Funding for the Proposed Kent Central Gateway Multimodal Transit ...

Funding for the Proposed Kent Central Gateway Multimodal Transit ...

Funding for the Proposed Kent Central Gateway Multimodal Transit ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TIGER Discretionary<br />

Grant Application<br />

U.S. Department Of Transportation<br />

September 15, 2009<br />

Prepared <strong>for</strong>:<br />

Portage Area Regional<br />

Transportation Authority<br />

<strong>Funding</strong> <strong>for</strong> <strong>the</strong> <strong>Proposed</strong><br />

<strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong><br />

<strong>Multimodal</strong> <strong>Transit</strong> Facility<br />

Project Partners<br />

<strong>Kent</strong> State University<br />

City of <strong>Kent</strong>, Ohio<br />

<strong>Transit</strong> Project Type<br />

Project Location:<br />

Downtown <strong>Kent</strong> (Urban)<br />

Portage County, Ohio<br />

OH 17 th Congressional District<br />

Amount of Grant Request:<br />

$ 21,000,000

TABLE OF CONTENTS<br />

Page No.<br />

I. INTRODUCTION 1<br />

II. GRANT FUNDS AND SOURCES AND USES OF PROJECT FUNDS 6<br />

III. PRIMARY SELECTION CRITERIA – LONG TERM OUTCOMES 8<br />

IV. PRIMARY SELECTION CRITERIA – JOB CREATION AND STIMULUS 12<br />

V. SECONDARY SELECTION CRITERIA 16<br />

APPENDICIES<br />

APPENDIX A – Detailed Construction Cost Estimates<br />

APPENDIX B – <strong>Proposed</strong> Construction Schedule<br />

APPENDIX C – Letters of Support<br />

APPENDIX D – Public-Private Partnership Memorandum<br />

APPENDIX E – Market and Financial Overview Report<br />

APPENDIX F – Table of Long Term Operating Costs<br />

APPENDIX G – Federal Wage Rate Requirement Certification<br />

UNDER SEPARATE COVER<br />

(Additional supporting materials may be accessed via <strong>the</strong> following website:<br />

ftp://tsftp.transystems.com (User = <strong>Kent</strong> , Password = <strong>Gateway</strong>)<br />

• Project Architectural and Civil Engineering Plan Sets<br />

• Site Selection Report (Completed 2008)<br />

• Facility Schematic Plan Report (Completed 2008)<br />

• Categorical Exclusion Document (Completed 2008)<br />

Phase II ESA (Completed July 2009)

I. INTRODUCTION<br />

The <strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong> (KCG) project has moved through <strong>the</strong> planning, environmental, site selection, and public<br />

involvement phases during <strong>the</strong> last two years. Preliminary Engineering and Architectural plans <strong>for</strong> <strong>the</strong> facility, and<br />

required adjacent infrastructure improvements, were completed in August 2009. Since <strong>the</strong> Phase 1 and Phase 2<br />

Environmental Site Assessment’s (ESA) have been completed, and an approved environmental document (CE) is<br />

expected be<strong>for</strong>e <strong>the</strong> end of 2009, this project is truly “shovel-ready”. There<strong>for</strong>e, PARTA and its stakeholders are<br />

applying <strong>for</strong> construction funds through <strong>the</strong> TIGER grant program in order <strong>the</strong> complete <strong>the</strong> construction phase of <strong>the</strong><br />

project. The following pages contain a project background, detailed description of existing and future facilities,<br />

economic development opportunities, and an explanation of how <strong>the</strong> project meets <strong>the</strong> TIGER grant application<br />

criteria. Previously completed documents and supporting documents are located in <strong>the</strong> Appendix.<br />

Project Background<br />

The <strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong> (KCG) is a proposed transit center being considered to improve <strong>the</strong> connections between<br />

city neighborhoods, <strong>Kent</strong> State University’s campus and <strong>the</strong> downtown; to enhance bicycle and pedestrian linkages;<br />

to support economic development; and to create opportunities <strong>for</strong> new community amenities. It would solve several<br />

transit-related problems: providing an efficient park-and-ride <strong>for</strong> express routes to Cleveland and Akron; serving as a<br />

transfer point <strong>for</strong> numerous PARTA routes; and providing a com<strong>for</strong>table location to load and unload passengers with<br />

special needs away from <strong>the</strong> traffic along a major roadway (Main Street). In addition to <strong>the</strong> transit benefits, <strong>the</strong> KCG<br />

offers <strong>the</strong> potential to incorporate businesses and community uses, which help to make it a destination that citizens<br />

can be proud of and spur economic development of <strong>the</strong> downtown.<br />

The KCG project was identified in <strong>the</strong> City of <strong>Kent</strong> Bicentennial Plan (2004), which resulted from a thirteen month<br />

planning process that included public input via 45 community meetings. The plan coordinated transportation and<br />

land use planning decisions as its findings linked land use, transportation, economic and community development<br />

issues. In 2006, <strong>the</strong> <strong>Kent</strong> Transportation Citizen’s Advisory Committee produced a Purpose and Needs Statement<br />

<strong>for</strong> a multimodal facility. The committee was comprised of representatives from <strong>Kent</strong> State, PARTA, City of <strong>Kent</strong>,<br />

<strong>Kent</strong> City Council, <strong>Kent</strong> residents, and o<strong>the</strong>r local citizens. This statement set <strong>the</strong> groundwork <strong>for</strong> a feasibility study<br />

<strong>for</strong> a facility that would emphasize taking <strong>the</strong> bus, bicycling, and walking as convenient and enjoyable modes of<br />

transportation in people’s everyday lives. <strong>Kent</strong> State University commissioned this study, with <strong>the</strong> City of <strong>Kent</strong> and<br />

PARTA as key stakeholders. The purpose of <strong>the</strong> multimodal facility, which was soon after named <strong>the</strong> <strong>Kent</strong> <strong>Central</strong><br />

<strong>Gateway</strong>, was to become a center of activity <strong>for</strong> residents, students, and visitors to <strong>Kent</strong>. Fur<strong>the</strong>rmore, <strong>the</strong> KCG<br />

would;<br />

• Increase transit accessibility and emphasize multi-modal transportation.<br />

• Be a catalyst <strong>for</strong> economic development that will contribute to a vibrant downtown that is seamlessly<br />

connected to <strong>the</strong> university campus.<br />

• Build upon <strong>Kent</strong>’s heritage of environmental awareness and recreational enjoyment.<br />

• Provide bicycle amenities and be both an entrance to and a destination along <strong>the</strong> Portage Hike and Bike<br />

Trail.<br />

• Be environmentally friendly by incorporating “green” design features.<br />

• Be a welcoming facility <strong>for</strong> people of all abilities and backgrounds.<br />

• Be a model of sustainable development that emphasizes a diverse transportation system.<br />

• Be a vital civic space that will contribute to <strong>the</strong> health, safety, and sustainability of <strong>the</strong> <strong>Kent</strong> community <strong>for</strong><br />

generations to come.<br />

1

The Purpose and Needs Statement set <strong>the</strong> groundwork <strong>for</strong> a feasibility study which was kicked off in 2007 and is<br />

nearing completion. The feasibility study included a site selection analysis, facility schematic plan, and<br />

environmental clearance which included coordination with various stakeholders and two public open houses. Several<br />

locations were evaluated based upon existing transit service, physical access <strong>for</strong> transit vehicles, exposure and<br />

visibility to encourage transit use, potential to connect to future passenger rail, support of existing planning, economic<br />

development potential, pedestrian and bicycle connectivity, social and environmental resource impact, property<br />

acquisition and traffic operations. The chosen location, call <strong>the</strong> Northwest <strong>Gateway</strong>, ranked as <strong>the</strong> highest location<br />

overall. Some of <strong>the</strong> specific reasons given <strong>for</strong> choosing this location included; good accessibility to current transit<br />

routes, good proximity to both downtown and KSU, good ability to foster economic development along Main Street,<br />

high visibility, partially vacant land, unique topography that allows <strong>for</strong> multi-level development, good ability to<br />

leverage public transportation funding, good ability to connect to proposed Portage Hike and Bike Trail, good ability<br />

to take advantage of currently underutilized Depeyster Street, good linkage to o<strong>the</strong>r proposed developments<br />

downtown, and good ability to improve pedestrian connection and town-gown link.<br />

Project Partners<br />

City of <strong>Kent</strong> – The City of <strong>Kent</strong> is located on <strong>the</strong> western edge of Portage County along <strong>the</strong> Cuyahoga River in <strong>the</strong><br />

nor<strong>the</strong>astern part of Ohio. <strong>Kent</strong> had a population in 2000 of 27,906 (U.S. Census Bureau) and a 2008 estimate of<br />

