Morning Coffee News (Asia)

Morning Coffee News (Asia)

Morning Coffee News (Asia)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Morning</strong> <strong>Coffee</strong> <strong>News</strong> (<strong>Asia</strong>)<br />

25 June 2012<br />

Top news*: Hong Kong’s LME Deal Spurs Industry’s Steepest Slump<br />

Hong Kong Exchanges & Clearing Ltd.’s pursuit of the London Metal Exchange is<br />

transforming the <strong>Asia</strong>n bourse into the industry’s worst performer.<br />

Hong Kong Exchanges’ $2.2 billion bid for the LME this month valued the<br />

world’s largest trading venue for industrial metals at 181 times earnings, making<br />

it the most expensive bourse acquisition exceeding $1 billion on record, accord-<br />

ing to data compiled by Bloomberg. With the <strong>Asia</strong>n company’s stock tumbling<br />

since the first report of its interest in the LME, it has now retreated 33 percent in<br />

the past year, the biggest decline among the world’s 20 largest exchanges, the<br />

data show.<br />

While the merger will give Hong Kong Exchanges control of about 80 percent of<br />

global trade in industrial-metal futures as it grapples with falling profits and a<br />

slump in initial public offerings, the New York Stock Exchange’s head said the<br />

price would have been too rich for the biggest U.S. bourse operator. An increase<br />

in trading by Chinese companies on the LME is vital to justify the deal, making<br />

the takeover’s success dependent on China’s regulators who have so far resisted<br />

granting the LME access to the mainland to protect its rival in Shanghai, accord-<br />

ing to Core Pacific-Yamaichi International (H.K.) Ltd.<br />

Market <strong>News</strong> APAC*<br />

<strong>Asia</strong>n stocks outside Japan fell amid concern from the Bank for International Set-<br />

tlements that the world’s central banks are confronting the limits of their ability to<br />

boost economic growth.<br />

BHP Billiton Ltd., the world’s largest mining company, led materials companies<br />

lower, sliding 1.8 percent as metal prices retreated. Samsung Electronics Co. fell 3.5<br />

percent as the world’s top mobile-phone maker investigated a complaint one of its<br />

smartphones overheated. Yahoo Japan Corp. lost 5.2 percent after a report that the<br />

Japanese government will question the firm on e-mail privacy.<br />

The MSCI <strong>Asia</strong> Pacific Index slid 0.4 percent to 113.73 as of 10:01 a.m. in Tokyo<br />

before markets in China and Hong Kong opened. The gauge has erased its advance<br />

for the year. Central banks are being “cornered into prolonging monetary stimulus,”<br />

the Basel, Switzerland-based BIS said in its annual report, published yesterday. “Both<br />

conventionally and unconventionally, accommodative monetary policies are palliatives<br />

