THE ANNUAL REVIEW 2010 - PEI Media

THE ANNUAL REVIEW 2010 - PEI Media

THE ANNUAL REVIEW 2010 - PEI Media

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>THE</strong> <strong>ANNUAL</strong> <strong>REVIEW</strong> <strong>2010</strong><br />

PE portfolios surge<br />

at CalPERS, CalSTRS<br />

Nigerian pensions eye alternatives<br />

Energy Capital closes second fund on $4.3bn<br />

Pantheon closes fourth secondaries fund on $3bn<br />

Indian exits reach<br />

ecord high in <strong>2010</strong><br />

India’s Religare to go global in $1bn push<br />

Standard Bank in top-level hiring spree<br />

Goldman plays down<br />

‘capital overhang’ fears<br />

Mezz funds take centre stage<br />

Montagu sells Sebia to Cinven for €800m<br />

New Horizon closes on $750m<br />

3i reaps 3.5x on healthcare exit<br />

TPG, KKR, GIC to spend<br />

Apax nets 4.5x on Tommy Hilfiger exit<br />

$1bn on Chinese bank stake<br />

Scholars find buyout funds produce alpha<br />

Abraaj boosts MENA totals with $545m deal<br />

Blackstone, Bain fund<br />

interests back at par<br />

Marks ‘shocked’<br />

by market return<br />

Private equity IPOs trump market average<br />

Bridgepoint fetches 8x<br />

with Pets at Home sale<br />

LPs keep faith with<br />

private equity<br />

Warburg goes<br />

back to Brazil<br />

Advent and Bain purchase<br />

£2bn of RBS assets<br />

CDH Fund IV heavily over-subscribed<br />

New pools of capital open<br />

Oncap in 5.8x<br />

CPPIB, Onex make £3bn play for Tomkins<br />

for private equity<br />

education exit<br />

Norway considers commitments<br />

Carlyle, TPG pip KKR with $2.3bn Healthscope bid

<strong>THE</strong> DIFFERENCE. With 40 years of private equity experience, Adams Street Partners<br />

offers investors an independent and employee-owned firm recognized for its disciplined<br />

investment approach and strong performance. Leveraging an integrated global platform<br />

of primary, secondary and direct investments, Adams Street operates as a cohesive<br />

team to successfully navigate the complexities of the private equity marketplace.<br />

Dedicated to excellence in serving its investors, Adams Street has managed through<br />

the most challenging investment cycles. By maintaining a disciplined approach that<br />

values quality over quantity, Adams Street provides tailored portfolio solutions born of<br />

experience and access to top investment opportunities.<br />

FUND OF FUNDS / SECONDARIES<br />

VENTURE CAPITAL & GROWTH EQUITY / BUYOUT CO-INVESTMENTS<br />

For information, contact Gary Fencik in London at +44 20 7823 0640 GFencik@AdamsStreetPartners.com<br />