27,983 (U.S. Census Bureau), making it <strong>the</strong> largest city in <strong>the</strong> county. <strong>Kent</strong> is located in <strong>the</strong> Akron Metropolitan<br />

Statistical Area (MSA) and <strong>the</strong> Cleveland-Akron-Elyria Combined Metropolitan Statistical Area (CMSA).<br />

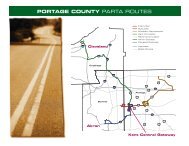

PARTA – The Portage Area Regional Transportation Authority (PARTA) serves Portage County with fixed route and<br />

demand response vehicles on an approximately 492 square mile area. In total, PARTA operates 73 vehicles and has<br />

167 employees. PARTA’s ridership has increased from 68,451 trips in 1996 to 1,299,113 trips in 2007 (ODOT Status<br />

of Public <strong>Transit</strong> in Ohio, May 2009). The area near <strong>Kent</strong>’s downtown and <strong>Kent</strong> State University is currently served<br />

by <strong>the</strong> greatest number of bus routes in <strong>the</strong> county including; <strong>the</strong> <strong>Kent</strong> Circulator, Campus Loop, Cleveland Express,<br />

Interurban #30, and Suburban #40.<br />

<strong>Kent</strong> State University – <strong>Kent</strong> State University, located just east of <strong>the</strong> downtown core, is <strong>the</strong> third largest university<br />

in Ohio and <strong>the</strong> largest residential university in nor<strong>the</strong>ast Ohio. The university has approximately 23,000 students<br />

and over 1,000 faculty members.<br />

Fairmount Properties & Pizzuti Companies – Private Development and Real Estate Management firms, partnering<br />

with <strong>the</strong> City of <strong>Kent</strong> and PARTA to develop <strong>the</strong> proposed multimodal transit center, an adjacent hotel and<br />

conference center, offices, and retail spaces.<br />

Existing Facilities<br />

PARTA has administrative offices, maintenance, and bus storage at a facility about 2 miles sou<strong>the</strong>ast of <strong>the</strong> study<br />

area at 2000 Summit Road, on <strong>the</strong> opposite side of <strong>the</strong> <strong>Kent</strong> State University campus. This facility meets PARTA’s<br />

needs <strong>for</strong> <strong>the</strong>se functions and does not require replacement. PARTA also operates a bus transfer station out of <strong>the</strong><br />

“Midway C Lot” on <strong>the</strong> <strong>Kent</strong> State University campus. Several deficiencies exist in this facility. It is located just under<br />

a half mile east of <strong>the</strong> study area along SR 59/Main Street. It is called Midway C because it is accessed along<br />

Midway Drive and it is a parking lot <strong>for</strong> KSU students with “C” parking permits, <strong>the</strong>re<strong>for</strong>e it does not allow members of<br />

<strong>the</strong> public to park at <strong>the</strong> facility in order to transfer to use <strong>the</strong> bus. Circulation at <strong>the</strong> Midway C Lot at KSU is<br />

complicated and potentially unsafe, with automobiles traveling in <strong>the</strong> same lanes as buses and parking adjacent to<br />

<strong>the</strong> bus waiting area. In addition, <strong>the</strong> Midway C Lot at KSU contains insufficient space <strong>for</strong> <strong>the</strong> number of buses that<br />

stack at <strong>the</strong> facility, and it lacks any bicycle amenities.<br />

2

<strong>Proposed</strong> Facility<br />

The <strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong> site is located in downtown <strong>Kent</strong>, along East Main Street, Depeyster Street, Erie Street,<br />

and Haymaker Parkway. The project as initially planned includes;<br />

• Bus transfer facility,<br />

• Parking garage to include 100 parking spaces <strong>for</strong> transit use as well as 200 to 300 spaces to support an<br />

adjacent planned hotel/conference center, office and retail development,<br />

• Commercial spaces to include approximately 22,000 square feet, initially broken out as; 9,900 square feet of<br />

retail, 3,200 square feet of restaurant, and 9,300 square feet of office.<br />

The building is proposed to include 10 bus bays, an indoor waiting area, small employee break area/storage area,<br />

public bathrooms, employee bathroom, communications/electrical/mechanical room, automobile parking, passenger<br />

pickup/drop-off area, outdoor waiting area, and bicycle storage area. Analysis conducted during <strong>the</strong> development of<br />

<strong>the</strong> facility schematic plan recommended 10 bus bays. That conclusion was reached using current PARTA schedule<br />

data and estimating route deviations to see that <strong>the</strong>re are numerous 15-minute periods throughout <strong>the</strong> day when 9 or<br />

more buses will be at <strong>the</strong> terminal. The 10 bays allow <strong>for</strong> some flexibility and leave open <strong>the</strong> possibility <strong>for</strong> a bay <strong>for</strong><br />

tour buses or an additional PARTA bus. The facility will be environmentally friendly by incorporating “green” design<br />

features such as a geo<strong>the</strong>rmal heating and cooling system, solar panels, natural materials from local and regional<br />

suppliers, and o<strong>the</strong>r LEED eligible building components. The facility will include civic space that will contribute to <strong>the</strong><br />

health and sustainability of <strong>the</strong> <strong>Kent</strong> community <strong>for</strong> generations to come. Elevations and Floor Plan renderings of <strong>the</strong><br />

proposed facility are shown in Figures 1 and 2 below. Full Architectural and Civil Engineering plans sets may be<br />

accessed on <strong>the</strong> project’s ftp site (see <strong>the</strong> Table of Contents <strong>for</strong> <strong>the</strong> web link).<br />

The facility will not be used as garage storage space <strong>for</strong> bus vehicles or as a service location <strong>for</strong> vehicles. Those<br />

functions will remain at PARTA’s headquarters. PARTA’s administrative offices will also remain at its headquarters.<br />

PARTA’s Midway C lot will to continue to operate <strong>for</strong> <strong>Kent</strong> State students, while <strong>the</strong> KCG will provide space<br />

specifically designed <strong>for</strong> PARTA buses, separation of cars and bus circulation, parking specifically devoted to public<br />

use, and space <strong>for</strong> bicycle racks. All of <strong>the</strong>se features will address <strong>the</strong> known issues with <strong>the</strong> Midway C lot and will<br />

increase <strong>the</strong> efficiency and effectiveness of <strong>the</strong> transportation system and <strong>the</strong> movement of workers (Source: <strong>Kent</strong><br />

<strong>Central</strong> <strong>Gateway</strong> Site Selection Report).<br />

Economic Development Opportunities<br />

There are many economic development benefits associated with <strong>the</strong> location of <strong>the</strong> KCG in downtown <strong>Kent</strong> at <strong>the</strong><br />

selected site. These include its potential to: attract activity; generate foot traffic <strong>for</strong> downtown businesses; and<br />

optimize transit/pedestrian activity. Ano<strong>the</strong>r benefit includes its ability to supply yet minimize and efficiently provide<br />

needed parking to support downtown development. In this sense, <strong>the</strong> KCG could serve as an important catalyst <strong>for</strong><br />

downtown development, and could help propel <strong>Kent</strong> fur<strong>the</strong>r toward becoming a vibrant university downtown similar<br />

to: Charlottesville, VA; Chapel Hill, NC; Austin, TX; Boulder, CO; West Lafayette, IN; Princeton, NJ; and that is being<br />

provided by multimodal transit facilities in A<strong>the</strong>ns, GA and Normal, IL.<br />

The market and financial overview assessment shows that sufficient demand exists to support <strong>the</strong> non-transit related<br />

spaces in <strong>the</strong> KCG as well as o<strong>the</strong>r mixed-use (i.e. office, multifamily housing and retail projects) planned downtown.<br />

The key lynchpin in making such downtown projects possible is <strong>the</strong> KCG, which will serve as a downtown attraction<br />

and source of efficient parking to support downtown revitalization. The downtown area is underserved with retail<br />

offerings, and needs a critical mass of retail which could be in part supported with <strong>the</strong> KCG. The expansion of <strong>the</strong><br />

3

etail sector could allow <strong>for</strong> a stronger connection between downtown and <strong>Kent</strong> State University, bringing stronger<br />

foot traffic between <strong>the</strong> two areas. Ultimately, a stronger connection with KSU will enhance ridership at <strong>the</strong> transit<br />

center, because many students take long-term trips on weekends to <strong>the</strong> Cleveland area.<br />

