Uncertainty and Risk - DARP

Uncertainty and Risk - DARP

Uncertainty and Risk - DARP

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

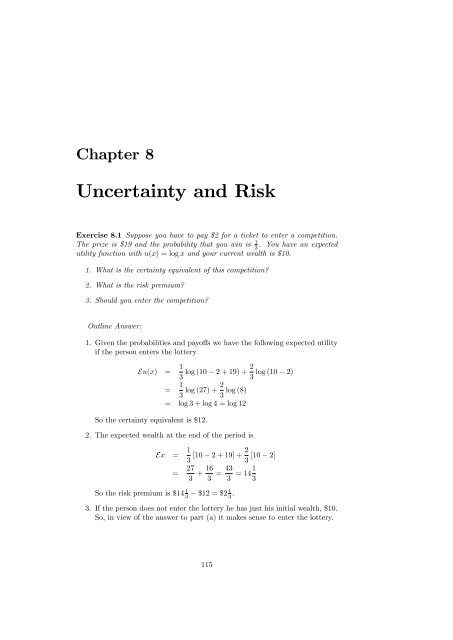

Chapter 8<br />

<strong>Uncertainty</strong> <strong>and</strong> <strong>Risk</strong><br />

Exercise 8.1 Suppose you have to pay $2 for a ticket to enter a competition.<br />

The prize is $19 <strong>and</strong> the probability that you win is 1 3<br />

. You have an expected<br />

utility function with u(x) = log x <strong>and</strong> your current wealth is $10.<br />

1. What is the certainty equivalent of this competition?<br />

2. What is the risk premium?<br />

3. Should you enter the competition?<br />

Outline Answer:<br />

1. Given the probabilities <strong>and</strong> payo¤s we have the following expected utility<br />

if the person enters the lottery<br />

Eu(x) = 1 3 log (10 2 + 19) + 2 log (10 2)<br />

3<br />

= 1 3 log (27) + 2 log (8)<br />

3<br />

= log 3 + log 4 = log 12<br />

So the certainty equivalent is $12.<br />

2. The expected wealth at the end of the period is<br />

Ex = 1 3 [10 2 + 19] + 2 [10 2]<br />

3<br />

= 27 3 + 16 3 = 43<br />

3 = 141 3<br />

So the risk premium is $14 1 3<br />

$12 = $2 1 3 .<br />

3. If the person does not enter the lottery he has just his initial wealth, $10.<br />

So, in view of the answer to part (a) it makes sense to enter the lottery.<br />

115

Microeconomics CHAPTER 8. UNCERTAINTY AND RISK<br />

Exercise 8.2 You are sending a package worth 10 000AC. You estimate that<br />

there is a 0.1 percent chance that the package will be lost or destroyed in transit.<br />

An insurance company o¤ers you insurance against this eventuality for a<br />

premium of 15AC. If you are risk-neutral, should you buy insurance?<br />

Outline Answer:<br />

No you should not. Your expected loss is 10 euros whereas the premium is<br />

15 euros.<br />

cFrank Cowell 2006 116

Microeconomics<br />

Exercise 8.3 Consider the following de…nition of risk aversion. Let P :=<br />

f(x ! ; ! ) : ! 2 g be a r<strong>and</strong>om prospect, where x ! is the payo¤ in state !<br />

<strong>and</strong> ! is the (subjective) probability of state ! , <strong>and</strong> let Ex := P !2 !x ! ,<br />

the mean of the prospect, <strong>and</strong> let P := f(x ! + [1 ]Ex; ! ) : ! 2 g be a<br />

“mixture” of the original prospect with the mean. De…ne an individual as risk<br />

averse if he always prefers P to P for 0 < < 1.<br />

1. Illustrate this concept in (x red ; x blue )-space <strong>and</strong> contrast it with the concept<br />

of risk aversion used in the text<br />

2. Show that this de…nition of risk aversion need not imply convex-to-theorigin<br />

indi¤erence curves.<br />

Outline Answer:<br />

1. See Figure 8.1.<br />

x BLUE<br />

P <br />

P λ<br />

P<br />

x RED<br />

Figure 8.1: Nonconvex indi¤erence curve<br />

2. Let P be the prospect <strong>and</strong> P its mean. P can be any point in the line<br />

joining them. The de…nition implies that moving along this line towards<br />

P puts the person on a successively higher indi¤erence curves. In Figure<br />

8.1 it is clear that this condition is consistent with there being indi¤erence<br />

curves that violate the convex-to-the-origin property locally.<br />

cFrank Cowell 2006 117

Microeconomics CHAPTER 8. UNCERTAINTY AND RISK<br />

Exercise 8.4 Suppose you are asked to choose between two lotteries. In one<br />

case the choice is between P 1 <strong>and</strong> P 2 ;<strong>and</strong> in the other case the choice o¤ered is<br />

between P 3 <strong>and</strong> P 4 , as speci…ed below:<br />

P 1 : $1; 000; 000 with probability 1<br />

8<br />

<<br />

P 2 :<br />

P 3 :<br />

P 4 :<br />

$5; 000; 000<br />

$1; 000; 000<br />

:<br />

$0<br />

$5; 000; 000<br />

$0<br />

$1; 000; 000<br />

$0<br />

with probability 0.1<br />

with probability 0.89<br />

with probability 0.01<br />

with probability 0.1<br />

with probability 0.9<br />

with probability 0.11<br />

with probability 0.89<br />

It is often the case that people prefer P 1 to P 2 <strong>and</strong> then also prefer P 3 to P 4 .<br />

