The Most Senior Level Speakers and Attendees of Any AML - IIR

The Most Senior Level Speakers and Attendees of Any AML - IIR

The Most Senior Level Speakers and Attendees of Any AML - IIR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Regulators &<br />

Enforcement Agents:<br />

Terry Arbit, U.S. Commodity Futures Trading<br />

Commission<br />

Gregory A. Coleman, FBI<br />

Marcy Forman, Department <strong>of</strong> Homel<strong>and</strong><br />

Security<br />

William Fox, FinCEN<br />

Udo Franke, Embassy <strong>of</strong> the Federal Republic<br />

<strong>of</strong> Germany<br />

Marc Hambach, Dubai Financial Services<br />

Authority<br />

Phillip D. Hull, IRS<br />

Stephen Helmstetter, IRS<br />

Lester Joseph, US Department <strong>of</strong> Justice<br />

William Langford, FinCEN<br />

Gary Murray, Immigration & Customs<br />

Enforcement<br />

Bridget Neill, Board <strong>of</strong> Governors <strong>of</strong> the<br />

Federal Reserve System<br />

Michael Rufino, New York Stock Exchange<br />

Donald C. Semesky, DEA Office <strong>of</strong> Financial<br />

Operations<br />

Joseph Sifuentes, OCC<br />

Judith Starr, FinCEN<br />

Gary W. Sutton, US Department <strong>of</strong> the Treasury<br />

John Wagner, OCC<br />

Robert W. Werner, Office <strong>of</strong> Foreign Assets<br />

Control<br />

Industry Experts:<br />

George W. Arnett III, Pershing LLC<br />

Robert M. Axelrod, Bank <strong>of</strong> New York<br />

Daniel Becker, Bank <strong>of</strong> New York<br />

Michael J. Bourke, Rietumu Bank, Latvia<br />

Kenneth L. Bryant, Compliance Solutions Ltd.<br />

John W. Campbell, PricewaterhouseCoopers<br />

LLP<br />

David Caruso, <strong>The</strong> Dominion Advisory Group<br />

John Caruso, Deutsche Bank<br />

Julie Copel<strong>and</strong>, Merrill Lynch<br />

Mireya D’Angelo, HSBC Private Bank<br />

Kate Dressel, Strategic Compliance Solutions<br />

LLC<br />

Robert Edwards, Citibank Private Bank,<br />

Singapore<br />

Cecilia Gardner, Jewelers Vigilence<br />

Commission<br />

Debra Geister, LexisNexis<br />

Jorge Guerrero, Optima Compliance &<br />

Consulting Inc.<br />

Stephen Harvey, Canadian Imperial Bank <strong>of</strong><br />

Commerce, Toronto<br />

Eileen Heisman, National Philanthropic Trust<br />

Jeffrey P. Horowitz, Citigroup Global Markets<br />

Elizabeth Jones, International Finance Corp.<br />

Kate Jones Troy, Credit Suisse First Boston<br />

Patrick Kidney, Lehman Brothers<br />

Barry M. Koch, American Express Co.<br />

Nikki Kowalski, Bear Stearns<br />

Stephanie Lawrence, Nationwide Mutual<br />

Insurance Co.<br />

Tara L<strong>of</strong>tus, UBS<br />

Tim O’Neal Lorah, Morgan Stanley<br />

Dennis M. Lormel, Corporate Risk International<br />

Brian Loutrel, New York Life Insurance Co.<br />

Stephanie Lowy, Smith Barney<br />

Michael Meyer, Goldman Sachs<br />

Stevenson Munro, UBS<br />

Michelle Neufeld, JPMorgan Chase<br />

Karen M. O'Toole, Fidelity Investments<br />

Margaret Paradis, Orrick Herrington & Sutcliffe LLP<br />

Teresa Pesce, HSBC North America Inc.<br />

Lauren Pickett, Citibank<br />

Stephanie Pries, Managed Funds Association<br />

C. Rachel Raemore, Wachovia Corp.<br />

Betty Santangelo, Schulte Roth & Zabel LLP<br />

<strong>The</strong>resa Schaefer, Nationwide Mutual<br />

Insurance Co.<br />

Michael Shepard, Commerce Bank<br />

Stephen Shine, Prudential Financial<br />

Alan Sorcher, Securities Industry Association<br />

Don Temple, Commerce Bank<br />

John F. Walsh, Bank <strong>of</strong> America<br />

Wendy Warren, Bahamas Financial Services<br />

Board<br />

William D. Wilcox, Travelers Life & Annuity<br />

Michael F. Zeldin, Deloitte & Touche<br />

Ellen Zimiles, KPMG<br />

Meg Zucker, Morgan Stanley<br />

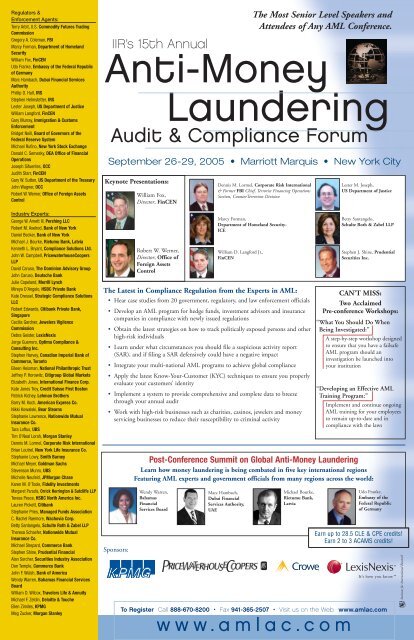

<strong>IIR</strong>’s 15th Annual<br />

Anti-Money<br />

Laundering<br />

Audit & Compliance Forum<br />

September 26-29, 2005 • Marriott Marquis • New York City<br />

Keynote Presentations:<br />

<strong>The</strong> Latest in Compliance Regulation from the Experts in <strong>AML</strong>:<br />

• Hear case studies from 20 government, regulatory, <strong>and</strong> law enforcement <strong>of</strong>ficials<br />

• Develop an <strong>AML</strong> program for hedge funds, investment advisors <strong>and</strong> insurance<br />

companies in compliance with newly issued regulations<br />

• Obtain the latest strategies on how to track politically exposed persons <strong>and</strong> other<br />

high-risk individuals<br />

• Learn under what circumstances you should file a suspicious activity report<br />

(SAR), <strong>and</strong> if filing a SAR defensively could have a negative impact<br />

• Integrate your multi-national <strong>AML</strong> programs to achieve global compliance<br />

• Apply the latest Know-Your-Customer (KYC) techniques to ensure you properly<br />

evaluate your customers’ identity<br />

• Implement a system to provide comprehensive <strong>and</strong> complete data to breeze<br />

through your annual audit<br />

• Work with high-risk businesses such as charities, casinos, jewelers <strong>and</strong> money<br />

servicing businesses to reduce their susceptibility to criminal activity<br />

Sponsors:<br />

William Fox,<br />

Director, FinCEN<br />

Robert W. Werner,<br />

Director, Office <strong>of</strong><br />

Foreign Assets<br />

Control<br />

Wendy Warren,<br />

Bahamas<br />

Financial<br />

Services Board<br />

Dennis M. Lormel, Corporate Risk International<br />

& Former FBI Chief, Terrorist Financing Operations<br />

Section, CounterTerrorism Division<br />

Marcy Forman,<br />

Department <strong>of</strong> Homel<strong>and</strong> Security-<br />

ICE<br />

William D. Langford Jr.,<br />

FinCEN<br />

Marc Hambach,<br />

Dubai Financial<br />

Services Authority,<br />

UAE<br />

<strong>The</strong> <strong>Most</strong> <strong>Senior</strong> <strong>Level</strong> <strong>Speakers</strong> <strong>and</strong><br />

<strong>Attendees</strong> <strong>of</strong> <strong>Any</strong> <strong>AML</strong> Conference.<br />

Michael Bourke,<br />

Rietumu Bank,<br />

Latvia<br />

To Register Call 888-670-8200 • Fax 941-365-2507 • Visit us on the Web: www.amlac.com<br />

www.amlac.com<br />

Lester M. Joseph,<br />

US Department <strong>of</strong> Justice<br />

Betty Santangelo,<br />

Schulte Roth & Zabel LLP<br />

Stephen J. Shine, Prudential<br />

Securities Inc.<br />

CAN’T MISS:<br />

Two Acclaimed<br />

Pre-conference Workshops:<br />

“What You Should Do When<br />

Being Investigated:”<br />

A step-by-step workshop designed<br />

to ensure that you have a failsafe<br />

<strong>AML</strong> program should an<br />

investigation be launched into<br />

your institution<br />

“Developing an Effective <strong>AML</strong><br />

Training Program:”<br />

Implement <strong>and</strong> continue ongoing<br />

<strong>AML</strong> training for your employees<br />

to remain up-to-date <strong>and</strong> in<br />

compliance with the laws<br />

Post-Conference Summit on Global Anti-Money Laundering<br />

Learn how money laundering is being combated in five key international regions<br />

Featuring <strong>AML</strong> experts <strong>and</strong> government <strong>of</strong>ficials from many regions across the world:<br />

