Term Sheet 3Y Twin Win on EURO STOXX 50 in ... - Prodottidiborsa

Term Sheet 3Y Twin Win on EURO STOXX 50 in ... - Prodottidiborsa

Term Sheet 3Y Twin Win on EURO STOXX 50 in ... - Prodottidiborsa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

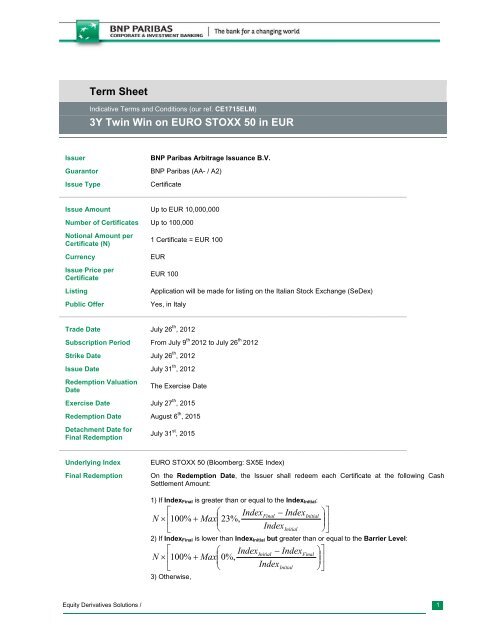

<str<strong>on</strong>g>Term</str<strong>on</strong>g> <str<strong>on</strong>g>Sheet</str<strong>on</strong>g><br />

Indicative <str<strong>on</strong>g>Term</str<strong>on</strong>g>s and C<strong>on</strong>diti<strong>on</strong>s (our ref. CE1715ELM)<br />

<str<strong>on</strong>g>3Y</str<strong>on</strong>g> <str<strong>on</strong>g>Tw<strong>in</strong></str<strong>on</strong>g> <str<strong>on</strong>g>W<strong>in</strong></str<strong>on</strong>g> <strong>on</strong> <strong>EURO</strong> <strong>STOXX</strong> <strong>50</strong> <strong>in</strong> EUR<br />

Issuer<br />

BNP Paribas Arbitrage Issuance B.V.<br />

Guarantor BNP Paribas (AA- / A2)<br />

Issue Type<br />

Certificate<br />

_______________________________________________________________________________________________________________________________________________________________________<br />

Issue Amount Up to EUR 10,000,000<br />

Number of Certificates Up to 100,000<br />

Noti<strong>on</strong>al Amount per<br />

Certificate (N)<br />

1 Certificate = EUR 100<br />

Currency<br />

Issue Price per<br />

Certificate<br />

List<strong>in</strong>g<br />

Public Offer<br />

EUR<br />

EUR 100<br />

Applicati<strong>on</strong> will be made for list<strong>in</strong>g <strong>on</strong> the Italian Stock Exchange (SeDex)<br />

Yes, <strong>in</strong> Italy<br />

_______________________________________________________________________________________________________________________________________________________________________<br />

Trade Date July 26 th , 2012<br />

Subscripti<strong>on</strong> Period From July 9 th 2012 to July 26 th 2012<br />

Strike Date July 26 th , 2012<br />

Issue Date July 31 th , 2012<br />

Redempti<strong>on</strong> Valuati<strong>on</strong><br />

Date<br />

The Exercise Date<br />

Exercise Date July 27 th , 2015<br />

Redempti<strong>on</strong> Date August 6 th , 2015<br />

Detachment Date for<br />

F<strong>in</strong>al Redempti<strong>on</strong><br />

July 31 st , 2015<br />

_______________________________________________________________________________________________________________________________________________________________________<br />

Underly<strong>in</strong>g Index<br />

F<strong>in</strong>al Redempti<strong>on</strong><br />

<strong>EURO</strong> <strong>STOXX</strong> <strong>50</strong> (Bloomberg: SX5E Index)<br />

On the Redempti<strong>on</strong> Date, the Issuer shall redeem each Certificate at the follow<strong>in</strong>g Cash<br />

Settlement Amount:<br />

1) If Index F<strong>in</strong>al is greater than or equal to the Index Initial:<br />