Show that these preferences violate the independence axiom.<br />

Outline Answer:<br />

Let there be only three possible states of the world: red, blue <strong>and</strong> green,<br />

with probabilities 0.01, 0.10, 0.89 respectively. Then the payo¤s in the four<br />

prospects can be written<br />

red blue green<br />

P 1 1 1 1<br />

P 2 0 5 1<br />

P 3 0 5 0<br />

P 4 1 1 0<br />

where all the entries in the table are in millions of dollars. Note that P 1 <strong>and</strong> P 2<br />

have the same payo¤ in the green state; P 3 <strong>and</strong> P 4 form a similar pair, except<br />

that the payo¤ in the green state is 0. Axiom 8.2 states that if P 1 is preferred<br />

to P 2 than any other similar pair of prospects (1; 1; z) <strong>and</strong> (0; 5; z) ought also<br />

to be ranked in the same order, for arbitrary z: but this would imply that P 4<br />

is preferred to P 3 , the opposite of the preferences as stated.<br />

Note also that if the preferences had been such that P 4 was preferred to P 3<br />

then the independence axiom would imply that P 1 was preferred to P 2 .<br />

cFrank Cowell 2006 118

Microeconomics<br />

Exercise 8.5 This is an example to illustrate disappointment. Suppose the<br />

payo¤s are as follows<br />

x 00 weekend for two in your favourite holiday location<br />

x 0 book of photographs of the same location<br />

x …sh-<strong>and</strong>-chip supper<br />

Your preferences under certainty are x 00 x 0 x . Now consider the following<br />

two prospects<br />

8<br />

< x 00<br />

P 1 :<br />

:<br />

x 0 with probability 0<br />

P 2 :<br />

8<br />

<<br />

with probability 0:99<br />

x with probability 0:01<br />

x 00 with probability 0:99<br />

x 0 with probability 0:01<br />

:<br />

x with probability 0<br />

Suppose a person expresses a preference for P 1 over P 2 . Brie‡y explain why<br />

this might be the case in practice. Which of the three axioms State Irrelevance,<br />

Independence, Revealed Likelihood, is violated by such preferences?<br />

Outline Answer:<br />

It is possible that, given the information that the …rst event (with payo¤ x 00 )<br />

has not happened you would then prefer x to x 0 : photographs of your favourite<br />

holiday spot may be too painful once you know that the holiday is not going to<br />

happen. So you may prefer P 1 over P 2 .<br />

These preferences violate the independence axiom. To see this, note that,<br />

by the revealed likelihood axiom, since x 0 is strictly preferred to x , it must be<br />

the case that P2 0 is strictly preferred to P1, 0 where<br />

P 0 1 :<br />

P 0 2 :<br />

x<br />

0<br />

with probability 0<br />

x with probability 1<br />

x<br />

0<br />

with probability 0:01<br />

x with probability 0:99<br />

But P1 0 <strong>and</strong> P2 0 can be written equivalently as<br />

8<br />

< x <br />

P1 0 : x 0 with probability 0<br />

:<br />

P 0 2 :<br />

8<br />

<<br />

with probability 0:99<br />

x with probability 0:01<br />

x with probability 0:99<br />

x 0 with probability 0:01<br />

:<br />

x with probability 0<br />

By the independence axiom if P 0 2 is strictly preferred to P 0 1, then P 2 must be<br />

strictly preferred to P 1 .<br />

cFrank Cowell 2006 119

Microeconomics CHAPTER 8. UNCERTAINTY AND RISK<br />

Exercise 8.6 An example to illustrate regret. Let<br />

P := f(x ! ; ! ) : ! 2 g<br />

P 0 := f(x 0 !; ! ) : ! 2 g<br />

be two prospects available to an individual. De…ne the expected regret if the<br />

person chooses P rather than P 0 as<br />

X<br />

! max fx 0 ! x ! ; 0g (8.1)<br />

!2<br />

Now consider the choices amongst prospects presented in Exercise 8.4. Show<br />

that if a person is concerned to minimise expected regret as measured by (8.1),<br />

then it is reasonable that the person select P 2 when P 1 is also available <strong>and</strong> then<br />

also select P 4 when P 3 is available.<br />

Outline Answer:<br />

Denote the regret in (8.1) by r (P; P 0 ).<br />

If I choose P 2 when P 1 is also available then the regret is<br />

r (P 2 ; P 1 ) = 0:1 [0] + 0:89 [0] + :01 [1]<br />

= 10; 000<br />

Whereas, had I chosen P 1 when P 2 was available, then the regret would have<br />

