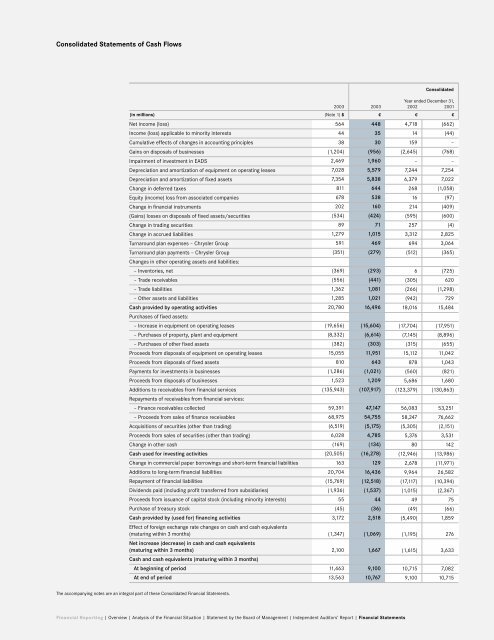

Consolidated Statements of Cash Flows (in millions) Net income (loss) Income (loss) applicable to minority interests Cumulative effects of changes in accounting principles Gains on disposals of businesses Impairment of investment in EADS Depreciation and amortization of equipment on operating leases Depreciation and amortization of fixed assets Change in deferred taxes Equity (income) loss from associated companies Change in financial instruments (Gains) losses on disposals of fixed assets/securities Change in trading securities Change in accrued liabilities Turnaround plan expenses – Chrysler Group Turnaround plan payments – Chrysler Group Changes in other operating assets and liabilities: – Inventories, net – Trade receivables – Trade liabilities – Other assets and liabilities Cash provided by operating activities Purchases of fixed assets: – Increase in equipment on operating leases – Purchases of property, plant and equipment – Purchases of other fixed assets Proceeds from disposals of equipment on operating leases Proceeds from disposals of fixed assets Payments for investments in businesses Proceeds from disposals of businesses Additions to receivables from financial services Repayments of receivables from financial services: – Finance receivables collected – Proceeds from sales of finance receivables Acquisitions of securities (other than trading) Proceeds from sales of securities (other than trading) Change in other cash Cash used for investing activities Change in commercial paper borrowings and short-term financial liabilities Additions to long-term financial liabilities Repayment of financial liabilities Dividends paid (including profit transferred from subsidiaries) Proceeds from issuance of capital stock (including minority interests) Purchase of treasury stock Cash provided by (used for) financing activities Effect of foreign exchange rate changes on cash and cash equivalents (maturing within 3 months) Net increase (decrease) in cash and cash equivalents (maturing within 3 months) Cash and cash equivalents (maturing within 3 months) At beginning of period At end of period The accompanying notes are an integral part of these Consolidated Financial Statements. <strong>2003</strong> (Note 1) $ 564 44 38 (1,204) 2,469 7,028 7,354 811 678 202 (534) 89 1,279 591 (351) (369) (556) 1,362 1,285 20,780 (19,656) (8,332) (382) 15,055 810 (1,286) 1,523 (135,943) 59,391 68,975 (6,519) 6,028 (169) (20,505) 163 20,704 (15,769) (1,936) 55 (45) 3,172 Financial <strong>Report</strong>ing | Overview | Analysis of the Financial Situation | Statement by the Board of Management | Independent Auditors’ <strong>Report</strong> | Financial Statements (1,347) 2,100 11,463 13,563 <strong>2003</strong> € 448 35 30 (956) 1,960 5,579 5,838 644 538 160 (424) 71 1,015 469 (279) (293) (441) 1,081 1,021 16,496 (15,604) (6,614) (303) 11,951 643 (1,021) 1,209 (107,917) 47,147 54,755 (5,175) 4,785 (134) (16,278) 129 16,436 (12,518) (1,537) 44 (36) 2,518 (1,069) 1,667 9,100 10,767 Consolidated Year ended December 31, 2002 2001 € € 4,718 (662) 14 (44) 159 – (2,645) (768) – – 7,244 7,254 6,379 7,022 268 (1,058) 16 (97) 214 (409) (595) (600) 257 (4) 3,312 2,825 694 3,064 (512) (365) 6 (305) (266) (942) 18,016 (17,704) (7,145) (315) 15,112 878 (560) 5,686 (123,379) 56,083 58,247 (5,305) 5,376 80 (12,946) 2,678 9,964 (17,117) (1,015) 49 (49) (5,490) (1,195) (1,615) 10,715 9,100 (725) 620 (1,298) 729 15,484 (17,951) (8,896) (655) 11,042 1,043 (821) 1,680 (130,863) 53,251 76,662 (2,151) 3,531 142 (13,986) (11,971) 26,582 (10,394) (2,367) 75 (66) 1,859 276 3,633 7,082 10,715