and have their limits.”<br />

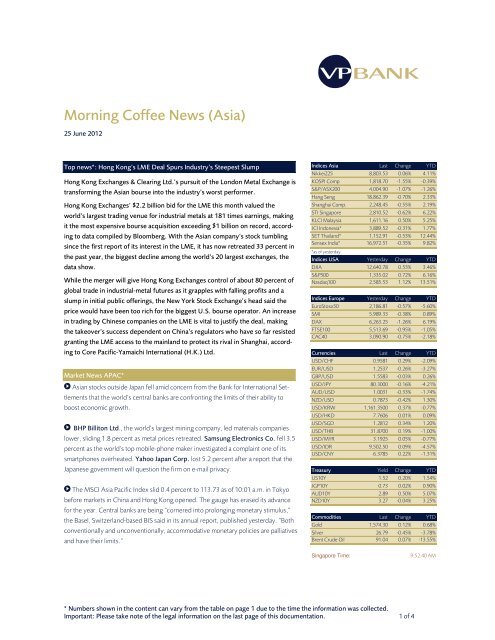

Indices <strong>Asia</strong> Last Change YTD<br />

Nikkei225 8,803.53 0.06% 4.11%<br />

KOSPI Comp 1,818.70 -1.55% -0.39%<br />

S&P/ASX200 4,004.90 -1.07% -1.26%<br />

Hang Seng 18,862.39 -0.70% 2.33%<br />

Shanghai Comp. 2,248.45 -0.55% 2.19%<br />

STI Singapore 2,810.52 -0.62% 6.22%<br />

KLCI Malaysia 1,611.16 0.50% 5.25%<br />

JCI Indonesia* 3,889.52 -0.31% 1.77%<br />

SET Thailand* 1,152.91 -0.53% 12.44%<br />

Sensex India* 16,972.51 -0.35% 9.82%<br />

*as of yesterday<br />

Indices USA Yesterday Change YTD<br />

DJIA 12,640.78 0.53% 3.46%<br />

S&P500 1,335.02 0.72% 6.16%<br />

Nasdaq100 2,585.53 1.12% 13.51%<br />

Indices Europe Yesterday Change YTD<br />

EuroStoxx50 2,186.81 -0.57% -5.60%<br />

SMI 5,989.33 -0.38% 0.89%<br />

DAX 6,263.25 -1.26% 6.19%<br />

FTSE100 5,513.69 -0.95% -1.05%<br />

CAC40 3,090.90 -0.75% -2.18%<br />

Currencies Last Change YTD<br />

USD/CHF 0.9581 0.29% -2.09%<br />

EUR/USD 1.2537 -0.26% -3.27%<br />

GBP/USD 1.5583 -0.03% 0.26%<br />

USD/JPY 80.3000 -0.16% -4.21%<br />

AUD/USD 1.0031 -0.33% -1.74%<br />

NZD/USD 0.7873 -0.42% 1.30%<br />

USD/KRW 1,161.3500 0.37% -0.77%<br />

USD/HKD 7.7606 0.01% 0.09%<br />

USD/SGD 1.2812 0.34% 1.20%<br />

USD/THB 31.8700 0.19% -1.00%<br />

USD/MYR 3.1925 0.05% -0.77%<br />

USD/IDR 9,502.50 0.09% -4.57%<br />

USD/CNY 6.3785 0.22% -1.31%<br />

Treasury Yield Change YTD<br />

US10Y 1.52 0.20% 1.54%<br />

JGP10Y 0.73 0.02% 0.90%<br />

AUD10Y 2.89 0.50% 5.07%<br />

NZD10Y 3.27 -0.04% 3.25%<br />

Commodities Last Change YTD<br />

Gold 1,574.30 0.12% 0.68%<br />

Silver 26.79 -0.45% -3.78%<br />

Brent Crude Oil 91.04 0.07% -13.55%<br />

Singapore Time: 9:52:40 AM<br />

* Numbers shown in the content can vary from the table on page 1 due to the time the information was collected.<br />

Important: Please take note of the legal information on the last page of this documentation. 1 of 4

What to Watch*<br />

<strong>News</strong> Corp.’s AUD 2 billion bid for ConsMedia faces challenge from No. 2 stakeholder Seven Group, which says it too may<br />

make offer<br />

Samsung is investigating customer complaint that its newest Galaxy phone overheated & caught fire; co. briefing at 8 am HKT<br />

India’s govt & central bank will today outline steps to support falling rupee, finance minister says; note PTI reports govt may<br />

fund public projects, helping to cut deficit<br />

drop<br />

BHP & Rio’s FY13 profit estimates were cut at UBS, which sees Australia levying heavier mining taxes as commodity prices<br />

Hon Hai says it will take USD 214 million loss on its purchase of stake in Sharp<br />

Chinese officials may be falsifying economic data to hide true degree of slowdown, NYT says, citing corporate execs<br />

Qatar wants to invest up to $5b, mainly in A-shrs, through newly China’s newly expanded QFII program, CSJ reports<br />

Aeon may create REIT that would raise up to 200 billion yen (USD 2.5 billion) through IPO this yr, Nikkei reports, without<br />

citing anyone<br />

Investment banks, brokers are said top have launched round of job cuts across <strong>Asia</strong>, mostly in equities, with more layoffs<br />

coming, Reuters reports<br />

PepsiCo is exploring loosened restrictions on investing in Myanmar as Coca-Cola plans its return to <strong>Asia</strong>n nation<br />