www.AdamsStreetPartners.com<br />

CHICAGO | MENLO PARK | LONDON | SINGAPORE

private equity annual review <strong>2010</strong> pa g e 1<br />

the pei annual review <strong>2010</strong><br />

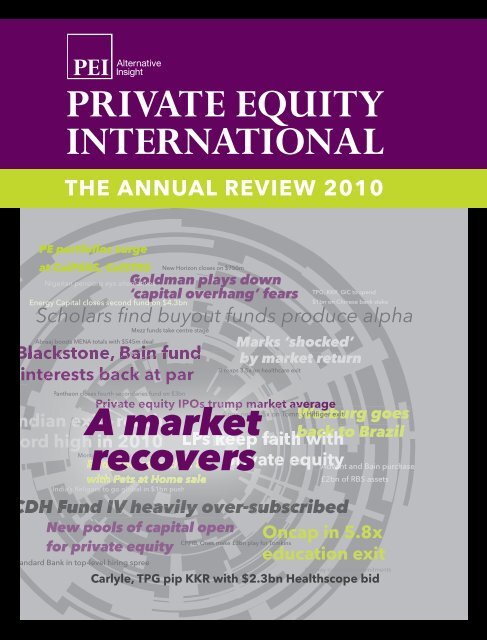

A market recovers<br />

i s s n 1 4 7 4 – 8 8 0 0<br />

It’s been a tough few years for the global private<br />

equity industry. The uncertainty and dislocation<br />

resulting from the credit collapse and global<br />

financial crisis in 2008 was followed in 2009<br />

by market unpredictability and upheaval. A<br />

dearth of leverage brought buyout markets to<br />

a standstill; too many portfolio companies were<br />

showing severe signs of distress; fund valuations<br />

were written down dramatically; limited partners<br />

kept tighter grips on their purse strings;<br />

and critics once again were taking aim at an<br />

industry whose core tenets were being called<br />

into question.<br />

Evidence of the revolution and evolution<br />

that detractors, as well as industry insiders,<br />

were subsequently calling for, however, is<br />

plain to see. Examining headlines carried in<br />

<strong>2010</strong> by PrivateEquityInternational.com –<br />

this review’s cover image – shows an industry<br />

firmly in recovery mode, adapting its approach<br />

as market cycles change. For instance: “Scholars<br />

find buyout funds produce alpha”; “Blackstone,<br />

Bain fund interests back at par”; “PE portfolios<br />

surge at CalPERS, CalSTRS”; and “Private<br />

equity IPOs trump market average”. There<br />

are plenty more.<br />

This edition looks back at some of the year’s<br />

key issues: the shifting relationships between<br />

fund managers and their investors; the revival<br />

of M&A activity; the secondaries surge fuelled<br />

by the withdrawing banking sector; and the<br />

widely anticipated distressed investment<br />

boom that didn’t quite happen as expected.<br />

We chronicle the year’s top stories (p. 6), from<br />

the rise of RMB funds in China and impressive<br />

momentum in emerging markets, to regulatory<br />

challenges and veteran private equity firms’<br />

changing compositions post-crisis.<br />

We also, of course, highlight the investors,<br />

managers, advisors and transactions that<br />

particularly stood out from the crowd in<br />

<strong>2010</strong> with our annual awards section (p. 30).<br />

The list of winners, decided by thousands of<br />

voters from around the world, makes plain that<br />

the brightest players in the industry are now<br />

thriving, rather than just surviving.<br />

Reading back through these pages, it’s clear<br />

that <strong>2010</strong> marked a much-needed turning point<br />

for the private equity industry. That’s not to say<br />

it’s all smooth sailing ahead, but if the energy<br />

and resolve displayed by hardworking GPs and<br />

investors in <strong>2010</strong> continues, then 2011 should<br />

be filled with even more positive headlines.<br />

Enjoy the Review,<br />

Amanda Janis<br />

Senior Editor<br />

Senior Editor, Private Equity<br />

Amanda Janis<br />

Tel: +44 20 7566 4270<br />

amanda.j@peimedia.com<br />

Editor, Private Equity International<br />

Toby Mitchenall<br />

Tel: +44 20 7566 5438<br />

toby.m@peimedia.com<br />

Editor, PrivateEquityInternational.com<br />

Christopher Witkowsky<br />

Tel: +1 212 633 1072<br />

christopher.w@peimedia.com<br />

Contributors<br />

Jenny Blinch<br />

Nicholas Donato<br />

Jenna Gottlieb<br />

Aston Tan<br />

Hsiang-Ching Tseng<br />

Graham Winfrey<br />

Editor-at-Large<br />

David Snow<br />

Tel: +1 212 633 1455<br />

david.s@peimedia.com<br />

Editorial Director<br />

Philip Borel<br />

Tel: +44 20 7566 5434<br />

philip.b@peimedia.com<br />

Head of Marketing<br />

Paul McLean<br />

Tel: +44 20 7566 5456<br />

Paul.m@peimedia.com<br />

Design and Production Manager<br />

Joshua Chong<br />

Tel: +44 20 7566 5433<br />

joshua.c@peimedia.com<br />

Head of Production<br />

Tian Mullarkey<br />

Tel: +44 20 7566 5436<br />

tian.m@peimedia.com<br />

Group Managing Director<br />

Tim McLoughlin<br />

Tel: +44 20 7566 4276<br />

tim.m@peimedia.com<br />

Co-founder<br />

David Hawkins<br />

Tel: +44 20 7566 5440<br />

david.h@peimedia.com<br />

Co-founder<br />

Richard O’Donohoe<br />

Tel: +44 20 7566 5430<br />

richard.o@peimedia.com<br />

Head of Advertising<br />

Alistair Robinson<br />

Tel: +44 20 7566 5454<br />

alistair.r@peimedia.com<br />

Head of Business Development<br />

Jeff Gendel<br />

Tel: +1 212 633 1452<br />

jeff.g@peimedia.com

page 2 private equity annual review <strong>2010</strong><br />

Contents<br />

STORIES OF <strong>THE</strong> YEAR<br />

6. Month-by-month highlights of<br />

the year in global private equity<br />

<strong>THE</strong> <strong>2010</strong> PRVATE EQUITY<br />

INTERNATIONAL AWARDS<br />

30. Introduction<br />

32. The roll of honour<br />

34. Europe<br />

50. North America<br />

58. Africa, Latin America and<br />

MENA<br />

59. Asia<br />

GLOBAL <strong>THE</strong>MES <strong>2010</strong><br />

68. The year in fundraising<br />

The firms that came to market and<br />

how they did<br />

70. Fundraising: Capital Pursuit!<br />

The board game that puts the<br />

“fun” back in fundraising<br />

72. Fundraising: In the money<br />

Highlighting successful fund<br />

closes during <strong>2010</strong><br />

73. Secondaries: Banking on it<br />

How changes in the banking<br />

market created opportunity for<br />

secondaries<br />

78. LP Focus: Cash back<br />

Tracking distributions and capital<br />

calls throughout the year<br />

79. Terms tug of war<br />

Mapping the tussle between LPs<br />

and GPs over Ts and Cs<br />

80. The year of regulation<br />

Following the twists and turns of<br />

the creation of various regulatory<br />

developments affecting the asset<br />

class<br />

82. Fund administration:<br />

Regulations on the horizon<br />

Mapping the globe’s various new<br />

fund laws<br />

84. Fund administration:<br />

Outlook<br />

Four forces affecting the lives of<br />

fund administrators<br />

85. Distress: Slim pickings<br />

What happened to the muchanticipated<br />

feast of distressed<br />

opportunities?<br />

123. LP Radar<br />

Limited partners have been<br />

flexing their muscles and making<br />

demands, according to extracts<br />

from <strong>PEI</strong>’s ‘LP Radar’ column<br />

125. Industry comment<br />

A collection of<br />

commentary as featured on<br />

PrivateEquityInternational.com<br />

127. Data room<br />

Key data points from the year’s<br />

private equity market<br />

26<br />

30<br />

79<br />

93

Passion for achievement.<br />

www.mvision.com<br />

for the 9th consecutive year

page 4 private equity annual review <strong>2010</strong><br />

Contents<br />

NORTH AMERICAN <strong>THE</strong>MES <strong>2010</strong><br />

88. First round<br />

<strong>PEI</strong>’s sideways look at the North American private<br />

equity market in <strong>2010</strong><br />

90. Stateside<br />

Extracts from <strong>PEI</strong>’s ‘Stateside’ column chronicle a<br />

shifting relationship between LP and GP<br />

92. M&A makes a comeback<br />

A review of the North American large buyout market<br />

93. Defrosting the mid-market<br />

A review of North American<br />

mid-market activity<br />

94. Tax changes: Carrying on<br />

Chronicling the rise of carry tax<br />

95. Leverage for sale<br />

Following developments in the US leveraged<br />

loan markets<br />

EUROPE <strong>THE</strong>MES <strong>2010</strong><br />

98. First round<br />

<strong>PEI</strong>’s sideways look at the European private equity<br />

market in <strong>2010</strong><br />

100. In Europe<br />

Extracts from <strong>PEI</strong>’s ‘In Europe’ column show<br />

a market reigniting<br />

102. Mid-market crowding<br />

Europe’s mid-market players found their hunting<br />

ground more crowded than usual<br />

104. Europe’s exclusive billionaires club<br />

Few firms managed to seal multi-billion deals<br />

EMERGING MARKETS <strong>THE</strong>MES<br />

108. Asia Monitor<br />

Extracts from <strong>PEI</strong>’s ‘Asia Monitor’ column show a<br />

region developing its own identity<br />

110. Greater China<br />

A market review and a closer look at the rise of<br />

domestic LPs<br />

112. India<br />

A market review and a look at the high number<br />

of GP spin-outs<br />

114. Latin America<br />

A market review and a look beyond the core market<br />

of Brazil<br />

116. Central and Eastern Europe<br />

The nuances of the region and its aging<br />

entrepreneurs<br />

118. Middle East and North Africa<br />

A transformational shake-out in the region is<br />

on its way<br />

121. Sub-Saharan Africa<br />

Private equity’s decade of opportunity<br />

MIX<br />

®<br />

Paper from<br />

responsible sources<br />

FSC ® C020438<br />

Published by<br />

<strong>PEI</strong> <strong>Media</strong> Ltd.<br />

LONDON<br />

Second floor, Sycamore House,<br />

Sycamore Street<br />

London ECIY 0SG<br />

New York<br />

3 East 28th Street, 7th Floor<br />

New York, NY 10016<br />

SINGAPORE<br />

105 Cecil Street<br />

Unit 10-01 The Octagon<br />

Singapore 069534<br />

Subscriptions<br />

London: +44 20 7566 5444<br />

New York: +1 212 645 1919<br />

Singapore: +65 6838 4563<br />

subscriptions@peimedia.com<br />

Reprints<br />

Fran Hobson<br />

+44 20 7566 5444<br />

fran.h@peimedia.com<br />

Annual subscription<br />

UK £795 US/RoW $1590 EU €1085<br />

Subscribe online<br />

www.PrivateEquityOnline.com/pei<br />

<strong>PEI</strong> is published 10 times a year.<br />

Printed in the UK by Hobbs the printers<br />

www. hobbs.uk.com ISSN 1474-8800<br />

© <strong>PEI</strong> <strong>Media</strong> Ltd 2011<br />

No statement in this magazine is to be construed as a recommendation to buy or sell<br />

securities. Neither this publication nor any part of it may be reproduced or transmitted<br />

in any form or by any means, electronic or mechanical, including photocopying,<br />

recording, or by any information storage or retrieval system, without the prior permission<br />

of the publisher. Whilst every effort has been made to ensure its accuracy, the<br />

publisher and contributors accept no responsibility for the accuracy of the content in<br />

this magazine. Readers should also be aware that external contributors may represent<br />

firms that may have an interest in companies and/or their securities mentioned in<br />

their contributions herein.<br />

Cancellation policy: you can cancel your subscription at any time during the first<br />

three months of subscribing and you will receive a refund of 70 per cent of the total<br />

annual subscription fee. Thereafter, no refund is available. Any cancellation request<br />

needs to be sent in writing [fax, mail or email] to the subscriptions departments in<br />

either our London or New York offices.

