How to reach emerging market consumers with new ... - Roland Berger

How to reach emerging market consumers with new ... - Roland Berger

How to reach emerging market consumers with new ... - Roland Berger

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Roland</strong> <strong>Berger</strong> Strategy Consultants<br />

January 2013<br />

Study<br />

In-depth knowledge for decision makers<br />

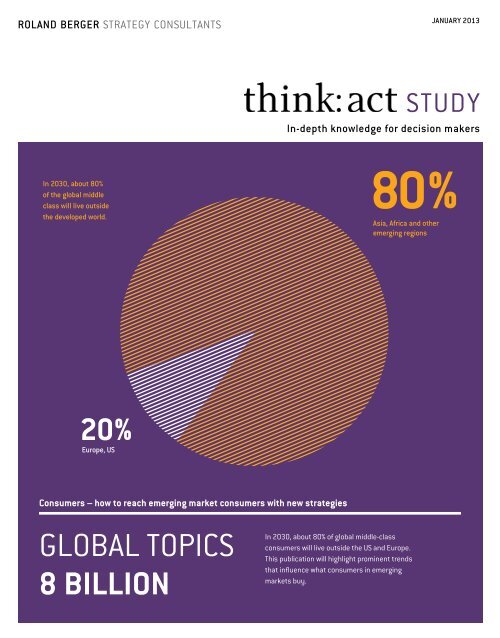

In 2030, about 80%<br />

of the global middle<br />

class will live outside<br />

the developed world.<br />

80%<br />

Asia, Africa and other<br />

<strong>emerging</strong> regions<br />

20%<br />

Europe, US<br />

Consumers – how <strong>to</strong> <strong>reach</strong> <strong>emerging</strong> <strong>market</strong> <strong>consumers</strong> <strong>with</strong> <strong>new</strong> strategies<br />

global <strong>to</strong>pics<br />

8 billion<br />

In 2030, about 80% of global middle-class<br />

<strong>consumers</strong> will live outside the US and Europe.<br />

This publication will highlight prominent trends<br />

that influence what <strong>consumers</strong> in <strong>emerging</strong><br />

<strong>market</strong>s buy.

Study 3<br />

global <strong>to</strong>pics<br />

8 billion<br />

Consumers – how <strong>to</strong> <strong>reach</strong> <strong>emerging</strong> <strong>market</strong><br />

<strong>consumers</strong> <strong>with</strong> <strong>new</strong> strategies<br />

Introduction<br />

Product portfolio and brand positioning –<br />

Meeting the needs of diverse <strong>consumers</strong><br />

Marketing and distribution –<br />

Think local but act global<br />

Conclusion<br />

p 4<br />

p 6<br />

p 22<br />

p 28

<strong>Roland</strong> <strong>Berger</strong> Strategy Consultants<br />

introduction<br />

Key questions for <strong>reach</strong>ing CONSUMERS<br />

in <strong>emerging</strong> <strong>market</strong>s

Study 5<br />

In 2030, about 80% of global middle-class <strong>consumers</strong> will live<br />

outside the US and Europe. In this fifth publication, we highlight<br />

the trends that are likely <strong>to</strong> influence how these <strong>consumers</strong><br />

in <strong>emerging</strong> <strong>market</strong>s weigh up their purchases, choose particular<br />

items and complete their transactions. 1<br />

We examine four areas in particular: product portfolio, brand<br />

positioning, <strong>market</strong>ing and distribution. In each area, we ask<br />

some key questions:<br />

Rapidly growing economies attract competi<strong>to</strong>rs and empower<br />

<strong>consumers</strong>. <strong>How</strong> can companies identify <strong>new</strong> consumer profiles<br />

and design versatile product portfolios?<br />

<strong>How</strong> do brand reputation and consumer values influence<br />

<strong>consumers</strong>' buying behavior?<br />

What techniques ensure that <strong>market</strong>ing messages really<br />

resonate <strong>with</strong> <strong>consumers</strong> in <strong>emerging</strong> <strong>market</strong>s? <strong>How</strong><br />

can companies use <strong>new</strong> mobile technology and networks<br />

<strong>to</strong> build their <strong>market</strong> share?<br />

Distribution strategies need <strong>to</strong> closely reflect local<br />

conditions. What distribution strategies work in countries<br />

<strong>with</strong> predominantly low-density rural populations?<br />

1) Some of these consumer trends are also discussed in publication 1. We<br />

will repeat these briefly wherever necessary <strong>to</strong> show the impact of the trend<br />

on a company's strategy.

<strong>Roland</strong> <strong>Berger</strong> Strategy Consultants<br />

Product portfolio and brand<br />

positioning – Meeting the<br />

needs of diverse <strong>consumers</strong><br />

Socio-demographic change IS DRIVING consumer power

Study 7<br />

Socio-demographic change IS DRIVING<br />

consumer power<br />

In publication 1, we saw how population growth – at extraordinary<br />

levels almost everywhere except Europe – will profoundly shape<br />

<strong>to</strong>morrow's global economy. According <strong>to</strong> forecasts, between 2012<br />

and 2030, some 1.2 billion of the world's 1.3 billion <strong>new</strong> citizens<br />

will be born in <strong>emerging</strong> or developing countries. That's equivalent<br />

<strong>to</strong> 95% of all births.<br />

What does this mean for specific regions between 2012 and<br />

2030? A predicted 600 million people in Asia, 500 million in Africa<br />

and about 90 million in Latin America and the Caribbean will be<br />

added <strong>to</strong> the local population. Europe will be tiny by comparison,<br />

<strong>with</strong> only 1 million <strong>new</strong> people, representing 0.1% of the <strong>new</strong><br />

global population.<br />

Emerging <strong>market</strong>s will be extremely young in terms of<br />

demographics. In 2030, 40% of the population will be under 25,<br />

compared <strong>to</strong> just 26% in developed nations. This fact will have a<br />

profound influence on consumption patterns.<br />

The number of young people in <strong>emerging</strong> <strong>market</strong>s who enjoy a<br />

better education will also increase. In the period up <strong>to</strong> 2020,<br />

private expenditure on education in <strong>emerging</strong> <strong>market</strong>s is set <strong>to</strong><br />

grow nearly 7% per annum, <strong>reach</strong>ing a level of USD 143 billion.<br />

Take China, for instance. Chinese society places a strong em phasis<br />

on education. The 2009 Pisa world education rankings put China<br />

in first place in all three educational categories: reading comprehension,<br />

mathematics and science. Many other develo ping<br />

countries, India and Brazil in particular, are also set <strong>to</strong> see<br />

an increasing number of university graduates. Since 2006, the<br />

number of students in China and India has grown by over 7% a<br />

year. China now produces half a million <strong>new</strong> engineers each year –<br />

while engineering skills shortages in Germany are leading <strong>to</strong><br />

an estimated annual economic loss of USD 2.3 billion for German<br />

business.<br />

Young people <strong>with</strong> better education and skills also have a greater<br />

chance of employment. Over the last 25 years, the number of<br />

people living in poverty in <strong>emerging</strong> and developing countries has<br />

fallen by half. Education has played a major role in this<br />

development, improving lives on the ground.<br />

f1 Every minute, fifty households in developing countries join the<br />

middle class. By 2030, an estimated 66% of the world's middle<br />

class will live in Asia, compared <strong>to</strong> just 21% in Europe and the<br />

United States. Indeed, China's burgeoning middle class is already<br />

bigger than the entire American population. As for the rich, the<br />

number of millionaires in China surpassed that in America some<br />

time ago. Other countries – not least Indonesia, India, Pakistan<br />

and Nigeria, along <strong>with</strong> other African nations – are also seeing an<br />

expanding middle class <strong>with</strong> money <strong>to</strong> spend. These upwardly<br />

mobile sec<strong>to</strong>rs of society share a common wish: <strong>to</strong> create for their<br />

children and grandchildren a world of affluence, political stability<br />

and opportunities.<br />

f2<br />

f3<br />

Disposable incomes are also on the rise. By 2020, many <strong>emerging</strong><br />

countries will see more than 80% of their population <strong>with</strong> annual<br />

disposable incomes in excess of USD 10,000. More than 25% of<br />

households in Saudi Arabia, Turkey, Argentina, Iran, Russia and<br />

Malaysia will command incomes above USD 50,000 a year.<br />

Changing spending patterns<br />

Total consumer spending in the developing world will nearly<br />

double over the next eight years, from USD 14 <strong>to</strong> 22 trillion. Per<br />

capita consumer expenditure is forecast <strong>to</strong> <strong>reach</strong> USD 3,319 a year<br />

in 2020. This growth will be largely driven by improved education<br />

and rising incomes. In particular, BRIC countries will see consumer<br />

spending grow from USD 7 <strong>to</strong> 11 trillion, Mercosur countries from<br />