Oil & gas cos. are curtailing output in Gulf of Mexico today as Tropical Storm Debby approaches<br />

Bank for Intl Settlements says central banks are approaching limit of what monetary stimulus can do to help economies<br />

Greece’s new leaders want EU to relent on demands for govt-job cuts, higher tax collections; troika has canceled visit planned<br />

for today<br />

Key Economic Event for this week (Last update on 25/06/12)<br />

Country Event/Data For Bloomberg Consensus Previous<br />

Monday, 25 June 2012<br />

Singapore CPI yoy % Jun 7.5 8.3<br />

Taiwan Commercial Sales yoy % May 5.1 5.4<br />

Taiwan Industrial Production yoy % May n.a. -2.4<br />

Tuesday, 26 June 2012<br />

Philippines Trade balance USD bn Apr n.a. -1.1<br />

Singapore Industrial production yoy % May 6.1 -0.3<br />

Hong Kong Trade balance HKD bn May n.a. -42.9<br />

Wednesday, 27 June 2012<br />

New Zealand Trade balance NZD mn May 300 355<br />

Thursday, 28 June 2012<br />

Japan Manufacturing PMI Jun n.a. 50.7<br />

Japan Retail Trade yoy % May 3.0 5.7<br />

Thailand Manufacturing Production Index May 2.5 0.5<br />

Friday, 29 June 2012<br />

Korea Industrial production yoy % May 0.5 0<br />

Japan Jobless rate % May 4.5 4.6<br />

Japan CPI yoy % May 0.2 0.4<br />

Japan Industrial production –prelim yoy % May 6.6 12.9<br />

China HSBC Manufacturing PMI Jun n.a. 48<br />

* Numbers shown in the content can vary from the table on page 1 due to the time the information was collected.<br />

Important: Please take note of the legal information on the last page of this documentation. 2 of 4

Earnings Releases (Singapore Time)<br />

• Aeon Credit Serv (8570 JP) 1Q<br />

• Aeon Mall Co Ltd (8905 JP) 1Q<br />

• J Front Retailing (3086 JP) 1Q 11:30am<br />

• Takashimaya Co (8233 JP) 1Q 12:30pm<br />

IPO Notice<br />

• No major IPOs scheduled<br />

New Bond Issues<br />

• Lippo Malls Indonesia has set up a S$ EMTN.<br />

• Yieh Phui Enterprise Co Ltd is planning CNH Issue<br />

• Swire Holding Ltd to issued S$ 4year bonds around 7%.<br />

Recent <strong>Asia</strong>n Bond Issues<br />

Date Issuer<br />

Ratings<br />

S&P/Moody’s/Fitch Size<br />

Tenor<br />

(Years) Pricing<br />

22-Jun-12 Veoila Environment SA BBB+/Baa1/BBB+ RMB 500mn 5yr 4.7%<br />

22-Jun-12 First Pacific Co Ltd NR/NR/NR USD 400mn 7yr 6%<br />

22-Jun-12 Housing and Development<br />

Board<br />

NR/NR/NR SGD 585mn 12yr 2.505%<br />

21-Jun-12 IOI Corporation Bhd BBB+/Baa1/BBB+ USD 600mn 10yr 4.464%<br />

19-Jun-12 Frasers Centrepoint Ltd NR/NR/NR SGD 50mn 10yr 3.8%<br />

19-Jun-12 Korea Exchange Bank A-/A2/A- USD 700mn 5yr CT5 + 255bp<br />

19-Jun-12 Hang Lung Properties Ltd NR/NR/NR USD 500mn 10yr CT10 + 335bp<br />

* Numbers shown in the content can vary from the table on page 1 due to the time the information was collected.<br />

Important: Please take note of the legal information on the last page of this documentation. 3 of 4

