Statement of Financial Accounting Standards No. 157 - Paper Audit ...

Statement of Financial Accounting Standards No. 157 - Paper Audit ...

Statement of Financial Accounting Standards No. 157 - Paper Audit ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

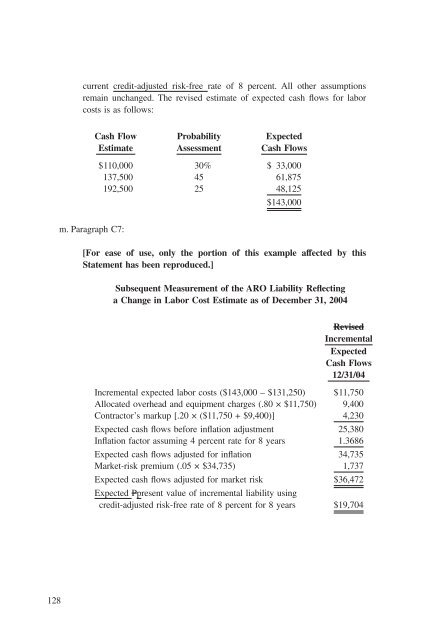

current credit-adjusted risk-free rate <strong>of</strong> 8 percent. All other assumptions<br />

remain unchanged. The revised estimate <strong>of</strong> expected cash flows for labor<br />

costs is as follows:<br />

Cash Flow<br />

Estimate<br />

Probability<br />

Assessment<br />

Expected<br />

Cash Flows<br />

$110,000 30% $ 33,000<br />

137,500 45 61,875<br />

192,500 25 48,125<br />

$143,000<br />

m. Paragraph C7:<br />

[For ease <strong>of</strong> use, only the portion <strong>of</strong> this example affected by this<br />

<strong>Statement</strong> has been reproduced.]<br />

Subsequent Measurement <strong>of</strong> the ARO Liability Reflecting<br />

a Change in Labor Cost Estimate as <strong>of</strong> December 31, 2004<br />

Revised<br />

Incremental<br />

Expected<br />

Cash Flows<br />

12/31/04<br />

Incremental expected labor costs ($143,000 – $131,250) $11,750<br />

Allocated overhead and equipment charges (.80 × $11,750) 9,400<br />

Contractor’s markup [.20 × ($11,750 + $9,400)] 4,230<br />

Expected cash flows before inflation adjustment 25,380<br />

Inflation factor assuming 4 percent rate for 8 years 1.3686<br />

Expected cash flows adjusted for inflation 34,735<br />

Market-risk premium (.05 × $34,735) 1,737<br />

Expected cash flows adjusted for market risk $36,472<br />

Expected Ppresent value <strong>of</strong> incremental liability using<br />

credit-adjusted risk-free rate <strong>of</strong> 8 percent for 8 years $19,704<br />

128