⎡ ⎛ IndexF<strong>in</strong>al<br />

− Index<br />

N × ⎢100<br />

% + Max<br />

⎜23%,<br />

⎣ ⎝ IndexInitial<br />

Initial<br />

2) If Index F<strong>in</strong>al is lower than Index Initial but greater than or equal to the Barrier Level:<br />

⎡ ⎛ IndexInitial<br />

− Index<br />

N × ⎢100<br />

% + Max<br />

⎜0%,<br />

⎣ ⎝ IndexInitial<br />

3) Otherwise,<br />

F<strong>in</strong>al<br />

⎞⎤<br />

⎟⎥<br />

⎠⎦<br />

⎞⎤<br />

⎟⎥<br />

⎠⎦<br />

Equity Derivatives Soluti<strong>on</strong>s / 1

Where<br />

Index Initial is the official Clos<strong>in</strong>g Level of the Underly<strong>in</strong>g Index <strong>on</strong> the Strike Date i.e. TBD<br />

Index F<strong>in</strong>al is the official Clos<strong>in</strong>g Level of the Underly<strong>in</strong>g Index <strong>on</strong> the Redempti<strong>on</strong> Valuati<strong>on</strong><br />

Date.<br />

Barrier Level<br />

Specified Maximum Days<br />

of Disrupti<strong>on</strong><br />

65% x Index Initial, i.e. TBD<br />

Three (3) Scheduled Trad<strong>in</strong>g Days<br />

_______________________________________________________________________________________________________________________________________________________________________<br />

Bus<strong>in</strong>ess Day<br />

C<strong>on</strong>venti<strong>on</strong><br />

Follow<strong>in</strong>g Bus<strong>in</strong>ess Day<br />

Payment Bus<strong>in</strong>ess Days TARGET2<br />

Calculati<strong>on</strong> Agent/<br />

Pr<strong>in</strong>cipal Security Agent<br />

Govern<strong>in</strong>g Law<br />

Documentati<strong>on</strong><br />

BNP Paribas Arbitrage S.N.C.<br />

English<br />

F<strong>in</strong>al <str<strong>on</strong>g>Term</str<strong>on</strong>g>s under the Warrant and Certificate Programme of the Issuer dated June 1 st , 2012 (as<br />

supplemented from time to time) (the "Base Prospectus") a copy of which is available from BNP<br />

Paribas Arbitrage S.N.C. <strong>on</strong> request.<br />

In the event of any <strong>in</strong>c<strong>on</strong>sistency between this termsheet and the F<strong>in</strong>al <str<strong>on</strong>g>Term</str<strong>on</strong>g>s relat<strong>in</strong>g to the<br />

Certificates, the F<strong>in</strong>al <str<strong>on</strong>g>Term</str<strong>on</strong>g>s will prevail.<br />

Form<br />

Italian Dematerialised Form<br />

Codes − ISIN: NL0010220984<br />

− Comm<strong>on</strong>: 080185189<br />

Reuters Ric for Structure ISIN=BNPP<br />

Comm<strong>on</strong> Depositary<br />

M<strong>in</strong>imum Trad<strong>in</strong>g Size<br />

Sec<strong>on</strong>dary Trad<strong>in</strong>g<br />

M<strong>on</strong>te Titoli<br />

1 certificate (and multiples of 1 certificate thereafter)<br />

Daily price <strong>in</strong>dicati<strong>on</strong>s <strong>in</strong>clud<strong>in</strong>g accrued <strong>in</strong>terest will be published <strong>on</strong> Reuters.<br />

No representati<strong>on</strong> is made as to the existence of a market for the Certificates. BNP Paribas<br />

Arbitrage SNC will endeavour to make a sec<strong>on</strong>dary market <strong>in</strong> the Certificates, subject to it be<strong>in</strong>g<br />

satisfied that normal market c<strong>on</strong>diti<strong>on</strong>s prevail. Any prices <strong>in</strong>dicated will be dependent up<strong>on</strong><br />

factors affect<strong>in</strong>g or likely to affect the value of the Certificates such as, but not limited to, the<br />

rema<strong>in</strong><strong>in</strong>g time to the Redempti<strong>on</strong> Date, the outstand<strong>in</strong>g pr<strong>in</strong>cipal amount, the Issuer's or, if<br />

applicable, the Guarantor's credit risk, the performance and volatility of the underly<strong>in</strong>g asset,<br />