been<br />

r (P 1 ; P 2 ) = 0:1 [4; 000; 000] + 0:89 [0] + :01 [0]<br />

= 400; 000<br />

If I choose P 4 when P 3 is also available then the regret is<br />

r (P 4 ; P 3 ) = 0:1 [0] + 0:89 [0] + :01 [0]<br />

= 0<br />

Whereas, had I chosen P 3 when P 4 was available, then the regret would have<br />

been<br />

r (P 3 ; P 4 ) = 0:1 [0] + 0:89 [0] + :01 [5; 000; 000]<br />

= 50; 000<br />

cFrank Cowell 2006 120

Microeconomics<br />

Exercise 8.7 An example of the Ellsberg paradox . There are two urns marked<br />

Left <strong>and</strong> Right each of which contains 100 balls. You know that in Urn L<br />

there exactly 49 white balls <strong>and</strong> the rest are black <strong>and</strong> that in Urn R there are<br />

black <strong>and</strong> white balls, but in unknown proportions. Consider the following two<br />

experiments:<br />

1. One ball is to be drawn from each of L <strong>and</strong> R. The person must choose<br />

between L <strong>and</strong> R before the draw is made. If the ball drawn from the chosen<br />

urn is black there is a prize of $1000, otherwise nothing.<br />

2. Again one ball is to be drawn from each of L <strong>and</strong> R; again the person must<br />

choose between L <strong>and</strong> R before the draw. Now if the ball drawn from the<br />

chosen urn is white there is a prize of $1000, otherwise nothing.<br />

You observe a person choose Urn L in both experiments. Show that this<br />

violates the Revealed Likelihood Axiom.<br />

Outline Answer<br />

The implication of the revealed likelihood axiom is that there exist subjective<br />

probabilities ! . The result is proved by showing that it the stated behaviour<br />

is inconsistent with the existence of subjective probabilities.<br />

In this case the revealed likelihood axiom implies that for each urn there is<br />

a given subjective probability of drawing a black ball L (left-h<strong>and</strong> urn) <strong>and</strong> R<br />

(right-h<strong>and</strong> urn) such that preferences can be represented as<br />

v black (x black ; x white ) + [1 ] v white (x black ; x white ) (8.2)<br />

where = L or R <strong>and</strong> x black <strong>and</strong> x white are the payo¤s if a black ball or a<br />

white ball are drawn respectively.<br />

Note that the representation (8.2) does not impose either the State Irrelevance<br />

Axiom (which would require that v black () <strong>and</strong> v white () be the same<br />

function) or the Independence axiom (which would require that v black () be a<br />

function only of x black etc.). Nor does it impose the common-sense requirement<br />

that L = 0:49. All we need below is the very weak assumption that preferences<br />

are not perverse:<br />

v black (1000; 0) > v white (1000; 0) (8.3)<br />

<strong>and</strong><br />

v black (0; 1000) < v white (0; 1000) (8.4)<br />

Condition (8.3) simply says that if the $1000 prize is attached to a black ball<br />

then the utility to be derived from having selected a black ball is higher than<br />

selecting a white ball; condition (8.4) is the counterpart when the prize attaches<br />

to the white ball..<br />

Experiment 1 suggests that<br />

L v black (1000; 0) + [1 L ] v white (1000; 0)<br />

> R v black (1000; 0) + [1 R ] v white (1000; 0) (8.5)<br />

cFrank Cowell 2006 121

Microeconomics CHAPTER 8. UNCERTAINTY AND RISK<br />

while experiment 2 suggests that<br />

L v black (0; 1000) + [1 L ] v white (0; 1000)<br />

> R v black (0; 1000) + [1 R ] v white (0; 1000) (8.6)<br />

We can see that (8.5) implies<br />

L [v black (1000; 0) v white (1000; 0)] > R [v black (1000; 0) v white (1000; 0)]<br />

from which we deduce that, given (8.3), L > R .<br />

However (8.5) implies<br />

L [v black (0; 1000) v white (0; 1000)] > R [v black (0; 1000) v white (0; 1000)] :<br />

So that, given (8.4), we would have L < R –a contradiction.<br />

revealed likelihood axiom must be violated.<br />

Therefore the<br />

cFrank Cowell 2006 122

Microeconomics<br />

Exercise 8.8 An individual faces a prospect with a monetary payo¤ represented<br />

by a r<strong>and</strong>om variable x that is distributed over the bounded interval of the real<br />

line [a; a]. He has a utility function Eu(x) where<br />

u(x) = a 0 + a 1 x<br />

<strong>and</strong> a 0 ; a 1 ; a 2 are all positive numbers.<br />

1<br />

2 a 2x 2<br />

1. Show that the individual’s utility function can also be written as '(Ex; var(x)).<br />

Sketch the indi¤erence curves in a diagram with Ex <strong>and</strong> var(x) on the<br />

