Working in the - AccessAllstate

Working in the - AccessAllstate

Working in the - AccessAllstate

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

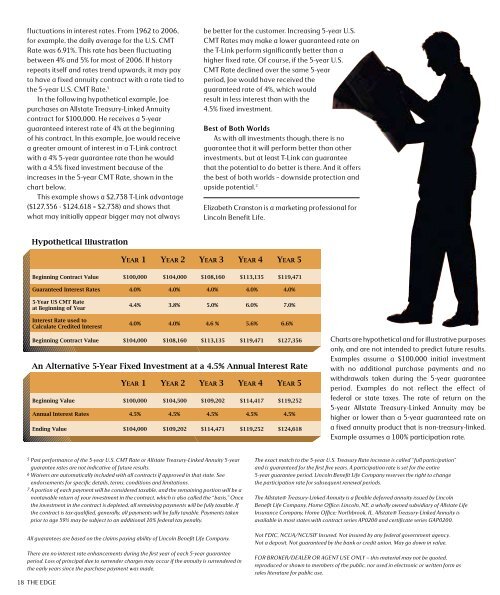

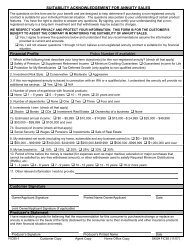

fluctuations <strong>in</strong> <strong>in</strong>terest rates. From 1962 to 2006,for example, <strong>the</strong> daily average for <strong>the</strong> U.S. CMTRate was 6.91%. This rate has been fluctuat<strong>in</strong>gbetween 4% and 5% for most of 2006. If historyrepeats itself and rates trend upwards, it may payto have a fixed annuity contract with a rate tied to<strong>the</strong> 5-year U.S. CMT Rate. 5In <strong>the</strong> follow<strong>in</strong>g hypo<strong>the</strong>tical example, Joepurchases an Allstate Treasury-L<strong>in</strong>ked Annuitycontract for $100,000. He receives a 5-yearguaranteed <strong>in</strong>terest rate of 4% at <strong>the</strong> beg<strong>in</strong>n<strong>in</strong>gof his contract. In this example, Joe would receivea greater amount of <strong>in</strong>terest <strong>in</strong> a T-L<strong>in</strong>k contractwith a 4% 5-year guarantee rate than he wouldwith a 4.5% fixed <strong>in</strong>vestment because of <strong>the</strong><strong>in</strong>creases <strong>in</strong> <strong>the</strong> 5-year CMT Rate, shown <strong>in</strong> <strong>the</strong>chart below.This example shows a $2,738 T-L<strong>in</strong>k advantage($127,356 - $124,618 = $2,738) and shows thatwhat may <strong>in</strong>itially appear bigger may not alwaysbe better for <strong>the</strong> customer. Increas<strong>in</strong>g 5-year U.S.CMT Rates may make a lower guaranteed rate on<strong>the</strong> T-L<strong>in</strong>k perform significantly better than ahigher fixed rate. Of course, if <strong>the</strong> 5-year U.S.CMT Rate decl<strong>in</strong>ed over <strong>the</strong> same 5-yearperiod, Joe would have received <strong>the</strong>guaranteed rate of 4%, which wouldresult <strong>in</strong> less <strong>in</strong>terest than with <strong>the</strong>4.5% fixed <strong>in</strong>vestment.Best of Both WorldsAs with all <strong>in</strong>vestments though, <strong>the</strong>re is noguarantee that it will perform better than o<strong>the</strong>r<strong>in</strong>vestments, but at least T-L<strong>in</strong>k can guaranteethat <strong>the</strong> potential to do better is <strong>the</strong>re. And it offers<strong>the</strong> best of both worlds – downside protection andupside potential. 2Elizabeth Cranston is a market<strong>in</strong>g professional forL<strong>in</strong>coln Benefit Life.Charts are hypo<strong>the</strong>tical and for illustrative purposesonly, and are not <strong>in</strong>tended to predict future results.Examples assume a $100,000 <strong>in</strong>itial <strong>in</strong>vestmentwith no additional purchase payments and nowithdrawals taken dur<strong>in</strong>g <strong>the</strong> 5-year guaranteeperiod. Examples do not reflect <strong>the</strong> effect offederal or state taxes. The rate of return on <strong>the</strong>5-year Allstate Treasury-L<strong>in</strong>ked Annuity may behigher or lower than a 5-year guaranteed rate ona fixed annuity product that is non-treasury-l<strong>in</strong>ked.Example assumes a 100% participation rate.5 Past performance of <strong>the</strong> 5-year U.S. CMT Rate or Allstate Treasury-L<strong>in</strong>ked Annuity 5-yearguarantee rates are not <strong>in</strong>dicative of future results.6 Waivers are automatically <strong>in</strong>cluded with all contracts if approved <strong>in</strong> that state. Seeendorsements for specific details, terms, conditions and limitations.7 A portion of each payment will be considered taxable, and <strong>the</strong> rema<strong>in</strong><strong>in</strong>g portion will be anontaxable return of your <strong>in</strong>vestment <strong>in</strong> <strong>the</strong> contract, which is also called <strong>the</strong> “basis.” Once<strong>the</strong> <strong>in</strong>vestment <strong>in</strong> <strong>the</strong> contract is depleted, all rema<strong>in</strong><strong>in</strong>g payments will be fully taxable. If<strong>the</strong> contract is tax-qualified, generally, all payments will be fully taxable. Payments takenprior to age 59½ may be subject to an additional 10% federal tax penalty.All guarantees are based on <strong>the</strong> claims pay<strong>in</strong>g ability of L<strong>in</strong>coln Benefit Life Company.There are no <strong>in</strong>terest rate enhancements dur<strong>in</strong>g <strong>the</strong> first year of each 5-year guaranteeperiod. Loss of pr<strong>in</strong>cipal due to surrender charges may occur if <strong>the</strong> annuity is surrendered <strong>in</strong><strong>the</strong> early years s<strong>in</strong>ce <strong>the</strong> purchase payment was made.18 <strong>the</strong> edgeThe exact match to <strong>the</strong> 5-year U.S. Treasury Rate <strong>in</strong>crease is called “ full participation”and is guaranteed for <strong>the</strong> first five years. A participation rate is set for <strong>the</strong> entire5-year guarantee period. L<strong>in</strong>coln Benefit Life Company reserves <strong>the</strong> right to change<strong>the</strong> participation rate for subsequent renewal periods.The Allstate® Treasury-L<strong>in</strong>ked Annuity is a flexible deferred annuity issued by L<strong>in</strong>colnBenefit Life Company, Home Office: L<strong>in</strong>coln, NE, a wholly owned subsidiary of Allstate LifeInsurance Company, Home Office: Northbrook, IL. Allstate® Treasury-L<strong>in</strong>ked Annuity isavailable <strong>in</strong> most states with contract series AP0200 and certificate series GAP0200.Not FDIC, NCUA/NCUSIF Insured. Not <strong>in</strong>sured by any federal government agency.Not a deposit. Not guaranteed by <strong>the</strong> bank or credit union. May go down <strong>in</strong> value.FOR BROKER/DEALER OR AGENT USE ONLY — this material may not be quoted,reproduced or shown to members of <strong>the</strong> public, nor used <strong>in</strong> electronic or written form assales literature for public use.