<strong>in</strong>terest rates, exchange rates, credit spreads, and any <strong>in</strong>cidental costs. To the extent BNP<br />

Paribas Arbitrage SNC holds Certificates that it can offer and subject to it be<strong>in</strong>g satisfied that<br />

normal market c<strong>on</strong>diti<strong>on</strong>s prevail, such prices will have a bid-offer spread no greater than 1.00%.<br />

Holders should be aware that the sec<strong>on</strong>dary market price for any Security quoted <strong>on</strong> or after the<br />

seventh (7 th ) Clear<strong>in</strong>g System bus<strong>in</strong>ess day preced<strong>in</strong>g any date <strong>on</strong> which the Issuer is due to<br />

make a payment there<strong>on</strong>, shall exclude the amount so payable per Security. The Holder of the<br />

Securities <strong>on</strong> the record date, as determ<strong>in</strong>ed by the rules of the relevant Clear<strong>in</strong>g System, shall<br />

be entitled to receive or reta<strong>in</strong> any such amount <strong>on</strong> the due date for payment thereof.<br />

Initial Settlement<br />

Fees<br />

Delivery versus payment.<br />

M<strong>on</strong>te Titoli.<br />

Settlement must be made <strong>in</strong> Unit.<br />

In c<strong>on</strong>necti<strong>on</strong> with the offer and sale of the Certificates, Banca Nazi<strong>on</strong>ale del Lavoro S.p.A. will<br />

acquire the Certificates from BNP Paribas Arbitrage S.N.C. at a discount to the Issue Price or at<br />

the Issue Price. If Banca Nazi<strong>on</strong>ale del Lavoro S.p.A. acquires the Certificates at the Issue Price,<br />

BNP Paribas Arbitrage S.N.C. will pay to Banca Nazi<strong>on</strong>ale del Lavoro S.p.A. a distributi<strong>on</strong> fee.<br />

Such amounts received by Banca Nazi<strong>on</strong>ale del Lavoro S.p.A. may be <strong>in</strong> additi<strong>on</strong> to the<br />

Equity Derivatives Soluti<strong>on</strong>s / 2

okerage cost/fee normally applied by Banca Nazi<strong>on</strong>ale del Lavoro S.p.A.. They cover<br />

distributi<strong>on</strong> and or structur<strong>in</strong>g cost for a maximum annual amount equivalent to 0.<strong>50</strong>% of the<br />

Issue Amount. The purchaser acknowledges that such distributi<strong>on</strong> fee may be reta<strong>in</strong>ed by Banca<br />

Nazi<strong>on</strong>ale del Lavoro S.p.A.. Further <strong>in</strong>formati<strong>on</strong> is available from Banca Nazi<strong>on</strong>ale del Lavoro<br />

S.p.A. <strong>on</strong> request.<br />

_______________________________________________________________________________________________________________________________________________________________________<br />

_______________________________________________________________________________________________________________________________________________________________________<br />

Sell<strong>in</strong>g Restricti<strong>on</strong>s<br />

As set out <strong>in</strong> the Base Prospectus.<br />

_______________________________________________________________________________________________________________________________________________________________________<br />

IMPORTANT INFORMATION<br />

This term sheet c<strong>on</strong>ta<strong>in</strong>s a proposal for discussi<strong>on</strong> purposes <strong>on</strong>ly and (unless otherwise stated) is <strong>in</strong>dicative <strong>on</strong>ly. BNP Paribas gives no<br />

assurance that any Certificate will be issued or any transacti<strong>on</strong> will be entered <strong>in</strong>to <strong>on</strong> the basis of these <strong>in</strong>dicative terms. The <strong>in</strong>formati<strong>on</strong><br />

c<strong>on</strong>ta<strong>in</strong>ed <strong>in</strong> this document is provided to you <strong>on</strong> a strictly c<strong>on</strong>fidential basis and you agree that it may not be distributed by you to other parties<br />

or potential purchasers of Certificates without our prior written c<strong>on</strong>sent. If you have received a copy of this document from any<strong>on</strong>e other than<br />

BNP Paribas, it will not c<strong>on</strong>ta<strong>in</strong> all the <strong>in</strong>formati<strong>on</strong> required for you to assess its c<strong>on</strong>tents.<br />