axes, <strong>and</strong> discuss the e¤ect on the indi¤erence map altering (i) the parameter<br />

a 1 , (ii) the parameter a 2 .<br />

2. For the model to make sense, what value must a have? [Hint: examine<br />

the …rst derivative of u.]<br />

3. Show that both absolute <strong>and</strong> relative risk aversion increase with x.<br />

Outline Answer:<br />

1. Clearly<br />

Eu(x) = a 0 + a 1 E(x) + a 2<br />

1<br />

2 [(E(x))2 var(x)]:<br />

Marginal utility is a 1 a 2 x:<br />

2. For this to be non-negative we must have E(x) a 1 =a 2 hence the indi¤erence<br />

curves are depicted with E(x) as good, var(x) as bad <strong>and</strong><br />

MRS = 2 [a 1 =a 2 E(x)] :<br />

3.<br />

u x (x) = a 1 + a 2 x<br />

u xx (x) = a 2<br />

(x) =<br />

(x) =<br />

%(x) =<br />

where <strong>and</strong> 0 x x max :=<br />

u xx (x)<br />

u x (x) = a 2<br />

a 1 + a 2 x<br />

1<br />

x max x<br />

1<br />

x max =x 1<br />

a1<br />

a 2<br />

:<br />

cFrank Cowell 2006 123

Microeconomics CHAPTER 8. UNCERTAINTY AND RISK<br />

Exercise 8.9 A person lives for 1 or 2 periods. If he lives for both periods he<br />

has a utility function given by<br />

U (x 1 ; x 2 ) = u (x 1 ) + u (x 2 ) (8.7)<br />

where the parameter is the pure rate of time preference. The probability of<br />

survival to period 2 is , <strong>and</strong> the person’s utility in period 2 if he does not<br />

survive is 0.<br />

1. Show that if the person’s preferences in the face of uncertainty are represented<br />

by the expected-utility functional form<br />

X<br />

! u (x ! ) (8.8)<br />

!2<br />

then the person’s utility can be written as<br />

What is the value of the parameter 0 ?<br />

u (x 1 ) + 0 u (x 2 ) : (8.9)<br />

2. What is the appropriate form of the utility function if the person could live<br />

for an inde…nite number of periods, the rate of time preference is the same<br />

for any adjacent pair of periods, <strong>and</strong> the probability of survival to the next<br />

period given survival to the current period remains constant?<br />

Outline Answer:<br />

1. Consider the person’s lifetime utility with the consumption x 1 <strong>and</strong> x 2<br />

in the two periods. If the person survives into the second period utility<br />

is given by u (x 1 ) + u (x 2 ) otherwise it is just u (x 1 ). Given that the<br />

probability of the event “survive to second period”is expected lifetime<br />

utility is<br />

[u (x 1 ) + u (x 2 )] + [1 ] u (x 1 ) :<br />

On rearranging we get<br />

in other words the form (8.9) with 0 = .<br />

u (x 1 ) + u (x 2 ) ; (8.10)<br />

2. Apply the argument to one more period. Now there is consumption<br />

x 1 ,x 2 ; x 3 in the three periods <strong>and</strong> the probability of surviving into period<br />

t + 1 given that you have made it to period t is still . Consider the<br />

situation of someone who survives to period 2. The person gets utility<br />

u (x 2 ) + u (x 3 ) (8.11)<br />

if he survives to period 3 <strong>and</strong> u (x 2 ) otherwise. His expected utility for<br />

the rest of his lifetime, contingent on having reached period 2 is therefore<br />

cFrank Cowell 2006 124<br />

[u (x 2 ) + u (x 3 )] + [1 ] u (x 2 )<br />

= u (x 2 ) + u (x 3 ) (8.12)

Microeconomics<br />

So now view the situation from the position of the beginning of the lifetime.<br />

The person gets utility<br />

u (x 1 ) + [u (x 2 ) + u (x 3 )] (8.13)<br />

if he makes it through to period 2, where the expression in square brackets<br />

in (8.13) is just the rest-of-lifetime expected utility if you get to period 2,<br />

taken from (8.12); of course if the person does not survive period 1 he gets<br />

just u (x 1 ). So, using the same reasoning as before, from the st<strong>and</strong>point<br />

of period 1 lifetime expected utility is now<br />

Rearranging this we have<br />

[u (x 1 ) + [u (x 2 ) + u (x 3 )]]<br />

+ [1 ] u (x 1 ) :<br />

u (x 1 ) + u (x 2 ) + 2 2 u (x 2 ) : (8.14)<br />

It is clear that the same argument could be applied to T > 2 periods <strong>and</strong><br />

that the resulting utility function would be of the form<br />

u (x 1 ) + u (x 2 ) + 2 2 u (x 2 ) + ::: + T T u (x 2 ) : (8.15)<br />

In other words we have the st<strong>and</strong>ard intertemporal utility function with<br />

the pure rate of time preference replaced by the modi…ed rate of time<br />

preference 0 := .<br />

cFrank Cowell 2006 125

Microeconomics CHAPTER 8. UNCERTAINTY AND RISK<br />

Exercise 8.10 A person has an objective function Eu(y) where u is an increasing,<br />

strictly concave, twice-di¤erentiable function, <strong>and</strong> y is the monetary value<br />

of his …nal wealth after tax. He has an initial stock of assets K which he may<br />

keep either in the form of bonds, where they earn a return at a stochastic rate<br />

r, or in the form of cash where they earn a return of zero. Assume that Er > 0<br />

