Working in the - AccessAllstate

Working in the - AccessAllstate

Working in the - AccessAllstate

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

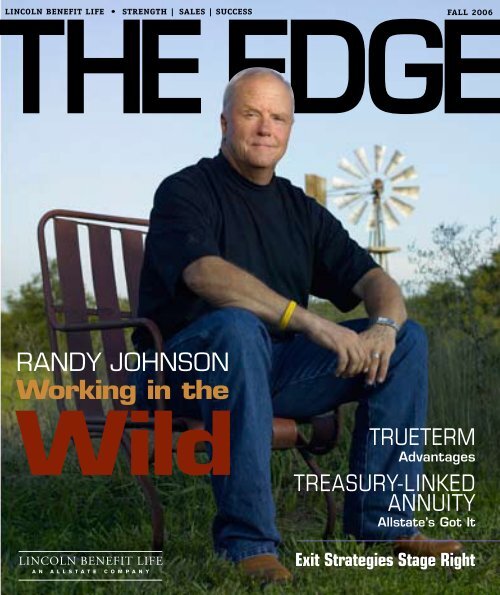

L<strong>in</strong>coln Benefit Life • Strength | Sales | SuccessFALL 2006he EdgeRandy Johnson<strong>Work<strong>in</strong>g</strong> <strong>in</strong> <strong>the</strong>WildTrueTermAdvantagesTreasury-L<strong>in</strong>kedAnnuityAllstate’s Got ItExit Strategies Stage Right

Make It Happen!To me, life is what we make it. I prefer to dr<strong>in</strong>k from a glass that is atleast half full, but never half empty. It’s about mak<strong>in</strong>g <strong>the</strong> most out ofevery hour of every day. It’s about choices, and I choose to take <strong>the</strong>let’s make it happen approach <strong>in</strong> life.At L<strong>in</strong>coln Benefit Life (LBL), we workhard to make it happen so that ourproducers have <strong>the</strong> best possible productsand services to offer <strong>the</strong>ir customers. Whenwe deliver on our commitments … <strong>the</strong>n youget to deliver on your commitments. And <strong>in</strong><strong>the</strong> end, everybody w<strong>in</strong>s.In this edition of The Edge, we featureRandy Johnson, one of our top – and newest– life producers who makes it happen for hiscustomers. Randy built his bus<strong>in</strong>ess on a“promises made, promises kept” philosophy.Even more than a philosophy, though, it’ssimply who Randy is and how he and hisstaff conduct <strong>the</strong>mselves. Today, his bus<strong>in</strong>esscomes completely from referrals, which is atestament to how far a man’s word can takehim. LBL is proud to be a part of what Randycalls his “centers of <strong>in</strong>fluence” and <strong>the</strong> teamof people help<strong>in</strong>g him deliver on hispromises. Read more about Randy and hisstory on page 6.Spend any amount of time with Randyand you’ll quickly see that his center of<strong>in</strong>fluence is vast and cont<strong>in</strong>ually grow<strong>in</strong>g.John Brown is one member of Randy’snetwork and jo<strong>in</strong>s us <strong>in</strong> this issue for a Q&Aon exit plann<strong>in</strong>g strategies. What’s uniqueabout Brown is that his company, Bus<strong>in</strong>essEnterprise Institute, is devoted solely to exitplann<strong>in</strong>g and educat<strong>in</strong>g <strong>in</strong>surance advisors<strong>in</strong> this specialized area. See page 14 forJohn’s answers to your most press<strong>in</strong>gquestions on exit and succession plann<strong>in</strong>g.Our Own K<strong>in</strong>d of InfluenceLBL is creat<strong>in</strong>g its own special <strong>in</strong>fluence,if you will, with core products like LegacySecure UL ® and <strong>the</strong> newly patentedAllstate ® Treasury-L<strong>in</strong>ked Annuity (T-L<strong>in</strong>k).We feature <strong>the</strong> complete Legacy Secure UL ®story on Page 12, which explores premiumcomparisons, a solid cash valueaccumulation and flexibility for yourcustomers today and <strong>in</strong> <strong>the</strong> future.Ano<strong>the</strong>r product mak<strong>in</strong>g it happen forLBL is T-L<strong>in</strong>k, which is hav<strong>in</strong>g a record year<strong>in</strong> this challeng<strong>in</strong>g <strong>in</strong>terest rate environment.Its patent tells you it’s a one-of-a-k<strong>in</strong>dproduct. Its strong performance this yearrem<strong>in</strong>ds you that LBL has annuity productsfor all seasons. Read more about <strong>the</strong> seasonfor T-L<strong>in</strong>k on Page 16.On Page 10, Hugh Smart rem<strong>in</strong>ds us allthat term <strong>in</strong>surance – namely TrueTerm SM –can play a vital role <strong>in</strong> bus<strong>in</strong>ess successionplann<strong>in</strong>g. It offers affordable coverage and,when <strong>the</strong> Return of Premium Rider is added(at an additional cost), it provides <strong>the</strong> abilityto recover premiums at <strong>the</strong> end of <strong>the</strong> levelpremium period. Try it <strong>in</strong> your next bus<strong>in</strong>esssuccession plan.At LBL, we look forward to help<strong>in</strong>g youmake it happen for yourself and yourcustomers each and every day. After all, it’sabout choices and mak<strong>in</strong>g good decisions,and we want to give you plenty of reasonsto choose us.S<strong>in</strong>cerely,Lawrence W. DahlPresidentL<strong>in</strong>coln Benefit LifeP.S. Don’t miss <strong>the</strong> opportunity to tellus what you th<strong>in</strong>k about – and would liketo read about – <strong>in</strong> future issues of The Edgeby complet<strong>in</strong>g <strong>the</strong> enclosed survey. Thisis a magaz<strong>in</strong>e for you, and this is youropportunity to make it happen.<strong>the</strong> edge

