Statement of Financial Accounting Standards No. 157 - Paper Audit ...

Statement of Financial Accounting Standards No. 157 - Paper Audit ...

Statement of Financial Accounting Standards No. 157 - Paper Audit ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

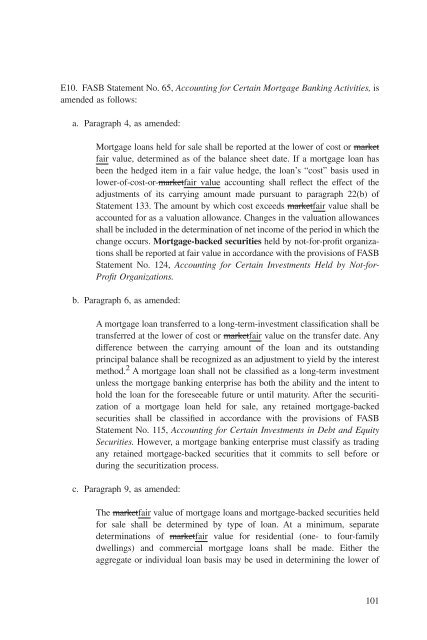

E10. FASB <strong>Statement</strong> <strong>No</strong>. 65, <strong>Accounting</strong> for Certain Mortgage Banking Activities, is<br />

amended as follows:<br />

a. Paragraph 4, as amended:<br />

Mortgage loans held for sale shall be reported at the lower <strong>of</strong> cost or market<br />

fair value, determined as <strong>of</strong> the balance sheet date. If a mortgage loan has<br />

been the hedged item in a fair value hedge, the loan’s “cost” basis used in<br />

lower-<strong>of</strong>-cost-or-marketfair value accounting shall reflect the effect <strong>of</strong> the<br />

adjustments <strong>of</strong> its carrying amount made pursuant to paragraph 22(b) <strong>of</strong><br />

<strong>Statement</strong> 133. The amount by which cost exceeds marketfair value shall be<br />

accounted for as a valuation allowance. Changes in the valuation allowances<br />

shall be included in the determination <strong>of</strong> net income <strong>of</strong> the period in which the<br />

change occurs. Mortgage-backed securities held by not-for-pr<strong>of</strong>it organizations<br />

shall be reported at fair value in accordance with the provisions <strong>of</strong> FASB<br />

<strong>Statement</strong> <strong>No</strong>. 124, <strong>Accounting</strong> for Certain Investments Held by <strong>No</strong>t-for-<br />

Pr<strong>of</strong>it Organizations.<br />

b. Paragraph 6, as amended:<br />

A mortgage loan transferred to a long-term-investment classification shall be<br />

transferred at the lower <strong>of</strong> cost or marketfair value on the transfer date. Any<br />

difference between the carrying amount <strong>of</strong> the loan and its outstanding<br />

principal balance shall be recognized as an adjustment to yield by the interest<br />

method. 2 A mortgage loan shall not be classified as a long-term investment<br />

unless the mortgage banking enterprise has both the ability and the intent to<br />

hold the loan for the foreseeable future or until maturity. After the securitization<br />

<strong>of</strong> a mortgage loan held for sale, any retained mortgage-backed<br />

securities shall be classified in accordance with the provisions <strong>of</strong> FASB<br />

<strong>Statement</strong> <strong>No</strong>. 115, <strong>Accounting</strong> for Certain Investments in Debt and Equity<br />

Securities. However, a mortgage banking enterprise must classify as trading<br />

any retained mortgage-backed securities that it commits to sell before or<br />

during the securitization process.<br />

c. Paragraph 9, as amended:<br />

The marketfair value <strong>of</strong> mortgage loans and mortgage-backed securities held<br />

for sale shall be determined by type <strong>of</strong> loan. At a minimum, separate<br />

determinations <strong>of</strong> marketfair value for residential (one- to four-family<br />

dwellings) and commercial mortgage loans shall be made. Either the<br />

aggregate or individual loan basis may be used in determining the lower <strong>of</strong><br />

101