USD 2 <strong>to</strong> 3 trillion, and in the Middle East and North Africa from USD<br />

1 <strong>to</strong> 2 trillion. Per capita consumer expenditure is forecast <strong>to</strong> grow<br />

at least 3% annually in each region by 2020. Mercosur will see<br />

the highest per capita spending <strong>with</strong> USD 10,112, followed by the<br />

BRIC countries <strong>with</strong> USD 3,619 and the Middle East and North<br />

Africa <strong>with</strong> USD 3,615.<br />

Traditional consumer goods segments such as fashion, leisure and<br />

communications are likely <strong>to</strong> enjoy per capita growth of about 30%<br />

by 2020 in <strong>emerging</strong> and developing countries. European fashion<br />

chains such as Zara are already a familiar sight in major cities<br />

across India, Indonesia, the Philippines, Saudi Arabia, Thailand and<br />

South Africa. Per capita clothing expenditure is forecast <strong>to</strong> <strong>reach</strong><br />

USD 183 a year in 2020, or a <strong>to</strong>tal of USD 1.2 trillion – including<br />

USD 800 billion in our Focus 20 countries alone. 2 Russia, Brazil and<br />

Turkey will be home <strong>to</strong> <strong>consumers</strong> spending the most on fashion.<br />

China, India and Vietnam will see a sharp increase – more than 8%

<strong>Roland</strong> <strong>Berger</strong> Strategy Consultants<br />

F1<br />

The <strong>emerging</strong> middle class – By<br />

2030, approximately 80% of<br />

the middle class will live outside<br />

Europe and the United States<br />

Share of the global middle class in 2030 (%)*<br />

7%<br />

14%<br />

6%<br />

7%<br />

66%<br />

Source: OECD<br />

* The "global middle class" is defined as households <strong>with</strong> daily expenditures between USD 10 and USD 100 per person.<br />

F2<br />

Spending on consumer goods will<br />

increase significantly<br />

Total consumer expenditure in selected regions,<br />

real value, 2012-2020 (USD trillion)<br />

Emerging and developing countries<br />

BRIC<br />

14<br />

22<br />

7<br />

11<br />

2012<br />

2020<br />

Source: Euromoni<strong>to</strong>r<br />

Mercosur<br />

Middle East and North Africa<br />

2<br />

3<br />

1<br />

2

Study 9<br />

a year – in spending on leisure and entertainment. Indeed, by<br />

2020, <strong>emerging</strong> <strong>market</strong>s will spend a <strong>to</strong>tal of USD 924 billion a<br />

year on leisure and entertainment.<br />

Consumers in the developing world will also invest strongly in<br />

improving and protecting their health. Spending will <strong>reach</strong> around<br />

USD 219 per capita per year by 2020. This is roughly USD 86 per<br />

capita more than at present, and represents a much greater per<br />

capita increase than that for fashion, communications or leisure.<br />

Of the Focus 20 countries, Argentina, Peru and South Africa will<br />

see the highest per capita expenditure.<br />

Communication technologies will have a strong impact on these<br />

<strong>new</strong> <strong>consumers</strong>. Consumer expenditure on communications will<br />

almost double between 2012 and 2020, from USD 593 billion <strong>to</strong><br />

USD 1.1 trillion. The countries <strong>with</strong> the highest spending on<br />

advertising per capita are likely <strong>to</strong> be Malaysia, Russia and Turkey.<br />

As <strong>consumers</strong> become better educated, they also require better<br />

information. In response, Nokia has developed its "Nokia Life<br />

Tools", a product that informs <strong>consumers</strong> about healthcare, agriculture,<br />

entertainment and education issues via cell phone. For<br />

example, the company will shortly launch a diabetes program via<br />

cell phone in India. Nokia Life Tools are currently in use in India,<br />

China, Indonesia and Nigeria.<br />

In a similar vein, Johnson & Johnson launched its "Text4Baby"<br />

product in 2010. This is a free mobile information service that<br />

helps educate pregnant women and <strong>new</strong> parents about childcare<br />

issues. More than 20 million people in China, India, Mexico,<br />

Bangladesh, South Africa and Nigeria currently use the program.<br />

Bot<strong>to</strong>m-of-the-pyramid consumption<br />

Yet despite rising incomes and consumer expenditures, the<br />

majority of people in developing nations continue <strong>to</strong> struggle. The<br />

proportion of Nigerians living on less than two dollars a day is<br />

currently 85%. In India the figure is 70%, in Indonesia 46%. Overall,<br />

an estimated four billion people worldwide survive on two dollars<br />

a day or less.<br />

The poor are what we might call "bot<strong>to</strong>m of the pyramid" <strong>consumers</strong>.<br />

Thanks <strong>to</strong> <strong>new</strong> technology and novel distribution<br />

methods, they <strong>to</strong>o have become a potentially profitable <strong>market</strong><br />

for companies. Consumer goods manufacturers are delivering<br />

inexpensive, easy-<strong>to</strong>-use products <strong>to</strong> them using low-overhead<br />

distribution. The most successful <strong>new</strong> products are often "frugal<br />

innovations" or feature frugal (or "Gandhian") engineering. This<br />

involves removing non-essential features and thereby<br />

significantly reducing the cost and complexity of manufacturing<br />

processes. 3<br />

One good example is ChotuKool, a USD 70 refrigera<strong>to</strong>r produced by<br />

the Indian firm Godrej. The appliance uses sophisticated cooling<br />

chips and a fan similar <strong>to</strong> computer temperature control systems<br />

in place of more costly conventional compressor technology.<br />

Other affordable "Chotu" innovations are a low-cost washing<br />

machine, ChotuWash, and an inexpensive water purifier.<br />

Sometimes all that is needed is a simple change of packaging.<br />

Beiersdorf sells shampoos <strong>to</strong> the low-end <strong>market</strong> under its<br />

subsidiary Beiersdorf Hair Care China in standardized plastic<br />

bottles <strong>with</strong> simple brand labels. Bottles that have expensive<br />

labels <strong>with</strong> special, glossy colors are used only for the consumer<br />

segments in tier-1 and tier-2 cities.<br />

Sophisticated <strong>consumers</strong> can also distribute bot<strong>to</strong>m-of-thepyramid<br />

solutions. Grameen Bank, for instance, organizes clubs of<br />

5-10 people – most often women – who share the responsibility<br />

for managing microloans. The clubs also regularly review the<br />

performance of borrowers.<br />

Another example is the brewer SABMiller. The company has<br />

sold beer <strong>to</strong> Africans for over a century, their upscale products<br />

including the European brands Peroni and Grolsch. The company<br />

now plans <strong>to</strong> cater <strong>to</strong> lower-income rural Africans who<br />

drink "informal" home-brewed beers. To this end, they developed<br />

Chibuku, a beer in a car<strong>to</strong>n, which costs up <strong>to</strong> 40% less than<br />

bottled beers, has a similar taste <strong>to</strong> home-brewed beers and is<br />

hygienically produced. The company estimates that the informal<br />

beer <strong>market</strong> in Africa is four times larger than the clear beer<br />

<strong>market</strong>. Over the next three years, it plans <strong>to</strong> expand distribution<br />

of the <strong>new</strong> product <strong>to</strong> around a dozen countries.<br />

2) Our Focus 20 countries – the 20 <strong>emerging</strong> <strong>market</strong>s projected <strong>to</strong><br />

see the most economic growth in the period <strong>to</strong> 2030 – are<br />

Argentina, Brazil, China, Colombia, Egypt, India, Indonesia, Iran, Iraq,<br />

Malaysia, Mexico, Nigeria, Pakistan, Peru, Russia, Saudi Arabia,<br />

South Africa, Thailand, Turkey and Vietnam. 3) See Publication 4 for<br />

a discussion of key frugal innovation strategies.