Udo Franke,<br />

Embassy <strong>of</strong> the<br />

Federal Republic<br />

<strong>of</strong> Germany<br />

Earn up to 28.5 CLE & CPE credits!<br />

Earn 2 to 3 ACAMS credits!<br />

Institute for International Research

7Seven Reason’s<br />

Not to Miss This Year’s <strong>AML</strong>AC Forum:<br />

1. Network with over 300 industry practitioners, regulators<br />

<strong>and</strong> enforcement agents to ensure your compliance<br />

program is as far-reaching as possible.<br />

2. Obtain guidance on how to comply with the justreleased<br />

regulations for insurance companies, hedge<br />

funds <strong>and</strong> investment advisors.<br />

3. Get the latest in money laundering schemes to aid in<br />

your institution’s efforts to spot suspicious activity <strong>and</strong><br />

red flags.<br />

4. Ensure your customer identification program is flawless<br />

<strong>and</strong> take advantage <strong>of</strong> the opportunity to ask the<br />

experts how to iron out any kinks.<br />

5. Learn the circumstances under which you should file a<br />

suspicious activity report (SAR).<br />

6. Identify how <strong>AML</strong> compliance st<strong>and</strong>ards are being<br />

upgraded globally.<br />

7. Discover how terrorist financing has changed since 9/11<br />

<strong>and</strong> how you can cut <strong>of</strong>f the flow <strong>of</strong> terrorist money.<br />

Who Should Attend the<br />

15th Annual Anti-Money Laundering Audit<br />

& Compliance Forum (<strong>AML</strong>AC):<br />

• Broker/Dealers <strong>and</strong> Securities Firms<br />

• Global Banks<br />

• Private Banks<br />

• Foreign banks with <strong>of</strong>fices in the US<br />

• Life Insurance Carriers<br />

• Mutual Funds <strong>and</strong> Investment Companies<br />

• Money Service Businesses<br />

• Hedge Funds <strong>and</strong> their Administrators<br />

• Investment Managers<br />

• Investment Advisors<br />

• Trust Companies <strong>and</strong> Savings Banks<br />

• Private Equity Firms<br />

• Commodity Dealers <strong>and</strong> Exchanges<br />

• Credit Card Companies<br />

• Law Firms<br />

• Surveillance <strong>and</strong> data base specialists<br />

• S<strong>of</strong>tware providers<br />

• Consultants <strong>and</strong> Training Companies<br />

• Accountants <strong>and</strong> Auditors<br />

Plus:<br />

• Federal Government Agents <strong>and</strong> Analysts<br />

• Federal <strong>and</strong> State Regulators<br />

• Enforcement Agencies<br />

• <strong>AML</strong> Task Forces<br />

with Responsibility for:<br />

• Retail <strong>and</strong> Institutional Practices<br />

• Anti-Money Laundering Compliance<br />

• General Counsel/Legal Department<br />

• Internal Operations<br />

• Corporate <strong>AML</strong><br />

• USA Patriot Act Compliance<br />

• Global Compliance<br />

• BSA Compliance<br />

• Internal Audit<br />

• Employee Training<br />

• Wire Transfers<br />

• Fraud Prevention<br />

• On-line Transaction<br />

• Surveillance<br />

• Private Banking<br />

• Corespondent banking<br />

• Cash <strong>and</strong> Credit management<br />

• Regulatory Control<br />

THE LONGEST RUNNING ANTI-MONEY<br />

LAUNDERING CONFERENCE IN THE US<br />

MORE SENIOR LEVEL SPEAKERS AND<br />

ATTENDEES THAN ANY OTHER <strong>AML</strong> EVENT<br />

“This is the best conference on <strong>AML</strong> that we have seen. Topics are not repetitive; they are always updated to<br />

reflect what is happening now. <strong>The</strong> quality <strong>of</strong> presentations is also superior to other <strong>AML</strong> conferences.”<br />

—Nancy Leo, Depository Trust Clearing Corp.<br />

“I am impressed with the high level <strong>of</strong> speakers—a great cross-section from the private <strong>and</strong> government sectors.”<br />

—Stephen A. Thompson, Compliance Commission <strong>of</strong> the Bahamas<br />

Dear <strong>AML</strong> Pr<strong>of</strong>essional,<br />

As the longest-running <strong>AML</strong> Conference in the US — now in its 15th year — <strong>IIR</strong>’s Annual Anti-Money<br />

Laundering Audit & Compliance Forum (<strong>AML</strong>AC) is the premier annual event focusing on the enormous<br />

changes to auditing <strong>and</strong> compliance requirements m<strong>and</strong>ated by the Bank Secrecy Act <strong>and</strong> the USA Patriot<br />

Act. Compliance is essential to ensure you avoid high-pr<strong>of</strong>ile investigations <strong>and</strong> large fines seen by the likes <strong>of</strong><br />

AmSouth, Riggs Bank, <strong>and</strong> more recently, Arab Bank.<br />

Financial services firms have been busy interpreting the Patriot Act since its inception in 2001, <strong>and</strong><br />

implementing <strong>AML</strong> programs to eliminate ill-gotten gains passing through their h<strong>and</strong>s from terrorists, drug<br />

traffickers <strong>and</strong> other criminals. As comprehensive due diligence <strong>and</strong> compliance programs have been put into<br />

place, this year’s program will take the next step <strong>and</strong> address how you must continue your efforts to know<br />

your customers, remain in compliance <strong>of</strong> both laws, <strong>and</strong> how regulators <strong>and</strong> enforcement agencies are<br />

cracking down on violators <strong>and</strong> perpetrators.<br />

NEW REGULATIONS FOR INSURANCE AND HEDGE FUNDS EXPLAINED<br />

Also, final regulations for insurance firms, hedge funds <strong>and</strong> investment advisors are expected to be issued<br />

this summer after years <strong>of</strong> anticipation. What will they say? Will they mirror the securities <strong>and</strong> banking<br />

regulations already in place? How will your firm need to adjust its business operations to remain in<br />

compliance? Top-notch regulators <strong>and</strong> model firms will discuss best practices on monitoring suspicious<br />

activity <strong>and</strong> stopping money launderers at the door, including Gary W. Sutton from the US Department <strong>of</strong><br />

the Treasury, one <strong>of</strong> the key authors <strong>of</strong> the new regulations.<br />

Featuring more than 70 speakers <strong>and</strong> more than a dozen networking opportunities, why attend<br />

multiple conferences, when you can get all you need at the 15th Annual <strong>AML</strong>AC!<br />

Main conference:<br />

• More than 15 regulators <strong>and</strong> enforcement agents will be on h<strong>and</strong> to talk about recent cases <strong>and</strong> how<br />

you can keep them from knocking on your door<br />

• Keynote presentations from two high-level government <strong>of</strong>ficials:<br />

• Robert Werner, Director, Office <strong>of</strong> Foreign Assets Control<br />

• William Fox, Director, FinCEN<br />

• <strong>The</strong> evolution <strong>of</strong> terrorist financing since September 11, 2001 featuring Dennis Lormel, the former chief<br />

<strong>of</strong> the FBI division which led the 9/11 terror financing investigations<br />

• Discover if filing defensive suspicious activity reports is helping or hurting your business<br />

• How you should h<strong>and</strong>le politically-exposed persons <strong>and</strong> other high-risk account holders<br />

• Integrating your multinational compliance programs into one comprehensive program<br />

• Managing high-risk businesses, including MSBs, charities, jewelers, <strong>and</strong> credit cards<br />

• Learn what auditors are looking for <strong>and</strong> how to pass your audit with flying colors<br />

Post-conference Summit on Global <strong>AML</strong>:<br />

• Get insight from the world’s regulators, <strong>and</strong> industry experts as they talk to you about how <strong>AML</strong><br />

compliance is changing in five key global regions<br />

• Featuring the most expert Global Summit speaker lineup ever, including: Wendy Warren, Bahamas<br />

Financial Services Board; Udo Franke, Embassy <strong>of</strong> the Federal Republic <strong>of</strong> Germany; Michael J<br />

Bourke, Rietumu Bank, Latvia; Marc Hambach, Dubai Financial Services Authority, UAE<br />

• Discover how authorities in the Caribbean, Latin America, Europe, Asia <strong>and</strong> the Middle East are dealing<br />

with PEPs, KYC issues <strong>and</strong> <strong>of</strong>fshore businesses<br />

Pre-conference workshops:<br />

• A step-by-step guide on what you should do when being investigated<br />

• Developing an effective <strong>AML</strong> training program to keep your staff aware <strong>of</strong> the latest compliance<br />

regulations<br />

Each year, <strong>AML</strong>AC attracts the most senior executives from across the globe, with topics customized<br />

to provide education at multiple levels <strong>of</strong> sophistication, covering the full gamut <strong>of</strong> industries that must comply<br />

with complex <strong>and</strong> ever-changing regulations.<br />

To reserve your place at the 15th Annual Anti-Money Laundering Audit <strong>and</strong> Compliance Forum, simply call<br />

888-670-8200, fax to 941-365-2507, email register@iirusa.com or visit the conference Web site at<br />

www.amlac.com.<br />

I look forward to seeing you in September!<br />

Sincerely,<br />

Keith Kirkpatrick<br />

Director, <strong>AML</strong>AC 2005<br />

Noel McDermott<br />

General Manager-Finance<br />

To Register Call 888-670-8200 • Fax 941-365-2507<br />

Visit us on the Web:<br />

2 www.am

Agenda-at-a-Glance<br />

©2005 <strong>IIR</strong> Holdings, Ltd.<br />

A<br />

M<br />

P<br />

M<br />

Monday, Sept. 26,2005: Pre-Conference Workshops<br />

8:00 Registration/Morning C<strong>of</strong>fee<br />

9:00 Workshop: What You Should Do When Being Investigated<br />

David Caruso, Managing Director & CEO<br />

THE DOMINION ADVISORY GROUP<br />

Steven J. Helmstetter, Special Agent<br />

INTERNAL REVENUE SERVICE<br />

Michael Shepard, <strong>Senior</strong> VP Anti-Money Laundering Program Director<br />