6 <strong>the</strong> edge

Legacy Secure UL ® …The Complete StoryAre your customers <strong>in</strong>terested <strong>in</strong> spreadsheets … or results?Spreadsheets andby Bob Jurgensmeierquote eng<strong>in</strong>esare great tools,but <strong>the</strong>y just can’t tellyou <strong>the</strong> whole storyabout universal life products or <strong>the</strong> companiesthat sell <strong>the</strong>m. They can’t tell you about <strong>the</strong>flexibility that customers need, how <strong>the</strong>irmoney can work for <strong>the</strong>m over <strong>the</strong> years,or how <strong>the</strong> premiums truly compare.If you’re search<strong>in</strong>g for real value <strong>in</strong>universal life policies, take a good lookat Legacy Secure Universal Life fromL<strong>in</strong>coln Benefit Life. It’s an excellent wayfor your customers to benefit from:• competitive premiums(and age last birthday pric<strong>in</strong>g)• flexibility to meet chang<strong>in</strong>g needs, and• strong cash value accumulationHow We ComparePremium comparison is but one part of <strong>the</strong>story. So make sure when you go down thispath, you’re giv<strong>in</strong>g <strong>the</strong> details. For <strong>in</strong>stance, areyou us<strong>in</strong>g age last birthday when appropriate?Are you us<strong>in</strong>g a real-world underwrit<strong>in</strong>g classfor that 65-year-old male? Are you consider<strong>in</strong>g<strong>the</strong> difference cash value can make and <strong>the</strong>flexibility it can give your customers down<strong>the</strong> road? Take a look at <strong>the</strong>se real-worldcomparisons (see charts on page 13).Competitive RatesLegacy Secure is simply a solid universallife product – built for competitiveness atall ages, premium scenarios and premiumclasses. Factor <strong>in</strong> age last birthday pric<strong>in</strong>g,where premiums aren’t affected until <strong>the</strong>policyholder’s next actual birthday (<strong>in</strong>steadof half birthday), and it makes an alreadycompetitive product that much moreattractive to your customers. Plus,12 <strong>the</strong> edge<strong>the</strong> sav<strong>in</strong>gs of age last birthday premiumsreally add up over <strong>the</strong> years.The Cash Value DifferenceLegacy Secure’s strong cash value potentialgives your customers an added layer offlexibility – on top of its guaranteed deathbenefit. Compare for yourself:• From a premium perspective, Legacy Securestands firmly <strong>in</strong> <strong>the</strong> competitive mix.• When look<strong>in</strong>g at cash value, Legacy Secureclearly stands out from <strong>the</strong> competition.The bottom l<strong>in</strong>e is that <strong>the</strong> Legacy Securecash value difference gives your customersoptions… if and when options are needed!So, if your customers’ needs change down <strong>the</strong>road, it’s nice to know that Legacy Secure has<strong>the</strong> flexibility to change with <strong>the</strong>m.Just how Flexible is It?Say<strong>in</strong>g <strong>the</strong> sky is <strong>the</strong> limit might be a littletoo bold … but Legacy Secure UL does provideconsiderable flexibility through a wide range ofoptions. Plus, it’s flexibility that your customerscan put to work for <strong>the</strong>m today, a year fromnow, or down <strong>the</strong> road as <strong>the</strong>ir needs change.So, when you offer your customers LegacySecure UL, you’ll be giv<strong>in</strong>g <strong>the</strong>m options like:• Choos<strong>in</strong>g - and chang<strong>in</strong>g - <strong>the</strong>ir level ofguarantee for periods up to and <strong>in</strong>clud<strong>in</strong>g<strong>the</strong>ir lifetime• Select<strong>in</strong>g <strong>the</strong>ir face amount, with <strong>the</strong>option to <strong>in</strong>crease or decrease it after <strong>the</strong>first policy year• Customiz<strong>in</strong>g premium payment schedulesthat best suit <strong>the</strong>ir needs – like monthly,quarterly, semiannually, annually, dump-<strong>in</strong>s,as well as amounts that are greater than orless than <strong>the</strong> scheduled payment• Utiliz<strong>in</strong>g <strong>the</strong> catch-up provision at any timedur<strong>in</strong>g <strong>the</strong> life of <strong>the</strong> policy to ei<strong>the</strong>r leng<strong>the</strong>n<strong>the</strong> guarantee period or prevent <strong>the</strong> policyfrom laps<strong>in</strong>g if <strong>the</strong>y fell beh<strong>in</strong>d <strong>in</strong> premiumpayments• Simply chang<strong>in</strong>g <strong>the</strong>ir m<strong>in</strong>ds ... after all, withLegacy Secure, that is <strong>the</strong>ir prerogativeNobody knows what <strong>the</strong> future will br<strong>in</strong>g,which is exactly why Legacy Secure UL givesyour customers so many options.Complet<strong>in</strong>g <strong>the</strong> PackageNot only can you offer your customers acompetitive and flexible universal life product<strong>in</strong> Legacy Secure but, with L<strong>in</strong>coln Benefit Life,<strong>the</strong>re is def<strong>in</strong>itely more to life.• Sherlock Underwrit<strong>in</strong>g Program– yourcustomers can qualify for a betterunderwrit<strong>in</strong>g rate us<strong>in</strong>g this program, as longas <strong>the</strong>y are compliant with <strong>the</strong>ir physician’sadvice, manage <strong>the</strong>ir health situations andfollow a regular exercise program 1• Premier Plus Bonus – <strong>in</strong> 2006, you canearn up to 25% more every quarter on yourqualified life sales us<strong>in</strong>g <strong>the</strong> Premier Plusbonus program 2• Conference of Leaders – <strong>the</strong> top 150qualifiers <strong>in</strong> 2006 will embark on a SilverseaCruise sett<strong>in</strong>g sail from Greece <strong>in</strong> April 2007Get Results for Your CustomersLook beyond <strong>the</strong> spreadsheet and take acloser look at LBL’s Legacy Secure UL. Foreven more options, check out our o<strong>the</strong>r Legacyproducts – Legacy Secure Survivorship Life andLegacy Choice Universal Life. Contact yoursales team today!Bob Jurgensmeier, FSA, MAAA, is Senior VicePresident and Actuary at LBL. He has been with<strong>the</strong> company five years and is responsible foruniversal life product development.