Despite <strong>the</strong> economic downturn at <strong>the</strong> national and regional levels, <strong>the</strong>re are reasons to be optimistic about <strong>the</strong><br />

market <strong>for</strong> mixed-use, pedestrian friendly development in downtown <strong>Kent</strong> that would be both transit oriented and<br />

downtown appropriate. Developers and businesses have expressed demonstrated interest in downtown’s relatively<br />

untapped market, and are planning high-quality new and rehabilitated spaces to accommodate this demand. Over<br />

<strong>the</strong> next five years, households and jobs are expected to grow despite <strong>the</strong> current downturn, and particular industries<br />

(notably education and health care) are even adding jobs during <strong>the</strong> economic downturn. The enhanced<br />

attractiveness of downtown with <strong>the</strong> catalytic investment in <strong>the</strong> KCG could fur<strong>the</strong>r increase <strong>the</strong> appeal of new<br />

downtown spaces.<br />

The trans<strong>for</strong>mation of downtown <strong>Kent</strong> into a lively commercial and residential hub similar to o<strong>the</strong>r university towns<br />

across <strong>the</strong> nation will not occur overnight. One potential method to jumpstart this trans<strong>for</strong>mation would be to allow<br />

<strong>the</strong> KCG to offer parking to support downtown revitalization projects. A master lease agreement that allows joint<br />

merchandising of commercial space also could potentially include developer operation of such parking. This would<br />

be relatively attractive to a developer in that construction of parking atop <strong>the</strong> KCG (which already would include 100<br />

spaces of parking spaces devoted to transit use) would be less costly than building an entire garage; <strong>the</strong> <strong>for</strong>mer does<br />

not have site acquisition costs, site work costs, nor elevator costs to <strong>the</strong> developer.<br />

Figure 1: First Floor Plan <strong>for</strong> <strong>the</strong> <strong>Proposed</strong> <strong>Multimodal</strong> <strong>Transit</strong> Center<br />

4

Figure 2: Rendered Elevations of <strong>the</strong> <strong>Proposed</strong> <strong>Multimodal</strong> <strong>Transit</strong> Center<br />

5

II.<br />

Grant Funds and Sources and Use of Project Funds<br />

i) Amount requested<br />

Total TIGER grant request: = $21.0 M<br />

The grant amount request was developed from detailed construction cost estimates, which are included in<br />

Appendix A. The grant request amount includes only those project elements which are FTA eligible (e.g.,<br />

<strong>the</strong> costs of <strong>the</strong> build-outs of <strong>the</strong> retail spaces will provided by a local development partner, and are not<br />

included in <strong>the</strong> grant request amount.)<br />

The total grant request is based on <strong>the</strong> following major construction components:<br />

<strong>Multimodal</strong> Facility $14,649,981<br />

Geo<strong>the</strong>rmal System $ 204,457<br />

Road/Pedestrian Connections & Utilities $ 6,145,562<br />

Total $21,000,000<br />

Tenant Improvements (Funded by Private Developer): $1.1 million 1<br />

ii) O<strong>the</strong>r funds being used-amount and source(include o<strong>the</strong>r federal)<br />

The following o<strong>the</strong>r funds were or are being used:<br />

Federal (used to fund feasibility studies, CE environmental investigations, and preliminary<br />

engineering and architectural plans):<br />

Surface Transportation Act, 2004 = $ 215,371<br />

Consolidated Appropriations Act, 2005 = $ 364,077<br />

SAFETEA-LU (thru 5309 Program) = $ 834,077<br />

H.R. 2764, Division K Earmark, 2008 = $ 196,000<br />

Total (Federal) = $ 1,609,525<br />

1 Private tenant improvement calculation assumes $50 per square foot in tenant improvements (to trans<strong>for</strong>m space from ‘cold dark shell’ space<br />

to finished space). Assumes 22,428 in private sector retail, restaurant and office space. Excludes 1,762 in public waiting area space.<br />

6

Local Match Commitments to date:<br />

PARTA, City of <strong>Kent</strong>, and <strong>Kent</strong> State University =<br />

$258,000 (CE Documents and PE)<br />

City of <strong>Kent</strong>:<br />

Upper levels of Parking in <strong>the</strong> Facility =<br />

$3.0 M (see Appendix C– Letters of Support)<br />

Private Development Partners (i.e., Fairmount Properties):<br />

Retail and Office Tenant Improvements =<br />

$1.1 M (current estimate)<br />

Total O<strong>the</strong>r Funds = $ 5,967,525<br />

Note: These funds do not include <strong>the</strong> proposed $61.818 M adjacent private developments by <strong>the</strong><br />

Fairmount-Pizzuti Group, which <strong>the</strong> multimodal center will support.<br />

iii) % of TIGER funds <strong>for</strong> <strong>the</strong> project<br />

Total Project Costs:<br />

Planning and Feasibility (completed 2008) = $421,823<br />

Preliminary A/E and Phase II ESA (completed 8/2009) = $450,600<br />

Estimated Remaining A/E & Property Acquisition = $737,102<br />

Estimated Office and Retail Tenant Improvements = $1,100,000<br />

Estimated Upper Levels of Parking (non FTA eligible) = $3,000,000<br />

Estimated Construction (FTA eligible) = $21,000,000<br />

Total = $26,709,525<br />

Percentage of Tiger Funds (NOT including adjacent proposed private development):<br />

($ 21,000,000 / $ 26,709,525) x 100 = 79%<br />

Percentage of Tiger Funds (including adjacent proposed private development):<br />

($ 21,000,000 / ($ 26,709,525+ $61,818,000)) x 100 = 24%<br />

iv) % share <strong>for</strong> o<strong>the</strong>r sources of funds<br />

Percent Share of O<strong>the</strong>r Funds (NOT including adjacent proposed private development):<br />

($5,967,525/ $ 26,709,525) x 100 = 22%<br />

7

III.<br />

Primary Selection Criteria – Long Term Outcomes<br />

• Project will measurably contribute over <strong>the</strong> long-term to growth in employment, and project<br />

will make improvements that allow <strong>for</strong> expansion, hiring, or o<strong>the</strong>r growth of private sector<br />

production<br />

The <strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong> project will create employment opportunities through both direct need<br />

<strong>for</strong> jobs on site to service parking, enhanced transit usage and commercial spaces, indirect<br />

employment impacts, and induced employment created through enhancement of <strong>the</strong> downtown.<br />

The <strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong> will improve <strong>the</strong> connectivity between downtown <strong>Kent</strong>, <strong>Kent</strong><br />

neighborhoods, and <strong>the</strong> <strong>Kent</strong> State University (KSU) campus, <strong>the</strong>reby bringing additional transit<br />

riders to <strong>the</strong> area and offering enhanced opportunities <strong>for</strong> downtown revitalization, which ultimately<br />

will lead to increased competitiveness and employment.<br />

In addition to increasing connectivity, <strong>the</strong> <strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong> will provide parking that will<br />

support projects planned and underway in downtown. These projects include a hotel and<br />

conference center (<strong>the</strong> result of a partnership between <strong>the</strong> City, KSU, and private developers), a<br />

new mixed-use development project (office, retail, restaurant and housing), and a rehabilitation<br />

project consisting of office and retail spaces which are fully leased. Jobs will be created and<br />

retained through support <strong>for</strong> <strong>the</strong>se projects, both during <strong>the</strong> construction period and during longterm<br />

operations. The estimated development cost of <strong>the</strong>se projects is in <strong>the</strong> range of $60 to $80<br />

million, and does not include o<strong>the</strong>r downtown development activities that may occur over <strong>the</strong> longterm<br />

as <strong>the</strong> <strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong> contributes to downtown revitalization.<br />

The <strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong> will enhance <strong>the</strong> position of <strong>Kent</strong> State University in that improvements<br />

associated with <strong>the</strong> project will support downtown revitalization. A thriving downtown will improve<br />

recruitment ef<strong>for</strong>ts at <strong>Kent</strong> State University, <strong>the</strong>reby supporting a stronger student body and faculty.<br />

The strength of students and faculty members may lead to enhanced university research, which<br />

ultimately will contribute to <strong>the</strong> economic competitiveness of <strong>the</strong> United States.<br />

• Project enhances hiring in an Economically Distressed Area:<br />

The KCG is located in Portage County, an economically distressed county in Ohio. The<br />

unemployment rate in Portage County, like many counties in Ohio, is higher than that of <strong>the</strong><br />

national average. Portage County’s unemployment rate is more than 1 percentage point higher<br />

than <strong>the</strong> national average, at 10.8 percent in June 2009 compared to 9.8 percent <strong>for</strong> <strong>the</strong> nation as<br />

a whole (Source: U.S. Bureau of Labor Statistics and Ohio Department of Job and Family<br />