1119<br />

The answer, my friend,<br />

is blowing in the wind<br />

The winds of change will always bring uncertainty<br />

but they also create opportunity wherever they<br />

blow, spreading seeds of wisdom, experience and<br />

new ideas; the most solid foundation for growth.<br />

Ethos enjoys an unparalleled history of over 25 years<br />

of successful investing across a broad range of<br />

economic and political cycles. It’s our innovative<br />

thinking, patience and inventive approach that enables<br />

Ethos to evaluate and execute transactions, generating<br />

value for investors and business partners alike,<br />

that sets us apart.<br />

www.ethos.co.za<br />

BUILDING BETTER BUSINESSES<br />

Ethos is an Authorised Financial Services Provider

<strong>2010</strong><br />

Stories of the year<br />

page 6 private equity annual review <strong>2010</strong><br />

January: Renminbi rising 10<br />

February: Volcker lays down the law 12<br />

March: Parcel passing 14<br />

April: Hugo Boss face-off 16<br />

May: Messing with the middlemen 18<br />

June: Leaving lobbyists 20<br />

July: Going to the bank 22<br />

August: Quality vs. quantity 24<br />

September: R.I.P. GSC 25<br />

October: Battle commences 26<br />

November: Assault on the<br />

public markets 27<br />

December: Closure for Candover 28<br />

Oncap in 5.8x education exit<br />

LPs keep faith with private equity<br />

Carlyle, TPG pip KKR with $2.3bn Healthscope bid<br />

Private equity IPOs trump<br />

New pools of capital open for private equity<br />

market average Marks ‘shocked’ by market return<br />

Bridgepoint fetches 8x with Pets at Home sale<br />

New pools of capital open for private equity<br />

CDH Fund IV heavily over-subscribed<br />

Warburg goes back to Brazil<br />

Indian exits reach<br />

record high in <strong>2010</strong><br />

New Jersey barters carry cut from Tenex<br />

Aldus settles New York<br />

pension probe<br />

Scholars find buyout funds produce alpha<br />

Blackstone, Bain fund<br />

interests back at par<br />

PE portfolios surge at<br />

CalPERS, CalSTRS<br />

Standard Bank in top-level hiring spree<br />

Goldman plays down<br />

‘capital overhang’ fears

Actis is a private equity investor that<br />

invests exclusively in the emerging<br />

markets. With a growing portfolio,<br />

we currently have US$4.7bn in funds<br />

under management.<br />

We bring more than capital to our<br />

investments and produce benefits for<br />

our investee companies, investors and<br />

society at large. In our approach to<br />

business ethics, the environment, our<br />

labour laws, and our stewardship of<br />

these businesses, we actively look for<br />

opportunities to do good.<br />

In 2011, Actis won ‘African Private Equity Firm<br />

of the Year’ for the fourth consecutive year, and<br />

‘Latin American Private Equity Firm of the Year’,<br />

both awarded by Private Equity International.<br />

www.act.is<br />

Latin America<br />

Africa<br />

South Asia<br />

China<br />

South East Asia

Middle East, North Africa & South Asia<br />

MENASA<br />

Turkey<br />

• Acibadem | Healthcare<br />

& Insurance<br />

• Numarine | Luxury<br />

Yacht Manufacturer<br />

Jordan<br />

• Aramex | Logistics*<br />

• D1g.com | <strong>Media</strong>**<br />

• JorAMco | MRO<br />

• Maktoob | <strong>Media</strong>*<br />

• The Dead Sea Company for Conferences &<br />

Exhibitions | Convention Complex<br />

Tunisia<br />

Lebanon<br />

• Spinneys | Retail<br />

Morocco<br />

Algeria<br />

Libya<br />

Egypt<br />

• Agrocorp | Agriculture<br />

• Al Borg Laboratories | Healthcare<br />

• EFC/Orascom | Fertilizer & Construction<br />

• OMS | Information Technology**<br />

• Spinneys | Retail<br />

• The 47th | Real Estate<br />

Countries outside investment area<br />

Abraaj Capital offices: Dubai, Istanbul, Cairo,<br />

Amman, Riyadh, Karachi, Beirut, Ramallah<br />

* Exited Investments<br />

** In process of closing<br />

Saudi Arabia<br />

• National Air Services |<br />

Aviation*<br />

• Tadawi | Healthcare<br />

Dubai International Financial Centre, Gate Village 8, 3rd Floor, PO Box 504905, Dubai, United Arab Emirates<br />

T: +971 4 506 4400, F: +971 4 506 4600, info@abraaj.com, www.abraaj.com<br />

Abraaj Capital Ltd. is regulated by the Dubai Financial Services Authority

ENGINEERING SUCCESS<br />

Kuwait<br />

Pakistan<br />

• Teshkeel <strong>Media</strong> Group | <strong>Media</strong>**<br />

• BMA | Financial Services<br />

• Byco (formerly Bosicor) |<br />

Oil & Gas<br />

• Karachi Electric Supply Co. |<br />

Utilities<br />

• MS Forgings | Steel Forging<br />

Abraaj Capital is the largest private equity group<br />

in the Middle East, North Africa and South Asia<br />

(MENASA). Since inception in 2002, it has raised close<br />

to US$ 7 billion and distributed almost US$ 3 billion<br />

to its investors. Based out of Dubai, the Abraaj Group<br />

operates eight offices in the MENASA region including<br />

Istanbul, Cairo and Riyadh.<br />

India<br />

• ECI | Infrastructure<br />

• Man Infraconstruction |<br />

Infrastructure<br />

• Osian’s | Art<br />

• Ramky | Infrastructure<br />

Bahrain<br />

Oman<br />

• ONIC Holding | Insurance*<br />

Qatar<br />

• Amwal | Financial Services*<br />

United Arab Emirates<br />

• Air Arabia | Airline Services<br />

• Arabtec Holding PJSC | Construction*<br />

• Emirates Heights Development Company | Real Estate<br />

• ENSHAA | Real Estate<br />

• E3 | Information Technology<br />

• GEMS | Education<br />

• GMMOS | Oil & Gas Fabrication<br />

• Marine Hospitality Holdings | Marine & Leisure Services<br />

• <strong>Media</strong>quest | <strong>Media</strong><br />

• Network International | Financial Services**<br />

• Septech | Waste Water Treatment*<br />

• Signature Clubs International | Private Member Clubs*

page 10 private equity annual review <strong>2010</strong><br />

s to r i e s o f t h e y e a r<br />

j a n | f e b | m a r | a p r | m a y | j u n e | j u ly | a u g | s e p | o c t | n o v | d e c<br />

r m b - d e n o m i n a t e d f u n d s<br />

Renminbi rising<br />

The prevalence of Chinese RMB funds continued to<br />

grow in <strong>2010</strong>, causing celebration in some quarters<br />

and concern in others<br />

Shanghai: the future is RMB-denominated<br />

China-focused private equity funds denominated<br />

in Yuan raised more capital than US<br />

dollar-denominated funds for the first time<br />

ever in 2009. Of the $13 billion raised by<br />

funds investing either only in China or with<br />

an exposure to China, a whopping $8.73<br />

billion was raised by 21 RMB-denominated<br />

funds, more than twice the amount raised<br />

by funds denominated in USD, according<br />

to Chinese data firm Zero2IPO Research<br />

Centre.<br />

The trend showed no sign of abating<br />

in <strong>2010</strong>. Among the many domestic and<br />

global firms to launch or close their first<br />

or second RMB funds were CITIC Private<br />

Equity Funds Management, The Carlyle<br />

Group, The Blackstone Group, TPG,<br />

Hony Capital, Kleiner Perkins Caufield &<br />

Byers, Blue Oak Capital, Infinity Equity<br />

and Everbright China. Funds of funds also<br />

got in on the action: Chinese state-backed<br />

Suzhou Ventures Group launched two funds<br />

of funds targeting a total of RMB15 billion<br />

(€1.7 billion; $2.3 billion), while emerging<br />

markets-focused EM Alternatives also began<br />

raising an RMB vehicle.<br />

While the RMB fervor has been seized<br />

upon by both domestic and foreign players,<br />

firms running parallel USD-denominated<br />

funds have had to navigate potential<br />

conflicts of interests or risk alienating<br />

offshore LPs. USD dollar funds face<br />

substantially greater restrictions on where<br />

they can invest and how quickly they can<br />

do it. With RMB funds, meanwhile, able<br />

to invest comparatively quickly, some<br />

foreign LPs have had to watch parallel<br />

RMB-denominated vehicles make deal<br />

after attractive deal, while counterpart<br />

USD-denominated fund, to which they<br />

committed, lies largely idle.<br />

Still, the growth of China’s RMB<br />

industry is not only unstoppable, but also<br />

natural, Vincent Huang, a Hong Kongbased<br />

partner at Pantheon previously told<br />

sister publication PE Asia. “We have to wake<br />

up to the reality that the RMB funding<br />

source is the future in China and returns<br />

from RMB funds are likely to be better<br />

in the near future,” he said. “We cannot<br />

change this; we can at best try to align<br />

interests with the GPs.” ■<br />

Passing the reigns<br />

Montagu and LMS Capital were<br />

among the European firms in<br />

<strong>2010</strong> that put leadership into the<br />

hands of the next generation<br />

Montagu Private Equity in January elevated<br />

longtime chief executive Chris Masterson to<br />

the newly created role of chairman, allowing<br />

10-year veteran Jason Gatenby to take on the<br />

chief executive role.<br />

Masterson had spent 18 years working for<br />

the mid-market European firm, which spun out<br />

of HSBC in 2003. Gatenby joined Montagu in<br />

2000 after having spent a decade at 3i Group.<br />

The management shuffle came ahead of<br />

launching Montagu’s fourth fund, which is<br />

targeting €2 billion with a hard-cap of €2.5<br />

billion.<br />

A few weeks later, publicly listed midmarket<br />

firm LMS Capital also revamped its<br />

leadership structure, bringing in former First<br />

Reserve director Glenn Payne to become its<br />

chief executive officer.<br />

“We’re laying the foundations for the next<br />

generation,” outgoing chief executive Robert<br />

Rayne told <strong>PEI</strong> at the time. Rayne, who helped<br />

established LMS Capital’s investment activities in<br />

the early 1980s as London Merchant Securities,<br />

succeeded retiring chairman Jonathan Agnew. ■<br />

CD&R raises $5bn<br />

The firm attracted several new<br />

LPs to its eighth buyout fund<br />

Clayton Dubilier & Rice rounded up $5<br />

billion for Fund VIII in January, ending a<br />

two-year fundraising effort independent of<br />

placement agents and besting its prior fund’s<br />

$4 billion in commitments.<br />

The 32-year-old firm held a first close in<br />

March 2008. In 2009, it lowered its original<br />

target to $5 billion from $7.5 billion. Fund<br />

VIII included several new limited partners,<br />

including the Maryland Retirement System,<br />

which committed $75 million; the Teachers’<br />

Retirement System of Texas; and the<br />

South Carolina Retirement System, which<br />

invested $100 million. ■

page 10 private equity annual review <strong>2010</strong><br />

s to r i e s o f t h e y e a r<br />

j a n | f e b | m a r | a p r | m a y | j u n e | j u ly | a u g | s e p | o c t | n o v | d e c<br />