Contacts<br />

VP Bank (Singapore) Ltd.<br />

Thomas Rupf, CFA, FRM, CAIA Tom Chen, CFP<br />

Head of Investment & Trading <strong>Asia</strong> Investment Advisor<br />

Tel +65 6305 0072, Fax +65 6305 0052 Tel +65 6305 0070, Fax +65 6305 0052<br />

thomas.rupf @vpbank.com tom.chen@vpbank.com<br />

Source: Bloomberg, unless otherwise stated<br />

VP Bank (Singapore) Ltd.<br />

9 Raffles Place<br />

#49-01 Republic Plaza<br />

Singapore 048919<br />

Disclaimer<br />

General: This document was produced by VP Bank (Singapore) Ltd. (hereinafter referred to as VP Bank) using sources that are believed to be reliable. It is intended solely for information<br />

purposes, and the utmost care has been exercised in its production. However, VP Bank does not warrant either expressly or tacitly that the contents of this document are complete, up-to-date or<br />

correct. In particular, the information in this document may not include all relevant information regarding financial instruments or their issuers. The sources for the information in this document<br />

may include national and international media, information services (e.g. Reuters, Bloomberg), publicly accessible databanks, publicly available corporate information, the publications of rating<br />

agencies, and information from companies (notably issuers, lead managers, co-managers, guarantors and sellers of financial instruments) with which VP Bank and/or its subsidiaries may have a<br />

business relationship relating to the products mentioned in this document or other business relationships. The opinions expressed in this document reflect the opinions of VP Bank on the date<br />

stated in the document. It is possible that VP Bank and/or its subsidiaries have published in the past or will publish in the future documents that contain information and opinions that do not<br />

accord with those in this document. VP Bank and/or its subsidiaries are not obliged to provide recipients of this document with such documents offering different information or opinions.<br />

Suitability / Not an Offer: The information contained in this document does not constitute a recommendation to buy, hold or sell the financial instruments described herein, nor does it<br />

constitute advice on legal, financial, accountancy or taxation matters or any form of personal advice. In particular, the financial instruments discussed in this document may be unsuitable for an<br />

investor on the basis of his/her investment objective, time horizon, risk-tolerance, financial situation or other personal circumstances. It may be the case that financial instruments described in this<br />

document (in particular investment funds, exchange-traded funds and certificates) are not authorized for sale in every country. The information provided in this document is therefore in no way a<br />

substitute for individual advice by a specialist qualified in the matters referred to or a substitute for perusal of the documents provided by the issuers and sellers of the financial instruments (e.g.<br />

issue prospectuses, term sheets, etc.). In particular, this document does not constitute an offer, a solicitation to make an offer or a public advertisement inviting participation in transactions<br />

involving the financial instruments described herein or an invitation to enter into any transaction. VP Bank and its subsidiaries expressly refuse to accept any liability for any detriment or loss that<br />

is claimed to have been incurred on the basis of information contained in this document.<br />

Notes on risk: The price and value of the investments mentioned in this document and the returns achieved on these investments may rise or fall. No assurance can be given to investors that<br />

they will recover the amounts that they investimate The past performance of an investment is not a reliable indicator of future performance. The same remarks apply to performance forecasts.<br />

Any investment mentioned in this document may involve the following risks: issuer (creditworthiness) risk, market risk, credit risk, liquidity risk, interest rate risk, currency risk, economic risk and<br />

political risk. Investments in emerging markets are speculative and particularly strongly exposed to such risks. This list of risks should not be regarded as exhaustive.<br />

Notes on VP Bank Investment Funds: VP Bank investment funds are managed by managers of VP Bank. Mention of these funds does not constitute a recommendation by VP Bank to buy<br />

these funds. The current full prospectus, simplified prospectus and annual and half-year reports may be obtained free of charge at Verwaltungs- und Privat-Bank Aktiengesellschaft, Aeulestrasse<br />

