Supplemental Disclosure Material - Ono

Supplemental Disclosure Material - Ono

Supplemental Disclosure Material - Ono

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

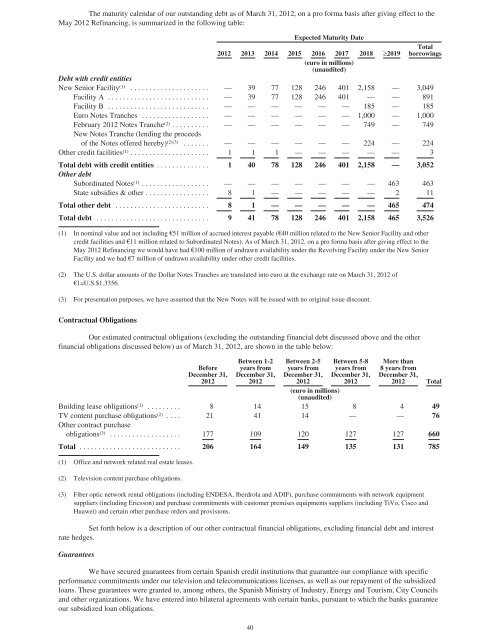

The maturity calendar of our outstanding debt as of March 31, 2012, on a pro forma basis after giving effect to the<br />

May 2012 Refinancing, is summarized in the following table:<br />

Expected Maturity Date<br />

2012 2013 2014 2015 2016 2017 2018 ≥2019<br />

Total<br />

borrowings<br />

(euro in millions)<br />

(unaudited)<br />

Debt with credit entities<br />

New Senior Facility (1) ..................... — 39 77 128 246 401 2,158 — 3,049<br />

Facility A ........................... — 39 77 128 246 401 — — 891<br />

Facility B ........................... — — — — — — 185 — 185<br />

Euro Notes Tranches .................. — — — — — — 1,000 — 1,000<br />

February 2012 Notes Tranche (2) .......... — — — — — — 749 — 749<br />

New Notes Tranche (lending the proceeds<br />

of the Notes offered hereby) (2)(3) ....... — — — — — — 224 — 224<br />

Other credit facilities (1) ..................... 1 1 1 — — — — — 3<br />

Total debt with credit entities .............. 1 40 78 128 246 401 2,158 — 3,052<br />

Other debt<br />

Subordinated Notes (1) .................. — — — — — — — 463 463<br />

State subsidies & other ................. 8 1 — — — — — 2 11<br />

Total other debt ......................... 8 1 — — — — — 465 474<br />

Total debt .............................. 9 41 78 128 246 401 2,158 465 3,526<br />

(1) In nominal value and not including €51 million of accrued interest payable (€40 million related to the New Senior Facility and other<br />

credit facilities and €11 million related to Subordinated Notes). As of March 31, 2012, on a pro forma basis after giving effect to the<br />

May 2012 Refinancing we would have had €100 million of undrawn availability under the Revolving Facility under the New Senior<br />

Facility and we had €7 million of undrawn availability under other credit facilities.<br />

(2) The U.S. dollar amounts of the Dollar Notes Tranches are translated into euro at the exchange rate on March 31, 2012 of<br />

€1=U.S.$1.3356.<br />

(3) For presentation purposes, we have assumed that the New Notes will be issued with no original issue discount.<br />

Contractual Obligations<br />

Our estimated contractual obligations (excluding the outstanding financial debt discussed above and the other<br />

financial obligations discussed below) as of March 31, 2012, are shown in the table below:<br />

Before<br />

December 31,<br />

2012<br />

Between 1-2<br />

years from<br />

December 31,<br />

2012<br />

Between 2-5<br />

years from<br />

December 31,<br />

2012<br />

Between 5-8<br />

years from<br />

December 31,<br />

2012<br />

More than<br />

8 years from<br />

December 31,<br />

2012 Total<br />

(euro in millions)<br />

(unaudited)<br />

Building lease obligations (1) ......... 8 14 15 8 4 49<br />

TV content purchase obligations (2) .... 21 41 14 — — 76<br />

Other contract purchase<br />

obligations (3) ................... 177 109 120 127 127 660<br />

Total ........................... 206 164 149 135 131 785<br />

(1) Office and network related real estate leases.<br />

(2) Television content purchase obligations.<br />

(3) Fiber optic network rental obligations (including ENDESA, Iberdrola and ADIF), purchase commitments with network equipment<br />

suppliers (including Ericsson) and purchase commitments with customer premises equipments suppliers (including TiVo, Cisco and<br />

Huawei) and certain other purchase orders and provisions.<br />

Set forth below is a description of our other contractual financial obligations, excluding financial debt and interest<br />

rate hedges.<br />

Guarantees<br />

We have secured guarantees from certain Spanish credit institutions that guarantee our compliance with specific<br />

performance commitments under our television and telecommunications licenses, as well as our repayment of the subsidized<br />

loans. These guarantees were granted to, among others, the Spanish Ministry of Industry, Energy and Tourism, City Councils<br />

and other organizations. We have entered into bilateral agreements with certain banks, pursuant to which the banks guarantee<br />

our subsidized loan obligations.<br />

40