Allstate Product Navigator Allstate Product Navigator - AccessAllstate

Allstate Product Navigator Allstate Product Navigator - AccessAllstate

Allstate Product Navigator Allstate Product Navigator - AccessAllstate

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

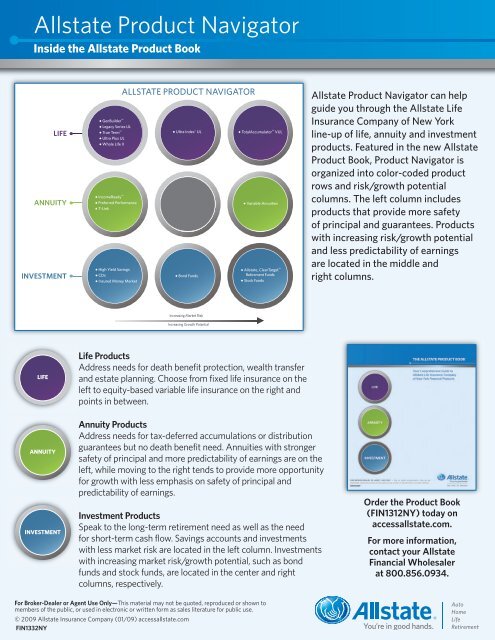

<strong>Allstate</strong> <strong>Product</strong> <strong>Navigator</strong><br />

Your Inside GPS For the <strong>Product</strong> <strong>Allstate</strong> Solutions <strong>Product</strong> Book<br />

LIFE<br />

ANNUITY<br />

INVESTMENT<br />

• GenBuilder SM<br />

• Legacy Series UL<br />

• True Term SM<br />

• Ultra Plus UL<br />

• Whole Life II<br />

• IncomeReady SM<br />

• Preferred Performance<br />

• T-Link<br />

• High Yield Savings<br />

• CDs<br />

• Insured Money Market<br />

ALLSTATE PRODUCT NAVIGATOR<br />

• Ultra Index ® UL<br />

• Bond Funds<br />

• TotalAccumulator SM VUL<br />

• Variable Annuities<br />

• <strong>Allstate</strong> ®<br />

ClearTarget SM<br />

Retirement Funds<br />

• Stock Funds<br />

<strong>Allstate</strong> <strong>Product</strong> <strong>Navigator</strong> can help<br />

guide you through the <strong>Allstate</strong> Life<br />

Insurance Company of New York<br />

line-up of life, annuity and investment<br />

products. Featured in the new <strong>Allstate</strong><br />

<strong>Product</strong> Book, <strong>Product</strong> <strong>Navigator</strong> is<br />

organized into color-coded product<br />

rows and risk/growth potential<br />

columns. The left column includes<br />

products that provide more safety<br />

of principal and guarantees. <strong>Product</strong>s<br />

with increasing risk/growth potential<br />

and less predictability of earnings<br />

are located in the middle and<br />

right columns.<br />

Increasing Market Risk<br />

Increasing Growth Potential<br />

LIFE<br />

Life <strong>Product</strong>s<br />

Address needs for death benefit protection, wealth transfer<br />

and estate planning. Choose from fixed life insurance on the<br />

left to equity-based variable life insurance on the right and<br />

points in between.<br />

ANNUITY<br />

INVESTMENT<br />

Annuity <strong>Product</strong>s<br />

Address needs for tax-deferred accumulations or distribution<br />

guarantees but no death benefit need. Annuities with stronger<br />

safety of principal and more predictability of earnings are on the<br />

left, while moving to the right tends to provide more opportunity<br />

for growth with less emphasis on safety of principal and<br />

predictability of earnings.<br />

Investment <strong>Product</strong>s<br />

Speak to the long-term retirement need as well as the need<br />

for short-term cash flow. Savings accounts and investments<br />

with less market risk are located in the left column. Investments<br />

with increasing market risk/growth potential, such as bond<br />

funds and stock funds, are located in the center and right<br />

columns, respectively.<br />

Order the <strong>Product</strong> Book<br />

(FIN1312NY) today on<br />

accessallstate.com.<br />

For more information,<br />

contact your <strong>Allstate</strong><br />

Financial Wholesaler<br />

at 800.856.0934.<br />

For Broker-Dealer or Agent Use Only— This material may not be quoted, reproduced or shown to<br />

members of the public, or used in electronic or written form as sales literature for public use.<br />

© 2009 <strong>Allstate</strong> Insurance Company (01/09) accessallstate.com<br />

FIN1332NY

<strong>Allstate</strong> <strong>Product</strong> <strong>Navigator</strong><br />

Inside the <strong>Allstate</strong> <strong>Product</strong> Book<br />

TrueTerm SM (NYLU666), Legacy Choice UL SM (NYLU678), Legacy Secure UL® (NYLU676), Legacy Secure SL® (NYLU722), Ultra Index® (NYLU707), Ultra Plus UL<br />

(NYLU690), Whole Life II (NYLU696), GenBuilder SM (LU10903NY), IncomeReady SM (NYLU738), <strong>Allstate</strong>® Treasury-Linked Annuity (NYLU561), <strong>Allstate</strong>®<br />