Spending will grow in many segments<br />

Annual per capita consumer spending by segment, real value, 2012-2020 (USD)<br />

F3<br />

Food<br />

Housing<br />

Transport<br />

Health<br />

Fashion<br />

Communication<br />

Leisure

CAGR<br />

558<br />

662<br />

399<br />

574<br />

270<br />

440<br />

133<br />

219<br />

135<br />

183<br />

100<br />

175<br />

98<br />

142<br />

2.2%<br />

4.7%<br />

5.5%<br />

6.4%<br />

3.9%<br />

7.3%<br />

4.7%<br />

Source: Euromoni<strong>to</strong>r

<strong>Roland</strong> <strong>Berger</strong> Strategy Consultants<br />

Low-income <strong>consumers</strong> can also be attracted by <strong>new</strong> service<br />

portfolios. The Mexican cement manufacturer Cemex, for instance,<br />

sells a versatile support package <strong>to</strong> low-income families <strong>to</strong> help<br />

them build homes inexpensively. For just USD 14 a week, the<br />

company provides inspections, materials warehousing, advice<br />

from professional architects and the required cement products.<br />

Unilever's African portfolio includes both affordable products and<br />

training services. It offers low-cost food items, water-thrifty<br />

washing powders and grooming products that suit local tastes. In<br />

addition, it provides professional training <strong>to</strong> African entrepreneurs.<br />

In 2011, the company opened an academy in Johannesburg that<br />

each year will train 5,000 hairdressers who plan <strong>to</strong> open their own<br />

salons. The academy also functions as a forum for testing <strong>new</strong><br />

products, business models and distribution methods.<br />

In some areas, <strong>new</strong> methods of delivery have emerged, such<br />

as medical services provided <strong>to</strong> poor rural communities by mobile<br />

clinics. The Sanjeevan Mobile Clinic operating in parts of India<br />

resembles a large bus. But inside it contains a fully equipped<br />

doc<strong>to</strong>r's office <strong>with</strong> X-ray, ultrasound, mammography or electrocardiogram<br />

machines, a second treatment room and a small<br />

darkroom <strong>to</strong> develop X-rays. It even has its own genera<strong>to</strong>r so it<br />

can operate independently of the local power grid. Each mobile<br />

clinic can service hundreds of temporary treatment sites. In<br />

one year, for example, a single such vehicle traveling across the<br />

Uttarakhand Province in northern India set up more than<br />

800 medical camps, helping some 60,000 patients. Siemens<br />

has equipped 18 of these mobile surgeries over the last 7 years.<br />

Urbanization<br />

Since 2008, over half the world's population has been living in<br />

cities. Enterprising companies will discover that urban landscapes<br />

offer many <strong>new</strong> business prospects. Supply chains, trade,<br />

transportation and Internet connections are expanding, often<br />

rapidly, <strong>to</strong> serve ever more city dwellers.<br />

f5 The scale of this rapid change is startling: Some 200,000 people<br />

will move <strong>to</strong> cities every day through 2030. Emerging <strong>market</strong>s will<br />

see most of this migration. Between 2010 and 2030, the global<br />

share of people inhabiting cities will climb from 45% <strong>to</strong> 55%. Most<br />

will be in the developing world. Thus, 3.9 billion – or 80% – of 4.9<br />

billion city dwellers worldwide will live in <strong>emerging</strong> and developing<br />

countries as the world's <strong>to</strong>tal urban population grows by more<br />

than 1.3 billion.<br />

Looking at specific regions, Latin America will have the highest<br />

share of urban residents as its cities grow <strong>to</strong> include 80% of the<br />

<strong>to</strong>tal population by 2030. The share of urban residents in Africa will<br />

increase from 39% <strong>to</strong> 48%, in India from 31% <strong>to</strong> 40%, in China from<br />

49% <strong>to</strong> 69%, and in the rest of Asia from 44% <strong>to</strong> 56%. By 2025,<br />

China will have no fewer than 139 cities <strong>with</strong> over a million<br />

inhabitants, the largest number of such agglomerations of any<br />

country in the world.<br />

Urban house and household sizes are also changing. In India, for<br />

instance, per household floor space has doubled every 14 years <strong>to</strong><br />

its current level of 31.5 m 2 . This is still two and a half times less<br />

than China's 85 m 2 . According <strong>to</strong> projections by Credit Suisse, India<br />

must construct three million houses and China five million houses<br />

every year through 2030 <strong>to</strong> accommodate future population<br />

growth.<br />

Although global sanitary conditions have improved considerably<br />

over the past several decades, 2.6 billion people still have no<br />

access <strong>to</strong> <strong>to</strong>ilets and 70% live in cities <strong>with</strong>out proper sanitation<br />

facilities. Lack of sanitation causes environmental pollution, social<br />

problems, unsafe surroundings and substantially more potential<br />

F4<br />

In several Focus 20 countries, a large<br />

share of the population needs better<br />

access <strong>to</strong> sanitary facilities<br />

Percentage of the urban population that<br />

currently has no access <strong>to</strong> sanitary facilities (%)<br />

Nigeria<br />

India<br />

China<br />

Indonesia<br />

64<br />

46<br />

42<br />

37<br />

Source: Euromoni<strong>to</strong>r

Study 13<br />

F5<br />

By 2025, 80% of cities <strong>with</strong> more<br />

than a million inhabitants will<br />

be outside the developed world<br />

Number of urban agglomerations <strong>with</strong> over a million inhabitants, 2025<br />

50<br />

57<br />

74<br />

81<br />

305<br />

China<br />

India<br />

US<br />

Nigeria<br />

139<br />

54<br />

45<br />

21<br />

Source: UN World Urbanization Prospects: The 2011 Revision

<strong>Roland</strong> <strong>Berger</strong> Strategy Consultants<br />

for epidemics. Indeed, one child dies every 15 seconds as a result<br />

of consuming water polluted <strong>with</strong> human excreta. Diarrheal<br />

diseases cause up <strong>to</strong> 50% of all deaths in emergency, refugee and<br />

IDP camp situations – more than 80% of them children under two<br />

years of age.<br />

Potential solutions<br />

These health and environmental challenges stimulate innovation.<br />

For example, Swedish architect Anders Wilhelmson designed<br />

"Peepoo", a personal, single-use, self-sanitizing, fully bio degradable<br />

<strong>to</strong>ilet that prevents feces from contaminating the<br />

immediate surrounding area and ecosystem. After use, Peepoo<br />

turns in<strong>to</strong> valuable fertilizer that can improve livelihoods and<br />

food security.<br />

In India, 40% <strong>to</strong> 60% of the urban population live in poorly developed,<br />

unhygienic conditions. In an effort <strong>to</strong> improve standards, an<br />

in ventive Indian real estate company introduced a program <strong>to</strong><br />

offer small land parcels <strong>with</strong> decent infrastructure and <strong>with</strong> a<br />

price tag of just USD 6,500 each. The examples of successful<br />

innovation don't s<strong>to</strong>p there, either. Three years ago, Tata Mo<strong>to</strong>rs<br />

launched the world's cheapest car, priced at just EUR 1,500. The<br />

company has now designed the Nano house, a 20 m 2 coconut<br />

and jute fiber unit that can be erected in just a week and is built <strong>to</strong><br />

last only a few years. Tata's plan is <strong>to</strong> offer affordable shelter <strong>to</strong><br />

poor people around the world. It believes that governmentsponsored<br />

mass residential developments for slum dwellers and<br />

the homeless will be one of its biggest <strong>market</strong>s. In developing<br />

the Nano house, Tata consulted local decision-makers, ensuring<br />

that the product met local requirements. The company is now<br />

analyzing user feedback from a pilot project in rural India. It plans<br />

<strong>to</strong> price the <strong>new</strong> home at about USD 700 – roughly what<br />

industrialized world <strong>consumers</strong> might pay for a <strong>new</strong> iPad.<br />

The design of low-cost housing also needs <strong>to</strong> take climate change<br />

in<strong>to</strong> account. A German initiative, ASH (Africa Sustainable House),<br />

has developed the world's first low-cost, climate-friendly home<br />

for Africa and Asia. Delivered in containers, the units are constructed<br />

on site in a single day. They are fitted <strong>with</strong> a solar module<br />

for lighting and radio reception, and even include air conditioning.<br />

Novel building materials can also make housing affordable.<br />

Taiwanese architect Arthur Huang developed a method of creating<br />

construction materials out of plastic waste. The EcoArk, built from<br />

1.5 million plastic bricks, was shown in November 2010 at Taipei's<br />

International Garden Festival. Even plastic bottles can be used<br />

<strong>to</strong> build houses. Assisted by experts in London, a Nigerian building<br />

project initiated by the non-governmental organization DARE<br />

(Development Association for Re<strong>new</strong>able Energies) is creating<br />

homes out of plastic bottles that can <strong>with</strong>stand earthquakes,<br />

fire and even bullets. By using unconventional building materials,<br />

DARE seeks <strong>to</strong> address two problems simultaneously: plastic<br />

bottles that pollute roads, sewers and gutters are recycled in<strong>to</strong><br />

buildings, and at the same time help alleviate housing shortages<br />

in Africa's most populous country.<br />

Demand for prime location luxury buildings in <strong>emerging</strong> <strong>market</strong>s<br />

is growing almost as fast as local incomes. The international<br />

property consulting firm Knight Frank regularly surveys <strong>to</strong>p real<br />

estate advisors <strong>to</strong> ask which nationalities will become the most<br />

important prime property buyers over the next five years. Chinese,<br />

Russian, Middle Eastern, Latin American and other high-growth<br />

economies consistently lead recent predictions. For example,<br />

<strong>emerging</strong> <strong>market</strong> cities such as Nairobi have seen prime property<br />

