From the Editor - Prison Legal News

From the Editor - Prison Legal News

From the Editor - Prison Legal News

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Cost Shifting (cont.)<br />

community. 51 What <strong>the</strong>se figures mean is<br />

that one in every 136 U.S. residents was in<br />

prison or jail. 52 There were 1,446,269 people<br />

in prison, and 747,529 people in jail, 53 figures<br />

representing a 1.7 percent growth in prison<br />

and a 4.7 percent growth in jail populations. 54<br />

Over 4.1 million people were on probation,<br />

and 784,408 people were on parole. 55 By<br />

yearend 2005 both <strong>the</strong> probation and parole<br />

populations had grown, 0.5 percent and 1.6<br />

percent respectively. 56 Fifty- five percent of<br />

those on probation are white, 30 percent are<br />

African-American, and 13 percent are Latina.<br />

57 Parole data show whites comprised 41<br />

percent, African-Americans, 40 percent, and<br />

Latinos, 18 percent of adults on parole. 58<br />

Along with <strong>the</strong> burgeoning population of<br />

people in jails and prisons or on probation<br />

or parole, <strong>the</strong> cost of <strong>the</strong> criminal justice<br />

system has grown, leading policymakers and<br />

legislators scrambling to find new sources of<br />

revenue without jeopardizing <strong>the</strong>ir political<br />

futures by raising taxes.<br />

Jail Fees are Common, and Costly<br />

In 2005 <strong>the</strong> U.S. Department of Justice,<br />

National Institute of Corrections<br />

surveyed state jails across <strong>the</strong> country “[t]<br />

o explore <strong>the</strong> extent to which local jails<br />

are charging fees to jail inmates,” “[t]o<br />

learn <strong>the</strong> actual amounts of <strong>the</strong> fees that<br />

are being charged and <strong>the</strong> revenues that<br />

are being generated,” and “[t]o learn jail<br />

managers’ views on <strong>the</strong> effectiveness of<br />

charging fees.” 59 This 2005 survey does not<br />

reflect a representative national sample,<br />

however it does provide “substantial<br />

information on jails’ current practices<br />

related to charging inmates for programs<br />

and services.” 60<br />

The report classifies jail fees as ei<strong>the</strong>r a<br />

“‘program fee’ . . . charged to jail inmates<br />

Hot Sexy Pics!<br />

1000S OF HOT! HOT! HOT!<br />

BLACK, EUROPEAN AND SPANISH<br />

GIRLS IN BIKINIS, THONGS,<br />

SHORTS AND MINIS!<br />

$3.00 for info $5.00 for a catalog<br />

$10.00 for a catalog and 8x10<br />

autographed picture. Full New Book<br />

Stamps accepted for payment.<br />

New & Highly Advertised site!<br />

www.writesomeoneinprison.com<br />

Nubian Princess Ent.<br />

POB 37<br />

Timmonsville, SC 29161<br />

April 2008<br />

who are participating in a program that<br />

is not a basic element of jail operations,<br />

or who are receiving a program-related<br />

service”; 61 or, alternatively, as non-program<br />

fees assessed in relation to everyday facility<br />

operations and services. 62 The purposes of<br />

non-program fees are to offset administrative<br />

costs, <strong>the</strong> costs of housing prisoners,<br />

costs of providing routine services (like<br />

phone service and hair cuts), <strong>the</strong> expense of<br />

medical services, and to deter <strong>the</strong> frivolous<br />

use of medical services. 63 Ninety percent of<br />

<strong>the</strong> jails that responded were charging jail inmate<br />

fees, 64 with <strong>the</strong> most common charges<br />

being in <strong>the</strong> “non-program” fee category for<br />

health-related services, like prescriptions (59<br />

percent of respondents) and physician visits<br />

(59 percent of respondents), and participation<br />

in work release programs (58 percent<br />

of respondents). These findings corroborate<br />

those of a 1997 NIC study of <strong>the</strong> largest jails<br />

nationwide that found “charging of inmate<br />

fees is both prevalent and increasing among<br />

<strong>the</strong> agencies surveyed,” with <strong>the</strong> most common<br />