COMMERCE BANK<br />

Thomas Green, Partner<br />

SIDLEY AUSTIN BROWN & WOOD LLP<br />

12:00 Luncheon for workshop attendees <strong>and</strong> leaders<br />

1:30 Workshop: Developing an Effective <strong>AML</strong> Training Program<br />

Stephanie Lawrence, <strong>AML</strong> & OFAC Compliance Director<br />

NATIONWIDE MUTUAL INSURANCE CO.<br />

Lauren Pickett, Director, Global Anti-Money Laundering Training<br />

CITIBANK<br />

4:30 Conclusion <strong>of</strong> Pre-conference workshops<br />

Tuesday, Sept. 27, 2005: Main Conference Day 1<br />

7:15 Registration/morning c<strong>of</strong>fee<br />

8:30 Opening Remarks from conference Co-chairs<br />

Betty Santangelo, Partner<br />

SCHULTE ROTH & ZABEL LLP<br />

Stephen Shine, <strong>Senior</strong> VP & <strong>Senior</strong> Regulatory Counsel<br />

PRUDENTIAL SECURITIES INC.<br />

8:45 <strong>AML</strong> Overview- How Financial Institutions Are Meeting the Challenges <strong>of</strong> <strong>The</strong> USA<br />

Patriot Act<br />

William Langford, Associate Director- Regulatory Policy <strong>and</strong> Programs Division<br />

FINCEN<br />

9:25 Legislative <strong>and</strong> Regulatory Impact on <strong>AML</strong>: An Update on Policies, Procedures,<br />

Controls <strong>and</strong> Examinations<br />

Moderator:<br />

Betty Santangelo, Partner<br />

SCHULTE ROTH & ZABEL LLP<br />

Panelists:<br />

William Langford, Associate Director- Regulatory Policy <strong>and</strong> Programs Division<br />

FINCEN<br />

Bridget Neill, Manager, Anti-Money Laundering Policy & Compliance Section-<br />

Division <strong>of</strong> Banking Supervision <strong>and</strong> Regulation<br />

BOARD OF GOVERNORS OF THE FEDERAL RESERVE SYSTEM<br />

Michael Rufino, Managing Director<br />

NEW YORK STOCK EXCHANGE<br />

Richard Saillard, National Bank Examiner, Large Bank Supervision<br />

OFFICE OF THE COMPTROLLER OF CURRENCY<br />

Lisa Arquette, Chief- Special Activities Division <strong>of</strong> Supervision <strong>and</strong> Consumer Protection, FDIC<br />

10:55 Morning Networking Break<br />

11:15 Know When to File Suspicious Activity Reports<br />

Moderator:<br />

Tim O'Neal Lorah, Executive Director & Global Coordinator, Anti-Money Laundering Group<br />

MORGAN STANLEY<br />

Panelists:<br />

Karen M. O'Toole, Associate General Counsel<br />

FIDELITY INVESTMENTS<br />

Don Temple, Director <strong>of</strong> <strong>AML</strong> Investigations<br />

COMMERCE BANK<br />

12:30 Luncheon for delegates <strong>and</strong> speakers<br />

1:45 Keynote Presentation<br />

William J. Fox, Director<br />

FINCEN<br />

2:45 Achieving Global Compliance By Integrating Your Multinational <strong>AML</strong> Programs<br />

Moderator:<br />

Julie Copel<strong>and</strong>, First Vice President, Director <strong>of</strong> Global Compliance<br />

MERRILL LYNCH<br />

Panelists:<br />

John W. Campbell, Partner, Anti-Money Laundering Practice Leader<br />

PRICEWATERHOUSECOOPERS LLP<br />

John Caruso, <strong>AML</strong> Compliance<br />

DEUTSCHE BANK<br />

Stephen Harvey, <strong>Senior</strong> Director Global Head Anti-Money Laundering Programs & Group Money Laundering<br />

Reporting Officer<br />

CANADIAN IMPERIAL BANK OF COMMERCE, TORONTO<br />

Stevenson Munro, Global Head <strong>of</strong> Economic Sanctions, UBS<br />

3:45 Afternoon Networking Break<br />

4:00 Achieve Compliance With Your Customer Identification Programs By Applying the<br />

Latest Know Your Customer Techniques<br />

Moderator:<br />

Alan Sorcher, Associate General Counsel<br />

SECURITIES INDUSTRY ASSOCIATION<br />

Panelists:<br />

Terry Arbit, Associate General Counsel for Legislative Affairs<br />

U.S. COMMODITY FUTURES TRADING COMMISSION<br />

Daniel Becker, Managing Director, Head <strong>of</strong> <strong>AML</strong> Compliance<br />

BANK OF NEW YORK<br />

Debra Geister, Director <strong>of</strong> Fraud Detection <strong>and</strong> Compliance Solutions<br />

LEXISNEXIS<br />

Michelle L. Neufeld, VP & Assistant General Counsel<br />

JPMORGAN CHASE & CO.<br />

5:00 End <strong>of</strong> Day 1<br />

Wednesday, Sept. 28, 2005: Main Conference Day 2<br />

7:45 Registration/morning c<strong>of</strong>fee<br />

8:15 Day 1 Recap from conference Co-chairs<br />

Betty Santangelo, Partner<br />

SCHULTE ROTH & ZABEL LLP<br />

Stephen Shine, <strong>Senior</strong> VP & <strong>Senior</strong> Regulatory Counsel<br />

PRUDENTIAL SECURITIES INC.<br />

8:30 CASE STUDIES: Discussing Investigations <strong>and</strong> Criminal Prosecutions With Law<br />

Enforcement Officers<br />

Moderator:<br />

Teresa Pesce, Executive Vice President <strong>and</strong> <strong>AML</strong> Director<br />

HSBC NORTH AMERICA INC.<br />

Panelists:<br />

Gregory A. Coleman, Special Agent<br />

FEDERAL BUREAU OF INVESTIGATIONS<br />

Marcy Forman, Director <strong>of</strong> Investigations<br />

DEPARTMENT OF HOMELAND SECURITY -ICE<br />

Phillip D. Hull, Special Agent<br />

INTERNAL REVENUE SERVICE<br />

Lester Joseph, Principal Deputy Chief- Asset Forfeiture & Money Laundering<br />

US DEPARTMENT OF JUSTICE<br />

Visit us on the Web:<br />

lac.com<br />

10:00 Morning Networking Break<br />

10:15 Reduce Exposure to Politically Exposed Persons <strong>and</strong> Other High-Risk Clients by Enacting a<br />

Thorough <strong>AML</strong> Risk Assessment Program<br />

Moderator:<br />

C. Rachel Raemore, CMG/WMG Compliance Director<br />

WACHOVIA CORP.<br />

Panelists:<br />

Marcy Forman, Director <strong>of</strong> Investigations<br />

DEPARTMENT OF HOMELAND SECURITY-ICE<br />

Kate Jones Troy, Director & Global Anti-Money Laundering Prevention Officer<br />

CREDIT SUISSE FIRST BOSTON<br />

Patrick Kidney, Director <strong>of</strong> Money Laundering Prevention<br />

LEHMAN BROTHERS<br />

11:15 Compiling Comprehensive <strong>and</strong> Complete Data for Your Annual <strong>AML</strong> Program Audit<br />

Ellen Zimiles, Principal<br />

KPMG LLP<br />

11:50 Combating the Financing <strong>of</strong> Terrorism<br />

Kenneth L. Bryant, Consultant<br />

ANTI-MONEY LAUNDERING (<strong>AML</strong>)/COMBATING THE FINANCING OF TERRORISM (CFT)<br />

Dennis M. Lormel, <strong>Senior</strong> Vice President, Anti Money Laundering<br />

CORPORATE RISK INTERNATIONAL;<br />

Former Chief, Terrorist Financing Operations Section, CounterTerrorism Division<br />

FEDERAL BUREAU OF INVESTIGATIONS<br />

12:25 Luncheon for delegates <strong>and</strong> speakers<br />

Keynote Presentation: <strong>The</strong> Office <strong>of</strong> Foreign Assets Control in the 21st Century<br />

Robert W. Werner, Director, OFFICE OF FOREIGN ASSETS CONTROL<br />

Concurrent Sessions, Choose A or B:<br />

1:45 Implementing a Thorough Transaction<br />

Monitoring & Surveillance Technology<br />

A System<br />

Michael Dougherty, Principal<br />

FTI CONSULTING<br />

Panelists:<br />

Tara L<strong>of</strong>tus, First Vice President & Deputy Director <strong>of</strong><br />

Compliance<br />

UBS FINANCIAL SERVICES INC.<br />

John F. Walsh, <strong>Senior</strong> Vice President- <strong>AML</strong> Technology<br />

Group<br />

BANK OF AMERICA<br />

Constructing an <strong>AML</strong> Program for<br />

B Insurance Companies to Comply with<br />

New Regulations<br />

Brian C. Loutrel, Vice President & <strong>AML</strong> Compliance<br />

Officer<br />

NEW YORK LIFE INSURANCE CO.<br />

<strong>The</strong>resa Schaefer, Associate General Counsel<br />

NATIONWIDE MUTUAL INSURANCE CO.<br />

Gary W. Sutton, <strong>Senior</strong> Banking Counsel, Office <strong>of</strong> the<br />

