The US Tax Effects Of Choice Of Entities For Foreign Investment - IIR

The US Tax Effects Of Choice Of Entities For Foreign Investment - IIR

The US Tax Effects Of Choice Of Entities For Foreign Investment - IIR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

gain under §865(e)(2) because the partnership interest is attributable to the foreign partner's<br />

U.S. trade or business. <strong>The</strong> IRS also concluded that, in those circumstances, a foreign partner's<br />

interest in the partnership is an asset of the partner effectively connected with that trade or<br />

business ("ECI property") under §864(c)(2). <strong>The</strong> IRS recognized, however, that strict<br />

application of an entity approach, in conjunction with the IRS's interpretation of §§864 and 865,<br />

might improperly subject a foreign partner to tax with respect to appreciated foreign source<br />

property. As a result, the IRS concluded that in applying the source rules of §865(e), and the<br />

effectively connected rules of §864(c), the sale of a foreign partner's interest in a partnership<br />

that is engaged in a trade or business through a fixed place of business in the United States<br />

should be treated on an aggregate basis. In other words, the foreign partner should be treated as<br />

having disposed of an aggregate interest in the partnership's underlying property for purposes of<br />

determining the source and effectively connected character of the gain or loss realized by the<br />

foreign partner.<br />

<strong>The</strong> IRS demonstrated application of this aggregate approach by use of three examples. In the<br />

first situation, a nonresident alien individual (FP1) is a partner in a partnership (PS1) that is<br />

engaged in a trade or business through a fixed place of business in the United States. PS1 owns<br />

appreciated personal property located in the United States that is used or held for use in PS1's<br />

U.S. trade or business. FP1 disposes of his partnership interest. On these facts, the IRS<br />

concludes that FP1's gain (or loss) is effectively connected U.S. source gain (or loss) to the<br />

extent such gain (or loss) is attributable to ECI property of the partnership.<br />

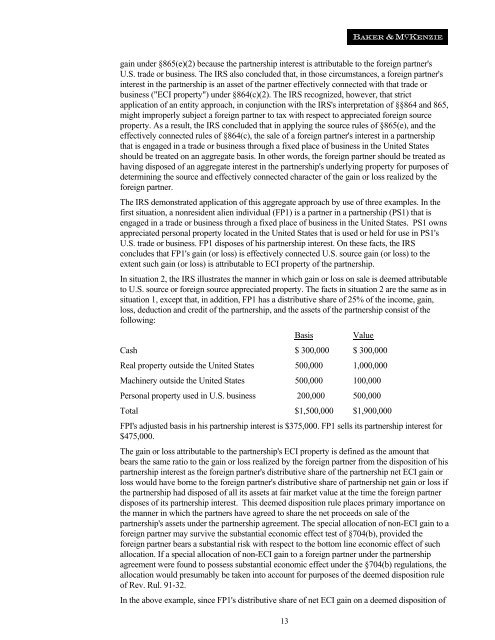

In situation 2, the IRS illustrates the manner in which gain or loss on sale is deemed attributable<br />

to U.S. source or foreign source appreciated property. <strong>The</strong> facts in situation 2 are the same as in<br />

situation 1, except that, in addition, FP1 has a distributive share of 25% of the income, gain,<br />

loss, deduction and credit of the partnership, and the assets of the partnership consist of the<br />

following:<br />

Basis<br />

Value<br />

Cash $ 300,000 $ 300,000<br />

Real property outside the United States 500,000 1,000,000<br />

Machinery outside the United States 500,000 100,000<br />

Personal property used in U.S. business 200,000 500,000<br />

Total $1,500,000 $1,900,000<br />

FPI's adjusted basis in his partnership interest is $375,000. FP1 sells its partnership interest for<br />

$475,000.<br />

<strong>The</strong> gain or loss attributable to the partnership's ECI property is defined as the amount that<br />

bears the same ratio to the gain or loss realized by the foreign partner from the disposition of his<br />

partnership interest as the foreign partner's distributive share of the partnership net ECI gain or<br />

loss would have borne to the foreign partner's distributive share of partnership net gain or loss if<br />

the partnership had disposed of all its assets at fair market value at the time the foreign partner<br />

disposes of its partnership interest. This deemed disposition rule places primary importance on<br />

the manner in which the partners have agreed to share the net proceeds on sale of the<br />

partnership's assets under the partnership agreement. <strong>The</strong> special allocation of non-ECI gain to a<br />

foreign partner may survive the substantial economic effect test of §704(b), provided the<br />

foreign partner bears a substantial risk with respect to the bottom line economic effect of such<br />

allocation. If a special allocation of non-ECI gain to a foreign partner under the partnership<br />

agreement were found to possess substantial economic effect under the §704(b) regulations, the<br />

allocation would presumably be taken into account for purposes of the deemed disposition rule<br />

of Rev. Rul. 91-32.<br />

In the above example, since FP1's distributive share of net ECI gain on a deemed disposition of<br />

13