Services).<br />

• Project will increase <strong>the</strong> efficiency and effectiveness of <strong>the</strong> transportation system through<br />

integration or better use of all existing transportation infrastructure, and project will<br />

improve long-term efficiency, reliability and cost-competitiveness in <strong>the</strong> movement of<br />

workers<br />

8

The site chosen <strong>for</strong> <strong>the</strong> <strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong> offers good access to existing bus routes, which will<br />

be re-aligned to service <strong>the</strong> transit center, making use of existing infrastructure. The new facility<br />

also will address a number of deficiencies at a bus transfer facility that PARTA has operated out of<br />

a parking lot at KSU, and by addressing <strong>the</strong>se deficiencies, increase <strong>the</strong> efficiency and<br />

effectiveness of <strong>the</strong> transportation system and <strong>the</strong> movement of workers. Such improvements may<br />

result in new ridership as new riders are attracted to <strong>the</strong> enhanced services and enhanced<br />

downtown.<br />

When located downtown, <strong>the</strong> <strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong> will provide a better location than <strong>the</strong> prior bus<br />

transfer station operated by PARTA at <strong>the</strong> “Midway C Lot” on <strong>the</strong> <strong>Kent</strong> State University campus,<br />

which is situated in a parking lot <strong>for</strong> KSU students with “C” parking permits. Since this prior station<br />

was located in a permit-only parking lot, it did not allow members of <strong>the</strong> public to park at <strong>the</strong> facility<br />

in order to transfer to use <strong>the</strong> bus. Circulation at <strong>the</strong> Midway C Lot at KSU is complicated and<br />

potentially unsafe, with automobiles traveling in <strong>the</strong> same lanes as buses and parking adjacent to<br />

<strong>the</strong> bus waiting area. The Midway C Lot at KSU contains insufficient space <strong>for</strong> <strong>the</strong> number of<br />

buses that stack at <strong>the</strong> facility, and lacks bicycle amenities. The KCG addresses <strong>the</strong>se issues, with<br />

space specifically designed <strong>for</strong> PARTA buses, separation of cars and bus circulation, parking<br />

specifically devoted to public use, and space <strong>for</strong> bicycle racks. All of <strong>the</strong>se features will increase<br />

<strong>the</strong> efficiency and effectiveness of <strong>the</strong> transportation system and <strong>the</strong> movement of workers<br />

(Source: <strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong> Site Selection Report).<br />

Ridership will increase as a result of <strong>the</strong> system and downtown enhancements, and currently, <strong>the</strong><br />

buses have excess passenger capacity. As ridership increases, <strong>the</strong> buses will decrease <strong>the</strong>ir<br />

operating costs which will enhance cost effectiveness indices. PARTA’s operating efficiency will<br />

rise as <strong>the</strong> cost per passenger mile decreases. The KCG project will increase bus utilization<br />

without substantially increasing operating costs and effectively put <strong>the</strong> buses to better use.<br />

• Project will have a positive impact on qualitative measures of community life, and will<br />

provide benefits to many users in <strong>the</strong> community (with description of <strong>the</strong> community and<br />

scale of project’s impact):<br />

The <strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong> project will not only improve transit service and connectivity in <strong>the</strong> City<br />

of <strong>Kent</strong> and to and from <strong>Kent</strong> State University and <strong>the</strong> downtown area, but also support downtown<br />

revitalization, <strong>the</strong> economic viability of <strong>the</strong> university and regional economic development. The<br />

KCG will potentially provide space <strong>for</strong> commercial and community uses, possibly to include space<br />

<strong>for</strong> university/student uses, classrooms, art events and a city and university welcome center, which<br />

would provide additional activity and community ga<strong>the</strong>ring space in downtown. It will serve as a<br />

catalyst <strong>for</strong> downtown revitalization as it provides better service and brings more people downtown.<br />

The KCG will serve as an anchor <strong>for</strong> downtown revitalization by becoming a destination in its own<br />

right, a civic focal point, and a transportation and parking hub. The KCG will enhance pedestrian<br />

and transit connections between residential neighborhoods, <strong>Kent</strong> State University and downtown,<br />

<strong>the</strong>reby encouraging potential customers to walk or use public transit throughout downtown and<br />

patronize businesses.<br />

9

The KCG has potential to enhance <strong>the</strong> quality of life of many people. The scale of <strong>the</strong> project<br />

includes:<br />

o<br />

o<br />

o<br />

The downtown walkshed, in which downtown revitalization will be catalyzed by <strong>the</strong><br />

center, and residents may walk to transit service and commercial and community uses<br />

downtown. This area includes <strong>the</strong> land generally within a quarter mile walk of <strong>the</strong> <strong>Kent</strong><br />

<strong>Central</strong> <strong>Gateway</strong>, bound by Crain Avenue to <strong>the</strong> north, Lincoln Street to <strong>the</strong> east, Summit<br />

Street to <strong>the</strong> south, and <strong>the</strong> Cuyahoga River to <strong>the</strong> west. In 2009, <strong>the</strong>re were an<br />

estimated 1,091 residents located in this area and 1,545 employees.<br />

Neighboring <strong>Kent</strong> State University (KSU), from which students will walk to <strong>the</strong> KCG to<br />

take long-distance buses to Cleveland and Akron, and from which students will walk<br />

downtown to patronize businesses created as a result of <strong>the</strong> KCG and o<strong>the</strong>r downtown<br />

investments. There were 23,000 students at <strong>the</strong> <strong>Kent</strong> campus of KSU in 2009 and 1,000<br />

faculty members. The population of <strong>the</strong> campus swells during special events, with up to<br />

46,000 parents, 92,000 grandparents, 166,000 alumni, and 14 NCAA sports teams<br />

visiting KSU throughout <strong>the</strong> year <strong>for</strong> various events. These visitors will be more likely to<br />

visit downtown with <strong>the</strong> KCG in that it will provide and support commercial spaces to<br />

accommodate businesses <strong>for</strong> a more active downtown.<br />

The driveshed surrounding <strong>the</strong> KCG, from which residents may easily travel to <strong>the</strong><br />

park-and-ride to take long-distance buses to Cleveland or Akron. Within an easy 15-<br />

minute drive of <strong>the</strong> KCG <strong>the</strong>re were over 195,000 residents in 2009.<br />

• Project will significantly enhance user mobility through <strong>the</strong> creation of more convenient<br />

transportation options <strong>for</strong> travelers<br />

As described above, <strong>the</strong> <strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong> will provide a more convenient bus transfer service<br />

than that which PARTA has operated at <strong>the</strong> Midway C Lot at KSU, and this enhanced convenience<br />

will enhance user mobility. Improvements to <strong>the</strong> service which will enhance <strong>the</strong> overall ease of use<br />

and convenience of transit use include <strong>the</strong> provision of parking specifically devoted to public use,<br />

space <strong>for</strong> bicycle racks, and separation of cars and buses. The KCG also will be located in<br />

convenient walking distance of o<strong>the</strong>r public services, including a courthouse, police station, fire<br />

station, and City Hall. The transit center will serve downtown residents, university-related users,<br />

and non-university related visitors.<br />

• Project will improve existing transportation choices by enhancing points of modal<br />

connectivity or by reducing congestion on existing modal assets<br />

The <strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong> will improve transit service by acting as an efficient park-and-ride <strong>for</strong><br />

passengers traveling to and from areas within <strong>the</strong> region, including Cleveland, Akron, and <strong>Kent</strong><br />

State University, and serving as a transfer point <strong>for</strong> PARTA routes.<br />

10

The <strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong> also offers potential to connect to a potential future passenger rail<br />

station, which is being studied through a NOACA commuter rail study and <strong>the</strong> Ohio Hub project<br />

that identify options to route such passenger rail through <strong>Kent</strong>.<br />

• Project will improve accessibility and transport services <strong>for</strong> economically disadvantaged<br />

populations<br />

The scale of <strong>the</strong> KCG encompasses areas that include economically disadvantaged populations,<br />

defined as low- and very low-income households earning less than 80 percent of area median<br />

income. These areas, defined above, are profiled below in terms of <strong>the</strong> number of households<br />

earning less than $65,000 annually (AMI per HUD <strong>for</strong> Portage County):<br />

o<br />

o<br />

The downtown walkshed included 272 households that earned less than $50,000 in<br />

2009 (data available provides number of households in <strong>the</strong> $50,000 to $74,999 income<br />

bracket), or 65 percent of <strong>the</strong> 419 households in <strong>the</strong> area.<br />