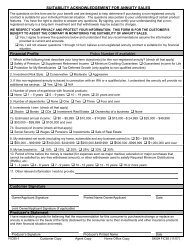

Assumptions–$1 Million Face Amount • Male • Age 55 •Standard Nonsmoker • Lifetime Guarantee PremiumsCompanyProductAnnualPremiumCash ValueYear 10 Year 20 Age 90 Age 100L<strong>in</strong>coln Benefit Life – (age 55) Legacy Secure UL 15,849 91,955 277,470 374,048 0L<strong>in</strong>coln Benefit Life – (age 54) Legacy Secure UL 14,943 90,449 271,168 377,245 0Jefferson Pilot JPF Legend XG 15,555 92,468 183,134 0 0John Hancock Protection UL G (2006) Reprice 15,830 53,680 62,534 0 0American General Cont<strong>in</strong>UL Extend 15,230 57,202 140,050 0 0Genworth F<strong>in</strong>ancial Lifetime Flex Plus 15,354 86,536 215,132 257,483 0Transamerica (age 55) TransACE LP 15,944 61,772 125,628 0 0Transamerica (age 54) TransACE LP 15,133 59,428 132,614 0 0SunLife F<strong>in</strong>ancial Sun Universal Protector LP3 15,247 52,521 177,339 155,789 0MetLife Guarantee Advantage UL 15,259 48,594 39,458 0 0ING Reliastar/Security Life of Denver ING Guaranteed Death Benefit UL 15,489 74,677 186,139 22,548 0L<strong>in</strong>coln National Life L<strong>in</strong>coln UL LPR -7 16,870 36,626 198,277 103,925 0Assumptions–$1 Million Face Amount • Male • Age 65 •Standard Nonsmoker • Lifetime Guarantee PremiumsCompanyProductAnnualPremiumCash ValueYear 10 Year 20 Age 90 Age 100L<strong>in</strong>coln Benefit Life – (age 65) Legacy Secure UL 26,509 143,949 332,450 302,905 0L<strong>in</strong>coln Benefit Life – (age 64) Legacy Secure UL 25,111 140,764 350,274 340,546 0Jefferson Pilot JPF Legend XG 26,539 129,205 102,525 0 0John Hancock Protection UL G (2006) Reprice 26,885 10,639 0 0 0American General Cont<strong>in</strong>UL Extend 26,334 84,485 152,953 0 0Genworth F<strong>in</strong>ancial Lifetime Flex Plus 26,113 108,509 181,632 63,138 0Transamerica (age 65) TransACE LP 26,483 94,249 135,217 0 0Transamerica (age 64) TransACE LP 25,230 91,823 153,189 0 0SunLife F<strong>in</strong>ancial Sun Universal Protector LP3 26,038 51,788 14,491 0 0MetLife Guarantee Advantage UL 26,160 78,457 0 0 0L<strong>in</strong>coln National L<strong>in</strong>coln UL LPR -7 27,930 42,831 69,286 0 0ING Reliastar/Security Life of Denver ING Guaranteed Death Benefit UL 27,485 139,600 251,580 26,458 0NOT FOR PUBLIC DISSEMINATION. LINCOLN BENEFIT LIFE POLICY PROHIBITS AGENTS OR EMPLOYEES FROM SHOWING OR MAKING THE DOCUMENTAVAILABLE TO CUSTOMERS OR POTENTIAL CUSTOMERS. Chart and competitor examples are for illustrative purpose only. All competitive <strong>in</strong>formation isbelieved current as of September 2006 from sources deemed reliable. However, its accuracy and completeness cannot be guaranteed. Data is subject tochange at any time. Competitor products may have features, costs, provisions and benefits that differ from <strong>the</strong>se policies and by state. Chang<strong>in</strong>g <strong>the</strong> variablefeatures (age, state underwrit<strong>in</strong>g class, benefit, etc) may cause a change <strong>in</strong> <strong>the</strong> competitive results.1 For complete details on <strong>the</strong> Sherlock Underwrit<strong>in</strong>g Program, <strong>in</strong>clud<strong>in</strong>g additional limitations and requirements, contact <strong>the</strong> home office.2 For complete details on <strong>the</strong> Premier Plus Bonus Program, <strong>in</strong>clud<strong>in</strong>g eligibility and additional requirements, contact <strong>the</strong> home office.Guarantees based on <strong>the</strong> claims-pay<strong>in</strong>g ability of L<strong>in</strong>coln Benefit Life Company. Policy fees and adm<strong>in</strong>istrative expense charges apply.Legacy Secure Universal Life Insurance Policy (series number UL0400), Legacy Choice Universal Life Insurance Policy (series number UL0420), and Legacy Secure SurvivorshipLife Insurance Policy (series number UL0520) are issued by L<strong>in</strong>coln Benefit Life Company, Home Office: L<strong>in</strong>coln, NE, a wholly owned subsidiary of Allstate Life Insurance Company,Home Office: Northbrook, IL.<strong>the</strong> edge 13

