- Page 1 and 2:

Deutsche Bahn 2010 Annual Report

- Page 3 and 4:

DB Group’s business units DB BAHN

- Page 5 and 6:

BACK ON TRACK DB Group after the ec

- Page 7 and 8:

95,000 EMPLOYEES IN EUROPE DENMARK

- Page 9 and 10:

No. 2 in rail passenger transport i

- Page 11 and 12:

91,000 EMPLOYEES AROUND THE WORLD 1

- Page 13 and 14:

No. 2 in global air freight 1,229 1

- Page 15 and 16:

49,600 EMPLOYEES IN GERMANY EC/ IC/

- Page 17 and 18:

PASSENGER STATIONS 5,700 IN GERMANY

- Page 19 and 20:

DB Group has been one of the bigges

- Page 21 and 22:

FROM THE FIRST RUN OF THE ADLER IN

- Page 23 and 24:

04 GROUP MANAGEMENT REPORT 56 OVERV

- Page 25 and 26:

| CHAIRMAN’S LETTER 21 Chairman

- Page 27 and 28:

| MANAGEMENT BOARD 23

- Page 29 and 30:

PROFESSOR DR. DR. UTZ-HELLMUTH FELC

- Page 31 and 32:

| REPORT OF THE SUPERVISORY BOARD 2

- Page 33 and 34:

| CORPORATE GOVERNANCE REPORT 29 An

- Page 35 and 36:

| CORPORATE GOVERNANCE REPORT 31 AC

- Page 37 and 38:

| CORPORATE GOVERNANCE REPORT 33 To

- Page 40 and 41:

03 GROUP INFORMATION FINANCIAL COMM

- Page 42 and 43:

38 | DEUTSCHE BAHN GROUP Financial

- Page 44 and 45:

40 | DEUTSCHE BAHN GROUP Compliance

- Page 46 and 47:

42 | DEUTSCHE BAHN GROUP Deutsche B

- Page 48 and 49:

44 | DEUTSCHE BAHN GROUP Annual rev

- Page 50 and 51:

46 | DEUTSCHE BAHN GROUP JULY AUGUS

- Page 52 and 53:

48 | DEUTSCHE BAHN GROUP Group prof

- Page 54 and 55:

50 | DEUTSCHE BAHN GROUP active in

- Page 56 and 57:

52 | DEUTSCHE BAHN GROUP Transport

- Page 58 and 59:

54 | DEUTSCHE BAHN GROUP Services D

- Page 60 and 61:

04 GROUP MANAGEMENT REPORT OVERVIEW

- Page 62 and 63:

58 | DEUTSCHE BAHN GROUP Overview a

- Page 64 and 65:

60 | DEUTSCHE BAHN GROUP Business a

- Page 66 and 67:

62 | DEUTSCHE BAHN GROUP The pace o

- Page 68 and 69:

64 | DEUTSCHE BAHN GROUP POLITICAL

- Page 70 and 71:

66 | DEUTSCHE BAHN GROUP STRUCTURIN

- Page 72 and 73:

68 | DEUTSCHE BAHN GROUP Freight tr

- Page 74 and 75:

70 | DEUTSCHE BAHN GROUP notably im

- Page 76 and 77:

72 | DEUTSCHE BAHN GROUP Business p

- Page 78 and 79:

74 | DEUTSCHE BAHN GROUP External r

- Page 80 and 81:

76 | DEUTSCHE BAHN GROUP Special it

- Page 82 and 83:

78 | DEUTSCHE BAHN GROUP The adjust

- Page 84 and 85:

80 | DEUTSCHE BAHN GROUP The purpos

- Page 86 and 87:

82 | DEUTSCHE BAHN GROUP TENDERS IN

- Page 88 and 89:

84 | DEUTSCHE BAHN GROUP IC DOUBLE-

- Page 90 and 91:

86 | DEUTSCHE BAHN GROUP Gross capi

- Page 92 and 93:

88 | DEUTSCHE BAHN GROUP DB Arriva

- Page 94 and 95:

90 | DEUTSCHE BAHN GROUP DB Schenke

- Page 96 and 97:

92 | DEUTSCHE BAHN GROUP BUSINESS D

- Page 98 and 99:

94 | DEUTSCHE BAHN GROUP personnel

- Page 100 and 101:

96 | DEUTSCHE BAHN GROUP DB Netze E

- Page 102 and 103:

98 | DEUTSCHE BAHN GROUP CASH FLOW

- Page 104 and 105:

