2012 Annual Report - Racing NSW

2012 Annual Report - Racing NSW

2012 Annual Report - Racing NSW

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

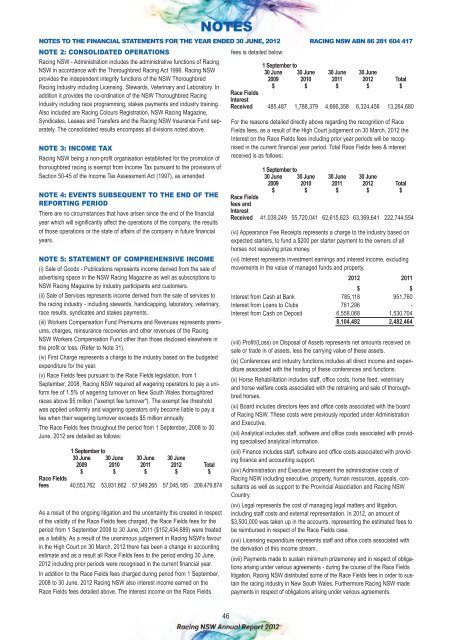

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 JUNE, <strong>2012</strong> RACING <strong>NSW</strong> ABN 86 281 604 417<br />

NOTE 2: CONSOLIDATED OPERATIONS<br />

fees is detailed below:<br />

<strong>Racing</strong> <strong>NSW</strong> - Administration includes the administrative functions of <strong>Racing</strong><br />

<strong>NSW</strong> in accordance with the Thoroughbred <strong>Racing</strong> Act 1996. <strong>Racing</strong> <strong>NSW</strong><br />

provides the independent integrity functions of the <strong>NSW</strong> Thoroughbred<br />

<strong>Racing</strong> Industry including Licensing, Stewards, Veterinary and Laboratory. In<br />

addition it provides the co-ordination of the <strong>NSW</strong> Thoroughbred <strong>Racing</strong><br />

Industry including race programming, stakes payments and industry training.<br />

Also included are <strong>Racing</strong> Colours Registration, <strong>NSW</strong> <strong>Racing</strong> Magazine,<br />

Syndicates, Leases and Transfers and the <strong>Racing</strong> <strong>NSW</strong> Insurance Fund separately.<br />

The consolidated results encompass all divisions noted above.<br />

NOTE 3: INCOME TAX<br />

<strong>Racing</strong> <strong>NSW</strong> being a non-profit organisation established for the promotion of<br />

thoroughbred racing is exempt from Income Tax pursuant to the provisions of<br />

Section 50-45 of the Income Tax Assessment Act (1997), as amended.<br />

NOTE 4: EVENTS SUBSEQUENT TO THE END OF THE<br />

REPORTING PERIOD<br />

There are no circumstances that have arisen since the end of the financial<br />

year which will significantly affect the operations of the company, the results<br />

of those operations or the state of affairs of the company in future financial<br />

years.<br />

NOTE 5: STATEMENT OF COMPREHENSIVE INCOME<br />

(i) Sale of Goods - Publications represents income derived from the sale of<br />

advertising space in the <strong>NSW</strong> <strong>Racing</strong> Magazine as well as subscriptions to<br />

<strong>NSW</strong> <strong>Racing</strong> Magazine by industry participants and customers.<br />

(ii) Sale of Services represents income derived from the sale of services to<br />

the racing industry - including stewards, handicapping, laboratory, veterinary,<br />

race results, syndicates and stakes payments.<br />

(iii) Workers Compensation Fund Premiums and Revenues represents premiums,<br />

charges, reinsurance recoveries and other revenues of the <strong>Racing</strong><br />

<strong>NSW</strong> Workers Compensation Fund other than those disclosed elsewhere in<br />

the profit or loss. (Refer to Note 31).<br />

(iv) First Charge represents a charge to the industry based on the budgeted<br />

expenditure for the year.<br />

(v) Race Fields fees pursuant to the Race Fields legislation, from 1<br />

September, 2008, <strong>Racing</strong> <strong>NSW</strong> required all wagering operators to pay a uniform<br />

fee of 1.5% of wagering turnover on New South Wales thoroughbred<br />

races above $5 million ("exempt fee turnover"). The exempt fee threshold<br />

was applied uniformly and wagering operators only become liable to pay a<br />

fee when their wagering turnover exceeds $5 million annually.<br />

The Race Fields fees throughout the period from 1 September, 2008 to 30<br />

June, <strong>2012</strong> are detailed as follows:<br />

1 September to<br />

30 June 30 June 30 June 30 June<br />

2009 2010 2011 <strong>2012</strong> Total<br />

$ $ $ $ $<br />

Race Fields<br />

fees 40,553,762 53,931,662 57,949,265 57,045,185 209,479,874<br />

As a result of the ongoing litigation and the uncertainty this created in respect<br />