The driveshed surrounding <strong>the</strong> KCG included 35,370 households that earned less<br />

than $50,000 in 2009 (data available provides number of households in <strong>the</strong> $50,000 to<br />

$74,999 income bracket), or 45 percent of <strong>the</strong> 78,951 households in <strong>the</strong> area.<br />

(Source: HUD, ESRI Business In<strong>for</strong>mation Solutions)<br />

• Project is <strong>the</strong> result of a planning process which coordinated transportation and land-use planning<br />

decisions and encouraged community participation in <strong>the</strong> process<br />

The <strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong> project was identified in <strong>the</strong> City of <strong>Kent</strong> Bicentennial Plan (2004), which<br />

resulted from a thirteen month planning process that included public input via 45 community<br />

meetings. The plan coordinated transportation and land use planning decisions as its findings<br />

linked land use, transportation, economic and community development issues.<br />

11

IV.<br />

Primary Selection Criteria – Job Creation and Economic Stimulus<br />

• Total amount of funds that will be expended on construction and construction-related<br />

activities:<br />

Estimated Construction Total (Including Public and Private Investments) = $ 25,100,000<br />

• Number and type of jobs to be created and/or preserved by <strong>the</strong> project during construction<br />

and <strong>the</strong>reafter:<br />

During <strong>the</strong> construction period, a variety of new economic opportunities will be created. The<br />

construction will create at least 142 direct on-site jobs with an aggregate payroll of $6.497 million.<br />

Fur<strong>the</strong>rmore, <strong>the</strong>se direct jobs will create 124 additional indirect, or spin-off, jobs off-site with an<br />

aggregate payroll of $4.9 million. Direct consumer expenditures will total roughly $9.253 million and<br />

an estimated $10.7 million in material purchases will be made, of which $7.9 million will be made in<br />

<strong>the</strong> <strong>Kent</strong> region. All amounts are in constant 2009 dollars to avoid counting any inflationary<br />

impacts.<br />

Construction Employment Impact<br />

Total<br />

FTE<br />

(6/)(7/)<br />

Average<br />

Earnings<br />

/Hour (1/)<br />

Consumption<br />

Expenditures<br />

(3/)<br />

Disposable<br />

Total Income Earnings (2/)<br />

Construction 142 $ 22 $ 6,497,920 $ 5,874,119 $ 5,274,958<br />

Spin-off Employment Impact (4/)(5/) 124 $ 19 $ 4,900,480 $ 4,430,033 $ 3,978,169<br />

Total Impact 266 $ 11,398,400 $ 10,304,152 $ 9,253,127<br />

Assumes construction period of 1 year min.<br />

1/ May 2008 Bureau of Labor Statistics Occupational Wage Estimates <strong>for</strong> Construction<br />

Sector<br />

<strong>for</strong> Pittsburgh MSA, inflated 3 percent annually to 2009 dollars<br />

2/ Disposable Income was 90.4% of Personal Income as of May 2009, Bureau of Economic Analysis<br />

3/ Consumption Expenditures was 89.8% of Disposable Income as of June 2006 (revised), Bureau of Economic<br />

Analysis<br />

4/ 1997 Employment Multiplier Estimates Per $1 Million Income <strong>for</strong> Construction Sector, RIMS II Model (1.8728)<br />

5/ 1997 Earnings Multiplier <strong>for</strong> Construction Sector, RIMS II Model (1.7718)<br />

6/ FTE indicates "full-time equivalent", working 2,080 hours annually<br />

7/ Employment estimates from 2009 Downtown <strong>Kent</strong> Revitalization Stimulus <strong>Funding</strong> Request<br />

Construction Material Purchase Impact<br />

Construction Cost (1/) $ 25,100,000<br />

Per $1,000<br />

Type of Purchase Const. Cost Expenditure<br />

Regionally Purchased $305 $7,655,500<br />

Purchased Out of Region $105 $2,635,500<br />

Total Material Purchases $10,291,000<br />

Percentage Total Purchases 74%<br />

1/ Construction cost includes planning and feasibility, preliminary A/E and Phase II ESA, estimated remaining A/E and property<br />

acquisition, estimated office and retail tenant improvements, estimated upper levels of parking and estimated facility construction<br />

Sources: Basile Baumann Prost Cole & Associates, Bureau of Labor Statistics, Bureau of Economic Analysis, Downtown <strong>Kent</strong><br />

Revitalization Stimulus <strong>Funding</strong> Request, April 2009<br />

12

Once construction is complete and market absorbed, impacts related to <strong>the</strong> development<br />

operations will continue on an annual, long term (e.g. 20 years) basis.<br />

The proposed <strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong> will create 647 direct permanent jobs at project build-out.<br />

Fur<strong>the</strong>rmore, <strong>the</strong> development will create nearly 120 hotel employees, 144 retail employees, 308<br />

office employees, and 75 conference facility employees.<br />

Permanent Employment Impact<br />

SF / Rooms Total Employees<br />

Hotel Rooms (1/) 120 120<br />

Retail SF (2/) 48,000 144<br />

Office SF (3/) 77,000 308<br />

Conference SF (4/) 25,000 75<br />

Total - 647<br />

1/ 1 employee per hotel room<br />

2/ 3 employees per 1,000 SF of retail<br />

3/ 4 employees per 1,000 SF of office<br />

4/ 3 employees per 1,000 SF of conference space<br />

Source: BBPC Industry Practices<br />

Estimates of <strong>the</strong> Projects Expected Quantitative and Qualitative Benefits<br />

The chart in Appendix F summarizes <strong>the</strong> quantitative benefits of <strong>the</strong> project in terms of <strong>the</strong> capital<br />

and operating costs of <strong>the</strong> KCG and in <strong>the</strong> economic benefits in terms of additional income to <strong>the</strong><br />

<strong>Kent</strong> area economy. This measures <strong>the</strong> dynamic effects that <strong>the</strong> transportation investment will<br />

have on land use and a household income. This in<strong>for</strong>mation is designed to help decision-makers<br />

determined <strong>the</strong> potential trade-offs of alternative transportation investments. This clearly benefits<br />

<strong>the</strong> land use and economic benefits of <strong>the</strong> transportation investments<br />

Additional benefits which have not been quantified include: health and safety benefits,<br />

environmental enhancements, fuel savings, travel time savings, reductions in greenhouse s<br />

emissions and public health effects of enhancing <strong>the</strong> pedestrian environment and transportation<br />

services in downtown <strong>Kent</strong>.<br />

• Business enterprises to be created or benefited by <strong>the</strong> project during its construction and<br />

once it becomes operational<br />

The commercial spaces within <strong>the</strong> KCG could accommodate six retail storefronts, one restaurant,<br />

and up to six small offices. However, <strong>the</strong> precise number of businesses to be created overall is not<br />

yet known. The KCG will serve as an anchor <strong>for</strong> downtown revitalization, and existing businesses<br />

will benefit from <strong>the</strong> increase in pedestrian traffic, parking supply and long term University<br />

growth.PARTA, <strong>the</strong> City, and <strong>the</strong> University are committed to using this project as a catalyst <strong>for</strong><br />

redevelopment in all of downtown <strong>Kent</strong>, both <strong>for</strong> construction companies during construction, and<br />

businesses that will put down permanent roots in <strong>the</strong> community.<br />

13

• Whe<strong>the</strong>r <strong>the</strong> project will promote <strong>the</strong> creation of job opportunities <strong>for</strong> low-income workers<br />

through <strong>the</strong> use of best practices hiring programs and utilization of apprenticeship<br />

programs<br />

PARTA is committed to helping low-income workers in several ways. PARTA has a long history of<br />

employing people with disabilities to work in our offices, and currently uses an apprenticeship<br />

program in maintenance to train new diesel mechanics from a local vocational school.<br />

• Whe<strong>the</strong>r <strong>the</strong> project will provide maximum practicable opportunities <strong>for</strong> small businesses<br />

and disadvantaged business enterprises, including veteran-owned small businesses<br />

PARTA has a long history of seeking out DBE’s <strong>for</strong> eligible projects. We currently have a long term<br />

relationship with a lubricant supply company that is a DBE. PARTA has a DBE program in place<br />

and is committed to using that program <strong>for</strong> this project as well.<br />

• Whe<strong>the</strong>r <strong>the</strong> project will make effective use of community-based organizations in<br />

connecting disadvantaged workers with economic opportunities<br />

PARTA has hired a Director of Mobility Management over a year ago whose primary goal is to<br />

connect PARTA with community-based organizations. This Director came from <strong>the</strong> largest<br />

community-based human service agency in <strong>the</strong> county and his last project at his <strong>for</strong>mer employer<br />

was to build <strong>the</strong> only veteran’s shelter in Portage County.<br />