prices soar more than 25% above 2011 prices, while Bali and<br />

Jakarta have seen prices increase about 15% – more than<br />

in London or Vancouver.<br />

The more people congregate in cities, the more critical it becomes<br />

<strong>to</strong> find ways <strong>to</strong> control streams of goods and waste. One promising<br />

method suggested by research in<strong>to</strong> contemporary urban data<br />

management is "smart" city designs – that apply innovative IT<br />

applications in building design, city planning and infrastructure.<br />

These aren't just drawing board recommendations, either.<br />

Singapore has become a model of urban IT prowess. The city<br />

collates and interlinks data on water and power supplies, traffic<br />

volumes for shipping, aircraft, cars and taxis, temperature and<br />

telephony, all in real time. The scope of the IT system is such<br />

that a subway train driver knows capacity loads, why trains are<br />

slowing down and whether it's advisable <strong>to</strong> wait longer at a<br />

particular station.<br />

The modern city dweller will increasingly require a smartphone<br />

<strong>to</strong> navigate the modern urban data jungle. A "virtuous commercial<br />

circle" will evolve as more data stimulates greater demand<br />

for multifunctional smart technologies. The potential for highly<br />

individualized distribution and <strong>market</strong>ing is almost unlimited:<br />

some vending machines in Asia even scan a person's face<br />

<strong>to</strong> cus<strong>to</strong>mize advertising.

Study 15<br />

Getting <strong>to</strong> know CONSUMERS<br />

in <strong>emerging</strong> <strong>market</strong>s<br />

The pace of change is speeding up. Living standards and the built<br />

environment are evolving faster than ever and <strong>market</strong>s are<br />

increasingly diverse in terms of educational levels, incomes and<br />

geographies. Consumer diversity creates a puzzle for <strong>market</strong>ing.<br />

<strong>How</strong> can companies identify niches for their <strong>new</strong> products and<br />

services? Their first step must be <strong>to</strong> analyze consumer habits and<br />

brand values. With this in mind, <strong>Roland</strong> <strong>Berger</strong> designed a cus<strong>to</strong>miz<br />

able <strong>to</strong>ol, the RB Profiler, <strong>to</strong> measure how <strong>consumers</strong><br />

perceive brands. Using a specially developed questionnaire, the<br />

RB Profiler investigates 20 fundamental values that influence<br />

all aspects of cus<strong>to</strong>mer behavior. The RB Profiler analyzes what<br />

people's requirements are and how they view brands, generating<br />

a range of consumer profiles. Companies can use these profiles<br />

<strong>to</strong> develop product positioning options and compare the performance<br />

of their current products <strong>with</strong> targets. At the same time, the<br />

<strong>to</strong>ol's intuitive format and statistical validation encourages organizational<br />

buy-in and efficient application in <strong>market</strong>ing.<br />

f6 Here's an example of the <strong>to</strong>ol in action: Between 2000 and 2030,<br />

China's urban population will nearly double, growing from 36%<br />

<strong>to</strong> 69% of the <strong>to</strong>tal population. This <strong>new</strong> urban population will<br />

demonstrate significant differences in terms of tastes and<br />

aspirations. A <strong>Roland</strong> <strong>Berger</strong> study using the RB Profiler asked<br />

Chinese <strong>consumers</strong> about their brand perceptions and<br />

differentiation, consumption behavior, purchase patterns and<br />

lifestyle. The study showed that consumer preferences vary<br />

significantly according <strong>to</strong> urban size and geographical location.<br />

Looking at the differences in more detail, it appears that<br />

smaller tier-3 cities exhibit different values and priorities than<br />

megacities, reflecting their regional orientation. Typical tier-3<br />

cities include Tongcheng in Anhui province, <strong>with</strong> roughly 744,000<br />

inhabitants, and Fengcheng on the Yellow Sea coast, <strong>with</strong> a<br />

population of approximately 630,000. To illustrate how the RB<br />

Profiler works, figure 6 translates the profiles for megacities and<br />

tier-3 cities in<strong>to</strong> two pro<strong>to</strong>type cus<strong>to</strong>mers, Susan Gan and Neil<br />

Zheng. The differences between the two are immediately obvious.<br />

F6<br />

The people behind the profiles – A possible<br />

translation of two typical consumer value profiles<br />

Chinese consumer value profiles <strong>with</strong> pro<strong>to</strong>type cus<strong>to</strong>mers,<br />

megacities vs. tier-3 cities<br />

Susan Gan, single, 35,<br />

from Guangzhou, megacity<br />

Works as a systems administra<strong>to</strong>r<br />

for a major Chinese company<br />

Main source of <strong>new</strong>s: Internet<br />

Newspaper: National daily<br />

Credit cards owned: Two<br />

Use of credit card: Several times a week<br />

Travels for leisure: Twice a year<br />

Clothes shopping: Once a week<br />

Preferred grocery shopping: Mall<br />

Accommodation: One bedroom flat near the city center<br />

Hours spent on watching TV a day: 1<br />

Hours spent on using the Internet a day: 3<br />

Likes: Risk-taking, innovative things, trendy features, just-in-time,<br />

price-defined buying decisions<br />

Neil Zheng, married, 43,<br />

one child, from tier-3 city<br />

Runs a small stationery shop<br />

Main source of <strong>new</strong>s: TV<br />

Newspaper: Local daily<br />

Credit cards owned: None<br />

Use of credit card: Never<br />

Travels for leisure: Once every three years<br />

Clothes shopping: Twice a year<br />

Preferred grocery shopping: Super<strong>market</strong> and own plot <strong>to</strong> grow vegetables<br />

Accommodation: Small house in the suburbs<br />

Hours spent watching TV a day: 3<br />

Hours spent on the Internet a week: 1<br />

Likes: Fitness, family, elegance

F7<br />

China<br />

Among <strong>emerging</strong> <strong>market</strong>s, China has the largest<br />

number of valuable brands<br />

Number of brands among the 500 most valuable worldwide, 2012<br />

Brazil<br />

Russia<br />

Mexico<br />

Hong Kong<br />

United Arab Emirates<br />

Malaysia<br />

Chile<br />

Saudi Arabia<br />

South Africa

27<br />

10<br />

8<br />

4<br />

3<br />

3<br />

2<br />

1<br />

1<br />

1<br />

Source: Interbrand

<strong>Roland</strong> <strong>Berger</strong> Strategy Consultants<br />

Brand positioning – Simple but creative<br />

The "country of origin" effect<br />

Rising incomes in <strong>emerging</strong> countries encourage <strong>consumers</strong> <strong>to</strong><br />

change their brand purchasing behavior. A welcome consequence<br />

of this for Western companies is their increasing preference for<br />

established Western brands. Local brands are often left far behind<br />

in the competition. For example, no local brand features among<br />

the leading fashion brands in Saudi Arabia, and only one domestic<br />

brand in India makes it in<strong>to</strong> the <strong>to</strong>p 10 beauty brands.<br />

f7 Manufacturers in <strong>emerging</strong> countries own just 12% of the world's<br />

500 most valuable brands. China leads the pack, <strong>with</strong> 27 internationally<br />

distributed brands, followed by Brazil, <strong>with</strong> 10 brands.<br />

In the long term, brands from <strong>emerging</strong> <strong>market</strong>s are likely <strong>to</strong><br />

become more prominent in Europe as manufacturers shift their<br />

attention from domestic <strong>to</strong> world <strong>market</strong>s. Products that are<br />

successful in <strong>emerging</strong> <strong>market</strong>s can often also be sold globally.<br />

For instance, Chinese au<strong>to</strong>makers – notably the company behind<br />

the Qoros brand – are confident that they can expand in<strong>to</strong> Europe<br />

following the example of global Chinese brands in the IT sec<strong>to</strong>r,<br />

such as Lenovo.<br />

Brand origination is a matter of considerable importance in<br />

<strong>emerging</strong> <strong>market</strong>s. The "country of origin" effect means that<br />

people associate particular countries <strong>with</strong> certain product<br />

characteristics. Consumers worldwide, for example, frequently<br />

associate German products <strong>with</strong> quality, reliability and durability.<br />

In the past, consumer goods manufacturers such as Coca-Cola<br />

transferred their successful national brands, logos and advertising<br />

<strong>to</strong> their worldwide subsidiaries. But building brand awareness<br />

<strong>to</strong>day calls for more imagination. Western companies must<br />

adapt <strong>to</strong> local and regional conditions. Often the most innovative<br />