100 | DEUTSCHE BAHN GROUP CAPITAL E

- Page 106 and 107:

102 | DEUTSCHE BAHN GROUP The DB Ne

- Page 108 and 109:

104 | DEUTSCHE BAHN GROUP Strategy

- Page 110 and 111:

106 | DEUTSCHE BAHN GROUP Climate c

- Page 112 and 113:

108 | DEUTSCHE BAHN GROUP DB Bahn R

- Page 114 and 115:

110 | DEUTSCHE BAHN GROUP Against t

- Page 116 and 117:

112 | DEUTSCHE BAHN GROUP Employees

- Page 118 and 119:

114 | DEUTSCHE BAHN GROUP SUSTAINAB

- Page 120 and 121:

116 | DEUTSCHE BAHN GROUP GROUP-WID

- Page 122 and 123:

118 | DEUTSCHE BAHN GROUP Technolog

- Page 124 and 125:

120 | DEUTSCHE BAHN GROUP PROCUREME

- Page 126 and 127:

122 | DEUTSCHE BAHN GROUP of wheel

- Page 128 and 129:

124 | DEUTSCHE BAHN GROUP Risk repo

- Page 130 and 131:

126 | DEUTSCHE BAHN GROUP Due to th

- Page 132 and 133:

128 | DEUTSCHE BAHN GROUP Regulator

- Page 134 and 135: 130 | DEUTSCHE BAHN GROUP WAGE NEGO

- Page 136 and 137: 132 | DEUTSCHE BAHN GROUP We antici

- Page 138 and 139: 134 | DEUTSCHE BAHN GROUP We antici

- Page 140 and 141: 136 | DEUTSCHE BAHN GROUP Business

- Page 142 and 143: 138 | DEUTSCHE BAHN GROUP OPPORTUNI

- Page 144 and 145: 05 CONSOLIDATED FINANCIAL STATEMENT

- Page 146 and 147: 142 | DEUTSCHE BAHN GROUP Auditorʼ

- Page 148 and 149: 144 | DEUTSCHE BAHN GROUP Consolida

- Page 150 and 151: 146 | DEUTSCHE BAHN GROUP Consolida

- Page 152 and 153: 148 | DEUTSCHE BAHN GROUP Notes to

- Page 154 and 155: 150 | DEUTSCHE BAHN GROUP BASIC PRI

- Page 156 and 157: 152 | DEUTSCHE BAHN GROUP B) STANDA

- Page 158 and 159: 154 | DEUTSCHE BAHN GROUP is taken

- Page 160 and 161: 156 | DEUTSCHE BAHN GROUP a On Janu

- Page 162 and 163: 158 | DEUTSCHE BAHN GROUP Purchase

- Page 164 and 165: 160 | DEUTSCHE BAHN GROUP The dispo

- Page 166 and 167: 162 | DEUTSCHE BAHN GROUP Aggregate

- Page 168 and 169: 164 | DEUTSCHE BAHN GROUP CURRENCY

- Page 170 and 171: 166 | DEUTSCHE BAHN GROUP C) INTANG

- Page 172 and 173: 168 | DEUTSCHE BAHN GROUP Asset imp

- Page 174 and 175: 170 | DEUTSCHE BAHN GROUP Interest-

- Page 176 and 177: 172 | DEUTSCHE BAHN GROUP N) DERIVA

- Page 178 and 179: 174 | DEUTSCHE BAHN GROUP The capit

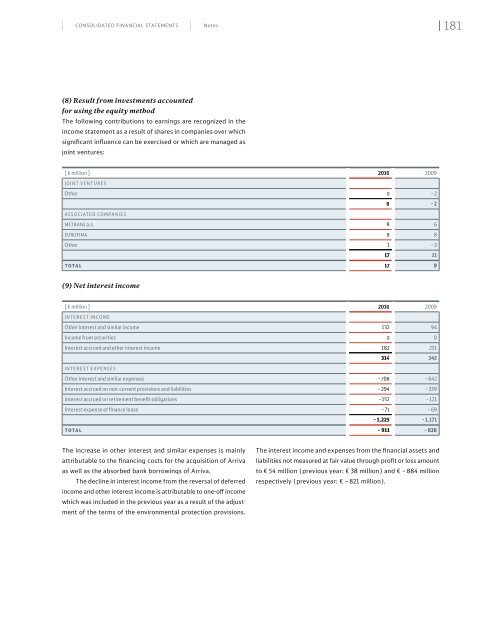

- Page 180 and 181: 176 | DEUTSCHE BAHN GROUP NOTES TO

- Page 182 and 183: 178 | DEUTSCHE BAHN GROUP (4) Cost

- Page 186 and 187: 182 | DEUTSCHE BAHN GROUP (10) Othe

- Page 188 and 189: 184 | DEUTSCHE BAHN GROUP NOTES TO

- Page 190 and 191: 186 | DEUTSCHE BAHN GROUP Impairmen