Go<strong>in</strong>g OutIn StyleJohn Brown On Exit Strategiesby Jack ApplemanPhoto byDiane HuntressJohn Brown helps bus<strong>in</strong>ess owners out <strong>the</strong> door– when <strong>the</strong>y choose to leave. Dur<strong>in</strong>g his threedecades as an estate and bus<strong>in</strong>ess plann<strong>in</strong>gattorney, Brown saw how many owners were unprepared forthat ultimate departure from <strong>the</strong>ir companies. So <strong>in</strong> 2003, hedecided to devote his Colorado-based firm, Bus<strong>in</strong>ess EnterpriseInstitute (BEI), exclusively to exit plann<strong>in</strong>g.His book, The Completely Revised Howto Run Your Bus<strong>in</strong>ess So You Can LeaveIt <strong>in</strong> Style, details BEI’s seven-step exitplann<strong>in</strong>g process.Today Brown is build<strong>in</strong>g a network of<strong>in</strong>surance professionals, attorneys, CPAsand o<strong>the</strong>r advisors to offer exit plann<strong>in</strong>g tobus<strong>in</strong>ess owners nationwide. He believes<strong>in</strong>surance advisors can drive <strong>the</strong> exitplann<strong>in</strong>g process – and take <strong>the</strong>ir ownbus<strong>in</strong>esses to a new level. Brown shareshis thoughts with The Edge’s readers.How would you def<strong>in</strong>e exit plann<strong>in</strong>g?Exit plann<strong>in</strong>g is <strong>the</strong> deliberate, adaptableand customized process that a bus<strong>in</strong>essowner uses to leave <strong>the</strong> company on his orher own terms and timetable.Why is exit plann<strong>in</strong>g so critical forbus<strong>in</strong>ess owners?There are more than n<strong>in</strong>e millionestablished bus<strong>in</strong>ess owners <strong>in</strong> <strong>the</strong> U.S., halfof whom are 50 years old or older. A recentsurvey of firms with $5 million to $150 million<strong>in</strong> revenues revealed that two out of threeowners plan to leave <strong>the</strong>ir firms with<strong>in</strong> 101 Source: 2005 survey conducted by Pricewaterhouse Coopers.14 <strong>the</strong> edgeyears. But more than 75% of <strong>the</strong>m haven’tdone much plann<strong>in</strong>g for what probably willbe <strong>the</strong> most significant f<strong>in</strong>ancial event of<strong>the</strong>ir lives. Th<strong>in</strong>k of <strong>the</strong> potential obstacles:huge tax bills after <strong>the</strong> sale of <strong>the</strong> bus<strong>in</strong>ess,potential chaos if <strong>the</strong> unexpected happensto <strong>the</strong> owner or a key employee, and feud<strong>in</strong>gfamily members, just to name a few. 1How does BEI help bus<strong>in</strong>ess owners wi<strong>the</strong>xit plann<strong>in</strong>g?BEI helps bus<strong>in</strong>ess owners exit <strong>the</strong>ircompanies <strong>in</strong> style by tra<strong>in</strong><strong>in</strong>g <strong>the</strong>ir advisors<strong>in</strong> <strong>the</strong> exit plann<strong>in</strong>g process. The exit plann<strong>in</strong>gprocess is facilitated through our membersnationwide – <strong>in</strong>surance professionals, suchas Randy Johnson (featured on The Edge’scover), attorneys, accountants and o<strong>the</strong>radvisors, all licensed <strong>in</strong> <strong>the</strong>ir states. Any of<strong>the</strong>se <strong>in</strong>dividuals can jo<strong>in</strong> BEI and receive<strong>the</strong> education, products, and market<strong>in</strong>gsupport needed to approach and engagebus<strong>in</strong>ess owners <strong>in</strong> <strong>the</strong> exit plann<strong>in</strong>g process.We teach <strong>the</strong>m our Seven Step Exit Plann<strong>in</strong>gProcess design process of establish<strong>in</strong>gowner objectives and bus<strong>in</strong>ess value, build<strong>in</strong>gcash flow, sell<strong>in</strong>g to a third party for topdollar, transferr<strong>in</strong>g to management or familymembers, develop<strong>in</strong>g a bus<strong>in</strong>ess cont<strong>in</strong>gencyplan and preserv<strong>in</strong>g family wealth.After be<strong>in</strong>g tra<strong>in</strong>ed <strong>in</strong> exit plann<strong>in</strong>g, anadvisor builds a team of specialists <strong>in</strong> <strong>the</strong>o<strong>the</strong>r discipl<strong>in</strong>es. So an <strong>in</strong>surance professionalwho jo<strong>in</strong>s BEI would <strong>the</strong>n recruit attorneys,CPAs and o<strong>the</strong>r specialists.What role can <strong>in</strong>surance brokers play <strong>in</strong>exit plann<strong>in</strong>g?Of all <strong>the</strong> professionals a bus<strong>in</strong>ess ownerdeals with, <strong>in</strong>surance advisors are <strong>in</strong> <strong>the</strong>best position to drive <strong>the</strong> exit plann<strong>in</strong>gprocess – for several reasons. First, <strong>in</strong>suranceadvisors usually have superior <strong>in</strong>terpersonalskills essential to develop<strong>in</strong>g a long-termrelationship with owners. Second, bus<strong>in</strong>essowners often feel more comfortable talk<strong>in</strong>gto <strong>the</strong>ir <strong>in</strong>surance advisors – who typicallydon’t charge by <strong>the</strong> hour – than with o<strong>the</strong>rtrusted advisors whose meter keeps runn<strong>in</strong>gdur<strong>in</strong>g every conversation. Third, life,disability and long-term care <strong>in</strong>suranceare primary tools used to implement<strong>the</strong> plann<strong>in</strong>g recommendations. Fourth,<strong>in</strong>surance professionals are more comfortable