of the validity of the Race Fields fees charged, the Race Fields fees for the<br />

period from 1 September 2008 to 30 June, 2011 ($152,434,689) were treated<br />

as a liability. As a result of the unanimous judgement in <strong>Racing</strong> <strong>NSW</strong>'s favour<br />

in the High Court on 30 March, <strong>2012</strong> there has been a change in accounting<br />

estimate and as a result all Race Fields fees to the period ending 30 June,<br />

<strong>2012</strong> including prior periods were recognised in the current financial year.<br />

In addition to the Race Fields fees charged during period from 1 September,<br />

2008 to 30 June, <strong>2012</strong> <strong>Racing</strong> <strong>NSW</strong> also interest income earned on the<br />

Race Fields fees detailed above. The interest income on the Race Fields<br />

NOTES<br />

1 September to<br />

30 June 30 June 30 June 30 June<br />

2009 2010 2011 <strong>2012</strong> Total<br />

$ $ $ $ $<br />

Race Fields<br />

Interest<br />

Received 485,487 1,788,379 4,666,358 6,324,456 13,264,680<br />

For the reasons detailed directly above regarding the recognition of Race<br />

Fields fees, as a result of the High Court judgement on 30 March, <strong>2012</strong> the<br />

Interest on the Race Fields fees including prior year periods will be recognised<br />

in the current financial year period. Total Race Fields fees & interest<br />

received is as follows:<br />

1 September to<br />

30 June 30 June 30 June 30 June<br />

2009 2010 2011 <strong>2012</strong> Total<br />

$ $ $ $ $<br />

Race Fields<br />

fees and<br />

Interest<br />

Received 41,039,249 55,720,041 62,615,623 63,369,641 222,744,554<br />

(vi) Appearance Fee Receipts represents a charge to the industry based on<br />

expected starters, to fund a $200 per starter payment to the owners of all<br />

horses not receiving prize money.<br />

(vii) Interest represents investment earnings and interest income, excluding<br />

movements in the value of managed funds and property.<br />

<strong>2012</strong> 2011<br />

$ $<br />

Interest from Cash at Bank 785,118 951,760<br />

Interest from Loans to Clubs 761,296 -<br />

Interest from Cash on Deposit 6,558,068 1,530,704<br />

8,104,482 2,482,464<br />

(viii) Profit/(Loss) on Disposal of Assets represents net amounts received on<br />

sale or trade in of assets, less the carrying value of these assets.<br />

(ix) Conferences and industry functions includes all direct income and expenditure<br />

associated with the hosting of these conferences and functions.<br />

(x) Horse Rehabilitation includes staff, office costs, horse feed, veterinary<br />

and horse welfare costs associated with the retraining and sale of thoroughbred<br />

horses.<br />

(xi) Board includes directors fees and office costs associated with the board<br />

of <strong>Racing</strong> <strong>NSW</strong>. These costs were previously reported under Administration<br />

and Executive.<br />

(xii) Analytical includes staff, software and office costs associated with providing<br />

specialised analytical information.<br />

(xiii) Finance includes staff, software and office costs associated with providing<br />

finance and accounting support.<br />

(xiv) Administration and Executive represent the administrative costs of<br />

<strong>Racing</strong> <strong>NSW</strong> including executive, property, human resources, appeals, consultants<br />

as well as support to the Provincial Association and <strong>Racing</strong> <strong>NSW</strong><br />

Country.<br />

(xv) Legal represents the cost of managing legal matters and litigation,<br />

including staff costs and external representation. In <strong>2012</strong>, an amount of<br />

$3,500,000 was taken up in the accounts, representing the estimated fees to<br />

be reimbursed in respect of the Race Fields case.<br />

(xvi) Licensing expenditure represents staff and office costs associated with<br />

the derivation of this income stream.<br />

(xvii) Payments made to sustain minimum prizemoney and in respect of obligations<br />

arising under various agreements - during the course of the Race Fields<br />

litigation, <strong>Racing</strong> <strong>NSW</strong> distributed some of the Race Fields fees in order to sustain<br />

the racing industry in New South Wales. Furthermore <strong>Racing</strong> <strong>NSW</strong> made<br />

payments in respect of obligations arising under various agreements.<br />

46