• Whe<strong>the</strong>r <strong>the</strong> project implements best practices, consistent with our nation’s civil rights and<br />

equal opportunity laws, <strong>for</strong> ensuring that all individuals, regardless of race, gender, age,<br />

disability, and national origin – benefit from <strong>the</strong> Recovery Act<br />

PARTA is committed to following <strong>the</strong> best practices with regard to civil rights and equal opportunity<br />

<strong>for</strong> all individuals throughout <strong>the</strong> procurement process.<br />

• Identify whe<strong>the</strong>r <strong>the</strong> populations most likely to benefit from <strong>the</strong> creation or preservation of<br />

jobs or new or expanded business opportunities are from Economically Distressed Areas<br />

It is likely that <strong>the</strong> employment resulting from investment in <strong>the</strong> KCG will benefit residents of<br />

surrounding Portage County, which is an economically distressed area.<br />

• Indicate whe<strong>the</strong>r <strong>the</strong> project’s procurement plan is likely to create follow-on jobs and<br />

economic stimulus <strong>for</strong> manufacturers and suppliers that support <strong>the</strong> construction industry,<br />

and how quickly such jobs would be created<br />

The KCG will require suppliers from throughout <strong>the</strong> construction industry. One of <strong>the</strong> great<br />

advantages to this project is <strong>the</strong> speed at which construction could begin. Since <strong>the</strong> Phase 1 and<br />

Phase 2 ESA’s have been completed, and a CE is expected anytime, this project is truly “shovelready”.<br />

14

• Provide a project schedule<br />

A proposed detailed construction schedule is included in Appendix B. Construction Contract Group<br />

No. 1: Roadway Connections and Utility Relocation may begin in May 2010 and is expected to be<br />

completed by August 2011. Construction Contract Group No. 2: Facility Construction may begin in<br />

January 2011 and is expected to be completed by September 2012. Estimated on-site<br />

employment is tabulated below.<br />

On-Site Construction Employment Impact by CY Quarter (1)<br />

Major Construction Activities<br />

Estimated Total Construction On-<br />

Site Employment<br />

CY 2010<br />

Q1<br />

Bidding and Permit Acquisition<br />

Q2 Construction Contract No. 1 42<br />

Q3 Construction Contract No. 1 42<br />

Q3 Construction Contract No. 1 42<br />

CY 2011<br />

Q1 Construction Contract No. 1 and No. 2 142<br />

Q2 Construction Contract No. 1 and No. 2 142<br />

Q3 Construction Contract No. 1 and No. 2 142<br />

Q4 Construction Contract No. 1 and No. 2 142<br />

CY 2012<br />

Q1 Construction Contract No. 2 100<br />

Q2 Construction Contract No. 2 100<br />

Q3 Construction Contract No. 2 100<br />

Q4 Tenant Build Outs (by Private Partners) 35<br />

(1) Estimates provided by TranSystems, Inc.<br />

15

V. Secondary Selection Criteria<br />

• Extent to which <strong>the</strong> project demonstrates new approaches to transportation funding and<br />

finance<br />

The KCG will be <strong>the</strong> result of public-private partnerships and could include innovative<br />

financing/funding arrangements <strong>for</strong> <strong>the</strong> non-transit elements of <strong>the</strong> project. This could include an<br />

arrangement between PARTA and private developers to allow <strong>for</strong> a master lease of <strong>the</strong> commercial<br />

space within <strong>the</strong> KCG, which would allow developers of mixed-use projects in downtown to attract<br />

retailers in <strong>the</strong>ir projects as well as in spaces within <strong>the</strong> KCG. A master lease agreement could<br />

potentially also include developer operation of parking within <strong>the</strong> KCG facility (above spaces<br />

devoted to transit use) to provide parking <strong>for</strong> projects downtown. A copy of <strong>the</strong> Memorandum of<br />

Understanding is included in Appendix D. A Market and Financial Overview, prepared during <strong>the</strong><br />

feasibility analysis of this project, is included in Appendix F.<br />

• Project involves State and local governments, o<strong>the</strong>r public entities, or private or nonprofit<br />

entities, including projects that engage parties that are not traditionally involved in<br />

transportation projects, such as nonprofit community groups<br />

The KCG will be <strong>the</strong> result of a partnership between PARTA, <strong>the</strong> City of <strong>Kent</strong>, <strong>Kent</strong> State<br />

University, and private developers. As described above related to innovations in financing, <strong>the</strong>re is<br />

potential <strong>for</strong> this partnership to include an arrangement between PARTA and private developers to<br />

allow <strong>for</strong> a master lease of <strong>the</strong> commercial space within <strong>the</strong> KCG. This would allow developers of<br />

mixed-use projects in downtown to attract retailers in <strong>the</strong>ir projects as well as in spaces within <strong>the</strong><br />

KCG. A master lease agreement could potentially also include developer operation of parking<br />

within <strong>the</strong> KCG facility (above spaces devoted to transit use) to provide parking <strong>for</strong> projects<br />

downtown.<br />

• Project effectively uses community-based organizations in connecting disadvantaged<br />

people with economic opportunities<br />

PARTA has hired a Director of Mobility Management over a year ago whose primary goal is to<br />

connect PARTA with community-based organizations. This Director came from <strong>the</strong> largest<br />

community-based human service agency in <strong>the</strong> county and his last project at his <strong>for</strong>mer employer<br />

was to build <strong>the</strong> only veteran’s shelter in Portage County.<br />

• Project cannot be readily and efficiently completed without Federal assistance, and o<strong>the</strong>r<br />

sources of Federal assistance are or are not readily available <strong>for</strong> <strong>the</strong> project<br />

Several multimodal facilities have been built in Ohio in <strong>the</strong> last several years, and none of <strong>the</strong>m<br />

have been built without <strong>the</strong> support of <strong>the</strong> federal government, and this project falls along those<br />

same lines. Given <strong>the</strong> size of <strong>the</strong> project, <strong>the</strong>re is not any of <strong>the</strong> standard federal avenues <strong>for</strong><br />

funding readily available in this region.<br />

• The amount of private debt and equity to be invested in <strong>the</strong> project<br />

PARTA estimates that $1,100,000 will be invested directly by private firms to finish <strong>the</strong> tenant build<br />

out of <strong>the</strong> retail and office spaces.<br />

16

• Project demonstrates collaboration among neighboring or regional jurisdictions to achieve<br />

National, regional or metropolitan benefits<br />

PARTA is collaborating directly with <strong>the</strong> City of <strong>Kent</strong>, and <strong>Kent</strong> State University, as well as private<br />

developers to make this project a reality. Letters of support from <strong>the</strong>se collaborating parties are<br />

included in Appendix C.<br />

17

APPENDIX A<br />

CONSTRUCTION COST ESTIMATES

APPENDIX B<br />

PROPOSED CONSTRUCTION SCHEDULE

ID Task Name Start Finish Predecessors<br />

1 PARTA to Submit <strong>the</strong> TIGER Grant Application Tue 9/15/09 Tue 9/15/09<br />

<strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong><br />

Anticipated Construction Schedule<br />

(Pending <strong>Funding</strong> Availability)<br />

Quart 4th Quarte 1st Quart 2nd Quart 3rd Quart 4th Quarte 1st Quart 2nd Quart 3rd Quart 4th Quarte 1st Quarte 2nd Quart 3rd Quart 4th Quarte 1st Quart<br />

u e Oct o e Jan e MarApr a Jun Jul u e Oct o e Jan e MarApr a Jun Jul u e Oct o e Jan e MarApr a Jun Jul u e Oct o e Jan e Mar<br />

9/15<br />

2 TIGER Grant Selection Process (Feb. 17, 2010 is <strong>the</strong> latest<br />

award notification date. However, assume notification will be<br />

received earlier in order to meet <strong>the</strong> President's ARRA goals.)<br />

Tue 9/15/09 Mon 1/18/10 1<br />

3 Complete Remaining ROW Acquisitions Utilizing Already<br />

Encumbered Funds (<strong>for</strong> Construction Contract No.2)<br />

Tue 9/15/09 Mon 8/30/10 1<br />

4 Begin Preparing Final Bid Documents. Two (2) Sets of Bid<br />

Documents will be Prepared - One <strong>for</strong> Utility and City Road<br />

Modifications, <strong>the</strong> O<strong>the</strong>r <strong>for</strong> <strong>the</strong> Construction of <strong>the</strong> MMC<br />