and skilled at work<strong>in</strong>g <strong>in</strong> a multi-discipl<strong>in</strong>ary process, whichis required <strong>in</strong> exit plann<strong>in</strong>g.Which <strong>in</strong>surance products are typically used <strong>in</strong> exitplann<strong>in</strong>g?Key-person <strong>in</strong>surance, buy-sell agreements, deferredcompensation and o<strong>the</strong>r forms of life <strong>in</strong>surance.How is life <strong>in</strong>surance typically used <strong>in</strong> exit plann<strong>in</strong>g?It’s used as key-person <strong>in</strong>surance, to fund buy-sellagreements, and <strong>in</strong> deferred compensation plans. Keypersonis often critical to <strong>the</strong> exit plann<strong>in</strong>g strategy s<strong>in</strong>ceit’s based on <strong>the</strong> money that would be required to replacesomeone considered essential to <strong>the</strong> bus<strong>in</strong>ess. If that<strong>in</strong>dividual dies without key-person coverage, <strong>the</strong> ownermay be forced to delay his or her exit from <strong>the</strong> bus<strong>in</strong>ess.That can ru<strong>in</strong> years of plann<strong>in</strong>g <strong>in</strong> a heartbeat.What k<strong>in</strong>d of opportunity does exit plann<strong>in</strong>g offer<strong>in</strong>surance professionals?The practice of exit plann<strong>in</strong>g can transform an<strong>in</strong>surance advisor’s career. By tak<strong>in</strong>g <strong>the</strong> lead <strong>in</strong>this process, an <strong>in</strong>surance professional can shift <strong>the</strong>fundamental relationships with clients. He or she can movebeyond just supply<strong>in</strong>g a product and offer<strong>in</strong>g some adviceto becom<strong>in</strong>g an essential part of <strong>the</strong> owner’s lifetimeplann<strong>in</strong>g. This can cultivate a long-term relationship thatcan pay off <strong>in</strong> many ways.Plus, now is <strong>the</strong> best time to become <strong>in</strong>volved <strong>in</strong> exitplann<strong>in</strong>g. Th<strong>in</strong>k of <strong>the</strong> millions of baby boomers whoown bus<strong>in</strong>esses and are beg<strong>in</strong>n<strong>in</strong>g to age and <strong>the</strong> lack ofadvisors who understand exit plann<strong>in</strong>g. We’re look<strong>in</strong>g at amassive opportunity.How does BEI tra<strong>in</strong> <strong>in</strong>surance advisors <strong>in</strong> exitplann<strong>in</strong>g?Once <strong>the</strong>y jo<strong>in</strong> <strong>the</strong> BEI network, advisors participate<strong>in</strong> a series of web<strong>in</strong>ars and our <strong>in</strong>tensive two-day bootcamp, which expla<strong>in</strong>s how to approach and engage <strong>the</strong>bus<strong>in</strong>ess owner with exit plann<strong>in</strong>g, market <strong>the</strong>ir exitplann<strong>in</strong>g process, and create and manage an exitplann<strong>in</strong>g advisor team and <strong>the</strong> Seven Step design process.Ultimately that <strong>in</strong>surance professional will be able toposition himself or herself as THE resource for bus<strong>in</strong>essowners. Follow-up tra<strong>in</strong><strong>in</strong>g cont<strong>in</strong>ues for <strong>the</strong> next12 months, which <strong>in</strong>cludes teach<strong>in</strong>g advisors’ assistantsto conduct mail<strong>in</strong>gs and o<strong>the</strong>r market<strong>in</strong>g activities.For more <strong>in</strong>formation, contact John Brown atjbrown@exitplann<strong>in</strong>gforadvisors.com or 888-206-3009.Jack E. Appleman, CBC, is a seasoned <strong>in</strong>surancecommunication professional with 20 years’ experienceas a PR specialist, corporate writ<strong>in</strong>g <strong>in</strong>structor andcollege professor.<strong>the</strong> edge 15

The Miss<strong>in</strong>g L<strong>in</strong>k <strong>in</strong>Retirement Portfoliosby Elizabeth CranstonAllstate’sTreasury-L<strong>in</strong>ked Annuity16 <strong>the</strong> edge

