Thomson Reuters Mid - BMR Advisors

Thomson Reuters Mid - BMR Advisors

Thomson Reuters Mid - BMR Advisors

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

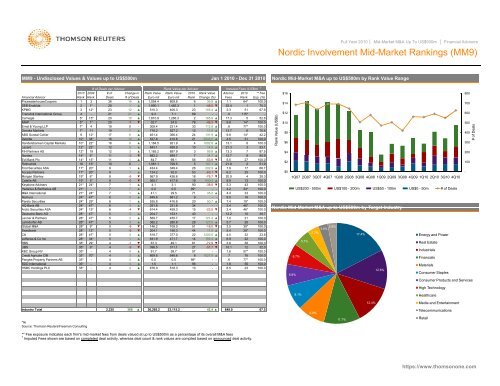

Full Year 2010 │ <strong>Mid</strong>-Market M&A Up To US$500m │ Financial <strong>Advisors</strong><br />

Nordic Involvement <strong>Mid</strong>-Market Rankings (MM9)<br />

MM9 - Undisclosed Values & Values up to US$500m<br />

Jan 1 2010 - Dec 31 2010<br />

Nordic <strong>Mid</strong>-Market M&A up to US$500m by Rank Value Range<br />

# of Deals per Advisor<br />

Rank Value per Advisor<br />

Imputed Fees (US$m) †<br />

2010 2009 # of Change in Rank Value Rank Value 2010 Rank Value Advisor 2010 ** Fee<br />

Financial Advisor<br />

Rank Rank Deals # of Deals Euro mil Euro mil Rank Change (%) Fees Rank Exp. (%)<br />

