Annual Report 2002 - Roche

Annual Report 2002 - Roche

Annual Report 2002 - Roche

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The Group has partially covered its exposure to the conversion of the ‘Sumo’ Japanese yen<br />

exchangeable bonds and fully covered its exposure to the ‘LYONs V’ zero coupon US dollar<br />

exchangeable notes. This has been achieved using written short put options and purchased long<br />

call options at the same strike price, which have the combined effect of a forward purchase with<br />

a commitment of 2,971 million Swiss francs to repurchase non-voting equity securities. This is<br />

reported within debt at its discounted present value of 2,413 million Swiss francs (see Note 29).<br />

These transactions are supported by 673 million Swiss francs of collateral recorded as restricted<br />

cash in financial long-term assets (see Note 17).<br />

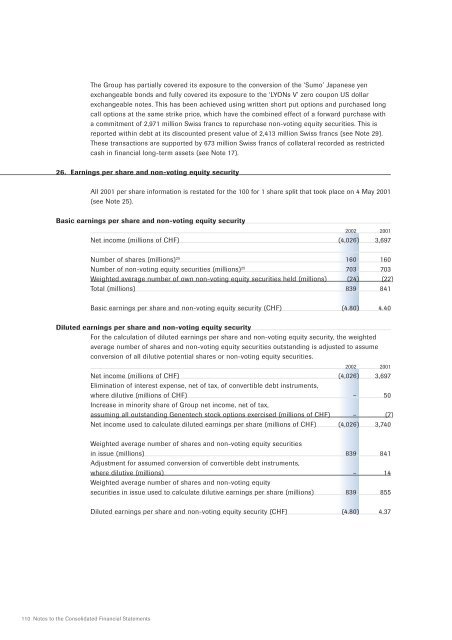

26. Earnings per share and non-voting equity security<br />

All 2001 per share information is restated for the 100 for 1 share split that took place on 4 May 2001<br />

(see Note 25).<br />

Basic earnings per share and non-voting equity security<br />

<strong>2002</strong> 2001<br />

Net income (millions of CHF) (4,026) 3,697<br />

Number of shares (millions) 25 160 160<br />

Number of non-voting equity securities (millions) 25 703 703<br />

Weighted average number of own non-voting equity securities held (millions) (24) (22)<br />

Total (millions) 839 841<br />

Basic earnings per share and non-voting equity security (CHF) (4.80) 4.40<br />

Diluted earnings per share and non-voting equity security<br />

For the calculation of diluted earnings per share and non-voting equity security, the weighted<br />

average number of shares and non-voting equity securities outstanding is adjusted to assume<br />

conversion of all dilutive potential shares or non-voting equity securities.<br />

<strong>2002</strong> 2001<br />

Net income (millions of CHF) (4,026) 3,697<br />

Elimination of interest expense, net of tax, of convertible debt instruments,<br />

where dilutive (millions of CHF) – 50<br />

Increase in minority share of Group net income, net of tax,<br />

assuming all outstanding Genentech stock options exercised (millions of CHF) – (7)<br />

Net income used to calculate diluted earnings per share (millions of CHF) (4,026) 3,740<br />

Weighted average number of shares and non-voting equity securities<br />

in issue (millions) 839 841<br />

Adjustment for assumed conversion of convertible debt instruments,<br />

where dilutive (millions) – 14<br />

Weighted average number of shares and non-voting equity<br />

securities in issue used to calculate dilutive earnings per share (millions) 839 855<br />

Diluted earnings per share and non-voting equity security (CHF) (4.80) 4.37<br />

110 Notes to the Consolidated Financial Statements