Generally speak<strong>in</strong>g, with securitycomes complacence and with opportunitycomes risk. In plann<strong>in</strong>g forretirement, customers generally seek safety<strong>in</strong> <strong>the</strong>ir <strong>in</strong>vestments; however, that doesn’thave to mean that opportunity will pass <strong>the</strong>mby. They can have <strong>the</strong> best of both worlds– safety and opportunity – <strong>in</strong> <strong>the</strong> Allstate ®Treasury-L<strong>in</strong>ked Annuity (T-L<strong>in</strong>k).This recently patented product givesyou a unique edge <strong>in</strong> sell<strong>in</strong>g annuities. First,with <strong>the</strong> patent <strong>in</strong> place, no o<strong>the</strong>r <strong>in</strong>surancecompany can create a product that offersT-L<strong>in</strong>k’s unique method to establish a fixedannuity credit<strong>in</strong>g rate. Second, becauseT-L<strong>in</strong>k may keep pace with <strong>in</strong>terest rates,money saved is money that earns, and thatmay help customers keep up with <strong>the</strong> ever<strong>in</strong>creas<strong>in</strong>gcost of liv<strong>in</strong>g.The benefit of hav<strong>in</strong>g safety with higher<strong>in</strong>terest rate potential also helped to spurT-L<strong>in</strong>k product sales, as more customersdiscovered it over <strong>the</strong> past year. “As <strong>in</strong>terestrates have risen, so have sales. Through<strong>the</strong> end of <strong>the</strong> second quarter of 2006,product sales were nearly eight timesgreater compared to <strong>the</strong> first six monthsof 2005,” 1 says Sarah Donahue, AssistantVice President, Annuity Products, AllstateF<strong>in</strong>ancial. “It’s clear that producers whounderstand this product and its value mayhelp customers capture <strong>the</strong> upside potentialthat ris<strong>in</strong>g <strong>in</strong>terest rates provide.”<strong>the</strong>ir own subaccounts and have <strong>the</strong>ir ownguaranteed <strong>in</strong>terest rates set for five years.Dur<strong>in</strong>g those five years, <strong>the</strong> customer willnot earn less than <strong>the</strong> m<strong>in</strong>imum guaranteedbase <strong>in</strong>terest rate; however, he may earn moredepend<strong>in</strong>g on <strong>the</strong> performance of <strong>the</strong> 5-yearU.S. CMT Rate. On <strong>the</strong> one-year anniversary ofa purchase payment, if <strong>the</strong> 5-year CMT Rate ishigher than it was on <strong>the</strong> date of <strong>the</strong> deposit,<strong>the</strong> difference will be added to <strong>the</strong> guaranteed<strong>in</strong>terest rate for <strong>the</strong> next year. If it is lower, <strong>the</strong>customer will simply earn <strong>the</strong> guaranteed5-year rate. At <strong>the</strong> end of <strong>the</strong> 5-year period,<strong>the</strong> guaranteed <strong>in</strong>terest rate is reset basedon market conditions at that time. Also, afterfive years <strong>the</strong> customer has a 45-day w<strong>in</strong>dowto withdraw all or some of <strong>the</strong> contractvalue, without <strong>in</strong>curr<strong>in</strong>g company imposedsurrender charges. 3, 4 Surrender charges expireafter 10 years for each subaccount.T-L<strong>in</strong>k vs. O<strong>the</strong>r Fixed AnnuitiesAs you can see, <strong>the</strong> potential for growthcould be appeal<strong>in</strong>g to anyone <strong>in</strong>terested <strong>in</strong>try<strong>in</strong>g to maximize retirement sav<strong>in</strong>gs.Over <strong>the</strong> long term, T-L<strong>in</strong>k may performbetter than a different fixed annuity with ahigher <strong>in</strong>terest rate. How? Just consider <strong>the</strong>O<strong>the</strong>r T-L<strong>in</strong>kFeatures• No up-front loads,expense charges,or annual fees• Waivers, <strong>in</strong>clud<strong>in</strong>gwaiver of withdrawalcharges for <strong>the</strong> <strong>in</strong>abilityto perform two or moreactivities of daily liv<strong>in</strong>g 4, 6• High premium <strong>in</strong>centivesfor contract values$100,000 or more• 10% free withdrawals 7T-L<strong>in</strong>k Expla<strong>in</strong>edSo how exactly does this product work,and how can a customer get his retirementsav<strong>in</strong>gs tied <strong>in</strong>to its growth potential? T-L<strong>in</strong>kis a flexible premium deferred annuitythat provides safety with greater growthpotential. When a customer purchases acontract, he or she is guaranteed a base<strong>in</strong>terest rate for five years. 2 He or she also has<strong>the</strong> opportunity to add m<strong>in</strong>imum purchasepayments of $100 at any time. Interest ratesfor new purchase payments are based ontotal contract value at <strong>the</strong> time of <strong>the</strong> newpurchase payments. These additions createThis example is for illustrative purposes only and not <strong>in</strong>tended to represent <strong>the</strong> actual performance of T-L<strong>in</strong>k.Rates and returns are hypo<strong>the</strong>tical. Real rates are subject to change.Example assumes a 100% participation rate.1 This statement is based on submitted new bus<strong>in</strong>ess sales figures for T-L<strong>in</strong>k. Actual <strong>in</strong>crease was 786%.2 Guarantees are based on <strong>the</strong> claims pay<strong>in</strong>g ability of L<strong>in</strong>coln Benefit Life Company.3 Loss of pr<strong>in</strong>cipal due to surrender charges rang<strong>in</strong>g from 0% to 9% <strong>in</strong> <strong>the</strong> first 10 years may occur if <strong>the</strong> annuity is surrendered <strong>in</strong> <strong>the</strong> early years s<strong>in</strong>ce <strong>the</strong> purchase payment was made.4 Distributions taken prior to annuitization are generally considered to come from <strong>the</strong> ga<strong>in</strong> <strong>in</strong> <strong>the</strong> contract first. If <strong>the</strong> contract is tax qualified, generally all withdrawals are treated asdistributions of ga<strong>in</strong>. Withdrawals of ga<strong>in</strong> are taxed as ord<strong>in</strong>ary <strong>in</strong>come and, if taken prior to age 59 ½, may be subject to an additional 10% federal tax penalty.<strong>the</strong> edge 17