General Counsel<br />

US DEPARTMENT OF THE TREASURY<br />

William D. Wilcox, Chief Compliance Officer & Counsel<br />

TRAVELERS LIFE AND ANNUITY<br />

2:45 Building a Compliant <strong>AML</strong> Requirement<br />

A for Hedge Funds, Investment Advisors<br />

<strong>and</strong> Other Small Businesses<br />

Kate Dressel, President<br />

STRATEGIC COMPLIANCE SOLUTIONS LLC<br />

Margaret Paradis, Of Counsel<br />

ORRICK HERRINGTON & SUTCLIFFE LLP<br />

Stephanie Pries, Esq., Vice President & <strong>Senior</strong> Legal<br />

Counsel<br />

MANAGED FUNDS ASSOCIATION<br />

Gary W. Sutton, <strong>Senior</strong> Legal Adviser for Financial<br />

Crimes<br />

US DEPARTMENT OF THE TREASURY<br />

5:00 Conclusion <strong>of</strong> Main Conference<br />

Thursday, Sept. 29, 2005: Post-Conference Summit on Global <strong>AML</strong><br />

8:00 Registration/Morning C<strong>of</strong>fee<br />

8:30 Opening Remarks<br />

Julie Copel<strong>and</strong>, First Vice President, Director <strong>of</strong> Global Compliance<br />

MERRILL LYNCH<br />

8:45 Overview: Global Anti-Money Laundering Industry St<strong>and</strong>ards—Implementing the New Best<br />

Practices in the Field<br />

Sarah Elizabeth Jones, <strong>Senior</strong> Anti-Money Laundering Officer<br />

INTERNATIONAL FINANCE CORP.<br />

Stephanie Lowy, VP, <strong>AML</strong> Compliance Analyst<br />

SMITH BARNEY<br />

Alan S. Abel, Anti-Money Laundering (<strong>AML</strong>) Risk Management Services Leader<br />

DELOITTE & TOUCHE<br />

9:30 Caribbean<br />

Kenneth L. Bryant, Managing Director<br />

COMPLIANCE SOLUTIONS LTD., JAMAICA<br />

Wendy Warren, CEO <strong>and</strong> Executive Director<br />

BAHAMAS FINANCIAL SERVICES BOARD<br />

10:30 Morning Networking Break<br />

10:45 Asia<br />

Robert Edwards, Global Director <strong>of</strong> <strong>AML</strong><br />

CITIBANK PRIVATE BANK, SINGAPORE<br />

11:30 Europe<br />

Part I: <strong>The</strong> Third European Union Money<br />

Laundering Directive<br />

Udo Franke, Counselor- Financial Sector Regulation,<br />

Anti-Money Laundering Policies<br />

EMBASSY OF THE FEDERAL REPUBLIC OF GERMANY<br />

12:45 Lunch<br />

2:00 Middle East<br />

Marc Hambach, Assistant Director - Supervision<br />

DUBAI FINANCIAL SERVICES AUTHORITY, UAE<br />

3:00 Latin America<br />

Mireya D’Angelo, Head <strong>of</strong> <strong>AML</strong> Compliance<br />

HSBC PRIVATE BANK<br />

4:00 Conclusion <strong>of</strong> Global Summit<br />

Ensure Failsafe Business Operations by<br />

B Conquering Additional <strong>AML</strong> Compliance<br />

Challenges Associated With High-Risk<br />

Businesses<br />

Gina Adelphia, Executive, Financial Institutions Group,<br />

CROWE CHIZEK & CO.<br />

Cecilia Gardner, Executive Director, General Counsel<br />

JEWELERS VIGILENCE COMMISSION<br />

Jorge Guerrero, CEO<br />

OPITMA COMPLIANCE & CONSULTING INC.<br />

Eileen Heisman, President<br />

NATIONAL PHILANTHROPIC TRUST<br />

Barry M. Koch, Executive Director, Money Laundering<br />

Prevention<br />

AMERICAN EXPRESS CO.<br />

3:45 Afternoon Networking Break<br />

4:00 Underst<strong>and</strong>ing the Role Clearing Firms<br />

Have in Complying with <strong>AML</strong> Regulations<br />

George W. Arnett III, Director & Counsel<br />

A<br />

PERSHING LLC<br />

Linda Busby, Anti-Money Laundering Officer<br />

RAYMOND JAMES FINANCIAL<br />

Bill Freilich, General Counsel<br />

BEAR STEARNS SECURITY CORP.<br />

Elizabeth Paige Baumann, Assistant Anti-Money<br />

Laundering Officer, Enterprise Compliance<br />

FIDELITY INVESTMENTS<br />

Aaron K. Fox, Vice President, <strong>AML</strong> Compliance<br />

RBC DAIN RAUSCHER<br />

Lourdes Gonzalez, Assistant Chief Counsel – Sales<br />

Practices, Division <strong>of</strong> Market Regulation<br />

SEC<br />

Overcoming <strong>AML</strong> Compliance Issues in<br />

B Institutional Businesses<br />

Connie M. Friesen, Partner<br />

SIDLEY AUSTIN BROWN & WOOD LLP<br />

Robert M. Axelrod, Managing Director, Global<br />

Compliance<br />

BANK OF NEW YORK<br />

Jeff Horowitz, Director, <strong>AML</strong> Compliance<br />

CITIGROUP CORPORATE & INVESTMENT BANK<br />

Michael Meyer, Vice President & Director <strong>of</strong> <strong>AML</strong><br />

Compliance GOLDMAN SACHS<br />

Meg Zucker, Executive Director, <strong>AML</strong> Group<br />

MORGAN STANLEY<br />

Part II: Eastern Europe Focus<br />

Michael J Bourke, President & CEO<br />

RIETUMU BANK, LATVIA<br />

To Register Call 888-670-8200 • Fax 941-365-2507<br />

3

<strong>The</strong> <strong>Most</strong> <strong>Senior</strong> <strong>Level</strong> <strong>Speakers</strong><br />

Monday, Sept. 26, 2005: Pre-Conference Workshops<br />

8:00 Registration/Morning C<strong>of</strong>fee<br />

9:00 AM Workshop: What You Should Do When Being Investigated<br />

This in-depth, interactive workshop has been designed to go over a thorough checklist<br />

on the steps you should take if the government should ever launch an investigation into<br />

possible money laundering activity at your institution. This panel <strong>of</strong> industry experts <strong>and</strong><br />

financial regulators will answer all your questions, including:<br />

• Learning what factors go into the government’s decision to investigate<br />

• <strong>The</strong> first step to take when issued a subpoena<br />

• Determining if you should also conduct an internal investigation<br />

• Implementing different processes depending on who the target <strong>of</strong> the investigation is:<br />

Account Holder; Employee; Officer; Institution<br />

• If you are a target, should you be considering a joint defense agreement?<br />

• If the account holder is the target, should you disclose information?<br />

• Interpreting the DOJ Memo on how to react when under investigation<br />

• Who is your counsel going to represent?<br />

• How to protect your employees during the investigative process<br />

• Identifying the circumstances under which the institution will be deemed significantly negligent<br />

• Did you file a SAR <strong>and</strong> follow your compliance program prior to the subpoena?<br />

• Determining your accountability under the willful blindness doctrine <strong>and</strong> liabilities for<br />

not following bank policy<br />

David B. Caruso, Managing Director & CEO<br />

THE DOMINION ADVISORY GROUP<br />

David B. Caruso joined <strong>The</strong> Dominion Advisory Group, a firm that specializes in assisting<br />

domestic <strong>and</strong> international banks in solving problems with their <strong>AML</strong>/BSA programs, in May<br />

2005. He previously served as Executive Vice President, Compliance <strong>and</strong> Security <strong>of</strong> Riggs Bank<br />

N.A. since June <strong>of</strong> 2003. Mr. Caruso was accountable for the Bank’s compliance with Department<br />

<strong>of</strong> Treasury regulations. Prior to joining Riggs, Mr. Caruso was a Director in KPMG’s Investigation<br />

<strong>and</strong> Integrity Advisory Services practice <strong>and</strong> the Director <strong>of</strong> Ernst & Young’s Anti-Money<br />

Laundering Compliance Practice. Prior to Ernst & Young he served as Manager <strong>of</strong> the Fraud <strong>and</strong><br />

Money Laundering Prevention Group at JP Morgan & Company. From 1991 to 1996 Mr. Caruso<br />

served as a Special Agent with the U.S. Secret Service where he was assigned to the New York Field<br />

Office’s Financial Institution Fraud Group.<br />

Steven J. Helmstetter, Special Agent<br />

INTERNAL REVENUE SERVICE<br />

Mr. Helmstetter began his career as a Revenue Agent in Mountainside, New Jersey in 1980. In<br />

1984 he was assigned to the Special Enforcement Program (SEP) specializing in tax fraud cases<br />

including testifying as an expert witness during criminal tax cases. Subsequently he became the<br />

Fraud Coordinator for New Jersey. This assignment entailed reviewing tax cases for criminal referral<br />

or for asserting civil fraud penalties. In 1996 he was selected as a Special Agent in the Criminal<br />

Investigation Division specializing in income tax <strong>and</strong> money laundering cases. Since September<br />

2001, after having received Top Secret Clearance, he has been a member <strong>of</strong> <strong>The</strong> Joint Terrorist Task<br />

Force investigating terrorism financing. In addition he heads the United States Attorney’s Suspicious<br />

Activity Report (SAR) Task Force.<br />

Michael Shepard, <strong>Senior</strong> VP Anti-Money Laundering Program Director<br />

COMMERCE BANK<br />

Michael D. Shepard is the Anti-Money Laundering Program Director at Commerce Bank, N.A.<br />

headquartered in Cherry Hill, New Jersey. Previously, he was a partner in the White Collar,<br />

Internal <strong>and</strong> Government Investigations Practice Group at Blank Rome LLP in Philadelphia where<br />

his practice focused on all aspects <strong>of</strong> white collar criminal defense, Bank Secrecy Act, USA Patriot<br />