PricewaterhouseCoopers<br />

1 3 36<br />

16 ▲ 1,054.4 809.8<br />

6 36.8 ▲ 1.1 64* 100.0<br />

SEB Enskilda 2 1* 28<br />

1 ▲ 1,890.1 1,465.3 1 -48.0 ▼ 52.4 1 75.3<br />

KPMG<br />

3 12* 23<br />

12 ▲ 510.3 406.3 23 105.4 ▲ 2.3 51 67.6<br />

Translink International Group 4 -<br />

21 21 ▲ 9.3 7.1<br />

89 - - .0 115*<br />

-<br />

Carnegie 5* 15* 20 10 ▲ 1,610.9 1,266.3 2 165.9 ▲ 17.3 5 52.6<br />

IMAP 5* 1* 20 -7 ▼ 32.7 24.5 78 -48.3 ▼ 9.8 14* 100.0<br />

Ernst & Young LLP 7* 4 19<br />

0 - 309.4 231.4 33 112.8 ▲ .6 77* 100.0<br />

Danske Markets 7* 11 19<br />

7 ▲ 716.2 527.2 12 11.8 ▲ 13.7 6 70.6<br />

ABG Sundal Collier 9 12* 17<br />

6 ▲ 461.4 366.4 24 131.9 ▲ 9.8 14* 42.2<br />

Deloitte 10* 34* 16<br />

12 ▲ 527.8 410.8 21 2045.5 ▲ 4.6 31 100.0<br />

Handelsbanken Capital Markets 10* 22* 16<br />

9 ▲ 1,184.5 921.9<br />

4 1092.8 ▲ 13.1 8 100.0<br />

Lazard<br />

12* 22* 12<br />

5 ▲ 843.1 658.9 10 14.9 ▲ 21.3 3 53.1<br />

FIH Partners AS<br />

12* 19 12<br />

3 ▲ 1,185.2 897.9<br />

3 99.8 ▲ 13.3 7 87.5<br />

Nordea 14* 6* 11<br />

-3 ▼ 882.2 699.7<br />

7 34.7 ▲ 12.7 9 80.9<br />

Evli Bank Plc 14* 15* 11<br />

1 ▲ 84.7 69.1 56 -53.9 ▼ 5.5 27 100.0<br />

Rothschild 16 15* 10 0 - 1,081.1 799.5<br />

5 107.1 ▲ 21.8 2 51.9<br />

First Securities ASA 17* 20* 9 1 ▲ 434.4 349.4 26 202.9 ▲ 7.9 17 68.7<br />

Access Partners 17* 20* 9<br />

1 ▲ 124.2 92.0 53 -63.1 ▼ 6.2 25 100.0<br />

Morgan Stanley 19* 6*<br />

8<br />

-6 ▼ 567.9 426.6 18 -76.7 ▼ 20.9 4 29.3<br />

Catella AB<br />

19* 6* 8<br />

-6<br />

▼<br />

565.7 417.6 19<br />

640.44<br />

▲ 99 9.9<br />

13<br />

100.00<br />

Keystone Advisers 21* 24* 7<br />

1 ▲ 4.1 3.1<br />

90 -38.8 ▼ 3.3 43 100.0<br />

Hedelius & Berthelius AB<br />

21* - 7<br />

7 ▲ 0.0 0.0 99* - - 4.2 34* 100.0<br />

M&A International<br />

21* 24* 7<br />

1 ▲ 41.1 29.5 71 45.2 ▲ 4.4 33 100.0<br />

Nomura<br />

24* 47* 6<br />

4 ▲ 849.6 681.2<br />

9<br />

- - 9.5 16 100.0<br />

Pareto Securities 24* 29* 6<br />

1 ▲ 535.8 416.8 20 50.7 ▲ 7.4 19* 100.0<br />

HQ Bank AB<br />

24* 47* 6<br />

4 ▲ 291.8 231.8 34 - - 2.4 46* 100.0<br />

Arctic Securities ASA 24* 15* 6<br />

-4 ▼ 614.4 459.3 15 -23.5 ▼ 2.4 46* 100.0<br />

Deutsche Bank AG 28* 47* 5<br />

3 ▲ 204.7 153.1 43<br />

- - 12.2 10 39.7<br />

Lenner & Partners 28* 47* 5<br />

3 ▲ 569.7 455.7 17 121.2 ▲ 7.0 21 100.0<br />

Leimdorfer AB 28* 47* 5<br />

3 ▲ 382.2 280.8 28 127.0 ▲ 5.7 26 100.0<br />

Global M&A 28* 9* 5<br />

-8 ▼ 146.2 109.0 51 -18.0 ▼ 3.5 39* 100.0<br />

Swedbank 28* 12* 5<br />

-6 ▼ 204.1 156.3 44 11.6 ▲ 5.4 28* 100.0<br />

Citi 28* 47* 5<br />

3 ▲ 518.7 377.0 22 1200.0 ▲ 4.5 32 23.8<br />

Jefferies & Co Inc 28* 34* 5<br />

1 ▲ 631.9 471.7 14 193.4 ▲ 6.9 22 100.0<br />

RBS 35* 29* 4 -1 ▼ 67.3 49.1 61 -72.9 ▼ 3.8 38 100.0<br />

UBS<br />

35* 9* 4<br />

-9 ▼ 396.5 311.1 27 -57.7 ▼ 10.1 12 32.0<br />

KBC Group NV<br />

35* -<br />

4<br />

4 ▲ 81.7 59.7 57 - - 1.6 57* 100.0<br />

Credit Agricole CIB<br />

35* 70* 4 3 ▲ 869.6 648.6<br />

8 1027.9 ▲ .7 76 100.0<br />

Pangea Property Partners AB 35* - 4 4 ▲ 0.0 0.0 99* - - .6 77* 100.0<br />

BDO International 35* - 4 4 ▲ 1.5 1.1<br />

96 - - 1.8 56 100.0<br />

HSBC Holdings PLC 35* - 4 4 ▲ 676.0 518.3 13 - - 6.5 23 100.0<br />

Rank Value (US$b)<br />

$16<br />

$14<br />

$12<br />

$10<br />

$8<br />

$6<br />

800<br />

700<br />

600<br />

Energy and Power<br />

$4<br />

200<br />

$2<br />

100<br />

$0<br />

-<br />

1Q07 2Q07 3Q07 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10<br />

US$200 - 500m US$100 - 200m US$50 - 100m US$0 - 50m # of Deals<br />

Nordic <strong>Mid</strong>-Market M&A up to US$500m by Target Industry<br />

3.7%<br />

17.4%<br />

3.0% 2.9%<br />

5.7%<br />

Real Estate<br />

Industrials<br />

6.7%<br />

Financials<br />

Materials<br />

12.6%<br />

Consumer Staples<br />

6.9%<br />

Consumer Products and Services<br />

500<br />

400<br />

300<br />

# of Deals<br />

8.1%<br />

High Technology<br />

Healthcare<br />

12.4%<br />

Media and Entertainment<br />

Industry Total<br />

*tie<br />

Source: <strong>Thomson</strong> <strong>Reuters</strong>/Freeman Consulting<br />

2,325<br />

368 ▲ 30,295.2 23,115.2<br />

42.4 ▲<br />

849.0<br />

67.5<br />

8.8%<br />

11.7%<br />

Telecommunications<br />

Retail<br />

** Fee exposure indicates each firm's mid-market fees from deals valued at up to US$500m as a percentage of its overall M&A fees<br />

† Imputed Fees shown are based on completed deal activity, whereas deal count & rank values are compiled based on announced deal activity.<br />

https://www.thomsonone.com