2012 Annual Report - Racing NSW

2012 Annual Report - Racing NSW

2012 Annual Report - Racing NSW

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

INSURANCE<br />

WORKers COMpensation<br />

<strong>Racing</strong> <strong>NSW</strong> is a specialised insurer licensed under the provisions<br />

of the Workers Compensation Act 1987 (<strong>NSW</strong>) (“the Act”) to<br />

provide workers compensation insurance to certain employers<br />

(racing clubs and licensed trainers) in the <strong>NSW</strong> Thoroughbred<br />

<strong>Racing</strong> Industry.<br />

Additionally, <strong>Racing</strong> <strong>NSW</strong> administers the run-off of claims<br />

under the former self-insurance licence which covered employees<br />

of <strong>Racing</strong> <strong>NSW</strong> prior to 30 June 1998.<br />

The <strong>Racing</strong> <strong>NSW</strong> Insurance Fund (“the Fund”) has been<br />

managed internally since 1 July 2006. All claims management,<br />

injury management, financial and administrative functions of the<br />

Fund are performed by an in-house team.<br />

The object of the Fund is to provide affordable insurance to<br />

participants and deliver industry-specific claims, injury and risk<br />

management services to assist employers and injured workers in<br />

what is a unique and inherently dangerous industry.<br />

2011/12 Financial Performance<br />

The Fund experienced a $1.44 million profit for <strong>2012</strong>. This result<br />

effectively extinguishes the loss of $1.5 million experienced for the<br />

2010/11 year and is largely attributable to the following factors:-<br />

●●<br />

●●<br />

●●<br />

●●<br />

●●<br />

Natalie Tipping<br />

General Manager –<br />

Insurance<br />

There was a 5% decrease in the incidence of new claims<br />

compared with the previous claim year. It is also pleasing to<br />

report that no claims were received during 2011/12 which<br />

could be classified as catastrophic;<br />

Investment income rose by approximately $300,000 compared<br />

to the 2010/11 performance;<br />

Payments made for medical and related expenses were almost<br />

exclusively confined to treatment incurred during the 2011/12<br />

year. This differed from the experience during 2010/11 when<br />

a large number of payments for medical expenses related to<br />

treatment incurred during prior years;<br />

Significant reductions were experienced in legal expenses and<br />

payments to other external service providers;<br />

Continuing improvements were achieved in return to work<br />

outcomes which led to the earlier finalisation of many claims<br />

and helped contain claims costs.<br />

In reversing the financial performance of the 2010/11 year, in<br />

2011/12 the Fund returned to financial neutrality which contained<br />

premium costs for the Fund’s employers.<br />

The actuarial central estimate of <strong>Racing</strong> <strong>NSW</strong>’s outstanding<br />

workers compensation claims liability as at 30 June <strong>2012</strong> is $33.6<br />

million (net of reinsurance recoveries and including an allowance<br />

John Galvin<br />

General Manager –<br />

Workers Compensation<br />

for claims handling expenses).<br />

The estimate of the outstanding claims liability includes an<br />

allowance for future inflation of claims payments (at 4.00%<br />

p.a. – down 0.5% from 2011) and is discounted (at 3.6% p.a.<br />

– significantly reduced from 5.35% in 2011) to allow for future<br />

investment income earned between the valuation date and<br />

expected payment date.<br />

These external economic influences adversely impacted the<br />

actuarial valuation with the actuaries reporting that lower discount<br />

rate increased liability by $4.6 million.<br />

The impact of these external influences was offset by of a raft<br />

of changes to <strong>NSW</strong> workers compensation legislation which is<br />

anticipated to reduce the Fund’s future exposure.<br />

These legislative changes were estimated to decrease liability<br />

by $7.1 million. Further relief was obtained from the reduction in<br />

the inflation rate which was estimated to reduce overall liability<br />

by $1.1 million.<br />

The net provision for outstanding claims liability inclusive of<br />

20% prudential margin as at 30 June <strong>2012</strong> is $40.3 million (0.25%<br />

increase of $100,000 from the 2011 provision of $40.2 million).<br />

The actuarial provision of outstanding claims liability at 30 June<br />

<strong>2012</strong> was $3.4 million lower than the projected estimate of $43.7<br />

million from the 2011 actuarial valuation.<br />

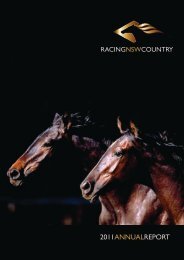

Summary of Actuarial Estimate of<br />

Outstanding Claims Liabilities<br />

Estimate of<br />

Liability as at<br />

30 June <strong>2012</strong><br />

($m)<br />

Projected<br />

Estimate of<br />

Liability as at<br />

30 June <strong>2012</strong><br />

(2011<br />

Valuation)<br />

($m)<br />

Estimate of<br />

Liability as at<br />

30 June 2011<br />

($m)<br />

Projected<br />

Estimate of<br />

Liability as at<br />

30 June 2013<br />

(<strong>2012</strong><br />

Valuation)<br />

($m)<br />

Net Central<br />

33.6 36.4 33.5 36.5<br />

Estimate 1<br />

Risk Margin 6.7 7.3 6.7 7.3<br />

Outstanding<br />

40.3 43.7 40.2 43.8<br />

Claims Provision 2<br />

1 Including claims handling expense and net of reinsurance and<br />

other recoveries<br />

2 Including risk margin of 20% of the net central estimate<br />

32<br />

<strong>Racing</strong> <strong>NSW</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>