Act, asset forfeiture <strong>and</strong> internal corporate investigations. From 1987 to 1991, Mr. Shepard was a<br />

federal prosecutor with the U.S. Department <strong>of</strong> Justice Tax Division, Criminal Section.<br />

Thomas Green, Partner<br />

SIDLEY AUSITN BROWN & WOOD LLP<br />

12:00 Luncheon for workshop attendees <strong>and</strong> leaders<br />

1:30 PM Workshop: Developing an Effective <strong>AML</strong> Training Program<br />

Implementing <strong>and</strong> continuing ongoing employee anti-money laundering training is<br />

required in accordance with Section 352 <strong>of</strong> the USA Patriot Act. This comprehensive<br />

workshop, structured for compliance <strong>and</strong> training pr<strong>of</strong>essionals from both bank <strong>and</strong> nonbank<br />

financial institutions, will prove valuable for your institution to stay on top <strong>of</strong> the<br />

evolving rules <strong>and</strong> regulations, <strong>and</strong> to fulfill retraining requirements on how to comply<br />

with the law. Securities, banking, insurance, credit card <strong>and</strong> investment management<br />

representatives will all benefit from this highly informative session.<br />

• Identifying <strong>and</strong> comparing the types <strong>of</strong> formalized outside training programs available<br />

• Determining if certification is necessary<br />

• How training should be conducted for administrators<br />

• Implementing procedures to demonstrate you’ve been sufficiently trained<br />

• Debating the advantages <strong>and</strong> disadvantages <strong>of</strong> whether <strong>AML</strong> practitioners should<br />

dem<strong>and</strong> <strong>of</strong>ficial licensing programs from regulators<br />

• In-house training: Using computers for baseline training for “priority” groups - client<br />

introducing <strong>and</strong> client vetting<br />

• Seek feedback, build on successes <strong>and</strong> eliminate what was ineffective to re-enforce <strong>and</strong><br />

reassess your internal training programs<br />

Stephanie Lawrence, <strong>AML</strong> & OFAC Compliance Director<br />

NATIONWIDE MUTUAL INSURANCE CO.<br />

Ms. Lawrence is charged with coordinating <strong>and</strong> monitoring the implementation <strong>of</strong> the anti-money<br />

laundering <strong>and</strong> OFAC compliance programs <strong>of</strong> Nationwide’s affiliates <strong>and</strong> subsidiaries. For over eleven<br />

years, she has worked with Nationwide in various capacities including financial services operations <strong>and</strong><br />

management, product <strong>and</strong> market compliance, <strong>and</strong> as in-house counsel to several <strong>of</strong> Nationwide’s<br />

subsidiaries.<br />

Lauren Pickett, Director, Global Anti-Money Laundering Training<br />

CITIBANK<br />

4:30 Conclusion <strong>of</strong> pre-conference workshops<br />

Tuesday, Sept. 27, 2005: Main Conference Day 1<br />

7:15 Registration/morning c<strong>of</strong>fee<br />

8:30 Opening Remarks from conference<br />

Co-chairs<br />

Betty Santangelo, Partner<br />

SCHULTE ROTH & ZABEL LLP<br />

Betty Santangelo specializes in white color criminal<br />

defense <strong>and</strong> securities enforcement, <strong>and</strong> has a nationally<br />

recognized expertise in anti-money laundering, OFAC<br />

<strong>and</strong> corporate compliance issues. Her practice includes<br />

representing financial institutions <strong>and</strong> individuals in<br />

various matters before the U.S. Attorney’s Office <strong>and</strong><br />

various regulatory agencies including the SEC, the CFTC,<br />

the NYSE <strong>and</strong> the NASD; advising financial institutions<br />

on their anti-money laundering/ OFAC procedures <strong>and</strong><br />

conducting internal investigations. She has also served as<br />

an independent Consultant in SEC enforcement matters.<br />

Stephen Shine, <strong>Senior</strong> VP & <strong>Senior</strong> Regulatory<br />

Counsel<br />

PRUDENTIAL SECURITIES INC.<br />

Stephen J. Shine is responsible for the case management<br />

<strong>and</strong> disposition <strong>of</strong> all current <strong>and</strong> legacy regulatory matters<br />

<strong>of</strong> Prudential Securities Inc., <strong>and</strong> serves as the legal<br />

advisor to all firm anti-money laundering efforts. In the<br />

early 90’s he helped design <strong>and</strong> implement one <strong>of</strong> the first<br />

comprehensive anti-money laundering programs on Wall<br />

Street <strong>and</strong> served as the securities industry representative to<br />

a number <strong>of</strong> FINCEN advisory groups. He is both a<br />

former state <strong>and</strong> federal prosecutor who was responsible for<br />

the prosecution <strong>of</strong> significant securities, commodities, <strong>and</strong><br />

bank fraud cases nationwide <strong>and</strong> served as the<br />

Department <strong>of</strong> Justice representative to the Investment<br />

Fraud Task Force in the Central District <strong>of</strong> California.<br />

8:45 <strong>AML</strong> Overview: How Financial<br />

Institutions Are Meeting the<br />

Challenges <strong>of</strong> <strong>The</strong> USA Patriot Act<br />

As anti-money laundering initiatives are at the top<br />

<strong>of</strong> every financial institution’s list, it is critical that<br />

you are up-to-date with the latest USA Patriot Act<br />

<strong>and</strong> anti-money laundering requirements. Be among<br />

the most well-informed as you hear how compliance<br />

is fairing among industries, what developments have<br />

occurred most recently <strong>and</strong> what Treasury anticipates<br />

for the future <strong>of</strong> anti-money laundering.<br />

William Langford, Associate Director-<br />

Regulatory Policy <strong>and</strong> Programs Division<br />

FINCEN<br />

William Langford oversees the regulatory, compliance<br />

<strong>and</strong> enforcement functions for the Agency. Prior to<br />

assuming this position, Mr. Langford served as FinCEN’s<br />

<strong>Senior</strong> Policy Advisor, where he was a principal advisor to<br />

the Director <strong>of</strong> FinCEN, focusing on a range <strong>of</strong> regulatory<br />

<strong>and</strong> enforcement issues, including the implementation <strong>of</strong><br />

the anti-money laundering <strong>and</strong> anti-terrorist financing<br />

provisions <strong>of</strong> the USA PATRIOT Act. Previously, Mr.<br />

Langford served as the <strong>Senior</strong> Advisor to the General<br />

Counsel <strong>of</strong> the U.S. Department <strong>of</strong> the Treasury, where he<br />

focused largely on the implementation <strong>of</strong> the antiterrorism<br />

<strong>and</strong> anti-money laundering provisions <strong>of</strong> the<br />

USA PATRIOT Act, including the drafting <strong>of</strong> regulations<br />

implementing these provisions.<br />

9:25 Legislative <strong>and</strong> Regulatory Impact<br />

on <strong>AML</strong>: An Update on Policies,<br />

Procedures, Controls <strong>and</strong><br />

Examinations<br />

• Additional guidance to be 100% “up to snuff”<br />

• Update on regulations guiding interagency<br />

procedures<br />

• Streamlining examinations <strong>of</strong> <strong>AML</strong> programs<br />

• Stopping the terrorist financing web<br />

Moderator:<br />

Betty Santangelo, Partner<br />

SCHULTE ROTH & ZABEL LLP<br />

Panelists:<br />

William Langford, Associate Director-<br />

Regulatory Policy <strong>and</strong> Programs Division<br />

FINCEN<br />

Bridget Neill, Manager, Anti-Money<br />

Laundering Policy & Compliance Section-<br />

Division <strong>of</strong> Banking Supervision <strong>and</strong><br />

Regulation<br />

BOARD OF GOVERNORS OF THE<br />

FEDERAL RESERVE SYSTEM<br />

Ms. Neill is responsible for formulating <strong>and</strong><br />

coordinating the implementation <strong>of</strong> the Federal Reserve’s<br />

<strong>AML</strong> supervisory efforts. Ms. Neill <strong>and</strong> the <strong>AML</strong> Policy<br />

<strong>and</strong> Compliance Section are responsible for ensuring that<br />

Bank Secrecy Act/<strong>AML</strong> <strong>and</strong> OFAC guidance <strong>and</strong><br />

examination procedures are consistent with prevailing<br />

U.S. laws <strong>and</strong> regulations, <strong>and</strong> are implemented<br />

consistently across the Federal Reserve System. Prior to<br />

joining the Federal Reserve, Ms. Neill served as a <strong>Senior</strong><br />

Policy Advisor at the U.S. Securities <strong>and</strong> Exchange<br />

Commission. Through her work in the Financial Action<br />

Task Force (FATF) <strong>and</strong> other international groups, she has<br />

contributed to the formulation <strong>of</strong> U.S. positions <strong>and</strong><br />

international initiatives to combat financial crime.<br />

Michael Rufino, Vice Preisdent<br />

NEW YORK STOCK EXCHANGE<br />

Michael Rufino has been with the New York Stock<br />

Exchange for 15 years. He spent 10 years working in the<br />

Financial/Operational department in the Division <strong>of</strong><br />

Member Firm Regulation at the New York Stock Exchange<br />

before moving to the Sales Practice Review Unit as an<br />

Examination Director. In 2002, Mr. Rufino took over the<br />

Sales Practice Review Unit as its Managing Director <strong>and</strong><br />

he was recently promoted to Vice President. He is<br />

responsible for overseeing a staff <strong>of</strong> 67 people, which<br />

includes the Investor Complaints <strong>and</strong> Inquiries<br />

Department, Qualifications & Registrations Department,<br />

Fingerprints, <strong>and</strong> the Sales Practice Examination Staff.<br />

©2005 <strong>IIR</strong> Holdings, Ltd.<br />

To Register Call 888-670-8200 • Fax 941-365-2507<br />

Visit us on the Web:<br />

4 www.am

<strong>and</strong> <strong>Attendees</strong> <strong>of</strong> any <strong>AML</strong> Conference.<br />