r m b - d e n o m i n a t e d f u n d s<br />

Renminbi rising<br />

The prevalence of Chinese RMB funds continued to<br />

grow in <strong>2010</strong>, causing celebration in some quarters<br />

and concern in others<br />

Shanghai: the future is RMB-denominated<br />

China-focused private equity funds denominated<br />

in Yuan raised more capital than US<br />

dollar-denominated funds for the first time<br />

ever in 2009. Of the $13 billion raised by<br />

funds investing either only in China or with<br />

an exposure to China, a whopping $8.73<br />

billion was raised by 21 RMB-denominated<br />

funds, more than twice the amount raised<br />

by funds denominated in USD, according<br />

to Chinese data firm Zero2IPO Research<br />

Centre.<br />

The trend showed no sign of abating<br />

in <strong>2010</strong>. Among the many domestic and<br />

global firms to launch or close their first<br />

or second RMB funds were CITIC Private<br />

Equity Funds Management, The Carlyle<br />

Group, The Blackstone Group, TPG,<br />

Hony Capital, Kleiner Perkins Caufield &<br />

Byers, Blue Oak Capital, Infinity Equity<br />

and Everbright China. Funds of funds also<br />

got in on the action: Chinese state-backed<br />

Suzhou Ventures Group launched two funds<br />

of funds targeting a total of RMB15 billion<br />

(€1.7 billion; $2.3 billion), while emerging<br />

markets-focused EM Alternatives also began<br />

raising an RMB vehicle.<br />

While the RMB fervor has been seized<br />

upon by both domestic and foreign players,<br />

firms running parallel USD-denominated<br />

funds have had to navigate potential<br />

conflicts of interests or risk alienating<br />

offshore LPs. USD dollar funds face<br />

substantially greater restrictions on where<br />

they can invest and how quickly they can<br />

do it. With RMB funds, meanwhile, able<br />

to invest comparatively quickly, some<br />

foreign LPs have had to watch parallel<br />

RMB-denominated vehicles make deal<br />

after attractive deal, while counterpart<br />

USD-denominated fund, to which they<br />

committed, lies largely idle.<br />

Still, the growth of China’s RMB<br />

industry is not only unstoppable, but also<br />

natural, Vincent Huang, a Hong Kongbased<br />

partner at Pantheon previously told<br />

sister publication PE Asia. “We have to wake<br />

up to the reality that the RMB funding<br />

source is the future in China and returns<br />

from RMB funds are likely to be better<br />

in the near future,” he said. “We cannot<br />

change this; we can at best try to align<br />

interests with the GPs.” ■<br />

Passing the reigns<br />

Montagu and LMS Capital were<br />

among the European firms in<br />

<strong>2010</strong> that put leadership into the<br />

hands of the next generation<br />

Montagu Private Equity in January elevated<br />

longtime chief executive Chris Masterson to<br />

the newly created role of chairman, allowing<br />

10-year veteran Jason Gatenby to take on the<br />

chief executive role.<br />

Masterson had spent 18 years working for<br />

the mid-market European firm, which spun out<br />

of HSBC in 2003. Gatenby joined Montagu in<br />

2000 after having spent a decade at 3i Group.<br />

The management shuffle came ahead of<br />

launching Montagu’s fourth fund, which is<br />

targeting €2 billion with a hard-cap of €2.5<br />

billion.<br />

A few weeks later, publicly listed midmarket<br />

firm LMS Capital also revamped its<br />

leadership structure, bringing in former First<br />

Reserve director Glenn Payne to become its<br />

chief executive officer.<br />

“We’re laying the foundations for the next<br />

generation,” outgoing chief executive Robert<br />

Rayne told <strong>PEI</strong> at the time. Rayne, who helped<br />

established LMS Capital’s investment activities in<br />

the early 1980s as London Merchant Securities,<br />

succeeded retiring chairman Jonathan Agnew. ■<br />

CD&R raises $5bn<br />

The firm attracted several new<br />

LPs to its eighth buyout fund<br />

Clayton Dubilier & Rice rounded up $5<br />

billion for Fund VIII in January, ending a<br />

two-year fundraising effort independent of<br />

placement agents and besting its prior fund’s<br />

$4 billion in commitments.<br />

The 32-year-old firm held a first close in<br />

March 2008. In 2009, it lowered its original<br />

target to $5 billion from $7.5 billion. Fund<br />

VIII included several new limited partners,<br />

including the Maryland Retirement System,<br />

which committed $75 million; the Teachers’<br />

Retirement System of Texas; and the<br />

South Carolina Retirement System, which<br />

invested $100 million. ■

page 12 private equity annual review <strong>2010</strong><br />

s to r i e s o f t h e y e a r<br />

j a n | f e b | m a r | a p r | m a y | j u n e | j u ly | a u g | s e p | o c t | n o v | d e c<br />

b a n k i n g re g u l a t i o n<br />

Volcker lays down the law<br />

Former Federal Reserve chairman Paul Volcker turned the spotlight on bank-owned<br />

private equity operations and got the ball rolling on industry-changing new rules<br />

