Working in the - AccessAllstate

Working in the - AccessAllstate

Working in the - AccessAllstate

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

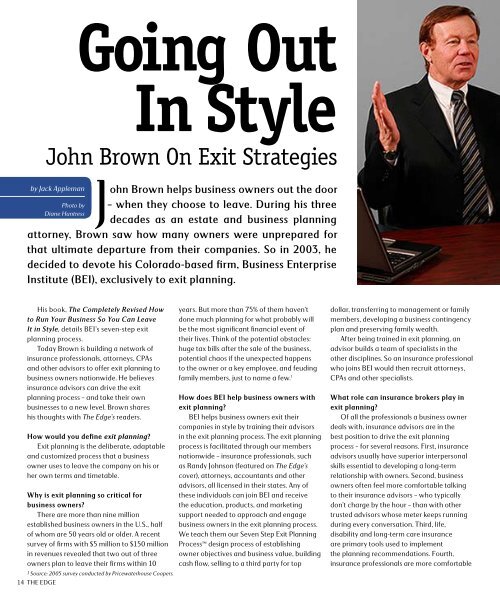

Go<strong>in</strong>g OutIn StyleJohn Brown On Exit Strategiesby Jack ApplemanPhoto byDiane HuntressJohn Brown helps bus<strong>in</strong>ess owners out <strong>the</strong> door– when <strong>the</strong>y choose to leave. Dur<strong>in</strong>g his threedecades as an estate and bus<strong>in</strong>ess plann<strong>in</strong>gattorney, Brown saw how many owners were unprepared forthat ultimate departure from <strong>the</strong>ir companies. So <strong>in</strong> 2003, hedecided to devote his Colorado-based firm, Bus<strong>in</strong>ess EnterpriseInstitute (BEI), exclusively to exit plann<strong>in</strong>g.His book, The Completely Revised Howto Run Your Bus<strong>in</strong>ess So You Can LeaveIt <strong>in</strong> Style, details BEI’s seven-step exitplann<strong>in</strong>g process.Today Brown is build<strong>in</strong>g a network of<strong>in</strong>surance professionals, attorneys, CPAsand o<strong>the</strong>r advisors to offer exit plann<strong>in</strong>g tobus<strong>in</strong>ess owners nationwide. He believes<strong>in</strong>surance advisors can drive <strong>the</strong> exitplann<strong>in</strong>g process – and take <strong>the</strong>ir ownbus<strong>in</strong>esses to a new level. Brown shareshis thoughts with The Edge’s readers.How would you def<strong>in</strong>e exit plann<strong>in</strong>g?Exit plann<strong>in</strong>g is <strong>the</strong> deliberate, adaptableand customized process that a bus<strong>in</strong>essowner uses to leave <strong>the</strong> company on his orher own terms and timetable.Why is exit plann<strong>in</strong>g so critical forbus<strong>in</strong>ess owners?There are more than n<strong>in</strong>e millionestablished bus<strong>in</strong>ess owners <strong>in</strong> <strong>the</strong> U.S., halfof whom are 50 years old or older. A recentsurvey of firms with $5 million to $150 million<strong>in</strong> revenues revealed that two out of threeowners plan to leave <strong>the</strong>ir firms with<strong>in</strong> 101 Source: 2005 survey conducted by Pricewaterhouse Coopers.14 <strong>the</strong> edgeyears. But more than 75% of <strong>the</strong>m haven’tdone much plann<strong>in</strong>g for what probably willbe <strong>the</strong> most significant f<strong>in</strong>ancial event of<strong>the</strong>ir lives. Th<strong>in</strong>k of <strong>the</strong> potential obstacles:huge tax bills after <strong>the</strong> sale of <strong>the</strong> bus<strong>in</strong>ess,potential chaos if <strong>the</strong> unexpected happensto <strong>the</strong> owner or a key employee, and feud<strong>in</strong>gfamily members, just to name a few. 1How does BEI help bus<strong>in</strong>ess owners wi<strong>the</strong>xit plann<strong>in</strong>g?BEI helps bus<strong>in</strong>ess owners exit <strong>the</strong>ircompanies <strong>in</strong> style by tra<strong>in</strong><strong>in</strong>g <strong>the</strong>ir advisors<strong>in</strong> <strong>the</strong> exit plann<strong>in</strong>g process. The exit plann<strong>in</strong>gprocess is facilitated through our membersnationwide – <strong>in</strong>surance professionals, suchas Randy Johnson (featured on The Edge’scover), attorneys, accountants and o<strong>the</strong>radvisors, all licensed <strong>in</strong> <strong>the</strong>ir states. Any of<strong>the</strong>se <strong>in</strong>dividuals can jo<strong>in</strong> BEI and receive<strong>the</strong> education, products, and market<strong>in</strong>gsupport needed to approach and engagebus<strong>in</strong>ess owners <strong>in</strong> <strong>the</strong> exit plann<strong>in</strong>g process.We teach <strong>the</strong>m our Seven Step Exit Plann<strong>in</strong>gProcess design process of establish<strong>in</strong>gowner objectives and bus<strong>in</strong>ess value, build<strong>in</strong>gcash flow, sell<strong>in</strong>g to a third party for topdollar, transferr<strong>in</strong>g to management or familymembers, develop<strong>in</strong>g a bus<strong>in</strong>ess cont<strong>in</strong>gencyplan and preserv<strong>in</strong>g family wealth.After be<strong>in</strong>g tra<strong>in</strong>ed <strong>in</strong> exit plann<strong>in</strong>g, anadvisor builds a team of specialists <strong>in</strong> <strong>the</strong>o<strong>the</strong>r discipl<strong>in</strong>es. So an <strong>in</strong>surance professionalwho jo<strong>in</strong>s BEI would <strong>the</strong>n recruit attorneys,CPAs and o<strong>the</strong>r specialists.What role can <strong>in</strong>surance brokers play <strong>in</strong>exit plann<strong>in</strong>g?Of all <strong>the</strong> professionals a bus<strong>in</strong>ess ownerdeals with, <strong>in</strong>surance advisors are <strong>in</strong> <strong>the</strong>best position to drive <strong>the</strong> exit plann<strong>in</strong>gprocess – for several reasons. First, <strong>in</strong>suranceadvisors usually have superior <strong>in</strong>terpersonalskills essential to develop<strong>in</strong>g a long-termrelationship with owners. Second, bus<strong>in</strong>essowners often feel more comfortable talk<strong>in</strong>gto <strong>the</strong>ir <strong>in</strong>surance advisors – who typicallydon’t charge by <strong>the</strong> hour – than with o<strong>the</strong>rtrusted advisors whose meter keeps runn<strong>in</strong>gdur<strong>in</strong>g every conversation. Third, life,disability and long-term care <strong>in</strong>suranceare primary tools used to implement<strong>the</strong> plann<strong>in</strong>g recommendations. Fourth,<strong>in</strong>surance professionals are more comfortable