6, LI-9490 Vaduz and IFOS Internationale Fonds Service AG, Aeulestrasse 6, LI-9490 Vaduz. Up-to-date information can be accessed at any time on the homepage of VP Bank at<br />

www.vpbank.com or the homepage of IFOS Internationale Fonds Service AG at www.ifos.li. Only some of these funds are authorized for public sale outside Liechtenstein. Sales authorizations<br />

are stated in the individual prospectuses and are subject to the laws and regulations of the country concerned. Citizens or residents of the US may not acquire these funds. A positive performance<br />

in the past is no guarantee of a positive performance in the future. The risk of capital losses and/or currency losses cannot be ruled out. It is possible that investors will not recover the full<br />

amount of their investment. The performance data do not take account of any commissions and costs payable on the issue and redemption of units. The information in this document does not<br />

constitute an offer. It serves merely as information.<br />

Other information: To the extent permitted by law, VP Bank and/or its subsidiaries may participate in other financial transactions with the issuers of assets mentioned in this document. They<br />

may invest in these issuers or render services to them, acquire orders from them, hold positions in their assets or in options on those assets, carry out transactions in these positions, or have<br />

another substantial interests relating to the issuers of assets mentioned in this document. Such actions or situations may already have occurred in the past. Employees of VP Bank who are<br />

involved in the production of this document are free to buy, hold or sell the assets discussed in this document. The contents of this publication are protected by copyright, and any utilization<br />

other than private use requires the prior authorization of VP Bank.<br />

Notes on the distribution of this document: This document may be distributed only in countries in which its distribution is permitted by law. Thus the contents of this document are not<br />

intended for persons subject to a jurisdiction that prohibits the dissemination of, access to or use of this document or makes such dissemination, access or use subject to authorization, whether<br />

on the basis of the nationality or residence of the person concerned or for other reasons. Persons who come into possession of this document or gain knowledge of its contents must therefore<br />

acquaint themselves with local laws and restrictions and abide by them.<br />

Germany: This document was produced by VP Bank (Singapore) Ltd. and distributed by VP Vermögensverwaltung GmbH, Theatinerstrasse 12, DE-80333 Munich. VP Vermögensverwaltung<br />

GmbH is subject to authorization and regulation by the German Federal Financial Supervisory Authority (BaFin). VP Bank (Singapore) Ltd. is licensed as a merchant bank by the Monetary<br />

Authority of Singapore.<br />

Hong Kong: This information has been distributed by VP Wealth Management (Hong Kong) Ltd. Related financial products or services are only available to wholesale clients with liquid assets of<br />

over USD 1 million that meet the regulatory criteria and the Company’s policy to be a client, and who have sufficient financial experience and understanding to participate in financial markets in a<br />

wholesale jurisdiction. VP Wealth Management (Hong Kong) Ltd. is a licensed corporation under the Securities and Futures Ordinance (Cap. 571) and regulated by the Securities and Futures<br />

Commission (SFC).<br />

Luxembourg: This document was produced by VP Bank (Singapore) Ltd. and distributed by VP Bank (Luxembourg) S.A., Avenue de la Liberté 26, LU-1930 Luxembourg. VP Bank (Luxembourg)<br />

S.A. is subject to authorization and regulation by the Luxembourg Commission de Surveillance du Secteur Financier (CSSF). VP Bank (Singapore) Ltd. is licensed as a merchant bank by the<br />

Monetary Authority of Singapore.<br />

Singapore: This document is distributed by VP Bank (Singapore) Ltd., which is licensed as a merchant bank by the Monetary Authority of Singapore.<br />

Switzerland: This document was produced by VP Bank (Singapore) Ltd., and distributed by VP Bank (Schweiz) AG, Bahnhofstrasse 3, 8022 Zurich. VP Bank (Singapore) Ltd. is licensed as a<br />

merchant bank by the Monetary Authority of Singapore. VP Bank (Schweiz) AG is subject to authorization and regulation by the Swiss Financial Market Supervisory Authority (FINMA).<br />

US/UK/Canada: This document or copies thereof may not be delivered to persons who are resident in the US, UK or Canada or who are citizens of one or more of these countries.<br />

* Numbers shown in the content can vary from the table on page 1 due to the time the information was collected.<br />

Important: Please take note of the legal information on the last page of this documentation. 4 of 4