Volcker: points out the dangers of bank-backed private equity<br />

Proposals to limit bank involvement with<br />

private equity outfits took a decisive tone in<br />

February when former Federal Reserve chairman<br />

Paul Volcker appeared before the Senate<br />

Banking Committee. The chairman testified on<br />

the behalf of the eponymous “Volcker Rule” –<br />

endorsed by President Obama just weeks earlier<br />

– which would restrict banks from owning,<br />

sponsoring and investing in hedge and private<br />

equity funds. Volcker argued such operations<br />

should live or die by their activities – without<br />

the unfair advantage of taxpayer support.<br />

During his testimony, Volcker stressed<br />

that commercial banks were covered by<br />

federal deposit insurance and have access<br />

to the Fed’s discount window for emergency<br />

loans due to the public’s interest in providing<br />

a “safety net”. However, Volcker insisted if<br />

bank holding companies wanted to invest<br />

in riskier activities, such as private equity<br />

funds, these operations should “stand alone”.<br />

“They are, and should be, free to trade,<br />

to innovate, to invest – and to fail,” he said.<br />

“[They should be] able to profit handsomely<br />

or fail entirely as appropriate in a free<br />

enterprise system.”<br />

In full agreement, the White House urged<br />

lawmakers to back the Volcker Rule, saying<br />

bank holding companies should choose<br />

between taking deposits and being a “financial<br />

company that can do other activities”.<br />

After months of negotiations and<br />

compromise, the Volcker Rule eventually<br />

cemented its place in history as part of the<br />

broader “Dodd-Frank Wall Street Reform<br />

and Consumer Protection Act”, signed<br />

into law on 21 July <strong>2010</strong>. The rule’s final<br />

language was watered down to prohibit<br />

banks from investing more than 3 percent<br />

of their Tier 1 capital in private equity and<br />

hedge funds, with an additional restriction<br />

from acquiring more than a 3 percent<br />

ownership stake in any private equity group<br />

or hedge fund.<br />

The signed bill, which provided only a<br />

framework around which the rules would be<br />

implemented, would not prove to be the end<br />

of the reform process, however. In October<br />

the newly formed Financial Stability Oversight<br />

Council began a public consultation period<br />

over the rule as mandated by the Dodd-Frank<br />

Act, which requires the council to complete<br />

a study of the rule no later than six months<br />

after the bill’s enactment.<br />

Upon completion of the study, which<br />

will help guide regulators in cementing the<br />

final details of the Volcker Rule, financial<br />

supervisory agencies will have nine months<br />

to implement the rule’s final language.<br />

The rule will ultimately become effective<br />

either one year following that, or on July<br />

21, 2012 (two years after Dodd-Frank was<br />

first enacted), whichever date comes first.<br />

Banks may be slightly comforted by<br />

provisions which allow for a comfortable<br />

lapse-time to sell or unwind assets should<br />

the 3 percent threshold be breached. Up<br />

to five years could be provided to banks<br />

to reach full compliance with the rule<br />

following its implementation, with the<br />

Federal Reserve Board authorized to grant<br />

further extensions in select circumstances.<br />

A number of banks have already started to<br />

unwind their private equity activities either<br />

by spinning out captive teams or selling off<br />

portfolios of fund interests. Most notably, in<br />

August a group of Bank of America private<br />

equity professionals spun out to launch<br />

independent firm Ridgemont Equity<br />

Partners; and in December the management<br />

buyout of HSBC Private Equity (Asia) was<br />

completed, reemerging as Headland Capital<br />

Partners.<br />

Better news for banks may come in 2011.<br />

With Republicans taking over the House of<br />

Representatives in 2011, they will wield<br />

increasing influence as details of the rule are<br />

drafted in the months to come. ■

This announcement appears as a matter of record only<br />

Rockland Power Partners, L.P.<br />

$333,000,000<br />

North American Power Asset Investments<br />

December <strong>2010</strong><br />

www.rocklandcapital.com<br />

The undersigned acted as exclusive global placement agent<br />

for the limited partnership interests<br />

www.berchwoodpartners.com

page 14 private equity annual review <strong>2010</strong><br />

s to r i e s o f t h e y e a r<br />

j a n | f e b | m a r | a p r | m a y | j u n e | j u ly | a u g | s e p | o c t | n o v | d e c<br />

s e c o n d a r y b u yo u t s<br />

Parcel passing<br />

Montagu was one of the most active firms on the sell-side of secondary buyouts,<br />

which dominated the <strong>2010</strong> deal landscape<br />

Passing the parcel: secondary deals flourished in <strong>2010</strong><br />

Montagu Private Equity in March sold medical technology business<br />

Sebia to Cinven in a deal understood to be worth roughly €800<br />

million. The transaction ended a long and hotly contested auction<br />

process, which ultimately earned Montagu a return of three times<br />

its invested capital.<br />

It also marked the third major asset sale by Monagu to a private<br />

equity buyer in as many months, having previously sold safety<br />

equipment manufacturer Survitec to Warburg Pincus for £280<br />

million and sausage casing manufacturer Kalle to Silverfleet Capital<br />

for €213 million.<br />

Montagu was not alone in selling assets to fellow GPs: in the first<br />

nine months of <strong>2010</strong> in the UK, for example, secondary buyouts<br />

accounted for nearly half (44 percent) of total buyout activity, with<br />

firms trading £5.5 billion-worth of investments between themselves,<br />

according to the Centre for Management Buy-out Research.<br />

Referred to as “pass-the-parcel” deals because they involve assets<br />

being passed from one financial sponsor to another, secondary<br />

buyouts have drawn criticism from limited partners and other market<br />

participants who argue the deals are often struck at high prices and<br />

provide little scope for further value creation. In some instances LPs<br />

find themselves indirectly owning the same asset, which has been<br />

passed between two of its GPs with all the associated transaction costs.<br />

Guy Hands, chief investment officer of Terra Firma, is one GP<br />

that has repeatedly criticised the practice. “Pass-the-parcel deals<br />

take substantial value away from LPs – I estimate approximately<br />

20 to 30 percent of equity each time,” Hands told delegates at a<br />

conference in November. “And if private equity increasingly goes this<br />

route, then it has only itself to blame when governments, unions,<br />

employees and eventually investors don’t support it.”<br />

The criticisms, however, may be unjustified, according to<br />

research produced in late <strong>2010</strong> by the Technische Universtät<br />

Mücnhen in conjunction with Munich-based fund of funds Golding<br />

Capital Partners. The study found that secondary buyouts have<br />

historically generated only marginally lower returns than primary<br />

buyouts. An analysis of 286 realised transactions from Golding’s deal<br />

database revealed that secondary buyouts had generated a median<br />

IRR of 31.9 percent, compared with 37.9 percent generated by<br />

primary investments.<br />

The difference in returns can largely be put down to the fact<br />

that secondary deals are on average larger in size than primary<br />

buyouts, and returns are inversely correlated to deal size, said<br />

the report. The study also concluded there is “little difference”<br />

in the levers for operational value creation between primary and<br />

secondary transactions. ■<br />

Goldman takes top rank in <strong>PEI</strong> 300<br />

The investment bank’s in-house group<br />

had the largest direct private equity<br />

investment programme in the world<br />

In Spring <strong>PEI</strong> revealed that private equity’s “silent<br />

giant”, Goldman Sachs’ Principal Investment Area,<br />

had catapulted to the No. 1 spot on the <strong>PEI</strong> 300,<br />

<strong>PEI</strong>’s annual proprietary ranking of private equity<br />

direct-investment programmes.<br />

The Wall Street behemoth raised nearly $55<br />

GS headquarters: towering<br />

above competition<br />

billion for direct private equity investment over<br />

the past five years, up from the $49 billion that<br />

earned Goldman the No. 2 spot on 2009’s list.<br />

The firm’s figures have remained high in part<br />

due to the impressive $13 billion it raised for its<br />

fifth mezzanine fund (a strategy that is counted<br />

in the <strong>PEI</strong> 300 methodology). And, unlike some<br />

other firms that raised large buyout funds in<br />

2007, Goldman has not downsized its $20.3<br />

billion GS Capital Partners VI, which is silently<br />

active all over the planet. ■

page 16 private equity annual review <strong>2010</strong><br />

s to r i e s o f t h e y e a r<br />

j a n | f e b | m a r | a p r | m a y | j u n e | j u ly | a u g | s e p | o c t | n o v | d e c<br />

i n d u s t r i a l re l a t i o n s<br />

Hugo Boss face-off<br />

Permira found itself at odds with some of its LPs after its portfolio company, Hugo Boss,<br />

announced a plant closure in Ohio<br />

Permira caused quite a stir with some of its limited partners<br />

when its portfolio company, Hugo Boss, announced plans<br />

to close a plant in Ohio, which would have put hundreds<br />

of jobs in jeopardy. The company’s management said it had<br />

tried to find ways to increase profitability at the plant, but<br />

after talks broke down with its production workers union,<br />

the company decided to shutter the plant.<br />

The decision was one of economics, but it quickly<br />

became political.<br />

The Ohio Public Employees’ Retirement System bypassed<br />

the Hugo Boss management and sent a letter directly to<br />

Permira, calling into question its relationship with the firm.<br />

OPERS had invested €110 million with the buyout shop.<br />

OPERS also expressed concern about the performance<br />

of Permira’s most recent fund – Fund IV – which closed<br />

in 2006 and was producing a -36.6 percent internal rate of return as<br />

of 30 September 2009, 60x multiple, according to performance data<br />

from the California Public Employees’ Retirement System. Permira’s<br />

funds were written up 31 percent by the end of <strong>2010</strong>, however,<br />

compared to 2009 figures.<br />

In what became a tough two months for Permira, some of<br />

the firm’s other LPs joined OPERS in expressing their concerns.<br />

CalPERS and the Pennsylvania State Employees’ Retirement System<br />

both sent letters to the firm.<br />

“Hugo Boss’s plan is problematic on many levels. Not only would<br />

it cost hundreds of jobs in a neighbouring state – therefore affecting a<br />

regional economy already hard hit by the recession – it implicates PA<br />

SERS, since PA SERS has invested in the partnership whose portfolio<br />

company is planning to close the plant,” wrote Robert McCord, a<br />

Hugo Boss: cutting its cloth<br />

member of the PA SERS board, at the time.<br />

Throughout the ordeal, Permira focused its attention on keeping<br />

communication channels with its investors open.<br />

Hugo Boss stressed it had done everything possible to keep the<br />

plant open and make the facility competitive. “And when that effort<br />

failed, we acted in the best interests of shareholders and customers<br />

by deciding to close the facility,” the company said.<br />

Hugo Boss eventually chose to reengage with the union, stressing<br />

that its decision to re-negotiate stemmed from contact it had with<br />

the National Labor Relations Board, which encouraged the firm<br />

to re-enter talks.<br />

After 12 months of dialogue between Hugo Boss management<br />

and the union, the two sides reached a solution that has allowed<br />

the plant to continue life in Ohio with changes to its benefits and<br />

remuneration packages. ■<br />

Expanding PEC<br />

An industry lobbying group<br />

formerly called the Private<br />

Equity Council, now known<br />

as the Private Equity Growth<br />

Capital Council, threw open<br />

its membership to include<br />

mid-market firms<br />

Private equity lobbying organisation the Private<br />

Equity Council, which launched in 2007<br />

with 11 mega-firm backers, announced a big<br />

move to expand and invite more mid-sized<br />

firms into the fold.<br />

The group had decided to make an effort<br />

to better portray the asset class to lawmakers<br />

as a diverse collection of business-builders and<br />

entrepreneurs, PEC’s president Doug Lowenstein<br />

told <strong>PEI</strong> at the time. PEC has since changed its<br />

name to the Private Equity Growth Capital<br />

Council to better reflect its wider membership.<br />

By opening its door to more members, the<br />

PEC was acknowledging that its profile as a<br />

collection of the most powerful private equity<br />

firms often presented obstacles when dealing<br />

with a Congress that was in no mood to be seen<br />

as doing favours for Wall Street.<br />

A more diverse organisation that included, for<br />

example, women-owned and ethnic minorityowned<br />

private equity firms would allow the PEC<br />

to more compellingly argue that private equity’s<br />

impact on the US economy was both broad and<br />

positive. ■

page 18 private equity annual review <strong>2010</strong><br />

s to r i e s o f t h e y e a r<br />

j a n | f e b | m a r | a p r | m a y | j u n e | j u ly | a u g | s e p | o c t | n o v | d e c<br />