©2005 <strong>IIR</strong> Holdings, Ltd.<br />

John Wagner, Director, Bank Secrecy Act &<br />

Anti-Money Laundering Compliance<br />

OFFICE OF THE COMPTROLLER OF<br />

THE CURRENCY<br />

John Wagner was named in March 2005 as director for<br />

Bank Secrecy Act <strong>and</strong> <strong>AML</strong> Compliance in the<br />

Compliance Policy Division <strong>of</strong> the Office <strong>of</strong> the<br />

Comptroller <strong>of</strong> the Currency (OCC). Mr. Wagner directs<br />

the development <strong>of</strong> Bank Secrecy Act <strong>and</strong> <strong>AML</strong><br />

examination policy <strong>and</strong> procedures. He also provides policy<br />

interpretations <strong>and</strong> guidance to field staff, represents the<br />

OCC <strong>and</strong> the U.S. Treasury on interagency task forces,<br />

<strong>and</strong> develops training programs. Prior to March 2005,<br />

Mr. Wagner served as a Bank Secrecy Act (BSA) / antimoney<br />

laundering (<strong>AML</strong>) specialist in the OCC’s<br />

Compliance Policy Division. Mr. Wagner is a certified<br />

anti-money laundering specialist (CAMS) <strong>and</strong> a<br />

commissioned national bank examiner. He began his<br />

OCC career 23 years ago in Dallas, Texas <strong>and</strong><br />

subsequently served in San Francisco, California<br />

Lisa Arquette, Chief- Special Activities Division<br />

<strong>of</strong> Supervision <strong>and</strong> Consumer Protection<br />

FDIC<br />

Richard Saillard, National Bank Examiner,<br />

Large Bank Supervision<br />

OFFICE OF THE COMPTROLLER OF<br />

CURRENCY<br />

Karen Burgess, <strong>Senior</strong> Advisor to the Director,<br />

Office <strong>of</strong> Compliance Inspections <strong>and</strong><br />

Examinations,<br />

SEC<br />

Emily Gordy, Sr. Vice President, Director,<br />

Regional Enforcement<br />

NASD<br />

10:55 Morning Networking Break<br />

11:15 Know When to File Suspicious<br />

Activity Reports<br />

• Working with regulatory agencies to develop a<br />

st<strong>and</strong>ard on when to file<br />

• A broker-dealers liability for filing SARs<br />

• Avoid filing defensive SARs by knowing what to<br />

look for in your monitoring<br />

• Learning how to rectify existing criticisms in the<br />

current SAR filing requirements<br />

• Determining when the 30-day period starts to<br />

properly time your SAR filings<br />

Moderator:<br />

Tim O’Neal Lorah, Executive Director &<br />

Global Coordinator, Anti-Money Laundering<br />

Group<br />

MORGAN STANLEY<br />

Tim O’Neal Lorah coordinates development <strong>and</strong><br />

implementation <strong>of</strong> the Firm’s global <strong>AML</strong> Program. Prior<br />

to joining Morgan Stanley, Mr. Lorah was a senior<br />

litigation associate at Schulte Roth & Zabel LLP in New<br />

York where he practiced primarily in the area <strong>of</strong><br />

regulatory enforcement litigation, advising financial<br />

institutions on various matters relating to Bank Secrecy<br />

Act/USA PATRIOT Act compliance, as well as other<br />

<strong>AML</strong>, suspicious activity, OFAC <strong>and</strong> corporate compliance<br />

issues. Mr. Lorah has also been involved in representing<br />

financial institutions <strong>and</strong> individuals in matters before<br />

various federal <strong>and</strong> state regulatory agencies, including the<br />

SEC <strong>and</strong> the CFTC.<br />

Panelists:<br />

Gary Murray, Director<br />

IMMIGRATION & CUSTOMS<br />

ENFORCEMENT- NEW YORK HICFA<br />

INTELLIGENCE CENTER<br />

Gary’s 27 year career started with the U.S. Customs<br />

Service in New York <strong>and</strong> Bermuda. He also spent 17 years<br />

as the Assistant Director, Office <strong>of</strong> Intelligence, New York<br />

where his responsibilities included narcotics <strong>and</strong> money<br />

laundering. Gary was appointed to the staff <strong>of</strong> the<br />

Executive Director, Office <strong>of</strong> Investigations overseeing<br />

seven <strong>of</strong>fices on the East Coast. Gary has been assigned to<br />

HIFCA since September 2000 <strong>and</strong> serves as the Director<br />

for this initiative. <strong>The</strong> HIFCA presently has a staff <strong>of</strong> 39<br />

representing 12 law enforcement <strong>and</strong> regulatory agencies.<br />

Karen M. O’Toole, Associate General Counsel<br />

FIDELITY INVESTMENTS<br />

Ms. O’Toole’s areas <strong>of</strong> responsibility include advising<br />

oversight groups such as audit, security <strong>and</strong> compliance,<br />

<strong>and</strong> representing the firm in regulatory investigations. In<br />

addition, she provides legal advice throughout the<br />

organization on issues relating to the USA PATRIOT Act,<br />

anti-money laundering <strong>and</strong> OFAC. Prior to joining<br />

Fidelity in 1997, Ms. O’Toole was in private practice<br />

with the law firm <strong>of</strong> Hutchins, Wheeler & Dittmar,<br />

where she represented clients in a broad array <strong>of</strong> securities<br />

litigation matters. She is currently the Co-Chairperson <strong>of</strong><br />

the Securities Industry Association’s Anti-Money<br />

Laundering Committee, <strong>and</strong> has been an active member<br />

<strong>of</strong> both this Committee <strong>and</strong> the Anti-Money Laundering<br />

Committee <strong>of</strong> the ICI.<br />

Don Temple, Director <strong>of</strong> <strong>AML</strong> Investigations<br />

COMMERCE BANK<br />

In July 2004 Don became the Director <strong>of</strong> Anti-Money<br />

Laundering Investigations at Commerce Bank, Cherry<br />

Hill, NJ. Don currently acts as liaison with industry<br />

experts, bank regulators <strong>and</strong> law enforcement to enhance<br />

the anti-money laundering policies <strong>and</strong> procedures for<br />

Commerce Bank as well as the entire industry. During his<br />

26 years with the Internal Revenue Service in the<br />

Delaware Maryl<strong>and</strong> District, where he served as a Special<br />

Agent, Don became the Title 31 Coordinator in 1984<br />

<strong>and</strong> later developed the Maryl<strong>and</strong> Financial Investigative<br />

Task Force; a multi agency task force which included the<br />

FBI, US Customs Service, US Postal Service, <strong>and</strong> the<br />

Drug Enforcement Administration. That task force was<br />

used as a model for subsequent task forces formed in the<br />

United States. After leaving IRS, in September 2000,<br />

Don joined Mantas, Inc., as an Industry Expert for<br />

currency reporting, fraud <strong>and</strong> money laundering detection,<br />

prevention <strong>and</strong> enforcement.<br />

Peter Trucksis, Special Agent<br />

INTERNAL REVENUE SERVICE<br />

12:30 Luncheon for delegates <strong>and</strong> speakers<br />

1:45 Keynote Presentation<br />

William J. Fox, Director<br />

FINCEN<br />

William J. Fox was appointed by Treasury Secretary<br />

John Snow to be the fourth Director <strong>of</strong> the Financial<br />

Crimes Enforcement Network on December 1, 2003. As<br />

Director, Mr. Fox will lead efforts to establish, oversee <strong>and</strong><br />

implement policies to detect <strong>and</strong> prevent money<br />

laundering <strong>and</strong> terrorist financing. Prior to his<br />

appointment as FinCEN’s Director, Mr. Fox served as<br />

Treasury’s Associate Deputy General Counsel <strong>and</strong> Acting<br />

Deputy General Counsel. Since September 11, 2001, he<br />

also served as the principal assistant <strong>and</strong> senior advisor to<br />

Treasury’s General Counsel on issues relating to terrorist<br />

financing <strong>and</strong> financial crime. Mr. Fox was recognized for<br />

his work on these issues with a Meritorious Rank Award<br />

in October 2003. Mr. Fox came to the Department <strong>of</strong> the<br />

Treasury in December 2000 as the Acting Deputy<br />

Assistant General Counsel for Enforcement. From 1988 to<br />

December 2000, Mr. Fox served at the Bureau <strong>of</strong> Alcohol,<br />

Tobacco <strong>and</strong> Firearms, first as an attorney in ATF’s<br />

Chicago <strong>of</strong>fice, then as the <strong>Senior</strong> Counsel for Alcohol <strong>and</strong><br />

Tobacco <strong>and</strong> finally as ATF’s Deputy Chief Counsel.<br />

2:45 Achieving Global Compliance By<br />

Integrating Your Multinational <strong>AML</strong><br />

Programs<br />

• How do you create a manageable, comprehensive<br />

<strong>AML</strong> program on a global basis without violating<br />

OFAC or multinational law?<br />

• Ringfencing issues- Making decisions across global<br />

groups to make the right trade<strong>of</strong>fs<br />

• Conceptual difficulties <strong>of</strong> managing such<br />

a program<br />

• Complying with US sanctions laws in a<br />

global environment<br />

• Facilitation vs. evasion<br />

Moderator:<br />

Julie Copel<strong>and</strong>, First Vice President, Director<br />

<strong>of</strong> Global Compliance<br />

MERRILL LYNCH<br />

Julie Copel<strong>and</strong> is the Director <strong>of</strong> the Global Monetary<br />