<strong>and</strong> that Prfr < 0g > 0.<br />

1. If he invests an amount in bonds (0 < < K) <strong>and</strong> is taxed at rate t<br />

on his income, write down the expression for his disposable …nal wealth y,<br />

assuming full loss o¤set of the tax.<br />

2. Find the …rst-order condition which determines his optimal bond portfolio<br />

.<br />

3. Examine the way in which a small increase in t will a¤ect .<br />

4. What would be the e¤ect of basing the tax on the person’s wealth rather<br />

than income?<br />

Outline Answer:<br />

1. Suppose the person puts an amount in bonds leaving the remaining<br />

K of assets in cash. Then, given that the rate of return on cash is<br />

zero <strong>and</strong> on bonds is the stochastic variable r, income is<br />

[K ] 0 + r = r<br />

If the tax rate is t then, given that full loss o¤set implies that losses <strong>and</strong><br />

gains are treated symmetrically, disposable income is<br />

<strong>and</strong> (disposable) …nal wealth is<br />

[1 t] r<br />

x = [K ] + + [1 t] r<br />

[cash] [value of bonds] [income]<br />

= K + [1 t] r: (8.16)<br />

Note that x is a stochastic variable <strong>and</strong> could be greater or less than initial<br />

wealth K.<br />

2. The individual’s optimisation problem is to choose to maximise Eu(x).<br />

Using (8.16) the FOC for an interior solution is<br />

which implies<br />

E (u x (x) [1 t] r) = 0;<br />

E (u x (x)r) = 0: (8.17)<br />

Solving this determines = (t; K), the optimal bond purchases that<br />

depends on the tax rate <strong>and</strong> initial wealth as well as the distribution of<br />

returns <strong>and</strong> risk aversion.<br />

cFrank Cowell 2006 126

Microeconomics<br />

3. Take the FOC (8.17). Substituting for x from (8.16) <strong>and</strong> di¤erentiating<br />

with respect to t we get<br />

<br />

<br />

E u xx (x) r + @<br />

@t [1 t] r r = 0;<br />

so that<br />

<br />

E<br />

u xx (x)r 2<br />

+ @<br />

@t<br />

+ @<br />

@t [1<br />

[1 t] = 0<br />

@ <br />

@t<br />

=<br />

<br />

t] = 0:<br />

<br />

1 t :<br />

An increase in the tax rate increases the dem<strong>and</strong> for bonds.<br />

4. Final wealth is initial wealth plus income. If the tax is on wealth then<br />

disposable …nal wealth is<br />

x = [1 t] K + [1 t] r (8.18)<br />

instead of (8.16). Clearly the FOC (8.17) remains essentially unaltered<br />

(the new tax just reduces total wealth). Di¤erentiating the FOC with x<br />

de…ned by (8.18) we now …nd<br />

This implies<br />

E<br />

<br />

u xx (x)<br />

KE (u xx (x)r) + E<br />

K r + @<br />

@t [1<br />

<br />

u xx (x)r 2<br />

<br />

t] r r = 0;<br />

+ @<br />

@t [1<br />

<br />

t] = 0:<br />

<br />

K E (u xx(x)r)<br />

E (u xx (x)r 2 ) + @ [1 t] = 0:<br />

@t<br />

@ <br />

@t [1<br />

@ <br />

@t<br />

t] = + K E (u xx(x)r)<br />

E (u xx (x)r 2 ) :<br />

= <br />

1 t + K<br />

1 t<br />

E (u xx (x)r)<br />

E (u xx (x)r 2 ) :<br />

The …rst term on the right-h<strong>and</strong> side is positive; as for the second term,<br />

the denominator is negative <strong>and</strong> the numerator is positive, given DARA.<br />

So the impact of tax on bond-holding is now ambiguous.<br />

cFrank Cowell 2006 127

Microeconomics CHAPTER 8. UNCERTAINTY AND RISK<br />

Exercise 8.11 An individual taxpayer has an income y that he should report to<br />

the tax authority. Tax is payable at a constant proportionate rate t. The taxpayer<br />

reports x where 0 x y <strong>and</strong> is aware that the tax authority audits some tax<br />

returns. Assume that the probability that the taxpayer’s report is audited is<br />

