Annual Report 2011 / 12 - New Zealand Trade and Enterprise

Annual Report 2011 / 12 - New Zealand Trade and Enterprise

Annual Report 2011 / 12 - New Zealand Trade and Enterprise

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NEW ZEALAND TRADE AND ENTERPRISE ANNUAL REPORT <strong>2011</strong>/<strong>12</strong> 51<br />

Note 26: Major budget variations<br />

Explanation of major budget variations in the statement of financial performance, statement of financial<br />

position, <strong>and</strong> statement of cash flows.<br />

Revenue from the Crown operating is below budget due to lower costs incurred for the capability building<br />

voucher programme which is only in its second year of implementation, the capital raising programme<br />

development slower than planned, <strong>and</strong> lower <strong>New</strong> <strong>Zeal<strong>and</strong></strong> <strong>and</strong> international operating costs.<br />

Revenue from the Crown – grants is below budget due to the impact of a reduced claim rate from previous<br />

years’ grants approved. This also applies to the Grant expense.<br />

Finance income is above budget due to the fair valuation of foreign exchnage derivative contracts due to be<br />

used in the next financial year.<br />

Personnel costs are below budget due to translating expenditure incurred overseas into <strong>New</strong> <strong>Zeal<strong>and</strong></strong> dollars<br />

at a higher rate than the budget exchange rate, <strong>and</strong> lower staff numbers than planned.<br />

Finance expenditure is above budget due to translating expenditure incurred overseas into <strong>New</strong> <strong>Zeal<strong>and</strong></strong><br />

dollars at a higher rate than the foreign exchange derivitives contracted exchange rates.<br />

Other operating expenditure is below budget due to translating expenditure incurred overseas into<br />

<strong>New</strong> <strong>Zeal<strong>and</strong></strong> dollars at a higher rate than the budget exchange rate, lower costs incurred for the capability<br />

building voucher programme, the capital raising programme development slower than planned, <strong>and</strong> lower<br />

<strong>New</strong> <strong>Zeal<strong>and</strong></strong> <strong>and</strong> international operating costs.<br />

The total comprehensive income for the year arises from the fair value of foreign exchange derivatives<br />

contracted for the 20<strong>12</strong>/13 financial year.<br />

Cash <strong>and</strong> cash equivalents is below budget due to higher capital expenditure, <strong>and</strong> lower payables than<br />

budgetd due to the timing of paying expenses incurred in the latter part of the financial year.<br />

Crown debtor – grants non current assets , are higher than budget due to slower claim rate than planned. This<br />

also applies to Provisions – Grants non-current liabilities.<br />

Equity is below budget, due to the budget including a capital increase that has not been drawn down, <strong>and</strong> the<br />

impact of the fair value of foreign exchange derivatives in the <strong>2011</strong> year end accounts, that was not included<br />

in the budget because the budget was completed prior to the <strong>2011</strong> year end.<br />

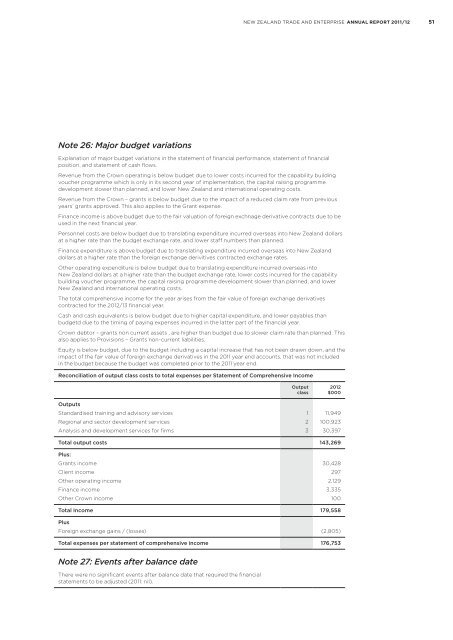

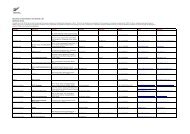

Reconciliation of output class costs to total expenses per Statement of Comprehensive Income<br />

Output<br />

class<br />

20<strong>12</strong><br />

$000<br />

Outputs<br />

St<strong>and</strong>ardised training <strong>and</strong> advisory services 1 11,949<br />

Regional <strong>and</strong> sector development services 2 100,923<br />

Analysis <strong>and</strong> development services for firms 3 30,397<br />

Total output costs 143,269<br />

Plus:<br />

Grants income 30,428<br />

Client income 297<br />

Other operating income 2,<strong>12</strong>9<br />

Finance income 3,335<br />

Other Crown income 100<br />

Total Income 179,558<br />

Plus<br />

Foreign exchange gains / (losses) (2,805)<br />

Total expenses per statement of comprehensive income 176,753<br />

Note 27: Events after balance date<br />

There were no significant events after balance date that required the financial<br />

statements to be adjusted (<strong>2011</strong>: nil).