<strong>and</strong> Financial Control Group for Merrill Lynch <strong>and</strong> was<br />

most recently appointed the Global Anti-Money<br />

Laundering Officer for the Firm. Prior to this position,<br />

Ms. Copel<strong>and</strong> was the Director <strong>of</strong> Global Compliance for<br />

Merrill Lynch’s International Private Client Group. When<br />

she came to Merrill Lynch in 1995, Ms. Copel<strong>and</strong> was<br />

appointed the head <strong>of</strong> Merrill Lynch’s Money Laundering<br />

Prevention Group, which was the first group <strong>of</strong> its kind in<br />

the securities industry. Her responsibilities have also<br />

included investigations related to criminal <strong>and</strong> regulatory<br />

matters. From 1986 <strong>and</strong> 1995, Ms. Copel<strong>and</strong> was an<br />

Assistant United States Attorney in the U.S. Attorney’s<br />

Office for the Eastern District <strong>of</strong> New York.<br />

Panelists:<br />

John Caruso, Director <strong>of</strong> <strong>AML</strong> Compliance<br />

DEUTSCHE BANK AMERICAS<br />

As Director <strong>of</strong> <strong>AML</strong> Compliance, John has<br />

responsibility for all lines <strong>of</strong> Deutsche Bank’s business in<br />

the Americas. Prior to joining Duetsche, John spent three<br />

years as an <strong>AML</strong> Compliance Officer <strong>and</strong> <strong>Senior</strong> Counsel<br />

for Merrill Lynch. Before joining Merrill Lynch, John<br />

served as an Assistant U.S. Attorney in the Eastern<br />

District <strong>of</strong> New York. In addition to prosecuting federal<br />

money laundering, fraud, drug trafficking <strong>and</strong> organized<br />

crime cases, John served as Chief <strong>of</strong> the General Crimes<br />

Section in the Eastern District.<br />

Stephen Harvey, <strong>Senior</strong> Director Global Head<br />

Anti-Money Laundering Programs & Group<br />

Money Laundering Reporting Officer<br />

CANADIAN IMPERIAL BANK OF<br />

COMMERCE, TORONTO<br />

Stephen Harvey has primary responsibility for global<br />

policy <strong>and</strong> program development, <strong>and</strong> works closely with<br />

business lines to ensure comprehensive implementation.<br />

Prior to assuming his current responsibilities with CIBC,<br />

Mr. Harvey managed Bank <strong>of</strong> America’s BSA Bankwide<br />

Compliance Group, where he was responsible for money<br />

laundering <strong>and</strong> know your customer issues bankwide. He<br />

represented the US banking industry at the 1998<br />

Financial Services Forum <strong>of</strong> the Financial Action Task<br />

Force (FATF) in Brussels, <strong>and</strong> is a past member <strong>of</strong> the US<br />

Treasury Department’s Bank Secrecy Act Advisory Group;<br />

the US Treasury Department’s BSA Advisory Group Funds<br />

Transfer Subgroup, <strong>and</strong> the American Bankers Association<br />

Money Laundering Task Force.<br />

Stevenson Munro, Global Head <strong>of</strong><br />

Economic Sanctions<br />

UBS INVESTMENT BANK<br />

Stevenson Munro joined UBS Investment Bank in 2005<br />

as Global Head for Economic Sanctions. Steve joined UBS<br />

from Capital One where he was the legal counsel for antimoney<br />

laundering, economic sanctions, trade control,<br />

homel<strong>and</strong> security, <strong>and</strong> related national security laws.<br />

Previously he was Deputy Chief Counsel at the U.S.<br />

Treasury Department’s Office <strong>of</strong> Foreign Assets Control. He<br />

also held various positions in the U.S. Military, including in<br />

the White House Military Office, focusing on intelligence<br />

<strong>and</strong> counter-terrorism issues.<br />

John W. Campbell, Partner, Anti-Money<br />

Laundering Practice Leader<br />

PRICEWATERHOUSECOOPERS LLP<br />

Mr. Campbell has been involved in financial regulatory,<br />

Anti Money Laundering, supervisory <strong>and</strong> accounting<br />

matters since 1973. He was admitted to the partnership <strong>of</strong><br />

PricewaterhouseCoopers, LLP (“PwC”) in Washington,<br />

DC in 1994. Prior to joining PwC, Mr. Campbell spent<br />

17 years with the Office <strong>of</strong> the Comptroller <strong>of</strong> Currency<br />

(OCC) in the U.S. Treasury Department. At PwC,<br />

Mr.Campbell has advised financial institutions, including<br />

central banks on bank regulatory matters, including<br />

examination policy <strong>and</strong> practice as well as compliance <strong>and</strong><br />

remedial actions. During the period 1994-1997 Mr.<br />

Campbell lived in Beijing, China <strong>and</strong> was the lead<br />

partner on a project for the World Bank Group (WBG)<br />

<strong>and</strong> Peoples Bank <strong>of</strong> China (PBC), to design <strong>and</strong><br />

supervise the implementation <strong>of</strong> a comprehensive program<br />

to strengthen financial supervision in the People’s Republic<br />

<strong>of</strong> China.<br />

3:45 Afternoon Networking Break<br />

4:00 Achieve Compliance With Your<br />

Customer Identification Programs<br />

By Applying the Latest Know Your<br />

Customer Techniques<br />

• CIP requirements for institutional products<br />

• How options, derivatives, <strong>and</strong> foreign currency<br />

accounts should be treated<br />

• How far investigation into beneficiaries <strong>of</strong><br />

counterparties should go<br />

• Determining the expectation for different accounts<br />

such as using advisory agency, third party vendors,<br />

<strong>and</strong> additional documents received from the<br />

different types <strong>of</strong> accounts<br />

• Implementing strategies to validate the identity <strong>of</strong><br />

your customers<br />

• International developments – IOSCO’s Client<br />

Identification <strong>and</strong> Beneficial Ownership<br />

(CIBO) Principles<br />

Moderator:<br />

Alan Sorcher, Associate General Counsel<br />

SECURITIES INDUSTRY ASSOCIATION<br />

Alan E. Sorcher is Vice President <strong>and</strong> Associate General<br />

Counsel at the Securities Industry Association. Mr. Sorcher<br />

is responsible for anti-money laundering issues <strong>and</strong> has<br />

directed SIA’s efforts on the implementation <strong>of</strong> the USA<br />

Patriot Act. Mr. Sorcher is also responsible for regulatory<br />

matters for SIA firms affiliated with banking institutions<br />

<strong>and</strong> financial holding companies, <strong>and</strong> oversaw the<br />

securities industry’s response to the Gramm-Leach-Bliley<br />

Act rulemaking. Mr. Sorcher also coordinates SIA’s antimoney<br />

laundering privacy regulatory initiatives.<br />

Visit us on the Web:<br />

lac.com<br />

To Register Call 888-670-8200 • Fax 941-365-2507<br />

5

<strong>The</strong> <strong>Most</strong> <strong>Senior</strong> <strong>Level</strong> <strong>Speakers</strong><br />

Panelists:<br />

Terry Arbit, Associate General Counsel for<br />

Legislative Affairs<br />

U.S. COMMODITY FUTURES TRADING<br />

COMMISSION<br />

Terry Arbit provides legal counsel to the CFTC General<br />

Counsel concerning all aspects <strong>of</strong> the implementation,<br />

interpretation, <strong>and</strong> enforcement <strong>of</strong> the Commodity<br />

Exchange Act. Mr. Arbit has played a key role in<br />

implementing the <strong>AML</strong> provisions <strong>of</strong> the USA Patriot Act<br />

in the futures industry. He has been involved in<br />

developing the applicable rulemakings, he provides<br />

guidance to CFTC staff on anti-money laundering issues,<br />

<strong>and</strong> he represents the CFTC on inter-agency anti-money<br />

laundering task forces. Prior to assuming his current<br />

position in 2002, Mr. Arbit served in the CFTC’s<br />

Division <strong>of</strong> Enforcement for six years, first as a trial<br />

attorney <strong>and</strong> subsequently as Acting Chief Counsel.<br />

Previously, he pursued pr<strong>of</strong>essional liability claims relating<br />

to failed financial institutions on behalf <strong>of</strong> the Resolution<br />

Trust Corporation <strong>and</strong> FDIC.<br />

Daniel Becker, Managing Director, Head <strong>of</strong><br />

<strong>AML</strong> Compliance<br />

BANK OF NEW YORK<br />

Dan Becker has been the Head <strong>of</strong> <strong>AML</strong> Compliance at<br />

<strong>The</strong> Bank <strong>of</strong> New York since December 2004, responsible<br />

for <strong>AML</strong>, BSA <strong>and</strong> OFAC compliance. Previously, Dan<br />

was the Head <strong>of</strong> <strong>AML</strong> Compliance for Deutsche Bank<br />