Investor Resp<strong>on</strong>sibilities<br />

The Certificates will be offered to the public <strong>in</strong> Italy, no acti<strong>on</strong> has been or will be taken <strong>in</strong> any jurisdicti<strong>on</strong> that would, or is <strong>in</strong>tended to, permit a<br />

public offer<strong>in</strong>g of the Certificates <strong>in</strong> another country.<br />

The Certificates are sold to <strong>in</strong>vestors <strong>on</strong> the understand<strong>in</strong>g that they will comply with all relevant securities laws and public offer requirements <strong>in</strong><br />

the jurisdicti<strong>on</strong>s <strong>in</strong> which they may purchase, place or resell the Certificates, <strong>in</strong>clud<strong>in</strong>g, without limitati<strong>on</strong>, the EU Prospectus Directive and the<br />

relevant implement<strong>in</strong>g measures <strong>in</strong> any EU member state. As you may not be the <strong>on</strong>ly purchaser of the Certificates, you should not rely <strong>on</strong> any<br />

public offer exempti<strong>on</strong> rely<strong>in</strong>g <strong>on</strong> offers <strong>on</strong>ly be<strong>in</strong>g made to a restricted number of <strong>in</strong>vestors (classified by type or locati<strong>on</strong> as applicable).<br />

Sell<strong>in</strong>g Restricti<strong>on</strong>s<br />

The Certificates may not be offered or sold <strong>in</strong> the United States or to U.S. pers<strong>on</strong>s at any time (as def<strong>in</strong>ed <strong>in</strong> regulati<strong>on</strong> S under the U.S.<br />

Securities Act of 1933 or the U.S. <strong>in</strong>ternal revenue code). The Certificates have not been and will not be registered under the U.S. Securities<br />

Act of 1933, as amended, or the securities laws of any state <strong>in</strong> the United States, and are subject to U.S. tax requirements. In purchas<strong>in</strong>g the<br />

Certificates you represent and warrant that you are neither located <strong>in</strong> the United States nor a U.S. pers<strong>on</strong> and that you are not purchas<strong>in</strong>g for<br />

the account or benefit of any such pers<strong>on</strong>. The Certificates may not be offered, sold, transferred or delivered without compliance with all<br />

applicable securities laws and regulati<strong>on</strong>s.<br />

Risk Analysis<br />

The Securities have no capital protecti<strong>on</strong> at any time and there can be a partial or total loss of any capital <strong>in</strong>vested. Investment <strong>in</strong> the Securities<br />

is therefore highly speculative and should <strong>on</strong>ly be c<strong>on</strong>sidered by pers<strong>on</strong>s who can afford to lose their entire <strong>in</strong>vestment.<br />

BNP Paribas is not provid<strong>in</strong>g the recipients of this document with any <strong>in</strong>vestment advice or recommendati<strong>on</strong> to enter <strong>in</strong>to any potential<br />

transacti<strong>on</strong>. Any purchaser of Certificates, other than a BNP Paribas counterparty or distributor, will be purchas<strong>in</strong>g the Notes from such<br />

counterparty or distributor and will have no c<strong>on</strong>tractual relati<strong>on</strong>ship with BNP Paribas or any of its affiliates. In particular BNP Paribas will not be<br />

resp<strong>on</strong>sible for assess<strong>in</strong>g the appropriateness or suitability of an <strong>in</strong>vestment <strong>in</strong> the Certificates <strong>in</strong> relati<strong>on</strong> to such third parties. This document<br />

should be read together with the Base Prospectus and the applicable F<strong>in</strong>al <str<strong>on</strong>g>Term</str<strong>on</strong>g>s for the Certificates. Any proposed issuance described <strong>in</strong> this<br />

document cannot be fully assessed without a careful review of the terms and c<strong>on</strong>diti<strong>on</strong>s c<strong>on</strong>ta<strong>in</strong>ed <strong>in</strong> the Base Prospectus and the F<strong>in</strong>al <str<strong>on</strong>g>Term</str<strong>on</strong>g>s.<br />