fluctuations <strong>in</strong> <strong>in</strong>terest rates. From 1962 to 2006,for example, <strong>the</strong> daily average for <strong>the</strong> U.S. CMTRate was 6.91%. This rate has been fluctuat<strong>in</strong>gbetween 4% and 5% for most of 2006. If historyrepeats itself and rates trend upwards, it may payto have a fixed annuity contract with a rate tied to<strong>the</strong> 5-year U.S. CMT Rate. 5In <strong>the</strong> follow<strong>in</strong>g hypo<strong>the</strong>tical example, Joepurchases an Allstate Treasury-L<strong>in</strong>ked Annuitycontract for $100,000. He receives a 5-yearguaranteed <strong>in</strong>terest rate of 4% at <strong>the</strong> beg<strong>in</strong>n<strong>in</strong>gof his contract. In this example, Joe would receivea greater amount of <strong>in</strong>terest <strong>in</strong> a T-L<strong>in</strong>k contractwith a 4% 5-year guarantee rate than he wouldwith a 4.5% fixed <strong>in</strong>vestment because of <strong>the</strong><strong>in</strong>creases <strong>in</strong> <strong>the</strong> 5-year CMT Rate, shown <strong>in</strong> <strong>the</strong>chart below.This example shows a $2,738 T-L<strong>in</strong>k advantage($127,356 - $124,618 = $2,738) and shows thatwhat may <strong>in</strong>itially appear bigger may not alwaysbe better for <strong>the</strong> customer. Increas<strong>in</strong>g 5-year U.S.CMT Rates may make a lower guaranteed rate on<strong>the</strong> T-L<strong>in</strong>k perform significantly better than ahigher fixed rate. Of course, if <strong>the</strong> 5-year U.S.CMT Rate decl<strong>in</strong>ed over <strong>the</strong> same 5-yearperiod, Joe would have received <strong>the</strong>guaranteed rate of 4%, which wouldresult <strong>in</strong> less <strong>in</strong>terest than with <strong>the</strong>4.5% fixed <strong>in</strong>vestment.Best of Both WorldsAs with all <strong>in</strong>vestments though, <strong>the</strong>re is noguarantee that it will perform better than o<strong>the</strong>r<strong>in</strong>vestments, but at least T-L<strong>in</strong>k can guaranteethat <strong>the</strong> potential to do better is <strong>the</strong>re. And it offers<strong>the</strong> best of both worlds – downside protection andupside potential. 2Elizabeth Cranston is a market<strong>in</strong>g professional forL<strong>in</strong>coln Benefit Life.Charts are hypo<strong>the</strong>tical and for illustrative purposesonly, and are not <strong>in</strong>tended to predict future results.Examples assume a $100,000 <strong>in</strong>itial <strong>in</strong>vestmentwith no additional purchase payments and nowithdrawals taken dur<strong>in</strong>g <strong>the</strong> 5-year guaranteeperiod. Examples do not reflect <strong>the</strong> effect offederal or state taxes. The rate of return on <strong>the</strong>5-year Allstate Treasury-L<strong>in</strong>ked Annuity may behigher or lower than a 5-year guaranteed rate ona fixed annuity product that is non-treasury-l<strong>in</strong>ked.Example assumes a 100% participation rate.5 Past performance of <strong>the</strong> 5-year U.S. CMT Rate or Allstate Treasury-L<strong>in</strong>ked Annuity 5-yearguarantee rates are not <strong>in</strong>dicative of future results.6 Waivers are automatically <strong>in</strong>cluded with all contracts if approved <strong>in</strong> that state. Seeendorsements for specific details, terms, conditions and limitations.7 A portion of each payment will be considered taxable, and <strong>the</strong> rema<strong>in</strong><strong>in</strong>g portion will be anontaxable return of your <strong>in</strong>vestment <strong>in</strong> <strong>the</strong> contract, which is also called <strong>the</strong> “basis.” Once<strong>the</strong> <strong>in</strong>vestment <strong>in</strong> <strong>the</strong> contract is depleted, all rema<strong>in</strong><strong>in</strong>g payments will be fully taxable. If<strong>the</strong> contract is tax-qualified, generally, all payments will be fully taxable. Payments takenprior to age 59½ may be subject to an additional 10% federal tax penalty.All guarantees are based on <strong>the</strong> claims pay<strong>in</strong>g ability of L<strong>in</strong>coln Benefit Life Company.There are no <strong>in</strong>terest rate enhancements dur<strong>in</strong>g <strong>the</strong> first year of each 5-year guaranteeperiod. Loss of pr<strong>in</strong>cipal due to surrender charges may occur if <strong>the</strong> annuity is surrendered <strong>in</strong><strong>the</strong> early years s<strong>in</strong>ce <strong>the</strong> purchase payment was made.18 <strong>the</strong> edgeThe exact match to <strong>the</strong> 5-year U.S. Treasury Rate <strong>in</strong>crease is called “ full participation”and is guaranteed for <strong>the</strong> first five years. A participation rate is set for <strong>the</strong> entire5-year guarantee period. L<strong>in</strong>coln Benefit Life Company reserves <strong>the</strong> right to change<strong>the</strong> participation rate for subsequent renewal periods.The Allstate® Treasury-L<strong>in</strong>ked Annuity is a flexible deferred annuity issued by L<strong>in</strong>colnBenefit Life Company, Home Office: L<strong>in</strong>coln, NE, a wholly owned subsidiary of Allstate LifeInsurance Company, Home Office: Northbrook, IL. Allstate® Treasury-L<strong>in</strong>ked Annuity isavailable <strong>in</strong> most states with contract series AP0200 and certificate series GAP0200.Not FDIC, NCUA/NCUSIF Insured. Not <strong>in</strong>sured by any federal government agency.Not a deposit. Not guaranteed by <strong>the</strong> bank or credit union. May go down <strong>in</strong> value.FOR BROKER/DEALER OR AGENT USE ONLY — this material may not be quoted,reproduced or shown to members of <strong>the</strong> public, nor used <strong>in</strong> electronic or written form assales literature for public use.