, that when an audit is carried out the true taxable income becomes public<br />

knowledge <strong>and</strong> that, if x < y, the taxpayer must pay both the underpaid tax <strong>and</strong><br />

a surcharge of s times the underpaid tax.<br />

1. If the taxpayer chooses x < y, show that disposable income c in the two<br />

possible states-of-the-world is given by<br />

c noaudit = y tx;<br />

c audit = [1 t st] y + stx:<br />

2. Assume that the individual chooses x so as to maximise the utility function<br />

[1 ] u (c noaudit ) + u (c audit ) :<br />

where u is increasing <strong>and</strong> strictly concave.<br />

(a) Write down the FOC for an interior maximum.<br />

(b) Show that if 1 s > 0 then the individual will de…nitely underreport<br />

income.<br />

3. If the optimal income report x satis…es 0 < x < y:<br />

(a) Show that if the surcharge is raised then under-reported income will<br />

decrease.<br />

(b) If true income increases will under-reported income increase or decrease?<br />

Outline Answer:<br />

If the individual reports x then he pays tax tx –i.e. he underpays an amount<br />

t [y x]. So<br />

1. If the under-reporting remains undetected then<br />

c noaudit = y tx<br />

<strong>and</strong> if the audit takes place then<br />

2. The individual maximises<br />

= y ty + t [y x]<br />

c audit = y tx [1 + s] t [y x]<br />

= [1 t st] y + stx<br />

Eu(c) = [1 ] u (y tx) + u ([1 t st] y + stx)<br />

Di¤erentiating this we have<br />

@Eu(c)<br />

@x<br />

= t [1 ] u c (y tx) + stu c ([1 t st] y + stx)<br />

where u c () denotes the …rst derivative of u.<br />

cFrank Cowell 2006 128

Microeconomics<br />

(a) If there is an interior maximum at x then the following FOC must<br />

hold<br />

[1 ] u c (y tx ) = su c ([1 t st] y + stx ) :<br />

(b) If the person reports fully then<br />

@Eu(c)<br />

@x = t [1 ] u c (y ty) + stu c ([1 t] y)<br />

x=y<br />

= [1 s] tu c (y ty)<br />

Given that t <strong>and</strong> u c are positive it is clear that the above expression<br />

is negative if 1 s > 0. Therefore the individual’s expected<br />

utility would increase if he reduced x below y.<br />

3. Di¤erentiating the FOC with respect to s <strong>and</strong> rearranging we get<br />

t [1 ] u cc (y tx ) @x s 2 tu cc ([1 t st] y + stx ) @x<br />

@s<br />

@s<br />

= u c ([1 t st] y + stx ) + st [x y] u cc ([1 t st] y + stx )<br />

(a) Therefore<br />

where<br />

@x <br />

@s = u c (c audit ) + st [x y] u cc (c audit )<br />

t<br />

(8.19)<br />

:= [1 ] u cc (y tx ) s 2 u cc ([1 t st] y + stx ) > 0<br />

Given that u c > 0, x < y <strong>and</strong> u cc < 0 it is clear that the numerator<br />

of (8.19) is positive.x increases with s so t [y x ] decreases.<br />

(b) Di¤erentiating the FOC with respect to y we get<br />

<br />

[1 ] u cc (y tx )<br />

1 t @x<br />

@y<br />

= su cc ([1 t st] y + stx )<br />

Therefore we have<br />

@ [y x ]<br />

@y<br />

[1 t st] + st @x<br />

@y<br />

@x <br />

@y = s [1 t st] u cc (c audit ) [1 ] u cc (c noaudit )<br />

t [[1 ] u cc (c noaudit ) + s 2 u cc (c audit )]<br />

@ [y x ]<br />

@y<br />

<br />

:<br />

= 1 + s [1 t st] u cc (c audit ) [1 ] u cc (c noaudit )<br />

[[1 ] tu cc (c noaudit ) + s 2 tu cc (c audit )]<br />

= 1 t<br />

t<br />

[1 ] u cc (c noaudit ) su cc (c audit )<br />

[[1 ] u cc (c noaudit ) + s 2 u cc (c audit )]<br />

This is of ambiguous sign unless we assume DARA in which case it<br />

is positive.<br />

cFrank Cowell 2006 129

Microeconomics CHAPTER 8. UNCERTAINTY AND RISK<br />

Exercise 8.12 A risk-averse person has wealth y 0 <strong>and</strong> faces a risk of loss<br />

L < y 0 with probability . An insurance company o¤ers cover of the loss at<br />

a premium > L. It is possible to take out partial cover on a pro-rata basis,<br />

