4.25 2014-08-15 US912828CT50<br />

44 000 000 <strong>30</strong>3 489 865<br />

US Govt Notes 4.25 2014-11-15 US912828DC17<br />

92 000 000 626 674 398<br />

US Govt Notes 4.5 2010-11-15 US912828EM89<br />

105 000 000 742 857 716<br />

US Govt Notes 4.5 2015-11-15 US912828EN62<br />

2 970 000 20 495 737<br />

US Govt TB <strong>2006</strong>-07-13 US912795XL03<br />

2 000 000 14 381 034<br />

US Govt TB <strong>2006</strong>-07-20 US912795XM85<br />

1 800 000 12 931 734<br />

Valero Energy Corporation 6.125 2007-04-15 US91913YAC49<br />

700 000 5 109 439<br />

Verizon Global Funding Corporation 7.75 20<strong>30</strong>-12-01 US92344GAM87<br />

3 285 000 25 614 018<br />

Verizon Global Funding Corporation 7.75 2032-06-15 US92344GAS57<br />

1 100 000 8 547 414<br />

Verizon Global FundingCorporation 6.125 2007-06-15 US92344GAR74<br />

3 000 000 21 740 351<br />

Verizon New Jersey Inc Global 5.875 2012-01-17 US92344UAA34<br />

580 000 4 198 451<br />

Viacom Inc 5.750 2011-04-<strong>30</strong> US925524AY62<br />

2 660 000 19 060 680<br />

Virginia Electric & Power Co 4.75 2013-03-01 US927804EU44<br />

1 650 000 11 207 055<br />

Wachovia Corporation 4.375 2008-08-15 US92976FAS20<br />

1 005 000 7 171 809<br />

Wachovia Corporation 5.25 2014-08-01 US929903AJ15<br />

1 865 000 13 060 452<br />

Wachovia Corporation 5.5 2035-08-01 US929903AM44<br />

1 000 000 6 458 100<br />

Wal Mart Stores Inc 4.125 2010-07-01 US931142BZ52<br />

10 000 000 69 734 067<br />

Washington Mutal Bank 5.125 2015-01-15 US93933WAC01<br />

1 500 000 10 255 077<br />

Washington Mutual Inc 4.375 2008-01-15 US939322AH68<br />

2 000 000 14 411 184<br />

Waste Management Inc 7.375 2010-08-01 US94106LAK52<br />

700 000 5 475 988<br />

Wellpoint Inc 5.95 2034-12-15 US94973VAH06<br />

1 935 000 12 753 034<br />

Wellpoint Inc 5.85 2036-01-15 US94973VAL18<br />

2 225 000 14 843 253<br />

Wells Fargo Bank NA 4.875 2011-01-12 US949746NB33<br />

585 000 4 173 345<br />

Wells Fargo Company 4 2007-09-10 US949746CN99<br />

4 275 000 <strong>30</strong> 523 141<br />

Wells Fargo Company 4.2 2010-01-15 US949746JJ15<br />

2 675 000 18 762 117<br />

Wells Fargo Company 4.95 2013-10-16 US949746FJ50<br />

3 500 000 24 087 441<br />

Wells Fargo Company 5.125 2007-02-15 US949746CH22<br />

1 425 000 10 431 408<br />

Weyerhaeuser Co 6.125 2007-03-15 US962166BM53<br />

85 000 623 936<br />

Wisconsin electric Pwr Co 5.625 2033-05-15 US976656BW74<br />

500 000 3 318 878<br />

World Savings Bank 4.125 2008-03-10 US98151GAC96<br />

1 500 000 10 671 332<br />

Wyeth 6.000 2036-02-15 US98<strong>30</strong>24AL46<br />

6 <strong>30</strong>0 000 43 386 656<br />

XTO Energy Inc 5 2015-01-31 US98385XAF33<br />

1 000 000 6 742 911<br />

Total Bonds<br />

19 055 736 158<br />

60 121 982 710<br />

Date (Time): 7/21/<strong>2006</strong> ( 4:45:33PM) Page 9

Holdings per Country<br />

<strong>As</strong> at 6/<strong>30</strong>/<strong>2006</strong><br />

Index bond<br />

Security<br />

ISIN<br />

Nominal amount<br />

Market Value (SEK)<br />

Sweden<br />

Specialfastigheter 123 4 2008-12-01 SE0001018961<br />

50 000 000 62 553 682<br />

Swedish Government 1 2012-04-01 #3106 SE0001517707<br />

315 000 000 <strong>30</strong>1 753 105<br />

Swedish Government 3.5 2015-12-01 #3105 SE0000555955<br />

3 602 000 000 4 606 619 000<br />

Swedish Government 3.5 2028-12-01 #3104 SE0000556599<br />

3 468 000 000 4 915 667 651<br />

Swedish Government 4 2008-12-01 #3101 SE0000<strong>30</strong>6805<br />

<strong>30</strong>6 000 000 385 086 814<br />

Swedish Government 4 2020-12-01 #3102 SE0000317943<br />

2 317 000 000 3 412 439 695<br />

13 684 119 947<br />

USA<br />

US Treasury Index Bond 1.875 2015-07-15 US912828EA42<br />

170 000 000 1 213 411 419<br />

US Treasury Index Bond 3.875 2029-04-15 US912810FH69<br />

50 000 000 549 214 577<br />

Total Index bonds<br />

1 762 625 996<br />

15 446 745 943<br />

Date (Time): 7/21/<strong>2006</strong> ( 4:45:33PM) Page 10

![Annual report 2005 [pdf 2.7 MB] - Första AP-fonden](https://img.yumpu.com/45756023/1/190x226/annual-report-2005-pdf-27-mb-farsta-ap-fonden.jpg?quality=85)

![Annual report 2004 [pdf 5.7 MB] - Första AP-fonden](https://img.yumpu.com/19949344/1/190x235/annual-report-2004-pdf-57-mb-forsta-ap-fonden.jpg?quality=85)