Industrial Business 1 Financial Services 1 Year ended December 31, Year ended December 31, <strong>2003</strong> 2002 2001 <strong>2003</strong> 2002 2001 € € € € € € (in millions) (568) 4,380 (980) 1,016 338 318 Net income (loss) 30 11 (46) 5 3 2 Income (loss) applicable to minority interests 30 124 – – 35 – Cumulative effects of changes in accounting principles (956) (2,645) (762) – – (6) Gains on disposals of businesses 1,960 – – – – – Impairment of investment in EADS 609 544 290 4,970 6,700 6,964 Depreciation and amortization of equipment on operating leases 5,735 6,257 6,917 103 122 105 Depreciation and amortization of fixed assets 194 (498) (1,595) 450 766 537 Change in deferred taxes 539 (78) (90) (1) 94 (7) Equity (income) loss from associated companies 141 205 (365) 19 9 (44) Change in financial instruments (424) (599) (600) – 4 – (Gains) losses on disposals of fixed assets/securities 82 312 3 (11) (55) (7) Change in trading securities 1,098 3,292 2,472 (83) 20 353 Change in accrued liabilities 469 694 3,064 – – – Turnaround plan expenses – Chrysler Group (279) (512) (365) – – – Turnaround plan payments – Chrysler Group Changes in other operating assets and liabilities: (502) 172 (549) 209 (166) (176) – Inventories, net (500) (314) 540 59 9 80 – Trade receivables 1,082 (97) (1,291) (1) (169) (7) – Trade liabilities 715 (2,187) (1,444) 306 1,245 2,173 – Other assets and liabilities 9,455 9,061 5,199 7,041 8,955 10,285 Cash provided by operating activities Purchases of fixed assets: (3,973) (4,842) (3,617) (11,631) (12,862) (14,334) – Increase in equipment on operating leases (6,539) (7,052) (8,785) (75) (93) (111) – Purchases of property, plant and equipment (250) (250) (564) (53) (65) (91) – Purchases of other fixed assets 4,577 4,974 3,951 7,374 10,138 7,091 Proceeds from disposals of equipment on operating leases 606 828 991 37 50 52 Proceeds from disposals of fixed assets (967) (532) (801) (54) (28) (20) Payments for investments in businesses 1,179 5,168 1,456 30 518 224 Proceeds from disposals of businesses – 232 207 (107,917) (123,611) (131,070) Additions to receivables from financial services Repayments of receivables from financial services: – – – 47,147 56,083 53,251 – Finance receivables collected – – – 54,755 58,247 76,662 – Proceeds from sales of finance receivables (4,963) (5,250) (1,931) (212) (55) (220) Acquisitions of securities (other than trading) 4,687 5,283 2,381 98 93 1,150 Proceeds from sales of securities (other than trading) (207) (191) 267 73 271 (125) Change in other cash (5,850) (1,632) (6,445) (10,428) (11,314) (7,541) Cash used for investing activities (1,392) 971 1,724 1,521 1,707 (13,695) Change in commercial paper borrowings and short-term financial liabilities 5,469 1,910 3,100 10,967 8,054 23,482 Additions to long-term financial liabilities (4,229) (7,696) (347) (8,289) (9,421) (10,047) Repayment of financial liabilities (908) (434) (2,356) (629) (581) (11) Dividends paid (including profit transferred from subsidiaries) (220) (227) (88) 264 276 163 Proceeds from issuance of capital stock (including minority interests) (36) (49) (66) – – – Purchase of treasury stock (1,316) (5,525) 1,967 3,834 35 (108) Cash provided by (used for) financing activities Effect of foreign exchange rate changes on cash and cash equivalents (981) (1,087) 223 (88) (108) 53 (maturing within 3 months) Net increase (decrease) in cash and cash equivalents 1,308 817 944 359 (2,432) 2,689 (maturing within 3 months) Cash and cash equivalents (maturing within 3 months) 8,161 7,344 6,400 939 3,371 682 At beginning of period 9,469 8,161 7,344 1,298 939 3,371 At end of period 1 Additional information about the Industrial Business and Financial Services is not required under U.S. GAAP and is unaudited. 114 | 115

- Page 1 and 2:

Moving People Annual Report 2003

- Page 3 and 4:

Divisions Mercedes Car Group Amount

- Page 5 and 6:

DaimlerChrysler is unique in the au

- Page 7 and 8:

4 Chairman’s Letter 8 Board of Ma

- Page 9 and 10:

- We also proved our leadership in

- Page 11 and 12:

We will make good use of this stimu

- Page 13 and 14:

Wolfgang Bernhard (43) Chief Operat

- Page 15 and 16:

Dividend of €1.50 per share. The

- Page 17 and 18:

Important projects for the Commerci

- Page 19 and 20:

Further growth for Mercedes Car Gro

- Page 21 and 22:

€38 billion to secure the future.