<strong>market</strong>ing technique is the simplest. In several <strong>emerging</strong><br />

countries, for example, Coca-Cola gives paint in its signature red<br />

F8<br />

Top-selling brands in <strong>emerging</strong> countries<br />

Sales by brand, 2012 (retail value, USD million)<br />

Top-selling fashion brands in Saudi Arabia – No homegrown brands<br />

Mothercare<br />

Next<br />

Zara<br />

Aldo<br />

Bossini/Sparkle<br />

Marks & Spencer<br />

Clarks Footwear<br />

Bershka<br />

Milano<br />

Calvin Klein<br />

231<br />

191<br />

164<br />

159<br />

121<br />

70<br />

60<br />

60<br />

47<br />

47<br />

Top-selling beauty brands in India – Dabur is the only Indian brand<br />

Fair & Lovely<br />

Colgate<br />

Lux<br />

Lifebuoy<br />

Godrej<br />

Det<strong>to</strong>l<br />

San<strong>to</strong>or<br />

Dove<br />

Clinic Plus<br />

Dabur<br />

465<br />

353<br />

336<br />

305<br />

257<br />

244<br />

208<br />

196<br />

159<br />

156<br />

Source: Euromoni<strong>to</strong>r

Study 19<br />

F9<br />

Emerging countries lead the<br />

ranking of global happiness<br />

Happy Planet Index (index value):<br />

The index's <strong>to</strong>p 10 are <strong>emerging</strong> countries<br />

Jamaica<br />

58.5<br />

Colombia<br />

59.8<br />

Costa Rica<br />

64.0<br />

<strong>to</strong>p<br />

ten<br />

El Salvador<br />

58.9<br />

Venezuela<br />

56.9<br />

Vietnam<br />

60.4<br />

Panama<br />

57.8 Nicaragua<br />

57.1<br />

Belize<br />

59.3<br />

Guatemala<br />

56.9<br />

Source: Centre for Well-being, <strong>new</strong> economics foundation<br />

#46 Germany 47.2<br />

#105 US 37.3

<strong>Roland</strong> <strong>Berger</strong> Strategy Consultants<br />

color <strong>to</strong> village residents <strong>to</strong> decorate the outside of their houses.<br />

Another inexpensive Coca-Cola <strong>market</strong>ing initiative turns shipping<br />

containers, again painted Coca-Cola red, in<strong>to</strong> s<strong>to</strong>rehouses or retail<br />

s<strong>to</strong>res.<br />

Ecuador and Bolivia have embarked on a similar path. The<br />

indigenous principle of "sumak kawsay" (meaning "good living")<br />

was enshrined in the Ecuadorian constitution in 2008 and in the<br />

Bolivian constitution a year later.<br />

Hindustan Lever uses other techniques <strong>to</strong> build brand awareness.<br />

The company frequently employs street performers – magicians,<br />

singers, dancers and ac<strong>to</strong>rs – <strong>to</strong> promote soap and <strong>to</strong>othpaste.<br />

Lever and Ogilvy Out<strong>reach</strong>, a <strong>market</strong>ing arm of Ogilvy & Mather,<br />

recruits the local performers, adjusting their scripts in line <strong>with</strong><br />

local dialects, education levels and religions. A series of such<br />

performances in northeastern India saw consumer awareness<br />

of Breeze, a low-cost 2-in-1 soap, rise from 22% <strong>to</strong> 30%. A similar<br />

program <strong>to</strong> promote Rin Shakti, a moderately priced detergent<br />

bar and powder brand, boosted recognition from 28% <strong>to</strong> 36% over<br />

a six-month period.<br />

Increasing relevance of values and sustainability<br />

Religious values are important for many <strong>consumers</strong>. Increasing<br />

numbers of religious people will drive the <strong>market</strong> for "valuesoriented"<br />

products. By 2030, when the global population is<br />

forecast <strong>to</strong> exceed 8 billion, approximately a quarter of people will<br />

be Muslim. Pakistan will likely overtake Indonesia as the world's<br />

largest Islamic country, <strong>with</strong> a predominantly Muslim population<br />

expected <strong>to</strong> exceed 256 million. Christianity will remain the world's<br />

dominant religion, however, <strong>with</strong> the Christian population expected<br />

<strong>to</strong> be 2.2 billion by 2030. Most <strong>new</strong> Christian converts will live in<br />

<strong>emerging</strong> countries. Together, Islam and Christianity will account<br />

for over half the global population (53%) by 2030. The impact<br />

on consumer preferences will be significant – Muslim women's<br />

fashion and non-pork meat products are two commonly cited<br />

examples.<br />

Values in a broader sense – religious, environmental and social –<br />

will play a major role in <strong>consumers</strong>' purchase decisions and brand<br />

loyalties. We are already seeing a strong move in some countries<br />

<strong>to</strong> integrate non-economic values in<strong>to</strong> their economic perspective.<br />

Bhutan, for example, first formulated a <strong>new</strong> official measure of<br />

living standards, Gross National Happiness (GNH), <strong>to</strong> measure<br />

economic progress as early as 1979. The four pillars of GNH are:<br />

Pursuing equitable and equal socio-economic development<br />

Preserving and promoting cultural heritage<br />

Conserving the environment<br />

Ensuring good governance<br />

f9 We are seeing increasing efforts <strong>to</strong> measure well-being across the<br />

globe. The London-based "Centre for Well-being" compiles a Happy<br />

Planet Index <strong>to</strong> record life expectancy, experienced well-being<br />

and people's satisfaction <strong>with</strong> the environmental impact of the<br />

goods and services consumed. Costa Rica scores highest, followed<br />

by Vietnam. Most of the other <strong>to</strong>p 10 are <strong>emerging</strong> countries in<br />

South America. Germany and the United States, <strong>with</strong> their large<br />

ecological footprints, rank 46th and 105th respectively.<br />

f10<br />

According <strong>to</strong> a recent goodpurpose® study by Edelman, <strong>consumers</strong><br />

in "rapid growth economies" (RGEs) such as China, India,<br />

Indonesia, Malaysia, UAE and Brazil have much higher ex pectations<br />

of brands and corporations <strong>with</strong> regard <strong>to</strong> social issues. As<br />

the middle class grows and acquires more purchasing power,<br />

<strong>consumers</strong> in RGEs demonstrate a commitment <strong>to</strong> "social<br />

purpose" across many different activities, such as buying, sharing,<br />

donating and volunteering. This commitment is considerably<br />

stronger than that found for many <strong>consumers</strong> in "bear" <strong>market</strong>s<br />

such as Western Europe.

Study 21<br />

F10<br />

Buying socially<br />

responsible goods is<br />

growing in importance<br />

in <strong>emerging</strong> <strong>market</strong>s<br />

On average, how<br />

often do you buy a<br />

brand that supports<br />

a good cause?<br />

Every 6 <strong>to</strong> 12 months<br />

At least once a month<br />

Bull <strong>market</strong>s *<br />

22%<br />

62%<br />

84%<br />

At least once a year<br />

Bear <strong>market</strong>s **<br />

19%<br />

37%<br />

56%<br />

At least once a year<br />

*) Consumers in <strong>emerging</strong> <strong>market</strong>s are "bullish" on purpose! They have high expectations of brands when it comes <strong>to</strong> social issues<br />

**) Bear <strong>market</strong>s are industrialized countries. Here, the <strong>consumers</strong> don't have such high expectations of brands regarding social issues<br />

Source: goodpurpose®

<strong>Roland</strong> <strong>Berger</strong> Strategy Consultants<br />

Marketing and distribution –<br />

Think local but act global<br />

Meeting consumer requirements

Study 23<br />

Online shopping and <strong>market</strong>ing on the rise<br />

The trend <strong>to</strong>ward more sophisticated information networking is<br />

certain <strong>to</strong> spread <strong>to</strong> <strong>emerging</strong> and developing nations. These<br />

countries have seen the number of Internet users increase<br />

annually by almost 50%, from 80 million in 2000 <strong>to</strong> 1.2 billion in<br />

2010. Projections anticipate 2.5 billion Internet users in <strong>emerging</strong><br />

countries by 2020, almost three times as many as in more<br />

advanced nations.<br />

Mobile telephony highlights how <strong>emerging</strong> country populations<br />

rapidly take <strong>to</strong> network technologies. In most <strong>emerging</strong> countries,<br />

the majority of people are under 25, meaning that they grew<br />

up using cell phones. By 2020, it is anticipated that developing<br />

nations will have 6.5 billion cell phone users, compared <strong>to</strong> just<br />