(Portions of this Work will Utilize Already Encumbered Funds)<br />

Tue 9/15/09 Mon 3/29/10 1<br />

5 Milestone: PARTA Receives Notice of TIGER Grant<br />

Award<br />

Mon 1/18/10 Mon 1/18/10 2<br />

1/18<br />

6 Execute Private Development Partnership Contracts and<br />

Agreements<br />

Tue 1/19/10 Mon 4/12/10 5<br />

7 Advertise Contract No. 1: Utility and Road Modifications Tue 3/30/10 Mon 5/10/10 5,4<br />

8 Contractor Selection <strong>for</strong> Contract No. 1 Tue 5/11/10 Mon 5/17/10 7<br />

9 Complete Contract No. 1: Construction of Utility and City<br />

Roadway Modifications<br />

Mon 5/31/10 Mon 8/1/11<br />

10 Milestone: Begin Construction <strong>for</strong> Contract Group 1 Mon 5/31/10 Mon 5/31/10 8FS+10 days<br />

5/31<br />

11 Set up Roadway/Pedestrian Maintenance-of-Traffic Tue 6/1/10 Mon 6/7/10 10<br />

12 Remove Existing Pavements and Sidewalks (Demo) Tue 6/8/10 Mon 7/5/10 11<br />

13 Construct and Install Required Drainage Features Tue 7/6/10 Mon 8/30/10 12<br />

14 Relocate Existing Overhead Utilities Tue 6/8/10 Mon 11/22/10 11<br />

15 Complete Grading Work Tue 6/8/10 Mon 11/22/10 11<br />

16 Construct New Pavements, Curbs, and Pedestrian<br />

Sidewalks (<strong>for</strong> continuation of <strong>the</strong> Esplanade)<br />

Tue 6/8/10 Mon 6/6/11 11<br />

17 Install Lighting Tue 6/7/11 Mon 7/4/11 16<br />

Project: Construction Schedule_Updat<br />

Date: Tue 9/15/09<br />

Task<br />

Split<br />

Progress<br />

Milestone<br />

Summary<br />

Project Summary<br />

External Tasks<br />

External Milestone<br />

Deadline<br />

Page 1

ID Task Name Start Finish Predecessors<br />

18 Install One (1) New Traffic Signal, and O<strong>the</strong>r Traffic Control<br />

Devices<br />

Tue 6/7/11 Mon 7/4/11 16<br />

<strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong><br />

Anticipated Construction Schedule<br />

(Pending <strong>Funding</strong> Availability)<br />

Quart 4th Quarte 1st Quart 2nd Quart 3rd Quart 4th Quarte 1st Quart 2nd Quart 3rd Quart 4th Quarte 1st Quarte 2nd Quart 3rd Quart 4th Quarte 1st Quart<br />

u e Oct o e Jan e MarApr a Jun Jul u e Oct o e Jan e MarApr a Jun Jul u e Oct o e Jan e MarApr a Jun Jul u e Oct o e Jan e Mar<br />

19 Complete Landscaping Tue 6/7/11 Mon 8/1/11 16<br />

20 Milestone: Construction Contract No.1 Competed Mon 8/1/11 Mon 8/1/11 19<br />

8/1<br />

21 Advertise Contract No. 2: Construction of <strong>the</strong> <strong>Multimodal</strong><br />

Center<br />

Tue 8/31/10 Mon 11/8/10 3,5,4<br />

22 Contractor Selection <strong>for</strong> Contract No. 2 Tue 11/9/10 Mon 11/22/10 21<br />

23 Complete Contract No. 2: Construction of <strong>the</strong> <strong>Multimodal</strong><br />

<strong>Transit</strong> Center<br />

Tue 1/18/11 Mon 9/10/12<br />

24 Clear Site and Demo One (1) Warehouse Building Tue 1/18/11 Mon 3/14/11 22FS+40 days<br />

25 Complete Site Mass Excavation and Grading Tue 3/15/11 Mon 4/25/11 24<br />

26 Install Building Foundations and Adjacent Retaining Walls Tue 4/26/11 Mon 8/15/11 25<br />

27 Install San, Storm, Water, and O<strong>the</strong>r Underground Utilities Tue 4/26/11 Mon 8/15/11 25<br />

28 Construct Building Framing Tue 8/16/11 Mon 12/5/11 26<br />

29 Install Facility Mechanical, Electrical, and Plumbing Systems Tue 12/6/11 Mon 3/26/12 28<br />

30 Complete Building Finishes Tue 3/27/12 Mon 7/16/12 29<br />

31 Complete Final Site Work and Landscaping Tue 7/17/12 Mon 9/10/12 30<br />

32 Milestone: Construction Contract No. 2 Completed Mon 9/10/12 Mon 9/10/12 31<br />

9/10<br />

33 Completion of Interior Finishes of Retail, Office, and<br />

O<strong>the</strong>r Rentable Spaces (Managed and Funded by<br />

Private Developers) - For In<strong>for</strong>mation Only. Job<br />

Creation Figures are Not Included in <strong>the</strong> Grant<br />

Application Tables.<br />

Tue 9/11/12 Mon 2/25/13 32<br />

34 Construction of Adjacent Hotel, Office, and Retail<br />

Center (Managed and Funded by Private Developers) -<br />

For In<strong>for</strong>mation Only. Job Creation Figures are Not<br />

Included in <strong>the</strong> Grant Application Tables.<br />

Tue 8/3/10 Fri 3/1/13 6FS+80 days<br />

Project: Construction Schedule_Updat<br />

Date: Tue 9/15/09<br />

Task<br />

Split<br />

Progress<br />

Milestone<br />

Summary<br />

Project Summary<br />

External Tasks<br />

External Milestone<br />

Deadline<br />

Page 2

APPENDIX C<br />

LETTERS OF PROJECT SUPPORT

September 2, 2009<br />

Michael P. Harrington, PE<br />

Railway & <strong>Transit</strong> Team Leader<br />

TranSystems<br />

55 Public Square, Suite 1900<br />

Cleveland, OH 44113<br />

Michael,<br />

We would like to take <strong>the</strong> opportunity to express our strong support <strong>for</strong> <strong>the</strong> application of <strong>the</strong> Portage Area<br />

Regional Transportation Authority (“PARTA”) <strong>for</strong> Federal funding in connection with <strong>the</strong> downtown <strong>Kent</strong><br />

<strong>Central</strong> <strong>Gateway</strong> (“Project”).<br />

In April of 2008 Fairmount Properties, LLC and Street-Works, LLC (collectively, University Realty Partners,<br />

LLC, “URP”) were chosen as <strong>the</strong> City of <strong>Kent</strong>’s Development Partner <strong>for</strong> <strong>the</strong> downtown district immediately<br />

adjacent to <strong>the</strong> Project site. URP was selected following a national Request <strong>for</strong> Qualifications as <strong>the</strong> most<br />

responsive to <strong>the</strong> City of <strong>Kent</strong>’s stated goal of achieving downtown revitalization through reinvestment and<br />

<strong>the</strong> creation of mixed-use density while enhancing long-term economic impact through job creation and<br />

increased tax revenues. Fur<strong>the</strong>r, URP brings an extensive background developing complex, urban, mixeduse<br />

districts within <strong>the</strong> framework of public-private partnerships.<br />

In collaboration with <strong>the</strong> City of <strong>Kent</strong>, <strong>Kent</strong> State University, and o<strong>the</strong>r community stakeholders, our<br />

partnership will design, build, entitle, lease, finance, and manage over 250,000 square feet of development<br />

including a new hotel and conference center, street-level retail, office and residential space. In addition,<br />

our site has been identified <strong>for</strong> <strong>the</strong> new Portage County courthouse. All of <strong>the</strong>se planned civic, commercial,<br />

and residential uses are, however, dependent on <strong>the</strong> much needed transit and parking which will be<br />

created as a result of this Federal funding, without which <strong>the</strong> planned development and economic<br />

revitalization of <strong>the</strong> greater <strong>Kent</strong> community will not be able to proceed.<br />

URP has been working with PARTA and we have identified a financial and legal framework that provides<br />