Preferred Performance (NYLU657) are fixed annuities and fixed life products issued by <strong>Allstate</strong> Life Insurance Company of New York. <strong>Allstate</strong> Life Insurance<br />

Company of New York is a wholly-owned subsidiary of <strong>Allstate</strong> Life Insurance Company, Northbrook, IL.<br />

TotalAccumulator is a variable universal life insurance policy issued by <strong>Allstate</strong> Life Insurance Company of New York, Home Office: Hauppauge, NY, a wholly<br />

owned subsidiary of <strong>Allstate</strong> Life Insurance Company, Home Office, Northbrook, Illinois. TotalAccumulator is available with contract series NYLU727.<br />

High-yield savings, CDs and IRA CDs, and insured money market accounts are available through <strong>Allstate</strong> Bank, a wholly owned subsidiary of The <strong>Allstate</strong><br />

Corporation and Member FDIC.<br />

In order to refer <strong>Allstate</strong> Bank products, producers must complete the <strong>Allstate</strong> Bank Deposit <strong>Product</strong>s Course for producers via the Learning Resource Network<br />

(LRN). In certain states, the referral of certificates of deposit (CDs) to <strong>Allstate</strong> Bank is limited by state securities laws to agents who are registered securities<br />

representatives. Contact an <strong>Allstate</strong> agency or <strong>Allstate</strong> Bank at 877-794-2265 for further information. <strong>Allstate</strong> agents receive compensation for the referral of<br />

<strong>Allstate</strong> Bank CDs, which may vary depending on the size of the deposit and the term of the account.<br />

Mutual funds and other securities products are offered through <strong>Allstate</strong> Financial Services, LLC. Along with its own proprietary mutual fund, <strong>Allstate</strong> Financial<br />

Services, LLC represents over 100 additional fund families including these Strategic Fund Families: AIM Investments (Invesco AIM), American Funds, Fidelity<br />

Investments (advisor funds only), Lord Abbett Funds (Strategic for 401(k) plans only), Oppenheimer Funds.<br />

Please note that an investment in an <strong>Allstate</strong> ClearTarget Retirement Fund offers no guarantee of future growth and may lose value. The value of the fund will<br />

fluctuate with market conditions and is subject to the volatility of the U.S. and International financial markets. The funds may be subject to additional risks<br />

associated with investing in high-yield, small-cap and foreign securities. Please see the prospectus for details.<br />

<strong>Allstate</strong> ClearTarget Retirement Funds are mutual funds and are designed for long-term investing. Investors<br />

should carefully consider the investment objectives, risks, charges and expenses of <strong>Allstate</strong> ClearTarget<br />

Retirement Funds before purchasing a fund or investing money. Please note that an investment in an <strong>Allstate</strong><br />

ClearTarget Retirement Fund offers no guarantee of future growth and may lose value. The value of the fund<br />

will fluctuate with market conditions and is subject to the volatility of the U.S. and International financial<br />

markets. The funds may be subject to additional risks associated with investing in high-yield, small-cap and<br />

foreign securities. Please see the prospectus for more details. This information is only a summary. The<br />

prospectus contains details on the investment alternatives, risks, fees, charges, expenses and other pertinent<br />

information. To obtain a prospectus, please contact your <strong>Allstate</strong> Financial Wholesaler at 800-856-0934 or<br />

visit accessallstate.com. Customers should read the prospectus carefully before purchasing shares or<br />

sending money.<br />

Securities offered by Personal Financial Representatives through <strong>Allstate</strong> Financial Services, LLC. Registered Broker-Dealer. Member FINRA, SIPC. Main Office:<br />

2920 South 84th Street, Lincoln, NE 68506. 877-525-5727. <strong>Allstate</strong> ClearTarget Retirement Funds are offered by <strong>Allstate</strong> Financial Investment Trust, a<br />

registered open-end investment company, Northbrook, IL and distributed by Funds Distributor, LLC, Columbus, OH.<br />

Variable annuities are long-term investments designed for retirement purposes. Variable universal life<br />

insurance policies are long-term investments designed to provide life insurance protection and flexibility in<br />

connection with premium payments and death benefits. You should advise your clients to carefully consider<br />

the investment objectives, risks, charges and expenses of the investment alternatives before purchasing a<br />

variable annuity contract or variable life insurance policy. The contracts and policies have limitations and<br />

are sold by prospectus only. The applicable prospectuses contain details on the investment alternatives,<br />

contract or policy features, the underlying portfolios, fees, charges, expenses and other pertinent information.<br />

This material is approved for Broker/Dealer use only and may not be quoted, reproduced or shown to<br />

members of the public, nor used in electronic or written form as sales literature for public use. To obtain a<br />

prospectus or a copy of the underlying portfolio prospectuses, please contact your <strong>Allstate</strong> Financial<br />

Wholesaler at 800-856-0934 or go to accessallstate.com.<br />

This information is intended for general informational purposes only and is not intended to provide tax, legal or investment advice.<br />

For Broker-Dealer or Agent Use Only— This material may not be quoted, reproduced or shown to<br />

members of the public, or used in electronic or written form as sales literature for public use.<br />

© 2009 <strong>Allstate</strong> Insurance Company (01/09) accessallstate.com<br />

FIN1332NY