- Page 192 and 193: 188 | DEUTSCHE BAHN GROUP (14) Inta

- Page 194 and 195: 190 | DEUTSCHE BAHN GROUP (15) Inve

- Page 196 and 197: 192 | DEUTSCHE BAHN GROUP (17) Avai

- Page 198 and 199: 194 | DEUTSCHE BAHN GROUP Individua

- Page 200 and 201: 196 | DEUTSCHE BAHN GROUP The volum

- Page 202 and 203: 198 | DEUTSCHE BAHN GROUP The follo

- Page 204 and 205: 200 | DEUTSCHE BAHN GROUP (22) Cash

- Page 206 and 207: 202 | DEUTSCHE BAHN GROUP The follo

- Page 208 and 209: 204 | DEUTSCHE BAHN GROUP Bank borr

- Page 210 and 211: 206 | DEUTSCHE BAHN GROUP The posit

- Page 212 and 213: 208 | DEUTSCHE BAHN GROUP CATEGORIE

- Page 214 and 215: 210 | DEUTSCHE BAHN GROUP CATEGORIE

- Page 216 and 217: 212 | DEUTSCHE BAHN GROUP CATEGORIE

- Page 218 and 219: 214 | DEUTSCHE BAHN GROUP CATEGORIE

- Page 220 and 221: 216 | DEUTSCHE BAHN GROUP The finan

- Page 222 and 223: 218 | DEUTSCHE BAHN GROUP e) In add

- Page 224 and 225: 220 | DEUTSCHE BAHN GROUP Changes i

- Page 226 and 227: 222 | DEUTSCHE BAHN GROUP The follo

- Page 228 and 229: 224 | DEUTSCHE BAHN GROUP NOTES TO

- Page 230 and 231: 226 | DEUTSCHE BAHN GROUP Segment r

- Page 232 and 233: 228 | DEUTSCHE BAHN GROUP Foreign c

- Page 234 and 235:

230 | DEUTSCHE BAHN GROUP MATURITY

- Page 236 and 237:

232 | DEUTSCHE BAHN GROUP MATURITY

- Page 238 and 239:

234 | DEUTSCHE BAHN GROUP OTHER DIS

- Page 240 and 241:

236 | DEUTSCHE BAHN GROUP The trans

- Page 242 and 243:

238 | DEUTSCHE BAHN GROUP For the y

- Page 244 and 245:

240 | DEUTSCHE BAHN GROUP (40) Exem

- Page 246 and 247:

242 | DEUTSCHE BAHN GROUP Subsidiar

- Page 248 and 249:

244 | DEUTSCHE BAHN GROUP Subsidiar

- Page 250 and 251:

246 | DEUTSCHE BAHN GROUP Subsidiar

- Page 252 and 253:

248 | DEUTSCHE BAHN GROUP Subsidiar

- Page 254 and 255:

250 | DEUTSCHE BAHN GROUP Subsidiar

- Page 256 and 257:

252 | DEUTSCHE BAHN GROUP Subsidiar

- Page 258 and 259:

254 | DEUTSCHE BAHN GROUP Subsidiar

- Page 260 and 261:

256 | DEUTSCHE BAHN GROUP Subsidiar

- Page 262 and 263:

258 | DEUTSCHE BAHN GROUP (42) Mana

- Page 264 and 265:

260 | DEUTSCHE BAHN GROUP a Horst H

- Page 266 and 267:

06 ADDITIONAL INFORMATION DB ADVISO

- Page 268 and 269:

264 | DEUTSCHE BAHN GROUP DB Adviso

- Page 270 and 271:

266 | DEUTSCHE BAHN GROUP DB-SPECIF

- Page 272 and 273:

268 | DEUTSCHE BAHN GROUP Contacts

- Page 274 and 275:

[ € million ] 2010 2009 2008 2007

- Page 276:

Deutsche Bahn AG Potsdamer Platz 2