so that an amount tL of the loss can be covered at cost t where 0 < t < 1.<br />

1. Explain why the person will not choose full insurance<br />

2. Find the conditions that will determine t , the optimal value of t.<br />

3. Show how t will change as y 0 increases if all other parameters remain<br />

unchanged.<br />

Outline Answer:<br />

1. Consider the person’s wealth after taking out (partial) insurance cover<br />

using the two-state model (no loss;loss). If the person remained uninsured<br />

it would be (y 0 ; y 0 L); if he insures fully it is (y 0 ; y 0 ). So<br />

if he insures a proportion t for the pro-rata premium wealth in the two<br />

states will be<br />

which becomes<br />

([1 t] y 0 + t [y 0 ] ; [1 t] [y 0 L] + t [y 0 ])<br />

So expected utility is given by<br />

Therefore<br />

@Eu<br />

@t<br />

(y 0 t; y 0 t [1 t] L)<br />

Eu = [1 ] u (y 0 t) + u (y 0 t [1 t] L)<br />

= [1 ] u y (y 0 t) + [L ] u y (y 0 t [1 t] L)<br />

Consider what happens in the neighbourhood of t = 1 (full insurance).<br />

We get<br />

@Eu<br />

@t = [1 ] u y (y 0 ) + [L ] u y (y 0 )<br />

t=1<br />

= [L ] u y (y 0 )<br />

We know that u y (y 0 ) > 0 (positive marginal utility of wealth) <strong>and</strong>, by<br />

assumption, L < . Therefore this expression is strictly negative which<br />

means that in the neighbourhood of full insurance (t = 1) the individual<br />

could increase expected utility by cutting down on the insurance cover.<br />

2. For an interior maximum we have<br />

@Eu<br />

@t<br />

which means that the optimal t is given as the solution to the equation<br />

= 0<br />

[1 ] u y (y 0 t ) + [L ] u y (y 0 t [1 t ] L) = 0<br />

cFrank Cowell 2006 130

Microeconomics<br />

3. Di¤erentiating the above equation with respect to y 0 we get<br />

<br />

<br />

[1 ] u yy (y 0 t )<br />

1 @t +[L ] u yy (y 0 t [1 t ] L)<br />

1 [ L] @t = 0<br />

@y 0 @y 0<br />

which gives<br />

@t <br />

@y 0<br />

= [1 ] u yy (y 0 t ) [L ] u yy (y 0 t [1 t ] L)<br />

[1 ] u yy (y 0 t ) 2 + [L ] 2 u yy (y 0 t [1 t ] L)<br />

The denominator of this must be negative: u yy () is everywhere negative<br />

<strong>and</strong> the other terms are positive. The numerator is positive if DARA<br />

holds: therefore an increase in wealth reduces the dem<strong>and</strong> for insurance<br />

coverage.<br />

cFrank Cowell 2006 131

Microeconomics CHAPTER 8. UNCERTAINTY AND RISK<br />

Exercise 8.13 Consider a competitive, price-taking …rm that confronts one of<br />

the following two situations:<br />

“uncertainty”: price p is a r<strong>and</strong>om variable with expectation p.<br />

“certainty”: price is …xed at p.<br />

It has a cost function C(q) where q is output <strong>and</strong> it seeks to maximise the<br />

expected utility of pro…t.<br />

1. Suppose that the …rm must choose the level of output before the particular<br />

realisation of p is announced. Set up the …rm’s optimisation problem <strong>and</strong><br />

derive the …rst- <strong>and</strong> second-order conditions for a maximum. Show that,<br />

if the …rm is risk averse, then increasing marginal cost is not a necessary<br />

condition for a maximum, <strong>and</strong> that it strictly prefers “certainty” to “uncertainty”.<br />

Show that if the …rm is risk neutral then the …rm is indi¤erent<br />

as between “certainty” <strong>and</strong> “uncertainty”.<br />

2. Now suppose that the …rm can select q after the realisation of p is announced,<br />

<strong>and</strong> that marginal cost is strictly increasing. Using the …rm’s<br />

competitive supply function write down pro…t as a function of p <strong>and</strong> show<br />

that this pro…t function is convex. Hence show that a risk-neutral …rm<br />

would strictly prefer “uncertainty” to “certainty”.<br />

Outline Answer:<br />

1. Pro…t is given by<br />

:= pq<br />

C(q)<br />

where p is a r<strong>and</strong>om variable. Maximising expected utility of pro…t Eu()<br />

by choice of q requires the FOC<br />

E(u ()p) E(u ())C q = 0<br />

where u () is the …rst derivative of u(). This will represent a maximum<br />

if<br />

d 2 Eu<br />

dq 2 < 0:<br />

We …nd that this implies<br />

E(u [p C q ] 2 ) E(u )C qq < 0:<br />

Notice that since the …rst term is negative for a risk-averse …rm then the<br />

condition can be satis…ed not only if C qq > 0 but also if C qq < 0 <strong>and</strong> jC qq j<br />

is not too large. Now consider transforming p to bp thus: bp = (1 )p + p<br />

then bp has the same mean as p but is less dispersed. Maximised utility for<br />

the r<strong>and</strong>om variable bp is<br />

Eu([(1 )p + p]q C(q ))<br />

where q is the output satisfying the …rst-order conditions for a maximum.<br />

Di¤erentiate this expected utility with respect to <br />

@Eu <br />

@ = [E(u [p p])]q + [E(u [bp C q ])] @q<br />

@<br />

cFrank Cowell 2006 132

Microeconomics<br />

where the last term vanishes because of the …rst order condition. So<br />

@Eu <br />

@<br />

has the sign of E(u [p p]): But this must be positive if u is<br />

decreasing with <strong>and</strong> will be zero if u is constant. Hence the …rm strictly<br />