charges imposed for medical care and<br />

participation in work release programs, and<br />

<strong>the</strong> most revenues generated by telephone<br />

services, work release programs, and home<br />

detention. 65<br />

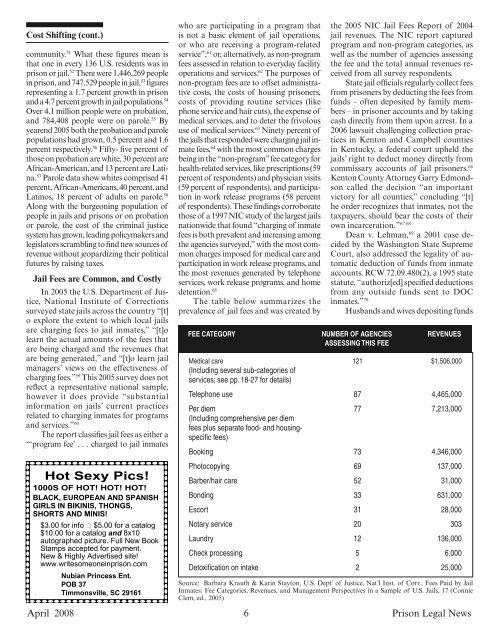

The table below summarizes <strong>the</strong><br />

prevalence of jail fees and was created by<br />

6<br />

<strong>the</strong> 2005 NIC Jail Fees Report of 2004<br />

jail revenues. The NIC report captured<br />

program and non-program categories, as<br />

well as <strong>the</strong> number of agencies assessing<br />

<strong>the</strong> fee and <strong>the</strong> total annual revenues received<br />

from all survey respondents.<br />

State jail officials regularly collect fees<br />

from prisoners by deducting <strong>the</strong> fees from<br />

funds – often deposited by family members<br />

– in prisoner accounts and by taking<br />

cash directly from <strong>the</strong>m upon arrest. In a<br />

2006 lawsuit challenging collection practices<br />

in Kenton and Campbell counties<br />

in Kentucky, a federal court upheld <strong>the</strong><br />

jails’ right to deduct money directly from<br />

commissary accounts of jail prisoners. 66<br />

Kenton County Attorney Garry Edmondson<br />

called <strong>the</strong> decision “an important<br />

victory for all counties,” concluding “[t]<br />

he order recognizes that inmates, not <strong>the</strong><br />

taxpayers, should bear <strong>the</strong> costs of <strong>the</strong>ir<br />

67 68<br />

own incarceration.”<br />

Dean v. Lehman, 69 a 2001 case decided<br />

by <strong>the</strong> Washington State Supreme<br />

Court, also addressed <strong>the</strong> legality of automatic<br />

deduction of funds from inmate<br />

accounts. RCW 72.09.480(2), a 1995 state<br />

statute, “authoriz[ed] specified deductions<br />

from any outside funds sent to DOC<br />

inmates.” 70<br />

Husbands and wives depositing funds<br />

Fee category Number of Agencies revenues<br />

A<br />

assessing this fee<br />

Medical care 121 $1,506,000<br />

(Including several sub-categories of<br />

services; see pp. 18-27 for details)<br />

Telephone use 87 4,465,000<br />

Per diem 77 7,213,000<br />

(Including comprehensive per diem<br />

fees plus separate food- and housingspecific<br />

fees)<br />

Booking 73 4,346,000<br />

Photocopying 69 137,000<br />

Barber/hair care 52 31,000<br />

Bonding 33 631,000<br />

Escort 31 28,000<br />

Notary service 20 303<br />

Laundry 12 136,000<br />

Check processing 5 6,000<br />

Detoxification on intake 2 25,000<br />

Source: Barbara Krauth & Karin Stayton, U.S. Dept’ of Justice, Nat’l Inst. of Corr., Fees Paid by Jail<br />

Inmates: Fee Categories, Revenues, and Management Perspectives in a Sample of U.S. Jails, 17 (Connie<br />

Clem, ed., 2005)<br />

<strong>Prison</strong> <strong>Legal</strong> <strong>News</strong>