1.2 billion in industrial countries. In less than ten years' time, 84%<br />

of the world's population will own a mobile device.<br />

Social networking is also spreading quickly. By mid-2012, there<br />

were more than 43 million Facebook users in Africa, including<br />

12 million in Egypt, 5.4 million in South Africa, 5.2 million in<br />

Nigeria, 4.5 million in Morocco, 3.8 million in Algeria, 3.2 million<br />

in Tunisia, 1.6 million in Kenya and 1.4 million in Ghana.<br />

Internet use in general is on the rise in the developing world.<br />

Numerous African network providers are currently competing<br />

for <strong>market</strong> share. Newspapers recently reported that one in<br />

four Kenyan residents now accesses the Internet at least once<br />

a week. 4<br />

Communication technology can also transform how business is<br />

done. In Kenya, the "m-pesa" (the "m" stands for mobile and "pesa"<br />

is Swahili for "money") is a versatile way of paying by text<br />

message where there is no Internet access. "m-pesa" gives even<br />

the poorest people access <strong>to</strong> banking services. Fifteen million<br />

Kenyans make use of the system, which has been copied from<br />

Kabul <strong>to</strong> California. The World Bank estimates that financial<br />

transactions of the m-pesa type currently <strong>to</strong>p USD 7 billion. Mobile<br />

payment systems also allow administra<strong>to</strong>rs <strong>to</strong> track national<br />

budget expenditure, such as the funds allocated <strong>to</strong> districts or<br />

<strong>to</strong>wns.<br />

of income <strong>to</strong> this channel of consumption. A recent WorldPay<br />

study finds that Indians spend 36% of their disposable income<br />

purchasing products and services online. The Chinese spend<br />

slightly less, at 31% of disposable income, and Brazilians 27%. 5<br />

Some 43% of all <strong>consumers</strong> in the Arab world buy online, and one<br />

in every three Internet users in these regions does so at least<br />

once a month. More than 60% of those buying online report that<br />

they use the Internet <strong>to</strong> research product features and prices<br />

before deciding what exactly <strong>to</strong> buy. The <strong>to</strong>p products sold online<br />

are games, software, electrical goods and clothing, just as in<br />

developed countries.<br />

The range of products and services offered online in developing<br />

countries is broad. In 2010, Iran launched its first online super<strong>market</strong>,<br />

Meydoonak.com. The site offers 2,500 grocery and<br />

household items at competitive prices. Homegrown Indian startups<br />

including fashionandyou.com, myntra.com, snapdeal.com,<br />

dealsandyou.com, yebhi.com and HomeShop 18 are introducing<br />

India's growing middle class <strong>to</strong> Western brands. And the growth of<br />

mobile device use in <strong>emerging</strong> <strong>market</strong>s such as China, India and<br />

South Africa is driving Estée Lauder's development of m-commerce<br />

sites, along <strong>with</strong> mobile- and tablet-friendly versions of its brand<br />

websites.<br />

<strong>How</strong> do the <strong>consumers</strong> themselves view these developments?<br />

A survey by WorldPay finds that half of all users see misappropriation<br />

of data and credit card fraud as the biggest<br />

obstacles <strong>to</strong> online shopping. 6 At the same time, websites are<br />

<strong>emerging</strong> where <strong>consumers</strong> share their information about<br />

product quality and prices. These websites are also valuable<br />

sources of information for consumer-savvy companies. By<br />

analyzing candid consumer opinions, platforms such as the<br />

Indian www.consumercomplaints.in can help consumer<br />

goods manufacturers improve their product and <strong>market</strong>ing<br />

strategies.<br />

Consumers in <strong>emerging</strong> <strong>market</strong>s are looking for greater choice,<br />

convenience and informed purchasing. More and more they are<br />

finding their needs met by online shopping. Perhaps surprisingly,<br />

in many <strong>emerging</strong> <strong>market</strong>s <strong>consumers</strong> allocate a high percentage<br />

4) Germany's Süddeutsche Zeitung (2012)<br />

5) WorldPay (2012) 6) Discover Digital Arabia (2012)

F11<br />

Morocco<br />

4,481,100<br />

Algeria<br />

3,826,940<br />

Senegal<br />

664,800<br />

Nigeria<br />

5,184,620<br />

Ghana<br />

1,436,380<br />

Congo (Zaire)<br />

795,300<br />

Facebook users in Africa<br />

Number of Facebook users in Africa, 2011<br />

Angola<br />

516,780<br />

South Africa<br />

5,431,280

Tunisia<br />

3,214,880<br />

Egypt<br />

11,658,000<br />

Ethiopia<br />

688,040<br />

Kenya<br />

1,634,940<br />

Uganda<br />

485,480<br />

Tanzania<br />

585,660<br />

Source: Allfacebook.de

<strong>Roland</strong> <strong>Berger</strong> Strategy Consultants<br />

The advertising landscape is also changing rapidly in <strong>emerging</strong><br />

countries. Advertisers are figuring out how <strong>to</strong> deliver relevant,<br />

measurable advertising <strong>to</strong> their next billion <strong>consumers</strong>. Mobile<br />

<strong>market</strong>ing spend will likely grow sixfold <strong>to</strong> more than USD 6 billion<br />

by 2016 in <strong>market</strong>s such as China, India and Brazil. By contrast,<br />

Europe's mobile <strong>market</strong>ing projections for 2016 are roughly the<br />

same as they were in 2012, at just USD 1 billion.<br />

f12 What lies behind this cultural divide? The principal reason is that<br />

mobile devices are the primary digital platform in <strong>emerging</strong><br />

countries, while PCs are more common in economically advanced<br />

countries. For example, Indian advertisers will be spending<br />

approximately 51% of their <strong>to</strong>tal digital advertising budgets on<br />

mobile channels by 2016, while US companies will spend just 11%.<br />

Over 80% of cell phone users in <strong>emerging</strong> <strong>market</strong>s use prepaid<br />

phones. Additional cell phone minutes are being offered as<br />

a reward for cus<strong>to</strong>mers completing surveys, receiving advertisements<br />

or purchasing products. Cus<strong>to</strong>mers appear <strong>to</strong> be happy<br />

<strong>with</strong> this arrangement, <strong>to</strong>o: In Brazil, 74% of prepaid users take<br />

a positive attitude <strong>to</strong>ward receiving advertising on their mobile<br />

devices in return for free airtime minutes, according <strong>to</strong> one<br />

recent study.<br />

F12<br />

Mobile advertising on the rise<br />

Mobile channels as percentage of <strong>to</strong>tal digital advertising budget<br />

Indian companies<br />

51%<br />

Distribution – Go "glocal"<br />

Products must be delivered not only <strong>to</strong> <strong>emerging</strong> middle-class<br />

<strong>consumers</strong> in cities but also <strong>to</strong> <strong>consumers</strong> in rural regions. In<br />

2030, the share of the rural population in developing countries will<br />

still be 45% (compared <strong>to</strong> 19% in developed countries). Companies<br />

need <strong>to</strong> adapt their distribution strategies <strong>to</strong> local conditions. For<br />

example, in countries where low-density rural areas predominate,<br />

firms should prioritize specific geographical areas and work<br />

closely <strong>with</strong> distribution partners. Often it will be <strong>to</strong>o expensive <strong>to</strong><br />

supply remote areas directly, especially at the <strong>market</strong>-entry<br />

stage.<br />

Large and less developed <strong>market</strong>s such as China are best<br />

approached city by city, using distribu<strong>to</strong>rs <strong>to</strong> provide services<br />

such as physical distribution and cash collection. Beiersdorf, for<br />

example, serves smaller tier-2 or tier-3 cities through a number<br />

of local and regional distribu<strong>to</strong>rs and sub-distribu<strong>to</strong>rs in China.<br />

Distribu<strong>to</strong>rs typically work on a non-exclusive basis.<br />

Simple distribution technologies such as ordering products by cell<br />

phone can help overcome deficiencies in the rural infrastructure.<br />

US companies<br />

11%<br />

Source: Digital Capital Advisors

Study 27<br />

Direct ordering reduces costs and saves time. On occasion,<br />

companies will find it profitable <strong>to</strong> invest in novel distribution<br />

methods that combine different products and services <strong>to</strong><br />

<strong>reach</strong> a particular consumer segment.<br />

Getting it right – Some examples<br />

Some companies are most definitely getting it right. Here are some<br />

examples from across the developing world that can serve as an<br />

inspiration <strong>to</strong> others.<br />

Project Shakti, jointly created by Unilever and an Indian consulting<br />

company, is an innovative delivery and procurement model. By<br />

hiring women from microfinance groups as last-mile distribu<strong>to</strong>rs<br />

for Unilever household products, the initiative improves the rural<br />

<strong>reach</strong> of fast-moving consumer goods. Bank loans are secured<br />

through microfinance, <strong>with</strong> Unilever guaranteeing the loans<br />

against default. The project currently employs over 45,000 female<br />

partners in rural areas across 12 different states, and accounts<br />

for 20% of Unilever's <strong>to</strong>tal rural sales.<br />

On the other side of the world, Avon saleswomen travel the<br />

Amazon and its tributaries in ferries, small boats and canoes <strong>to</strong><br />

serve remote Brazilian mining <strong>to</strong>wns located up <strong>to</strong> 1,500 kilometers<br />

from anything resembling urban civilization. The<br />

saleswomen's persistence in overcoming distribution barriers<br />

has helped propel Avon in<strong>to</strong> a leading position in the Brazilian<br />

cosmetics <strong>market</strong>. In South Africa, Avon delivers merchandise <strong>to</strong><br />

post offices for sales representatives <strong>to</strong> pick up. Where no bank is<br />

available, Avon organizes payment through the post office or a<br />

major retailer.<br />

Coca-Cola has evolved a "hub and spoke" distribution model <strong>to</strong><br />