prefers certainty if it is risk averse <strong>and</strong> is indi¤erent between certainty <strong>and</strong><br />

uncertainty if it is risk neutral.<br />

2. For any known realization p we may write q = S(p) where S is the competitive<br />

…rm supply curve. Pro…ts as a function of P may thus be written:<br />

(p) = pS(p)<br />

C(S(p))<br />

which implies<br />

d(p)<br />

dp<br />

= [p C q ]S p (p) + S(p) = S(p) (8.20)<br />

where S p (p) is the slope of the supply curve at p, a positive number.<br />

Therefore, di¤erentiating (8.20) we have<br />

d 2 (p)<br />

dp 2 = S p (p) > 0:<br />

Hence () is increasing <strong>and</strong> convex. So it is immediate that E(p) > (p):<br />

cFrank Cowell 2006 133

Microeconomics CHAPTER 8. UNCERTAINTY AND RISK<br />

Exercise 8.14 Every year Alf sells apples from his orchard. Although the market<br />

price of apples remains constant (<strong>and</strong> equal to 1), the output of Alf’s orchard<br />

is variable yielding an amount R 1 ; R 2 in good <strong>and</strong> poor years respectively; the<br />

probability of good <strong>and</strong> poor years is known to be 1 <strong>and</strong> respectively. A<br />

buyer, Bill, o¤ers Alf a contract for his apple crop which stipulates a down payment<br />

(irrespective of whether the year is good or poor) <strong>and</strong> a bonus if the year<br />

turns out to be good.<br />

1. Assuming Alf is risk averse, use an Edgeworth box diagram to sketch the<br />

set of such contracts which he would be prepared to accept. Assuming that<br />

Bill is also risk averse, sketch his indi¤erence curves in the same diagram.<br />

2. Assuming that Bill knows the shape of Alf’s acceptance set, illustrate the<br />

optimum contract on the diagram. Write down the …rst-order conditions<br />

for this in terms of Alf’s <strong>and</strong> Bill’s utility functions.<br />

b<br />

x RED<br />

a<br />

x BLUE<br />

0 b<br />

R 2<br />

•<br />

D<br />

0 a a<br />

R 1<br />

x RED<br />

b<br />

x BLUE<br />

Figure 8.2: Acceptable contracts<br />

Outline Answer:<br />

1. In Figure 8.2 the contours represent Alf’s indi¤erence curves: note that<br />

they are convex to the point 0 a (risk aversion) <strong>and</strong> that they have the same<br />

slope [1 ] = where they cross the 45 ray through 0 a (consequence of<br />

von-Neumann utility function). Point D represents the initial endowment;<br />

Alf’s endowment is (R 1 ; R 2 ). Alf’s indi¤erence curve through point D<br />

represents the boundary of the set of consumptions that Alf would regard<br />

as being at least as good as the initial endowment: the shaded area is his<br />

acceptance set. The buyer (Bill) has an endowment K that is independent<br />

of the state of the world –see Figure 8.3. Note that the indi¤erence curves<br />

for Bill also have the slope [1 ] = where they cross the 45 ray through<br />

0 b :<br />

2. Point E in Figure ?? represents the optimum contract (from Bill’s point<br />

of view) since it is a point of common tangency of two indi¤erence curves.<br />

cFrank Cowell 2006 134

Microeconomics<br />

b<br />

x RED<br />

a<br />

x BLUE<br />

0 b<br />

K<br />

D•<br />

b<br />

0 a a<br />

K<br />

x RED<br />

x BLUE<br />

Figure 8.3: Buyer’s situation<br />

b<br />

x RED<br />

a<br />

x BLUE<br />

0 b<br />

E<br />

•<br />

R 2<br />

D•<br />

0 a a<br />

R 1<br />

x RED<br />

b<br />

x BLUE<br />

Figure 8.4: Optimal contract<br />

At E we have that<br />

u a0 (x a 1)<br />

u a0 (x a 2 ) = ub0 (x b 1)<br />

u b0 (x b 2 ):<br />

cFrank Cowell 2006 135

Microeconomics CHAPTER 8. UNCERTAINTY AND RISK<br />

Exercise 8.15 In exercise 8.14, what would be the e¤ect on the contract if (i)<br />

Bill were risk neutral; (ii) Alf risk neutral?<br />

Outline Answer:<br />

In case (i) Bill’s indi¤erence curves become lines with slope [1 ] = <strong>and</strong><br />

the optimum is at E in Figure 8.5. In case (ii) Alf’s indi¤erence curves become<br />

lines with slope [1 ] = <strong>and</strong> the optimum is at the endowment point D.<br />

b<br />

x RED<br />

a<br />

x BLUE<br />

0 b<br />

•<br />

E<br />

R 2<br />

D•<br />

0 a<br />

b<br />

x BLUE<br />

R 1<br />

Figure 8.5: Optimal contract: risk-neutral buyer<br />

cFrank Cowell 2006 136