In particular, potential <strong>in</strong>vestors should carefully read the secti<strong>on</strong>s headed "Risk Factors" <strong>in</strong> the Base Prospectus [and the F<strong>in</strong>al <str<strong>on</strong>g>Term</str<strong>on</strong>g>s] for a full<br />

descripti<strong>on</strong> of the potential risks associated with the Notes, and "Sell<strong>in</strong>g Restricti<strong>on</strong>s", for certa<strong>in</strong> limitati<strong>on</strong>s <strong>on</strong> the purchase and <strong>on</strong>ward sales<br />

of the Certificates.<br />

Any <strong>in</strong>dicative price quotati<strong>on</strong>s, <strong>in</strong>vestment cases or market analysis c<strong>on</strong>ta<strong>in</strong>ed <strong>in</strong> this document or any related market<strong>in</strong>g materials we may<br />

have provided to you have been prepared <strong>on</strong> assumpti<strong>on</strong>s and parameters that reflect our good faith judgement or selecti<strong>on</strong> but must be<br />

subject to your own <strong>in</strong>dependent analysis and due diligence before you make any <strong>in</strong>vestment decisi<strong>on</strong>. Please note that there can be c<strong>on</strong>flicts<br />

of <strong>in</strong>terests between BNP Paribas and potential <strong>in</strong>vestors (see below) and we can therefore not assume any resp<strong>on</strong>sibility for the f<strong>in</strong>ancial<br />

c<strong>on</strong>sequences of your <strong>in</strong>vestment decisi<strong>on</strong>, which must be <strong>in</strong>dependent. We require that you undertake your own <strong>in</strong>dependent due diligence<br />

and avail yourself of your own advisors <strong>in</strong> order to assess the suitability of Certificates <strong>in</strong> relati<strong>on</strong> to your own f<strong>in</strong>ancial objectives. Accord<strong>in</strong>gly, if<br />

you decide to purchase Certificates, you will be deemed to understand and accept the terms, c<strong>on</strong>diti<strong>on</strong>s and risks associated with the<br />

Certificates. You will also be deemed to act for your own account, to have made your own <strong>in</strong>dependent decisi<strong>on</strong> to purchase the Certificates<br />

and to declare that such transacti<strong>on</strong> is appropriate for you based up<strong>on</strong> your own judgement the advice from such advisers as you have deemed<br />

necessary to c<strong>on</strong>sult. Each holder of the Certificates shall also be deemed to assume and be resp<strong>on</strong>sible for any and all taxes of any jurisdicti<strong>on</strong><br />

or governmental or regulatory authority and should c<strong>on</strong>sult their own tax advisers <strong>in</strong> this respect.<br />

You should note and assess for the purposes of any <strong>in</strong>vestment decisi<strong>on</strong> that members of the BNP Paribas group may face possible c<strong>on</strong>flicts of<br />

<strong>in</strong>terest <strong>in</strong> c<strong>on</strong>necti<strong>on</strong> with certa<strong>in</strong> duties under the Certificates, such as trad<strong>in</strong>g <strong>in</strong> an underly<strong>in</strong>g for their own account or for the account of<br />

others, receiv<strong>in</strong>g fees <strong>in</strong> a number of capacities or tak<strong>in</strong>g market views which are not c<strong>on</strong>sistent with the objective of the Certificates.<br />

Equity Derivatives Soluti<strong>on</strong>s / 3

BNP Paribas is <strong>in</strong>corporated <strong>in</strong> France with Limited Liability and is regulated by the Autorité de C<strong>on</strong>trôle Prudentiel for the c<strong>on</strong>duct of its<br />

<strong>in</strong>vestment bus<strong>in</strong>ess <strong>in</strong> France. Registered Office: 16 Boulevard des Italiens, 7<strong>50</strong>09 Paris, France. www.bnpparibas.com.<br />

Index Disclaimer<br />

Neither the Issuer nor the Guarantor shall have any liability for any act or failure to act by an Index Sp<strong>on</strong>sor <strong>in</strong> c<strong>on</strong>necti<strong>on</strong> with the calculati<strong>on</strong>,<br />

adjustment or ma<strong>in</strong>tenance of an Index. Except as disclosed prior to the Issue Date, neither the Issuer, the Guarantor nor their affiliates has any<br />

affiliati<strong>on</strong> with or c<strong>on</strong>trol over an Index or Index Sp<strong>on</strong>sor or any c<strong>on</strong>trol over the computati<strong>on</strong>, compositi<strong>on</strong> or dissem<strong>in</strong>ati<strong>on</strong> of an Index.<br />