Choice is GoodL<strong>in</strong>coln Benefit Life’s SureHorizon SM II and SureHorizon SMChoice annuities offer a selection of features yourcustomers will appreciate, <strong>in</strong>clud<strong>in</strong>g:• A choice of four different guarantee periods• First year <strong>in</strong>terest bonuses• No withdrawal charge on <strong>the</strong> standard death benefit• 15% free withdrawals*• Trail commission options• Activities of Daily Liv<strong>in</strong>g**Whe<strong>the</strong>r it be s<strong>in</strong>gle or flexible premium, lowm<strong>in</strong>imum premiums or higher credit<strong>in</strong>g rates, get<strong>the</strong> choice of features you need for your annuitysales with <strong>the</strong> SureHorizon series.Choose now to get more <strong>in</strong>formation— callL<strong>in</strong>coln Benefit Lifetoday at 888-525-7355.*Distributions taken prior to annuitization are generally considered to come from <strong>the</strong> ga<strong>in</strong> <strong>in</strong> <strong>the</strong> contract first. If <strong>the</strong> contract is tax-qualified, generally all withdrawals aretreated as distributions of ga<strong>in</strong>. Withdrawals of ga<strong>in</strong> are taxed as ord<strong>in</strong>ary <strong>in</strong>come and, if taken prior to age 59 1/2 may be subject to an additional 10% federal tax penalty.**Activities of Daily Liv<strong>in</strong>g Waiver is now part of <strong>the</strong> Emergency Waiver that allows withdrawal charges to be waived if <strong>the</strong> owner is unable to perform two or more of <strong>the</strong>def<strong>in</strong>ed activities of daily liv<strong>in</strong>g, conf<strong>in</strong>ed to a long-term care facility or hospital for at least 90 consecutive days, diagnosed with a term<strong>in</strong>al illness, or becomes unemployed.May be subject to state availability. See endorsement for specific details, terms and conditions.Guarantees are based on <strong>the</strong> claims pay<strong>in</strong>g ability of L<strong>in</strong>coln Benefit Life.Not FDIC, NCUA/NCUSIF <strong>in</strong>suredNot <strong>in</strong>sured by any federalgovernment agencyNot a depositNot guaranteed by <strong>the</strong>bank or credit unionMay go down<strong>in</strong> valueFOR BROKER-DEALER OR AGENT USE ONLY—may not be quoted, reproduced, shown to members of <strong>the</strong> public or used <strong>in</strong> oral, written or electronic form as sales literaturefor public use.SureHorizon SM Choice (AP0510), a s<strong>in</strong>gle premium deferred annuity, and SureHorizon SM II (AP0500), a flexible premium deferred annuity, are both issued by L<strong>in</strong>coln Benefit LifeCompany, L<strong>in</strong>coln, NE, a wholly owned subsidiary of Allstate Life Insurance Company, Northbrook, IL. Products may not be available <strong>in</strong> all states.AC6043©2006 Allstate Insurance Company, Home Office, Northbrook, IL

The MostSuccessfulProducers Know How toAdaptSharks can sense and adapt to subtle changes <strong>in</strong><strong>the</strong>ir environment. You, however, need to rapidlyadapt to chang<strong>in</strong>g product <strong>in</strong>formation <strong>in</strong> order tooffer <strong>the</strong> best service to your clients.That’s why L<strong>in</strong>coln Benefit Life uses Bra<strong>in</strong>shark...to keep producers up-to-date on LBL products.To learn more about how you can use Bra<strong>in</strong>shark,and to sign up for a FREE Bra<strong>in</strong>shark Express TrialAccount, please view this Bra<strong>in</strong>shark presentation:http://www.bra<strong>in</strong>shark.com/bra<strong>in</strong>shark<strong>in</strong>c/LBLYou can use Bra<strong>in</strong>shark for:• Increas<strong>in</strong>g <strong>the</strong> reach and impactof your personal communications• Improv<strong>in</strong>g lead generation programs• Deliver<strong>in</strong>g post-meet<strong>in</strong>g follow-upCast a Smarter Net