2004 Gerdau Annual Report

2004 Gerdau Annual Report

2004 Gerdau Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

26 27 capital markets<br />

Publicly traded company in Canada<br />

The debut of <strong>Gerdau</strong> Ameristeel on the New York Stock Exchange (NYSE) in <strong>2004</strong> translated into a new level<br />

of liquidity for its shares. Starting in October, when trading of Ameristeel stock at the NYSE began, until<br />

the end of December, trading volume reached US$ 107.5 million, representing an average daily volume of<br />

US$ 2.6 million. In addition, the listing in the U.S. increased the trading volume on the Toronto Stock Exchange,<br />

where <strong>Gerdau</strong> Ameristeel has been listed since 2002. In the first nine months of <strong>2004</strong>, the average daily<br />

trading volume on the Toronto Stock Exchange was US$ 871,000. Taking into consideration the trades at the<br />

NYSE, this volume reached US$ 5.9 million in the last quarter.<br />

<strong>Gerdau</strong> Ameristeel is the second <strong>Gerdau</strong> Group company listed on the main world financial center. <strong>Gerdau</strong><br />

S.A., one of the Group’s publicly traded companies in Brazil, was listed in 1999.<br />

<strong>Gerdau</strong> Ameristeel carried out two capital increase operations in <strong>2004</strong>. In April, 26.8 million common shares<br />

were purchased by <strong>Gerdau</strong> Ameristeel’s parent company, <strong>Gerdau</strong> S.A., for Cdn$ 4.90 per share, for a total of<br />

US$ 100 million, generating resources for equipment financing, working capital, and debt payment.<br />

In November, <strong>Gerdau</strong> Ameristeel issued a public offering of 78.8 million common shares to raise<br />

US$ 370 million. This was the Company’s first international fund raising effort through the issuance of new<br />

shares. The aim of the operation was to secure funds for the acquisition of North Star Steel assets, increase<br />

the shareholder base in the United States and increase the liquidity of shares.<br />

After these operations, <strong>Gerdau</strong> S.A. had increased its stake in <strong>Gerdau</strong> Ameristeel to 66.5%.<br />

The company’s net revenues, adjusted to Brazilian accounting practices, reached R$ 8.9 billion in <strong>2004</strong>,<br />

with a profit of R$ 896.3 million. As a result, the Board of Directors decided for the quarterly payment<br />

of dividends to shareholders starting in 2005. In March, individuals holding shares on February 16, 2005,<br />

received US$ 0.02 per share in dividends. This amount refers to the first quarter of 2005, and totals<br />

US$ 6.1 million.<br />

Relationship with shareholders, investors and analysts<br />

The <strong>Gerdau</strong> Group’s relationship with shareholders, investors and analysts is guided by disclosure and<br />

fast response to market demands. In <strong>2004</strong>, six meetings were held with Apimec, the Association of<br />

Market Analysts and Investment Brokers. The meetings, broadcast in real time through the Internet and<br />

available for replay until the end of the quarter, attracted 870 people. <strong>Gerdau</strong>’s investor relations team<br />

held 280 individual meetings with market professionals in Brazil, North America and Europe. It organized<br />

eight conference calls to discuss quarterly results in both Portuguese and English, attracting over 800<br />

participants.<br />

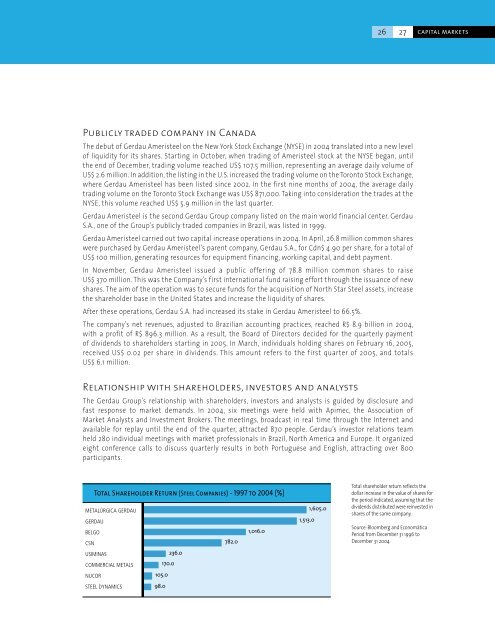

Total Shareholder Return (Steel Companies) - 1997 to <strong>2004</strong> (%)<br />

METALÚRGICA GERDAU<br />

GERDAU<br />

BELGO<br />

1,016.0<br />

CSN<br />

782.0<br />

USIMINAS<br />

236.0<br />

COMMERCIAL METALS<br />

170.0<br />

NUCOR<br />

105.0<br />

STEEL DYNAMICS<br />

98.0<br />

1,513.0<br />

1,605.0<br />

Total shareholder return reflects the<br />

dollar increase in the value of shares for<br />

the period indicated, assuming that the<br />

dividends distributed were reinvested in<br />

shares of the same company.<br />

Source: Bloomberg and Economática<br />

Period from December 31 1996 to<br />

December 31 <strong>2004</strong>