Statement of Financial Accounting Standards No. 157 - Paper Audit ...

Statement of Financial Accounting Standards No. 157 - Paper Audit ...

Statement of Financial Accounting Standards No. 157 - Paper Audit ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

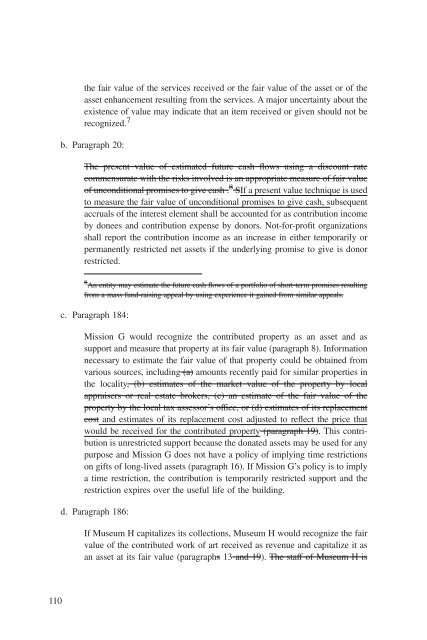

the fair value <strong>of</strong> the services received or the fair value <strong>of</strong> the asset or <strong>of</strong> the<br />

asset enhancement resulting from the services. A major uncertainty about the<br />

existence <strong>of</strong> value may indicate that an item received or given should not be<br />

recognized. 7<br />

b. Paragraph 20:<br />

The present value <strong>of</strong> estimated future cash flows using a discount rate<br />

commensurate with the risks involved is an appropriate measure <strong>of</strong> fair value<br />

<strong>of</strong> unconditional promises to give cash . 8 SIf a present value technique is used<br />

to measure the fair value <strong>of</strong> unconditional promises to give cash, subsequent<br />

accruals <strong>of</strong> the interest element shall be accounted for as contribution income<br />

by donees and contribution expense by donors. <strong>No</strong>t-for-pr<strong>of</strong>it organizations<br />

shall report the contribution income as an increase in either temporarily or<br />

permanently restricted net assets if the underlying promise to give is donor<br />

restricted.<br />

8 An entity may estimate the future cash flows <strong>of</strong> a portfolio <strong>of</strong> short-term promises resulting<br />

from a mass fund-raising appeal by using experience it gained from similar appeals.<br />

c. Paragraph 184:<br />

Mission G would recognize the contributed property as an asset and as<br />

support and measure that property at its fair value (paragraph 8). Information<br />

necessary to estimate the fair value <strong>of</strong> that property could be obtained from<br />

various sources, including (a) amounts recently paid for similar properties in<br />

the locality, (b) estimates <strong>of</strong> the market value <strong>of</strong> the property by local<br />

appraisers or real estate brokers, (c) an estimate <strong>of</strong> the fair value <strong>of</strong> the<br />

property by the local tax assessor’s <strong>of</strong>fice, or (d) estimates <strong>of</strong> its replacement<br />

cost and estimates <strong>of</strong> its replacement cost adjusted to reflect the price that<br />

would be received for the contributed property (paragraph 19). This contribution<br />

is unrestricted support because the donated assets may be used for any<br />

purpose and Mission G does not have a policy <strong>of</strong> implying time restrictions<br />

on gifts <strong>of</strong> long-lived assets (paragraph 16). If Mission G’s policy is to imply<br />

a time restriction, the contribution is temporarily restricted support and the<br />

restriction expires over the useful life <strong>of</strong> the building.<br />

d. Paragraph 186:<br />

If Museum H capitalizes its collections, Museum H would recognize the fair<br />

value <strong>of</strong> the contributed work <strong>of</strong> art received as revenue and capitalize it as<br />

an asset at its fair value (paragraphs 13 and 19). The staff <strong>of</strong> Museum H is<br />

110