p l a c e m e n t a g e n t s c a n d a l<br />

Messing with the middlemen<br />

After an investigation into ‘pay-to-play’ activity was undertaken in New York,<br />

California’s state attorney general Jerry Brown took action on the West Coast<br />

As part of a wide-ranging investigation, California<br />

came out hard against placement agent Alfred Villalobos<br />

in May, filing a civil fraud suit against him,<br />

his company ARVCO Capital and former CalP-<br />

ERS chief executive officer Federico Buenrostro.<br />

State Attorney General Edmund Brown<br />

alleged that Villalobos “attempted to bribe”,<br />

the head of CalPERS alternative investment<br />

programme, Leon Shahinian, who had been<br />

placed on administrative leave. Shahinian no<br />

longer works for the pension.<br />

Brown: turning the heat up on ARVCO<br />

Former New York State Comptroller,<br />

Alan Hevesi, who oversaw the state’s<br />

massive public pension system, pleaded<br />

guilty to accepting nearly $1 million in<br />

exchange for approving a $250 million<br />

commitment to Markstone Capital<br />

Partners, an investment firm based in<br />

California.<br />

While Villalobos fights in California,<br />

placement agents in the US have been<br />

faced with a barrage of regulations in<br />

“Working as a placement agent for ARVCO, Villalobos spent tens of<br />

thousands of dollars to lavishly entertain key senior executives at CalPERS,<br />

who then influenced the board to authorise investments that generated<br />

over $40 million in commission to Villalobos,” Brown said in a statement.<br />

Villalobos denied the accusations. He eventually filed for bankruptcy<br />

and the case against him is pending in state court.<br />

The lawsuit led to CalPERS reviewing its relationship with Apollo<br />

Global Management, which used Villalobos to help raise money from the<br />

pension, even though CalPERS holds an ownership stake in the Apollo.<br />

The California lawsuit came after a vigorous investigation in New<br />

York exposed wide-ranging pension “pay-to-play” activities, in which<br />

investment firms paid sham finder’s fees in exchange for commitments<br />

from the New York State Common Retirement Fund.<br />

The New York investigation eventually uncovered connections to<br />

New Mexico’s state pension systems, and eventually connections to<br />

California firms.<br />

the wake of the various scandals.<br />

US regulators, both state and federal, latched onto the scandal<br />

and proposed various rules they said would prevent similar payto-play<br />

activities in the future. The SEC for a brief time considered<br />

enacting a nationwide law that would have banned placement agents<br />

from interacting with public pensions on behalf of investment firms.<br />

That rule never happened, but the SEC did eventually pass a rule<br />

forcing all placement agents to register with the SEC. California<br />

also considered a rule that would force placement agents wanting<br />

to work with pensions in the state to register as lobbyists.<br />

The state assembly eventually passed a law that ends payments for<br />

successful fundraisings. Placement agents under the law are instead<br />

paid flat fees up front, as are lobbyists. Agents also are subject to<br />

stricter disclosure requirements.<br />

The scandal also prompted US institutions like CalPERS to revise<br />

disclosure policies for third-party marketers. ■<br />

Apax debuts in Brazil with $1bn deal<br />

Apax joined a host of private equity firms that struck deals<br />

as part of a hot M&A surge in the country in <strong>2010</strong><br />

Apax Partners inked its debut Brazil deal,<br />

agreeing to acquire a 54 percent stake in<br />

Tivit, an integrated IT and BPO services<br />

company, for about $1 billion.<br />

Apax’s entrance into Brazil came at a<br />

time when private equity firms everywhere<br />

were looking for ways to get exposure to the<br />

country, either through deals, fundraisings or<br />

even picking up stakes in native Brazilian firms.<br />

The Carlyle Group started the year off<br />

with its debut Brazil deal, committing $250<br />

million for a 63.6 percent stake in CVC<br />

Brasil Operadore e Agencia de Viagens,<br />

an operator of tours and travel services in<br />

Brazil and throughout Latin America.<br />

DLJ South American Partners, which<br />

closed its debut fund in 2008 on $300<br />

million, got in on the act and led an investor<br />

group that committed $370 million for a<br />

25 percent stake in Grupo Santillana de<br />

Ediciones, which publishes educational text<br />

books in Latin America and Spain.<br />

First Reserve found an energy-related<br />

opportunity in the country, investing $500<br />

million in Barra Energia, an independent<br />

exploration and production company.<br />

Not to be outdone, The Blackstone<br />

Group chose to ramp up its presence in<br />

Brazil this year by taking a 40 percent stake<br />

in Sao Paulo-based Patria Investments, one<br />

of Brazil’s largest asset managers. ■

This announcement appears as a matter of record only.<br />

is pleased to announce the closing of<br />

Southern Cross Latin America Private Equity Fund IV, L.P.<br />

A Value-Oriented Buyout Fund Focused on<br />

Operational and Strategic Management<br />

$1,681,013,000<br />

Limited Partnership Interests<br />

The undersigned acted as financial advisor and<br />

placement agent for the limited partnership interests.<br />

www.stanwichadvisors.com

page 20 private equity annual review <strong>2010</strong><br />

s to r i e s o f t h e y e a r<br />

j a n | f e b | m a r | a p r | m a y | j u n e | j u ly | a u g | s e p | o c t | n o v | d e c<br />