PARTA with a much needed ongoing source of revenue while at <strong>the</strong> same time provides <strong>for</strong> a seamless<br />

relationship between <strong>the</strong> Project site and <strong>the</strong> surrounding commercial development. We believe that<br />

through a district-wide tenanting, ownership, marketing and management strategy <strong>the</strong> essential long-term<br />

integrity of <strong>the</strong> Project, both physically and functionally, will be preserved as a multi-purpose transit<br />

gateway within <strong>the</strong> community.<br />

2618 N. Moreland Boulevard • Cleveland, Ohio 44120 • Phone: 216.514.8700 • Fax: 216.514.1484

We would be happy to provide more detailed in<strong>for</strong>mation regarding our partnership, <strong>the</strong> plan and vision <strong>for</strong><br />

downtown <strong>Kent</strong>, references from both <strong>the</strong> public and/or private sector, as well as answer any additional<br />

questions. Please do not hesitate to contact us and thank you <strong>for</strong> your consideration of this letter.<br />

Sincerely,<br />

Fairmount Properties, LLC<br />

Street-Works Development, LLC<br />

Randy Ruttenberg, Principal<br />

Jeff Levien, Sr. Director of Development<br />

1-216-514-8700 1-914-949-6505<br />

CC: John Drew, Bryan Smith, Jim Prost, Adam Branscomb

APPENDIX D<br />

PUBLIC – PRIVATE PARTNERSHIP MEMORANDUM

MEMORANDUM<br />

Via E-Mail<br />

TO:<br />

cc:<br />

FROM:<br />

Jim Prost<br />

John Drew<br />

Bryan Smith<br />

Mike Harrington<br />

Adam Branscomb, Randy Ruttenberg, and Jeff Levien<br />

DATE: August 6, 2009<br />

RE:<br />

<strong>Proposed</strong> <strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong> public-private partnership<br />

We would like to thank you <strong>for</strong> <strong>the</strong> opportunity to express our interest in shaping a public-private<br />

partnership with <strong>the</strong> Portage Area Regional Transportation Authority (“PARTA”) in connection with<br />

<strong>the</strong> commercial space component of <strong>the</strong> downtown <strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong> (“Project”).<br />

Although a number of details are yet to be determined regarding Project design, timing and<br />

delivery, we feel that as <strong>the</strong> City of <strong>Kent</strong>’s chosen Development Partner <strong>for</strong> <strong>the</strong> surrounding<br />

downtown district immediately adjacent to <strong>the</strong> Project site, Fairmount Properties, LLC and Street-<br />

Works, LLC (collectively University Realty Partners, LLC, “URP”) is <strong>the</strong> best choice to cohesively<br />

unite <strong>the</strong> Project’s commercial component with <strong>the</strong> balance of <strong>the</strong> district through a comprehensive<br />

merchandizing, leasing and management strategy.<br />

Recognizing that <strong>the</strong> commercial space within <strong>the</strong> Project represents a potential ongoing source of<br />

revenue <strong>for</strong> PARTA, we present <strong>the</strong> following outline of a proposed public-private partnership<br />

between URP and PARTA:<br />

1. URP will purchase from PARTA through a condominium sale <strong>the</strong> approximately 30-35K SF<br />

of commercial space within <strong>the</strong> Project. The Terms of Purchase will be determined once a<br />

cost estimate <strong>for</strong> <strong>the</strong> construction is complete, space delivery specifications are complete,<br />

and fur<strong>the</strong>r analysis of market demand is complete.<br />

2. URP will pay a monthly Condominium Assessment to PARTA. Monthly Assessment Fee<br />

will be determined once a thorough expense analysis and projections <strong>for</strong> <strong>the</strong> Project has<br />

been completed. URP would like to explore an incentive-based Assessment Fee structure<br />

whereby consideration is given to <strong>the</strong> incremental income generated by <strong>the</strong> commercial<br />

space as <strong>the</strong> cash flow increases corresponding to market absorption.<br />

2618 N. MORELAND BOULEVARD • CLEVELAND, OHIO 44120 • PHONE 216.514.8700 • FACSIMILE 216.514.1484

3. URP will pay a pro-rata share of Common Area Maintenance.<br />

4. URP and PARTA will enter into standard Reciprocal Operating and Easement Agreements<br />

5. URP will maintain design oversight as it relates to <strong>the</strong> commercial space, storefronts, and<br />

mechanicals distribution in order to ensure retail and office viability.<br />

Although we have some concerns regarding <strong>the</strong> design of <strong>the</strong> commercial space which would need<br />

to be addressed in order to ensure <strong>the</strong> long term economic viability of that space, we believe that<br />

<strong>the</strong> above framework will succeed in providing an on-going revenue source <strong>for</strong> PARTA while<br />

maintaining a cohesive and sustainable commercial environment in downtown <strong>Kent</strong>. We look<br />

<strong>for</strong>ward to hearing your thoughts on what we feel can be a very exciting and mutually rewarding<br />

public-private partnership.<br />

2618 N. MORELAND BOULEVARD • CLEVELAND, OHIO 44120 • PHONE 216.514.8700 • FACSIMILE 216.514.1484

APPENDIX E<br />

KENT MARKET AND FINANCIAL OVERVIEW REPORT

<strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong><br />

Market and Financial Overview<br />

August 2009<br />

Prepared by:<br />

Basile Baumann Prost Cole & Associates, Inc.

<strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong> Market and Financial Overview DRAFT<br />

Table of Contents<br />

1.0 Introduction ......................................................................................................... 2<br />

1.1 Purpose ............................................................................................................... 2<br />

1.2 Work Completed .................................................................................................. 3<br />

1.3 Description of Project .......................................................................................... 3<br />

1.4 Existing Downtown Conditions ............................................................................ 4<br />

2.0 Demographic and Economic Profile ................................................................. 6<br />

2.1 Analysis Areas ..................................................................................................... 6<br />

2.2 Selected Economic and Demographic Conditions .............................................. 9<br />

3.0 Office Market ......................................................................................................14<br />

3.1 Market Overview ............................................................................................... 14<br />

3.2 Supply Characteristics ...................................................................................... 15<br />

3.3 Demand Characteristics .................................................................................... 16<br />

4.0 Residential Market .............................................................................................20<br />

4.1 Market Overview ............................................................................................... 20<br />

4.2 Supply Characteristics ...................................................................................... 21<br />

4.3 Demand Characteristics .................................................................................... 22<br />

5.1 Market Overview ............................................................................................... 28<br />

5.3 Supply Characteristics ...................................................................................... 29<br />

5.4 Demand Characteristics .................................................................................... 31<br />

6.0 Market Summary and Next Steps .....................................................................36<br />

6.1 Summary Market Observations ......................................................................... 36<br />

6.2 Opportunities <strong>for</strong> Leased Space in <strong>the</strong> <strong>Transit</strong> Center ...................................... 37<br />

6.3 Opportunities <strong>for</strong> <strong>Transit</strong> Oriented and Downtown Development ...................... 37<br />

6.4 Preliminary Public Private Partnership Opportunities ....................................... 37<br />

Basile Baumann Prost Cole & Associates, Inc.<br />

1 | P age

<strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong> Market and Financial Overview DRAFT<br />

1.0 Introduction<br />

1.1 Purpose<br />

The <strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong> (KCG) will be a new multimodal transportation center that will not only improve<br />

transit service and connectivity in <strong>the</strong> City of <strong>Kent</strong> and to and from <strong>Kent</strong> State University and <strong>the</strong> downtown<br />

area, but also support downtown revitalization, <strong>the</strong> economic viability of <strong>the</strong> university and regional<br />

economic development. The project as envisioned will:<br />

• Improve transit service by acting as an efficient park-and-ride <strong>for</strong> passengers traveling to and from<br />

local areas and <strong>the</strong> larger region, including <strong>Kent</strong>, <strong>Kent</strong> State University, Cleveland, and Akron, and<br />

serving as a transfer point <strong>for</strong> PARTA routes.<br />

• Provide space <strong>for</strong> commercial and community uses, including potential space <strong>for</strong> selected<br />

university/student uses, classrooms, art events and a city and university welcome center, which<br />

would provide additional activity and community ga<strong>the</strong>ring space in downtown.<br />

• Serve as an anchor <strong>for</strong> downtown revitalization by becoming a destination in its own right, a civic<br />

focal point, and a transportation hub.<br />

• Enhance pedestrian and transit connections between <strong>the</strong> downtown, residential neighborhoods,<br />

and <strong>Kent</strong> State University, <strong>the</strong>reby encouraging potential customers to walk or use public transit<br />

throughout downtown and patronize businesses, recognizing yet minimizing <strong>the</strong> need to provide<br />

additional parking to accommodate downtown revitalization.<br />

The proposed site <strong>for</strong> <strong>the</strong> <strong>Kent</strong> <strong>Central</strong> <strong>Gateway</strong> is bound by Depeyster Street, Erie Street, East Main<br />

Street, and Haymaker Parkway (S.R. 59).<br />