- Page 23 and 24:

Share Price Index 140 130 120 110 1

- Page 25 and 26:

Africa Mercedes Car Group Chrysler

- Page 27 and 28:

24 Mercedes-Benz Passenger Cars 26

- Page 29 and 30:

Mari and Samuli Törönen live on t

- Page 31 and 32:

Time for a break. And then rock the

- Page 33 and 34:

Six months out of the year, Michael

- Page 35 and 36:

Footballs, skateboards, rackets. .

- Page 37 and 38:

Franco and Leslie are just married.

- Page 39 and 40:

Big size. Smooth ride. And HEMI Pow

- Page 41 and 42:

The new Mercedes-Benz Actros has al

- Page 43 and 44:

Contented faces. Faithful customers

- Page 45 and 46:

North America rides more miles with

- Page 47 and 48:

Monica Brem and her two sons have a

- Page 49 and 50:

46 Mercedes Car Group 50 Chrysler G

- Page 51 and 52:

Highly successful launch of new E-C

- Page 53 and 54:

New markets for the smart brand. In

- Page 55 and 56:

Significant gains in quality and ef

- Page 57 and 58:

The Jeep ® Treo was shown at the T

- Page 59 and 60:

In 2003, Freightliner sold 128,300

- Page 61 and 62:

In the first nine months of the yea

- Page 63 and 64:

Additional significant benefits are

- Page 65 and 66:

In 2003, North America remained Dai

- Page 67 and 68: EADS The Airbus A300-600 ST “Belu

- Page 69 and 70: Further expansion of business in Ch

- Page 71 and 72: 66 Sustainability and Social Respon

- Page 73 and 74: Innovations in the F 500 Mind range

- Page 75 and 76: We see hybrids as an intermediate s

- Page 77 and 78: Partnerships for sustainability. Fo

- Page 79 and 80: Awards for the best suppliers. The

- Page 81 and 82: Sparking curiosity, promoting ideas

- Page 83 and 84: Training and continuing education t

- Page 85 and 86: 82 Members of the Supervisory Board

- Page 87 and 88: Report of the Supervisory Board In

- Page 89 and 90: In the last meeting of the year in

- Page 91 and 92: The Board of Management. At present

- Page 93 and 94: DaimlerChrysler AG endeavors to sta

- Page 95 and 96: 138 Notes to Consolidated Balance S

- Page 97 and 98: The contribution to earnings from t

- Page 99 and 100: Eliminations in the operating profi

- Page 101 and 102: enefit was partly offset by a tax e

- Page 103 and 104: Balance Sheet Structure In billions

- Page 105 and 106: Refinancing at the DaimlerChrysler

- Page 107 and 108: completion of the system. Contract

- Page 109 and 110: Three purported class action lawsui

- Page 111 and 112: As previously reported, in 2002 sev

- Page 113 and 114: Independent Auditors’ Report The

- Page 115 and 116: 2003 € 122,397 (98,937) 23,460 (1

- Page 117: Consolidated Statements of Changes

- Page 121 and 122: Balance at January 1, 2003 1,427 63

- Page 123 and 124: Investments in Associated Companies

- Page 125 and 126: Discontinued Operations. The result

- Page 127 and 128: Marketable Securities and Investmen

- Page 129 and 130: See Notes 2 and 3 for further infor

- Page 131 and 132: 3. Significant Investments and Vari

- Page 133 and 134: In November 2003, as part of the Gr

- Page 135 and 136: Notes to Consolidated Statements of

- Page 137 and 138: 7. Turnaround Plan for the Chrysler

- Page 139 and 140: 9. Income Taxes Income (loss) befor

- Page 141 and 142: Including the items charged or cred

- Page 143 and 144: DaimlerChrysler’s other intangibl

- Page 145 and 146: 20. Securities, Investments and Lon

- Page 147 and 148: DaimlerChrysler is authorized to is

- Page 149 and 150: Analysis of the stock options issue

- Page 151 and 152: Investment Policies and Strategies.

- Page 153 and 154: Expected Return on Plan Assets. The

- Page 155 and 156: The impact of the Medical Drug Act,

- Page 157 and 158: Accruals for restructuring measures

- Page 159 and 160: Other Notes 30. Litigation and Clai

- Page 161 and 162: As previously reported, on April 30

- Page 163 and 164: Further funding requirements could

- Page 165 and 166: Receivables from Financial Services

- Page 167 and 168: 33. Retained Interests in Sold Rece

- Page 169 and 170:

34. Segment Reporting Information w

- Page 171 and 172:

For the year ended December 31, 200

- Page 173 and 174:

The Group purchases products and se

- Page 175 and 176:

172 Major Subsidiaries 174 Eight-Ye

- Page 177 and 178:

Vehicles Sales Organization Mercede

- Page 179 and 180:

International Representative Office

- Page 181 and 182:

Convenience with the interactive An

- Page 183 and 184:

Finance Calendar 2004 Annual Result