e u ro p e a n t r a d e b o d i e s<br />

Leaving lobbyists<br />

As debate around the AIFM directive drew toward<br />

a conclusion, two prominent trade body members<br />

decided to step down from their posts<br />

Two years of rugged debate over the European<br />

Union Directive on Alternative Investment<br />

Fund Managers had the unintended consequence<br />

of transforming the European Private<br />

Equity and Venture Capital Association into a<br />

unified lobbying force for the industry.<br />

In June, the association’s long-time<br />

secretary general Javier Echarri said he would<br />

step down from his post before the end of<br />

the year. Echarri had been at the helm of the<br />

organisation since 2000.<br />

In a letter to contacts, he said the<br />

organisation had not achieved “everything<br />

that we set out to gain” in lobbying on the<br />

AIFM directive, but that it had “succeeded in<br />

having many of the most egregious proposals<br />

excluded”. He also praised 3i Group’s<br />

Jonathan Russell and Apax Partners’ Richard<br />

Wilson – two former chairman of EVCA –<br />

for “pulling the whole industry together to<br />

speak with a single voice over the past three<br />

years”. Echarri’s replacement would be<br />

unveiled later in the year as Dörte Höppner,<br />

the then head of the German private equity<br />

association BVK.<br />

Also in June, Wilson vacated the EVCA<br />

chair, making way for Uli Fricke, cofounder<br />

Echarri (left) and Höppner: EVCA’s changing<br />

guard<br />

and chief executive officer of the Triangle<br />

Group. An incoming Fricke said the AIFM<br />

poses ongoing challenges to the industry as a<br />

whole, but that EVCA was also looking ahead<br />

to tackle other issues on the table such as<br />

Solvency II, which could limit flexibility of LP<br />

investments in certain private equity funds.<br />

Later on in the year it would emerge<br />

that a replacement was being sought for<br />

Simon Walker, chief executive of the British<br />

Private Equity & Venture Capital Association.<br />

Walker, who has consistently worked to dispel<br />

criticism of the industry in the UK, indicated<br />

that he would be stepping down at some point<br />

in 2011. He was replaced by former Doughty<br />

Hanson pricipal Mark Florman ■<br />

Dubai’s private<br />

equity retrench<br />

DIC’s woes prompted a<br />

parental takeover<br />

Dubai’s private equity retrench may be<br />

far from over. In mid-December 2009<br />

Dubai International Capital, the private<br />

equity investment arm of Dubai Holding,<br />

was in earnest talks to negotiate the<br />

refinancing of $2.6 billion in debt, half of<br />

which matured at the end of November.<br />

In June <strong>2010</strong>, it emerged that DIC was<br />

effectively rudderless following the dissolution<br />

of its board and the exit of the<br />

board’s non-executive chair, Sameer Al<br />

Ansari of SHUAA Capital. The changes<br />

put DIC under the direct control of its<br />

parent group Dubai Holding, which is currently<br />

looking to restructure $12 billion<br />

in debt of its own.<br />

By December the situation had eased<br />

for the private equity unit. A committee<br />

negotiating on the behalf of its lenders,<br />

which together holds 67 percent of the<br />

debt value, recommended the wider<br />

lending group accept a debt extension<br />

plan for up to 6 years, with $2 billion<br />

of the loans to receive a 2 percent cash<br />

interest coupon in exchange. ■<br />

Dual deals renew PAI<br />

A long-standing name in European private equity returned to action<br />

In a signal that the “shake out” of the private<br />

equity industry may not be as severe as once<br />

thought, PAI Partners, a firm considered to<br />

be on the verge of implosion during 2009,<br />

returned to deal mode with a deal double. A<br />

spokesman for the firm described it as a return<br />

to “business as usual”, as the firm agreed to<br />

buy a majority stake in Cerba, a Franceheadquartered<br />

clinical laboratory business<br />

currently owned by IK Investment Partners,<br />

another European private equity firm.<br />

The investment in Cerba was inked just<br />

a week after the IPO of CHR Hansen, a<br />

biosciences firm PAI took private in a 2005<br />

deal that valued it at around €1.1 billion. The<br />

IPO raised proceeds of DKK3.2 billion (€430<br />

million; $513 million) for the company and<br />

gave the business a market capitalisation of<br />

DKK 12.4 billion. PAI retained a stake of<br />

59.6 percent.<br />

The return to the business of making and<br />

exiting investments follow a turbulent year<br />

for the firm. The shock departure of chief<br />

executive Dominique Megrét in September,<br />

and his replacement with Lionel Zinsou, led<br />

to a protracted period of negotiation – during<br />

which the fund’s investment period was<br />

suspended – while LPs debated what should<br />

become of the €5.35 billion fund. Ultimately<br />

the fund had been slashed to €2.7 billion. ■

INSIDE <strong>THE</strong><br />

LIMITED PARTNER<br />

A COMPENDIUM OF INVESTOR ATTITUDES TO PRIVATE EQUITY<br />

Getting to the heart of limited partner thinking:<br />

• Incisive fundraising intelligence summarised from <strong>PEI</strong>’s research into<br />

over 3,400 active private equity investors<br />

• Interviews with key industry professionals, including CalSTRS, Pantheon<br />

and SVG<br />

• Results from an extensive institutional investor survey on due diligence<br />

• In-depth chapters on investor<br />

activity, written by leading organisations<br />

such as Allianz, Capital Dynamics and<br />

Probitas Partners<br />

• Summary of an investor<br />

roundtable, covering the ILPA<br />

private equity principles, as well<br />

as other top issues<br />

For further details please visit<br />

www.peimedia.com/insidelp<br />

Order your<br />

copy today:<br />

Online<br />

www.peimedia.com/insidelp<br />

Phone<br />

+44 (0)20 7566 5444<br />

Email<br />

fran.h@peimedia.com

page 22 private equity annual review <strong>2010</strong><br />

s to r i e s o f t h e y e a r<br />

j a n | f e b | m a r | a p r | m a y | j u n e | j u ly | a u g | s e p | o c t | n o v | d e c<br />

s e c o n d a r i e s<br />

Going to the bank<br />

A pair of over-sized secondary transactions illustrated<br />

a trend of banks withdrawing from the asset class<br />

Bank of America: backing away<br />

from private equity<br />

The sale of private equity portfolios by banks hoping to<br />

relieve financial and political pressure was a significant<br />

theme in <strong>2010</strong> and two of the year’s most significant<br />

emerged in July.<br />

In Europe Lloyds Banking Group offloaded a majority<br />

stake in the 40 private equity assets it inherited when it<br />

subsumed Bank of Scotland’s Integrated Finance unit in<br />

2008. The spin-off was rebranded as Cavendish Square<br />

Partners, a joint venture 70 percent owned by secondaries<br />

firm Coller Capital and 30 percent owned by Lloyds..<br />

Coller won an auction process for the assets, beating out<br />

competition from Bridgepoint, 3i Group and Lexington Partners.<br />

Coller paid £332 million (€401 million; $502 million) for its stake in the joint venture, valuing<br />

the portfolio as a whole at approximately £480 million. This represented a “small premium to<br />

current book value” according to a press release at the time. Coller and Lloyds, which retained<br />

the remaining 30 percent, kept the existing BOSIF management team, led by Graeme Shankland,<br />

on to manage the portfolio.<br />

On the other side of the Atlantic, Bank of America was also working to reduce its private equity<br />

exposure. Bank of America sold $1.2 billion in commitments it had to Warburg Pincus-managed<br />

funds. Portions of Bank of America’s assets sold went to the China Investment Corp, which was<br />

seeking to build up its private equity book, and Lexington Partners. The July deal followed the<br />

sale of $1.9 billion of Bank of America’s private equity assets to France’s AXA Private Equity,<br />

which earlier in year itself had picked up a portfolio of private equity assets from French bank<br />

Natixis valued at €534 million.<br />

In a move also prompted by balance-book reshuffling, HSBC announced that it was actively<br />

considering management buyout offers for its various in-house private equity operations. Though<br />

much of the secondaries volume was tied to bank activity, wider market forces played a part in<br />

stirring activity. The chasm between bid-ask prices seen in 2009 began to narrow. As the second<br />

half of <strong>2010</strong> got underway, industry insiders were estimating annual secondary transactions would<br />

weigh in at a cumulative $20 billion to $30 billion, up from an estimated $10 billion seen in 2009. ■<br />

Think tank trouble<br />

Coverage of a negative<br />

report on private equity fired<br />

up a heated debate<br />

Apax Partners inked its debut Brazil deal,<br />

agreeing to acquire a 54 percent stake in Tivit,<br />

an integrated IT and BPO services company,<br />

for about $1 billion.<br />

Apax’s entrance into Brazil came at a<br />

time when private equity firms everywhere<br />

were looking for ways to get exposure to the<br />

country, either through deals, fundraisings or<br />

even picking up stakes in native Brazilian firms.<br />

The Carlyle Group started the year off<br />

with its debut Brazil deal, committing $250<br />

million for a 63.6 percent stake in CVC Brasil<br />

Operadore e Agencia de Viagens, an operator<br />

of tours and travel services in Brazil and<br />

throughout Latin America.<br />

DLJ South American Partners, which<br />

closed its debut fund in 2008 on $300 million,<br />

got in on the act and led an investor group<br />

that committed $370 million for a 25 percent<br />

stake in Grupo Santillana de Ediciones, which<br />

publishes educational text books in Latin<br />

America and Spain.<br />

First Reserve found an energy-related<br />

opportunity in the country, investing $500<br />

million in Barra Energia, an independent<br />

exploration and production company.<br />

Not to be outdone, The Blackstone Group<br />

chose to ramp up its presence in Brazil this<br />

year by taking a 40 percent stake in Sao Paulobased<br />

Patria Investments, one of Brazil’s<br />

largest asset managers. ■<br />

Registration, compliance looms large<br />

SEC registration became a reality for private equity funds<br />

After months of debate, the US Senate passed a version of the financial<br />

reform bill that would force private equity firms with more than $150<br />

million in assets to register with the US Securities and Exchange Commission<br />

by 21 July 2011. While venture capital firms escaped registration<br />

requirements, the legislative changes signed into law by President Barrack<br />

Obama required private equity firms to designate a compliance officer<br />

and face regular SEC inspections, as is already the case for US hedge<br />

funds. Foreign funds with more than 15 US-based limited partners also<br />

must register as an investment advisor with the SEC. It’s worth noting<br />

that even prior to passage of the legislation, the SEC had already formed<br />

an Asset Management Unit, charged with overseeing compliance for<br />

private equity funds and other alternative investments. ■

This announcement appears as a matter of record only<br />

AIRLINE CREDIT OPPORTUNITIES II<br />

U.S. $604,750,000<br />

Limited Partnership and Limited Liability Company formed to make<br />

investments in asset and credit opportunities in the global airline industry<br />

