Working in the - AccessAllstate

Working in the - AccessAllstate

Working in the - AccessAllstate

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

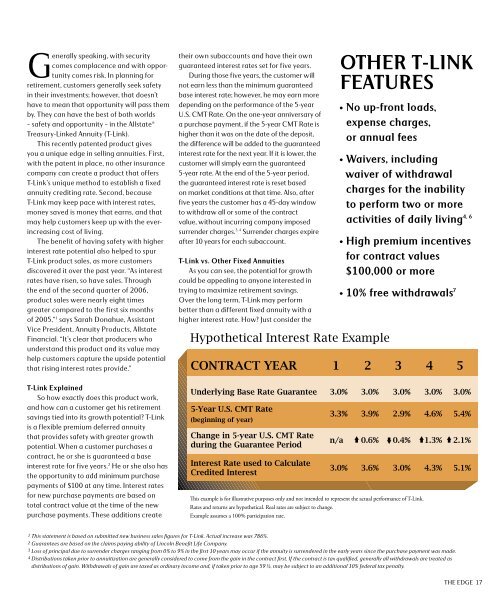

Generally speak<strong>in</strong>g, with securitycomes complacence and with opportunitycomes risk. In plann<strong>in</strong>g forretirement, customers generally seek safety<strong>in</strong> <strong>the</strong>ir <strong>in</strong>vestments; however, that doesn’thave to mean that opportunity will pass <strong>the</strong>mby. They can have <strong>the</strong> best of both worlds– safety and opportunity – <strong>in</strong> <strong>the</strong> Allstate ®Treasury-L<strong>in</strong>ked Annuity (T-L<strong>in</strong>k).This recently patented product givesyou a unique edge <strong>in</strong> sell<strong>in</strong>g annuities. First,with <strong>the</strong> patent <strong>in</strong> place, no o<strong>the</strong>r <strong>in</strong>surancecompany can create a product that offersT-L<strong>in</strong>k’s unique method to establish a fixedannuity credit<strong>in</strong>g rate. Second, becauseT-L<strong>in</strong>k may keep pace with <strong>in</strong>terest rates,money saved is money that earns, and thatmay help customers keep up with <strong>the</strong> ever<strong>in</strong>creas<strong>in</strong>gcost of liv<strong>in</strong>g.The benefit of hav<strong>in</strong>g safety with higher<strong>in</strong>terest rate potential also helped to spurT-L<strong>in</strong>k product sales, as more customersdiscovered it over <strong>the</strong> past year. “As <strong>in</strong>terestrates have risen, so have sales. Through<strong>the</strong> end of <strong>the</strong> second quarter of 2006,product sales were nearly eight timesgreater compared to <strong>the</strong> first six monthsof 2005,” 1 says Sarah Donahue, AssistantVice President, Annuity Products, AllstateF<strong>in</strong>ancial. “It’s clear that producers whounderstand this product and its value mayhelp customers capture <strong>the</strong> upside potentialthat ris<strong>in</strong>g <strong>in</strong>terest rates provide.”<strong>the</strong>ir own subaccounts and have <strong>the</strong>ir ownguaranteed <strong>in</strong>terest rates set for five years.Dur<strong>in</strong>g those five years, <strong>the</strong> customer willnot earn less than <strong>the</strong> m<strong>in</strong>imum guaranteedbase <strong>in</strong>terest rate; however, he may earn moredepend<strong>in</strong>g on <strong>the</strong> performance of <strong>the</strong> 5-yearU.S. CMT Rate. On <strong>the</strong> one-year anniversary ofa purchase payment, if <strong>the</strong> 5-year CMT Rate ishigher than it was on <strong>the</strong> date of <strong>the</strong> deposit,<strong>the</strong> difference will be added to <strong>the</strong> guaranteed<strong>in</strong>terest rate for <strong>the</strong> next year. If it is lower, <strong>the</strong>customer will simply earn <strong>the</strong> guaranteed5-year rate. At <strong>the</strong> end of <strong>the</strong> 5-year period,<strong>the</strong> guaranteed <strong>in</strong>terest rate is reset basedon market conditions at that time. Also, afterfive years <strong>the</strong> customer has a 45-day w<strong>in</strong>dowto withdraw all or some of <strong>the</strong> contractvalue, without <strong>in</strong>curr<strong>in</strong>g company imposedsurrender charges. 3, 4 Surrender charges expireafter 10 years for each subaccount.T-L<strong>in</strong>k vs. O<strong>the</strong>r Fixed AnnuitiesAs you can see, <strong>the</strong> potential for growthcould be appeal<strong>in</strong>g to anyone <strong>in</strong>terested <strong>in</strong>try<strong>in</strong>g to maximize retirement sav<strong>in</strong>gs.Over <strong>the</strong> long term, T-L<strong>in</strong>k may performbetter than a different fixed annuity with ahigher <strong>in</strong>terest rate. How? Just consider <strong>the</strong>O<strong>the</strong>r T-L<strong>in</strong>kFeatures• No up-front loads,expense charges,or annual fees• Waivers, <strong>in</strong>clud<strong>in</strong>gwaiver of withdrawalcharges for <strong>the</strong> <strong>in</strong>abilityto perform two or moreactivities of daily liv<strong>in</strong>g 4, 6• High premium <strong>in</strong>centivesfor contract values$100,000 or more• 10% free withdrawals 7T-L<strong>in</strong>k Expla<strong>in</strong>edSo how exactly does this product work,and how can a customer get his retirementsav<strong>in</strong>gs tied <strong>in</strong>to its growth potential? T-L<strong>in</strong>kis a flexible premium deferred annuitythat provides safety with greater growthpotential. When a customer purchases acontract, he or she is guaranteed a base<strong>in</strong>terest rate for five years. 2 He or she also has<strong>the</strong> opportunity to add m<strong>in</strong>imum purchasepayments of $100 at any time. Interest ratesfor new purchase payments are based ontotal contract value at <strong>the</strong> time of <strong>the</strong> newpurchase payments. These additions createThis example is for illustrative purposes only and not <strong>in</strong>tended to represent <strong>the</strong> actual performance of T-L<strong>in</strong>k.Rates and returns are hypo<strong>the</strong>tical. Real rates are subject to change.Example assumes a 100% participation rate.1 This statement is based on submitted new bus<strong>in</strong>ess sales figures for T-L<strong>in</strong>k. Actual <strong>in</strong>crease was 786%.2 Guarantees are based on <strong>the</strong> claims pay<strong>in</strong>g ability of L<strong>in</strong>coln Benefit Life Company.3 Loss of pr<strong>in</strong>cipal due to surrender charges rang<strong>in</strong>g from 0% to 9% <strong>in</strong> <strong>the</strong> first 10 years may occur if <strong>the</strong> annuity is surrendered <strong>in</strong> <strong>the</strong> early years s<strong>in</strong>ce <strong>the</strong> purchase payment was made.4 Distributions taken prior to annuitization are generally considered to come from <strong>the</strong> ga<strong>in</strong> <strong>in</strong> <strong>the</strong> contract first. If <strong>the</strong> contract is tax qualified, generally all withdrawals are treated asdistributions of ga<strong>in</strong>. Withdrawals of ga<strong>in</strong> are taxed as ord<strong>in</strong>ary <strong>in</strong>come and, if taken prior to age 59 ½, may be subject to an additional 10% federal tax penalty.<strong>the</strong> edge 17