Americas, responsible for developing, implementing <strong>and</strong><br />

supervising <strong>AML</strong> compliance programs throughout DB’s<br />

businesses in the Americas <strong>and</strong> the Manager/Counsel for<br />

the UBS PaineWebber Money Laundering Prevention<br />

Group. From 1994 through 1999, Dan was an Assistant<br />

United States Attorney in the Southern District <strong>of</strong> New<br />

York. From 1998-1993, he was a litigation associate at<br />

Simpson, Thacher & Bartlett.<br />

Debra Geister, Director <strong>of</strong> Fraud Detection<br />

<strong>and</strong> Compliance Solutions<br />

LEXISNEXIS<br />

Debra Geister has worked with hundreds <strong>of</strong> businesses<br />

<strong>of</strong> all types as an independent consultant specializing in<br />

product development <strong>and</strong> business process. She recently<br />

worked to develop a line <strong>of</strong> fraud prevention <strong>and</strong><br />

compliance products for Bankers Systems <strong>and</strong> subsequently<br />

managed those product lines. Debra has spoken at<br />

hundreds <strong>of</strong> speaking engagements over the past several<br />

years <strong>and</strong> trained countless executives <strong>and</strong> sales<br />

pr<strong>of</strong>essionals in consultative selling, compliance <strong>and</strong> fraud<br />

prevention. She recently joined LexisNexis as the Director<br />

<strong>of</strong> Fraud Prevention <strong>and</strong> Compliance Solutions.<br />

Michelle L. Neufeld, VP & Assistant<br />

General Counsel<br />

JPMORGAN CHASE & CO.<br />

Michelle L. Neufeld’s area <strong>of</strong> primary focus is antimoney<br />

laundering compliance for the Investment Bank.<br />

Additionally, she also has responsibility for technology <strong>and</strong><br />

operations, foreign exchange trading <strong>and</strong> proprietary<br />

trading. She represents the US Investment Bank on the<br />

firm’s Anti-Money Laundering Oversight Committee<br />

(“<strong>AML</strong>OC”) <strong>and</strong> serves as a co-chair for the Global KYC<br />

sub-committee to <strong>AML</strong>OC. She also actively participates<br />

on the SIA’s Anti-Money Laundering Committee. Prior to<br />

joining JPMorganChase in 1998, Ms. Neufeld was<br />

Counsel to the Reserve Funds, responsible for maintaining<br />

the legal <strong>and</strong> compliance functions for the various<br />

broker/dealers <strong>and</strong> investment advisory firms.<br />

5:00 End <strong>of</strong> Day 1<br />

Wednesday, Sept. 28, 2005: Main Conference Day 2<br />

7:45 Registration/morning c<strong>of</strong>fee<br />

8:15 Day 1 Recap from conference Cochairs<br />

Betty Santangelo, Partner<br />

SCHULTE ROTH & ZABEL LLP<br />

Stephen Shine, <strong>Senior</strong> VP & <strong>Senior</strong> Regulatory<br />

Counsel<br />

PRUDENTIAL SECURITIES INC.<br />

8:30 CASE STUDIES: Discussing<br />

Investigations <strong>and</strong> Criminal<br />

Prosecutions With Law<br />

Enforcement Officers<br />

After your SAR is filed, what happens next? Will<br />

the terrorists, drug traffickers <strong>and</strong> other criminals<br />

ever get caught? This session brings together various<br />

law enforcement <strong>of</strong>ficials to take you into the heart<br />

<strong>of</strong> the investigation <strong>and</strong> prosecution process, so you<br />

know that all your hard work in monitoring for<br />

suspicious transactions, <strong>and</strong> questionable account<br />

holders, is actually paying <strong>of</strong>f. If you’ve ever<br />

wondered how the bad guys get taken down, here’s<br />

your chance to find out.<br />

Moderator:<br />

Teresa A. Pesce, Executive Vice President <strong>and</strong><br />

<strong>AML</strong> Director<br />

HSBC NORTH AMERICA INC.<br />

Prior to joining HSBC in October 2003, Ms. Pesce was<br />

<strong>Senior</strong> Trial Counsel at the United States Attorney’s Office<br />

for the Southern District <strong>of</strong> New York where she had been<br />

responsible for approval <strong>and</strong> oversight <strong>of</strong> all money<br />

laundering <strong>and</strong> tax investigations <strong>and</strong> prosecutions in the<br />

Southern District. From December 1999 through January<br />

<strong>of</strong> 2002, she was Chief <strong>of</strong> the Major Crimes Unit for the<br />

Southern District, the unit with primary responsibility for<br />

investigating <strong>and</strong> prosecuting financial crimes exclusive <strong>of</strong><br />

securities fraud, including financial institution frauds, tax<br />

frauds, <strong>and</strong> money laundering. Ms. Pesce joined the U.S.<br />

Attorney’s Office in 1992 as an Assistant U.S. Attorney,<br />

passing first through the General Crimes <strong>and</strong> Narcotics<br />

Units, before joining the Major Crimes Unit as a line<br />

assistant in 1995.<br />

Panelists:<br />

Gregory A. Coleman, Special Agent<br />

FEDERAL BUREAU OF<br />

INVESTIGATIONS<br />

Mr. Coleman joined the FBI in 1989 <strong>and</strong> has been<br />

assigned to the NY <strong>of</strong>fice since completing training at the<br />

FBI academy in Quantico, VA. He spent his first year<br />

conducting Fraud by Wire investigations (Ponzi schemes)<br />

<strong>and</strong> the next two years as a contact agent on an<br />

undercover investigation targeting corruption in the<br />

commodities industry. In 1992, Mr. Coleman became one<br />

<strong>of</strong> the original members <strong>of</strong> a squad established to<br />

investigate securities fraud <strong>and</strong> commodities fraud on a<br />

full time basis. He specializes in stock manipulation cases<br />

that have an international aspect <strong>and</strong> securities fraud<br />

based international money laundering investigations.<br />

Marcy Forman, Director <strong>of</strong> Investigations<br />

DEPARTMENT OF HOMELAND SECURITY-<br />

ICE<br />

Ms. Forman is responsible for all aspects <strong>of</strong> the ICE<br />

investigative mission to include the supervision <strong>of</strong> over<br />

6,000 Special Agents, 156 field <strong>of</strong>fice to include 26 ICE<br />

Special Agent-in-Charge <strong>of</strong>fices; four major investigative<br />

program divisions at ICE Headquarters: Financial<br />

Investigations, Investigative Services, National Security<br />

Investigations <strong>and</strong> Smuggling/Public Safety Investigations;<br />

the Office <strong>of</strong> International Affairs; <strong>and</strong> responsibility for<br />

administering a budget <strong>of</strong> nearly $1 billion dollars. Prior<br />

to assuming the position <strong>of</strong> Director <strong>of</strong> Investigations, Ms.<br />

Forman was the Deputy Assistant Director, Financial<br />

Investigations Division, for ICE, overseeing three specific<br />

initiatives, the centerpiece <strong>of</strong> which is Cornerstone, which<br />

identifies the means <strong>and</strong> methods used by criminal<br />

organizations to exploit U.S. financial <strong>and</strong> trade systems.<br />

Phillip D. Hull, Special Agent<br />

INTERNAL REVENUE SERVICE<br />

Phil Hull currently serves as a Special Agent for IRS-<br />

Criminal Investigation in Jackson, Mississippi He joined<br />

IRS in 1987. During his career he has successfully<br />

completed over one hundred (100) criminal investigations<br />

including numerous large scale non-narcotic money<br />

laundering organizations which involved domestic <strong>and</strong><br />

international money laundering activity. His investigative<br />

experience includes being the case agent for a gr<strong>and</strong> jury<br />

criminal investigation <strong>of</strong> a financial institution involving<br />

Bank Secrecy Act reporting requirements including failure<br />

to file suspicious activity reports in a timely, complete <strong>and</strong><br />

accurate manner <strong>and</strong> for failing to have an appropriate<br />

program for detecting <strong>and</strong> reporting suspicious activity.<br />

Lester Joseph, Principal Deputy Chief- Asset<br />

Forfeiture & Money Laundering<br />

US DEPARTMENT OF JUSTICE<br />

Lester M. Joseph is the Principal Deputy Chief <strong>of</strong> the<br />

Asset Forfeiture <strong>and</strong> Money Laundering Section <strong>of</strong> the<br />

Criminal Division, U.S. Department <strong>of</strong> Justice. He has<br />

been a Deputy Chief in the Section since October 1991<br />

<strong>and</strong> Principal Deputy Chief since January 2002. <strong>The</strong><br />

Asset Forfeiture <strong>and</strong> Money Laundering Section is<br />

responsible for coordinating policy with respect to the<br />

application <strong>and</strong> enforcement <strong>of</strong> the asset forfeiture <strong>and</strong><br />

money laundering statutes by federal prosecutors <strong>and</strong> the<br />

federal law enforcement agencies. Prior to working in the<br />

Asset Forfeiture <strong>and</strong> Money Laundering Section, Mr.<br />

Joseph worked for seven years as a Trial Attorney in the<br />

Organized Crime <strong>and</strong> Racketeering Section. From 1981-<br />

1984, Mr. Joseph was an Assistant State’s Attorney in<br />

Cook County (Chicago), Illinois.<br />

10:00 Morning Networking Break<br />

10:15 Reduce Exposure to Politically<br />

Exposed Persons <strong>and</strong> Other High-<br />

Risk Clients by Enacting a Thorough<br />

<strong>AML</strong> Risk Assessment Program<br />

• Complying with Sections 312 <strong>and</strong> 311 <strong>of</strong> the USA<br />

Patriot Act<br />

• Determining if the FATF list <strong>of</strong> noncooperative<br />

countries is still relevant<br />

• How to develop a new list to identify highrisk<br />

countries<br />

• Risk-based analysis from foreign private bank<br />

accounts <strong>and</strong> political <strong>of</strong>ficials<br />

• Defining exactly who a PEP is, the risk they carry,<br />

<strong>and</strong> implementing a system to identify them<br />