Placement of the Limited Partnership and membership interests were exclusively arranged by<br />

Member of FINRA and SIPC<br />

November <strong>2010</strong><br />

Spotlight Africa<br />

In July, Africa-focused private equity outfit Emerging Capital Partners demonstrated the<br />

‘forgotten continent’ of Africa is anything but<br />

While GPs in more developed markets came to<br />

terms with a tighter fundraising environment,<br />

certain African firms had a more positive experience<br />

and even managed to set some records.<br />

Washington DC-based Emerging Capital<br />

Partners secured $613 million in commitments<br />

for its Africa Fund III, closing it in July. It was<br />

the single largest Africa-focused private equity<br />

fund raised to date. While the fund fell short<br />

of its original $1 billion target, the final figure<br />

eclipsed the group’s prior vehicle which closed<br />

on $523 million during a bustling 2007.<br />

A look at the fund’s limited partner roster revealed a mix<br />

of development finance institutions and more recently added<br />

commercially-focused private and institutional investors.<br />

Returning LPs committed $450 million of the fund’s total<br />

committed capital. These included the African Development<br />

Bank, the International Finance Corporation, OPIC and CDC—<br />

the UK government-backed development finance institution. The<br />

remainder of the fund received commitment from new investors,<br />

including pan-African fund of funds manager, South Suez.<br />

Africa: fundraising success<br />

Earlier on in the year another Pan Africafocused<br />

private equity firm, Kingdom Zephyr<br />

Africa Management, had set the benchmark<br />

for African private equity high, when it<br />

closed its second fund narrowly short of its<br />

$500 million target. Development finance<br />

institutions such as the European Investment<br />

Bank, FMO (Netherlands Development<br />

Finance Company), and the Development Bank<br />

of Southern Africa committed cash, as well<br />

as the aforementioned African Development<br />

Bank and IFC. The fundraise represented a huge<br />

step up for Kingdom Zephyr. The firm had previously raised a<br />

$122.5 million fund in 2003.<br />

A total of $11 billion was raised for emerging markets private<br />

equity in the first half of <strong>2010</strong>, representing an increase of 22<br />

percent on the same period of 2009, according to the Emerging<br />

Markets Private Equity Association. A significant increase in<br />

the total amount raised for African and Latin American funds<br />

contributed to the <strong>2010</strong> half-year totals; with both regions<br />

already able to exceed their full 2009 stats, said the EMPEA. ■

page 24 private equity annual review <strong>2010</strong><br />

s to r i e s o f t h e y e a r<br />

j a n | f e b | m a r | a p r | m a y | j u n e | j u ly | a u g | s e p | o c t | n o v | d e c<br />

l p a p p e t i t e<br />

Quality vs. quantity<br />

A number of large LPs announced they would reduce<br />

their GP base to improve performance<br />

CalSTRS: eyes open to<br />

‘less traditional opportunities’<br />

The California State Teachers’ Retirement System took proactive<br />

measures to manage its private equity portfolio in August<br />

by cutting out underperforming managers and keeping its eyes<br />

open for “new and potentially less traditional” opportunities.<br />

The pension said it had “entered a period in which there<br />

will be a net reduction in the number of its active general<br />

partner relationships,” according to board documents. “Staff<br />

is redoubling its efforts to monitor its existing partnerships<br />

and detect those heading in errant directions.”<br />

CalSTRS was not the only large limited partner who saw<br />

value in fewer, better managers. In August, Credit Suisse,<br />

which received a $150 million mandate for private equity<br />

investing from The San Diego City Employees’ Retirement<br />

System in 2009, said in a report that “one of the guiding<br />

principles of [San Diego’s] programme will be to invest in<br />

fewer better managers”.<br />

Harvard University’s $27.4 billion endowment also<br />

announced over the summer that it would continue to reduce its private equity relationships.<br />

“The field of private equity has become more and more crowded – with capital, with<br />

managers and with investors – over the last decade,” said Jane Mendillo, president and chief<br />

executive officer of the Harvard Management Company. “Our expectations for this asset<br />

class are that returns will be more muted going forward, and we are even more committed<br />

to holding our fire for the best-in-class opportunities.” Her comments were published in<br />

one of the endowment’s fiscal <strong>2010</strong> performance reports.<br />

“We will continue to have a meaningful level of exposure to this asset class over the long<br />

term … but we anticipate that the number of active relationships within our private equity<br />

and venture capital portfolio will be reduced, while the concentration will be increased in<br />

our highest conviction managers.” ■<br />

Cashing out<br />

The Royal Bank of Scotland<br />

unloaded a number of noncore<br />

businesses after being<br />

forced to dispose of assets<br />

by the European Union<br />

After receiving a total £45.5 billion (€53.6<br />

billion; $71.5 billion) in government bailout<br />

funds – the largest bailout of any bank<br />

worldwide – the Royal Bank of Scotland<br />

was forced by European Union regulators<br />

to sell off a number of assets, which it<br />

did in August to the tune of roughly £3.2<br />

billion.<br />

The bulk of that sum came from the sale<br />

of RBS WorldPay, its card payment subsidiary<br />

business, to Advent International and Bain<br />

Capital for an enterprise value of more than<br />

£2 billion.<br />

Government-owned RBS retained a<br />

minority stake of 19.9 percent in WorldPay,<br />

with Advent and Bain evenly splitting the<br />

remainder. Approximately £299 million<br />

of mezzanine finance was provided by a<br />

consortium of lenders comprising Kohlberg<br />

Kravis Roberts’ KKR Asset Management,<br />

mezzanine specialist TCW/Crescent<br />

Mezzanine and Bain Capital affiliate Sankaty<br />

Advisors.<br />

Within two weeks of selling off WorldPay,<br />

RBS sold a portfolio of leveraged loans to<br />

Intermediate Capital Group for £1.2 billion.<br />

It went on to sell mental health and rehab<br />

clinic group Priory to Advent in January. ■<br />

Dwindling debt<br />

The sale of a Spanish toll road operator to CVC<br />

Capital Partners started as a €12bn LBO before<br />

shrinking to a €1.7bn transaction<br />

One of the summer’s hottest private equity infrastructure deals closed<br />

in August when Spanish infrastructure group ACS sold part of its stake<br />

in toll road operator Abertis to CVC Capital Partners for €1.7 billion.<br />

The transaction had originally been conceived as a €12 billion<br />

leveraged buyout involving Abertis’ main shareholders – La Caixa and<br />

ACS – and CVC, with €8 billion of bank debt and €4 billion in equity<br />

from the consortium members.<br />

Mediobanca found it difficult to get banks to commit financing,<br />

however, in part because of their reticence to being exposed to the<br />

troubled Spanish economy, diminishing the original debt package down<br />

to just over € 5 billion. In the end, even that amount proved troublesome,<br />

prompting the deal to steadily mutate from a three-way leveraged buyout<br />

to a stake sale from ACS to CVC.<br />

At the height of the transaction, between 14 and 20 banks were<br />

said to be looking at the deal, which was ultimately closed by a<br />

four-bank syndicate. ■

private equity annual review <strong>2010</strong> pa g e 25<br />

s to r i e s o f t h e y e a r<br />

j a n | f e b | m a r | a p r | m a y | j u n e | j u ly | a u g | s e p | o c t | n o v | d e c<br />

g f c c a s u a lt y n o . 1<br />

R.I.P GSC<br />

Alfred Eckert’s debt-focused firm was one of the most<br />

significant casualties during <strong>2010</strong><br />

GSC Group, once a bright star in the private<br />

debt universe, filed for bankruptcy in<br />

September, citing a “lack of liquidity in the<br />

credit markets”, “declining asset values” and<br />

a “deterioration in investor relations”.<br />

The firm, co-founded in 1994 by Alfred<br />

Eckert and former Blackstone Group<br />

managing director Keith Abell as a subsidiary<br />

of Travelers Group, said in bankruptcy<br />

documents it had about $8.4 billion in<br />

assets under management as of 31 March,<br />

<strong>2010</strong>, down from its peak of $28 billion.<br />

The firm was originally called Greenwich<br />

Street Capital Partners and changed to GSC<br />

Eckert: moving on to Black Diamond in 1999.<br />

In the downturn of the credit markets in 2008, the firm’s funds, including those related<br />

to distressed debt, US and European corporate debt, European mezzanine and US assetbacked<br />

securities CDOs, struggled, and GSC resigned as the manager of certain funds<br />

while opting for early termination of others.<br />