<strong>reach</strong> rural <strong>market</strong>s. Twice a week, the company depot supplies<br />

large distribu<strong>to</strong>rs who act as hubs for small distribu<strong>to</strong>rs. Rural<br />

<strong>market</strong>s frequently lack electricity and refrigera<strong>to</strong>rs, so Coca-Cola<br />

also provides low-cost ice boxes – a tin box for <strong>new</strong> outlets<br />

and a thermocol box for seasonal outlets.<br />

Heineken and Guinness have developed <strong>new</strong> products for local<br />

<strong>market</strong>s in <strong>emerging</strong> countries. A core part of their strategy is <strong>to</strong><br />

master lower-cost production and develop distribution systems<br />

linking independent wholesalers, retailers and street vendors.<br />

These networks provide products and income <strong>to</strong> millions of people.<br />

Another strategy for many retail brands has been <strong>to</strong> secure a<br />

strong local partner <strong>to</strong> help pave the way for international growth.<br />

J.Crew, a retailer from the United States, has entered in<strong>to</strong> a<br />

partnership <strong>with</strong> Hong Kong-based specialty s<strong>to</strong>re opera<strong>to</strong>r Lane<br />

Crawford <strong>to</strong> expand in<strong>to</strong> Asia. From the end of 2012, their women's<br />

ready-<strong>to</strong>-wear clothes and shoes, men's apparel, and accessories<br />

collections will be available at certain Lane Crawford s<strong>to</strong>res in<br />

Hong Kong and China.<br />

Samsonite also uses local distribution partners <strong>to</strong> supply its<br />

products <strong>to</strong> remote areas. Recently the company opened a<br />

flagship s<strong>to</strong>re at the airport in Urumqi, a tier-3 city in China.<br />

Similarly, Procter & Gamble uses many local shops and employs<br />

popular Bollywood ac<strong>to</strong>rs <strong>to</strong> endorse its products. Half a year<br />

after its release in Oc<strong>to</strong>ber 2010, Gillette Guard held 50% of the<br />

<strong>market</strong> for razors.

<strong>Roland</strong> <strong>Berger</strong> Strategy Consultants<br />

Conclusion<br />

Five key actions for success

Study 29<br />

In the coming two decades, <strong>consumers</strong> in <strong>emerging</strong> countries will<br />

experience change at rates unparalleled in economic his<strong>to</strong>ry. The<br />

range of goods and services available, the extent of the urban<br />

environment, and for many the size of disposable incomes will<br />

grow at a speed surpassing that seen in all previous major<br />

economic phases.<br />

<strong>How</strong> should companies respond <strong>to</strong> these changes? What strategic<br />

steps must they take <strong>to</strong> benefit from the opportunities offered by<br />

<strong>new</strong> consumer <strong>market</strong>s in the developing world? We summarize<br />

the key actions needed below.<br />

Analyze trends and <strong>market</strong> environments – A world of change<br />

A prerequisite for understanding consumer behavior is <strong>to</strong> see how<br />

fundamental megatrends such as population growth, urbanization<br />

and globalization are driving the development of <strong>emerging</strong><br />

countries. Tools such as scenario planning can help companies<br />

develop detailed pictures of the future and identify the main<br />

fac<strong>to</strong>rs influencing consumer behavior. Extended <strong>market</strong> analyses<br />

add detail <strong>to</strong> these scenarios.<br />

Understand <strong>consumers</strong> in <strong>emerging</strong> <strong>market</strong>s – Not a closed book<br />

Significant differences in consumer behavior will persist both<br />

between rural and urban areas and between cities of different<br />

sizes. Companies can use <strong>to</strong>ols such as the RB Profiler <strong>to</strong> derive<br />

detailed consumer profiles and identify brand preferences.<br />

They should also remember that ethical and religious values in<br />

<strong>emerging</strong> countries will favor more socially oriented, ecological<br />

consumerism.<br />

Find the right <strong>market</strong>ing strategy – Simple but creative<br />

The <strong>market</strong>ing strategy and message have <strong>to</strong> speak <strong>to</strong> local<br />

consumer needs. Here, again, companies must strike a balance<br />

between rural and urban cus<strong>to</strong>mers' preferences. Sometimes<br />

simple <strong>market</strong>ing strategies are the solution. Urban, middle-class<br />

<strong>consumers</strong> prefer online shopping and use social media such<br />

as Facebook, so targeted mobile <strong>market</strong>ing strategies can often<br />

be effective here.<br />

Adapt your distribution strategy – Go glocal<br />

Companies face a wide range of challenges when it comes <strong>to</strong><br />

designing distribution strategies that adequately reflect local<br />

conditions. Especially at the <strong>market</strong> entry stage, it is often simply<br />

<strong>to</strong>o expensive <strong>to</strong> supply remote regions directly. Companies need<br />

strong partnerships <strong>with</strong> regional distribu<strong>to</strong>rs or subcontrac<strong>to</strong>rs.<br />

Import and tax regulations must be clarified. Firms should<br />

re member that bureaucracy can slow processes down con siderably.<br />

Sometimes a strategic alliance <strong>with</strong> competi<strong>to</strong>rs can create<br />

an opportunity <strong>to</strong> distribute products in <strong>new</strong> regions or cities.<br />

For the urban middle class, whose purchasing behavior is very<br />

similar <strong>to</strong> <strong>consumers</strong> in industrialized <strong>market</strong>s, innovative<br />

technology-intensive strategies may prove the most effective.<br />

Create the right portfolio – Broad but specialized<br />

Bot<strong>to</strong>m-of-the-pyramid <strong>consumers</strong> prefer cheap products that<br />

are simple <strong>to</strong> use. This may mean offering products in different<br />

sizes and packaging formats. The company's familiarity <strong>with</strong> local<br />

and cultural preferences is also crucial. The product portfolio<br />

must meet the needs of both poor cus<strong>to</strong>mers and the growing<br />

middle classes. To satisfy the requirements of both groups,<br />

companies need critical mass, solid financial resources, a broad<br />

product mix and strategic partnerships <strong>with</strong> local manufacturers.<br />

They must also clarify patent issues in <strong>emerging</strong> <strong>market</strong>s,<br />

as several countries still fail <strong>to</strong> provide sufficient protection for<br />

foreign brands.

<strong>Roland</strong> <strong>Berger</strong> Strategy Consultants<br />

Author<br />

Bernd Brunke<br />

Partner and Member of the<br />

Global Executive Committee, Berlin<br />

bernd.brunke@rolandberger.com<br />

Benno van Dongen<br />

Partner, Amsterdam<br />

benno.dongen@rolandberger.com<br />

William Downey<br />

Partner, New York<br />

william.downey@rolandberger.com<br />

Co-Authors<br />

Chris<strong>to</strong>phe Angoulvant<br />

Partner, Paris<br />

chris<strong>to</strong>phe.angoulvant@rolandberger.com<br />

Duce Go<strong>to</strong>ra<br />

Project Manager, London<br />

duce.go<strong>to</strong>ra@rolandberger.com<br />

Dr. Wilfried Aulbur<br />

Partner, Mumbai<br />

wilfried.aulbur@rolandberger.com<br />

Carolin Griese-Michels<br />

Principal, Hamburg<br />

carolin.griese@rolandberger.com<br />

Andreas Bauer<br />

Partner, Munich<br />

andreas.bauer@rolandberger.com<br />

Maren Hauptmann<br />

Partner, Munich<br />

maren.hauptmann@rolandberger.com

Study 31<br />

Daniel Himmel<br />

Project Manager, Berlin<br />

daniel.himmel@rolandberger.com<br />

Per I. Nilsson<br />

Partner, S<strong>to</strong>ckholm<br />

per-i.nilsson@rolandberger.com<br />

Nicklas Holgersson<br />

Project Manager, London<br />

nicklas.holgersson@rolandberger.com<br />

Dr. Verena Reichl<br />

Senior Expert, Munich<br />

verena.reichl@rolandberger.com<br />

Fabian Huhle<br />

Principal, Munich<br />

fabian.huhle@rolandberger.com<br />

Tina Wang<br />

Partner, Beijing<br />

tina.wang@rolandberger.com<br />

Dr. Johannes Klein<br />

Principal, Berlin<br />

johannes.klein@rolandberger.com<br />

Dr. Tim Zimmermann<br />

Partner, Munich<br />

tim.zimmermann@rolandberger.com<br />

Frank Lateur<br />

Principal, Brussels<br />

frank.lateur@rolandberger.com<br />

Dr. Michael Zollenkop<br />

Principal, Stuttgart<br />

michael.zollenkop@rolandberger.com

<strong>Roland</strong> <strong>Berger</strong> Strategy Consultants<br />

Sources<br />

African Business Magazine (2012)<br />

ICT: Silicon Savanna ready <strong>to</strong> take on the world<br />

Allfacebook.de (2012)<br />

Facebook user statistics<br />

S. D. Anthony et al. (2006)<br />

Seven principles of disruptive innovation<br />

S. Arrison (2011)<br />

100 plus: <strong>How</strong> the coming age of longevity will change everything,<br />