Although the Calculati<strong>on</strong> Agent will obta<strong>in</strong> <strong>in</strong>formati<strong>on</strong> c<strong>on</strong>cern<strong>in</strong>g an Index from publicly available sources it believes reliable, it will not<br />

<strong>in</strong>dependently verify this <strong>in</strong>formati<strong>on</strong>. Accord<strong>in</strong>gly, no representati<strong>on</strong>, warranty or undertak<strong>in</strong>g (express or implied) is made and no resp<strong>on</strong>sibility<br />

is accepted by the Issuer, the Guarantor, their affiliates or the Calculati<strong>on</strong> Agent as to the accuracy, completeness and timel<strong>in</strong>ess of <strong>in</strong>formati<strong>on</strong><br />

c<strong>on</strong>cern<strong>in</strong>g an Index.<br />

<strong>EURO</strong> <strong>STOXX</strong> <strong>50</strong>® Index<br />

<strong>STOXX</strong> and its licensors (the "Licensors") have no relati<strong>on</strong>ship to BNP PARIBAS, other than the licens<strong>in</strong>g of the <strong>EURO</strong> <strong>STOXX</strong> <strong>50</strong>® Index and<br />

the related trademarks for use <strong>in</strong> c<strong>on</strong>necti<strong>on</strong> with the Certificates.<br />

<strong>STOXX</strong> and its Licensors do not:<br />

• Sp<strong>on</strong>sor, endorse, sell or promote the Certificates.<br />

• Recommend that any pers<strong>on</strong> <strong>in</strong>vest <strong>in</strong> the Certificates or any other securities.<br />

• Have any resp<strong>on</strong>sibility or liability for or make any decisi<strong>on</strong>s about the tim<strong>in</strong>g, amount or pric<strong>in</strong>g of Certificates.<br />

• Have any resp<strong>on</strong>sibility or liability for the adm<strong>in</strong>istrati<strong>on</strong>, management or market<strong>in</strong>g of the Certificates.<br />

• C<strong>on</strong>sider the needs of the Certificates or the owners of the Certificates <strong>in</strong> determ<strong>in</strong><strong>in</strong>g, compos<strong>in</strong>g or calculat<strong>in</strong>g the <strong>EURO</strong> <strong>STOXX</strong><br />

<strong>50</strong>® Index or have any obligati<strong>on</strong> to do so.<br />

<strong>STOXX</strong> and its Licensors will not have any liability <strong>in</strong> c<strong>on</strong>necti<strong>on</strong> with the Certificates. Specifically,<br />

• <strong>STOXX</strong> and its Licensors do not make any warranty, express or implied and disclaim any and all warranty about:<br />

• The results to be obta<strong>in</strong>ed by the Certificates, the owner of the Certificates or any other pers<strong>on</strong> <strong>in</strong> c<strong>on</strong>necti<strong>on</strong> with<br />

the use of the <strong>EURO</strong> <strong>STOXX</strong> <strong>50</strong>® Index and the data <strong>in</strong>cluded <strong>in</strong> the <strong>EURO</strong> <strong>STOXX</strong> <strong>50</strong>® Index;<br />

• The accuracy or completeness of the <strong>EURO</strong> <strong>STOXX</strong> <strong>50</strong>® Index and its data;<br />

• The merchantability and the fitness for a particular purpose or use of the <strong>EURO</strong> <strong>STOXX</strong> <strong>50</strong>® Index and its data;<br />

• <strong>STOXX</strong> and its Licensors will have no liability for any errors, omissi<strong>on</strong>s or <strong>in</strong>terrupti<strong>on</strong>s <strong>in</strong> the <strong>EURO</strong> <strong>STOXX</strong> <strong>50</strong>® Index or its<br />

data;<br />

• Under no circumstances will <strong>STOXX</strong> or its Licensors be liable for any lost profits or <strong>in</strong>direct, punitive, special or<br />

c<strong>on</strong>sequential damages or losses, even if <strong>STOXX</strong> or its Licensors knows that they might occur.<br />

The licens<strong>in</strong>g agreement between BNP PARIBAS and <strong>STOXX</strong> is solely for their benefit and not for the benefit of the owners of the<br />

Certificates or any other third parties.<br />

Equity Derivatives Soluti<strong>on</strong>s / 4