from careers and relationships <strong>to</strong> family and faith<br />

G. O. Barney (1980)<br />

The Global 2000 Report <strong>to</strong> the President<br />

Battelle (2012)<br />

Global R&D Funding Forecast (2012)<br />

K. Below et al. (2012)<br />

Der Aufstieg der BIC-Staaten als Wissensmächte<br />

Bloomberg (2012)<br />

Share price and index data<br />

W. H. Buiter and E. Rahbari (2011)<br />

Global growth genera<strong>to</strong>rs: Moving beyond<br />

<strong>emerging</strong> <strong>market</strong>s and BRICs<br />

Catalyst (2005)<br />

The bot<strong>to</strong>m line: Connecting corporate performance and gender<br />

diversity<br />

M. Chutnik and K. Grzesik (2009)<br />

Leading a virtual intercultural team. Implications for virtual team<br />

leaders<br />

CNN Money (2011)<br />

Global Fortune 500<br />

Credit Suisse (2012)<br />

Emerging Markets Research Institute –<br />

Opportunities in an urbanizing world<br />

CTPartners (2012)<br />

Emerging <strong>market</strong>s trend talk report<br />

DB Research (2011)<br />

Research follows production<br />

Diabetes Atlas (2010)<br />

Global estimates of the prevalence of diabetes<br />

for 2010 and 2030<br />

Digital Capital Advisors (2012)<br />

The evolutionary shift <strong>to</strong> mobile<br />

Discover Digital Arabia (2012)<br />

Online shopping in the Arab world<br />

Economist (2012)<br />

Consumer goods in Africa – A continent goes shopping<br />

Economist Intelligence Unit<br />

– Country data (2011, 2012)<br />

– People for growth: The talent challenge<br />

in <strong>emerging</strong> <strong>market</strong>s (2008)<br />

Edelman (2012)<br />

goodpurpose® study<br />

Y. Emmanuel and B.D. Gelb (2010)<br />

Better <strong>market</strong>ing <strong>to</strong> developing countries: Why and how<br />

Euromoni<strong>to</strong>r (2011, 2012)<br />

Country and consumer data<br />

Eurostat (2012)<br />

Innovation and research data<br />

Experientia (2012)<br />

Designing for <strong>emerging</strong> <strong>market</strong>s<br />

Food and Agriculture Organization (2009/2010)<br />

<strong>How</strong> <strong>to</strong> feed the world in 2050<br />

Forbes (2011)<br />

Diversity & inclusion: Unlocking global potential<br />

Global diversity rankings by country, sec<strong>to</strong>r and occupation

Study 33<br />

S. S. Garr (2011)<br />

Retaining talent in <strong>emerging</strong> <strong>market</strong>s<br />

Gartner Inc. (2011)<br />

Market Trends: Mobile payments worldwide<br />

General Electric (2012)<br />

Global Innovation Barometer<br />

Global Industry Analysts (2010)<br />

Biosimilars: A global strategic business report<br />

Goldman Sachs (2010)<br />

Global Economics Paper No. 170 and 204<br />

The power of the purse<br />

V. Govindarajan (2012)<br />

The $2,000 car<br />

S. A. Hewlett et al. (2010)<br />

Winning the war for talent in <strong>emerging</strong> <strong>market</strong>s<br />

S. A. Hewlett and R. Rashid (2010)<br />

The globe: The battle for female talent in <strong>emerging</strong> <strong>market</strong>s<br />

IBM (2011)<br />

Global Location Trends<br />

IHS Global Insight (2011, 2012)<br />

Data Insight Web<br />

J. R. Immelt (2009)<br />

<strong>How</strong> GE is disrupting itself<br />

Innovation 360 Group (2012)<br />

The missing link between innovation strategy<br />

and leadership in the Middle East<br />

INSEAD (2011)<br />

The Global Innovation Index 2011<br />

Interbrand (2012)<br />

Best global brands 2011<br />

International Institute for Applied Systems Analysis (2007)<br />

2007 update of probabilistic world population projections<br />

International Labor Organization (2011)<br />

Global employment trends 2012<br />

International Monetary Fund (2011)<br />

World Economic Outlook databases<br />

Internet World Stats (2011)<br />

Usage and population statistics<br />

jana.com (2012)<br />

Why mobile ads in <strong>emerging</strong> <strong>market</strong>s are the future<br />

B. Jaruzelski, Kevin Dehoff (2008)<br />

The Global Innovation 1000<br />

Knight Frank (2012)<br />

Prime International Residential Index (PIRI)<br />

Leipzig Graduate School of Management (2010)<br />

Future scenarios for the European airline industry<br />

T. R. Malthus (1798)<br />

An essay on the principle of population<br />

B. Minching<strong>to</strong>n (2011)<br />

Employer branding <strong>with</strong>out borders – a pathway<br />

<strong>to</strong> corporate success<br />

National Science Board (2012)<br />

Science and engineering indica<strong>to</strong>rs 2012<br />

<strong>new</strong> economic foundation, Centre for Well-being (2012)<br />

Happy Planet Index<br />

OECD (2010)<br />

The <strong>emerging</strong> middle class in developing countries<br />

F. Pearce (2011)<br />

The coming population crash – And our planet's surprising future<br />

Population Resource Center (2008)<br />

Population and the food crisis<br />

C. K. Prahalad (2006)<br />

The innovation paradox

<strong>Roland</strong> <strong>Berger</strong> Strategy Consultants<br />

I. Razak (2009)<br />

The correlation between population and<br />

economic growth in Malaysia<br />

P. Reddy (2008)<br />

Global innovation in <strong>emerging</strong> economies –<br />

Implications for other developing countries<br />

Q. M. Robinson and H. J. Park (2006)<br />

Examining the link between diversity and firm performance:<br />

The effects of diversity reputation and leader racial diversity<br />

<strong>Roland</strong> <strong>Berger</strong> Strategy Consultants<br />

– Au<strong>to</strong>motive Landscape 2025 (2011)<br />

– Corporate headquarters study (2005, 2008, 2010)<br />

– Frugal products (2012)<br />

– Manufacturing futures – Using scenario planning <strong>to</strong> identify<br />

opportunities in a multi-sec<strong>to</strong>r industry (2011)<br />

– Modular products – <strong>How</strong> <strong>to</strong> leverage modular product kits<br />

for growth and globalization (2012)<br />

– Organizing and managing R&D in high-tech industries (2011)<br />

– think: act CONTENT – Diversity and inclusion <strong>to</strong>o soft a subject?<br />

Not at all (2010)<br />

– think: act CONTENT – Scenario planning (2009)<br />

– think: act STUDY – Chinese consumer report (2009)<br />

– think: act STUDY – Delivering financial services in<br />

sub-Saharan Africa (2011)<br />

– Trend Compendium 2030 (2011)<br />

<strong>Roland</strong> <strong>Berger</strong> School of Strategy and Economics (2012)<br />

Scenario update 2012<br />

Saleschase (2012)<br />

Why mobile <strong>market</strong>ing in <strong>emerging</strong> <strong>market</strong>s is the next big thing<br />

F. Siebdrat, M. Hoegl and H. Ernst (2009)<br />

<strong>How</strong> <strong>to</strong> manage virtual teams<br />

L. Taylor (2011)<br />

Diabetes - pharma's fastest-growing <strong>market</strong><br />

The German Foundation for World Population (2011, 2012)<br />

Online project: 7 billion<br />

United Nations Conference on Trade and Development<br />

(2010, 2011)<br />

World Investment Report<br />

United Nations (1960, 2009, 2010, 2011)<br />

The future growth of the world population (1960)<br />

World Population Prospects – The 2009 and 2010 Revision<br />

World Urbanization Prospects – The 2009 and 2011 Revision<br />

W. W. Weber (2008)<br />

Managing complexity – Lessons from Peter Drucker and<br />

Niklas Luhmann<br />

World Bank (2011)<br />