European Private Equity Outlook 2012 (PDF, 1293 ... - Roland Berger

European Private Equity Outlook 2012 (PDF, 1293 ... - Roland Berger

European Private Equity Outlook 2012 (PDF, 1293 ... - Roland Berger

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Source: <strong>Roland</strong> <strong>Berger</strong><br />

<strong>European</strong>_<strong>Private</strong>_<strong>Equity</strong>_<strong>Outlook</strong>_<strong>2012</strong>_final.pptx<br />

18<br />

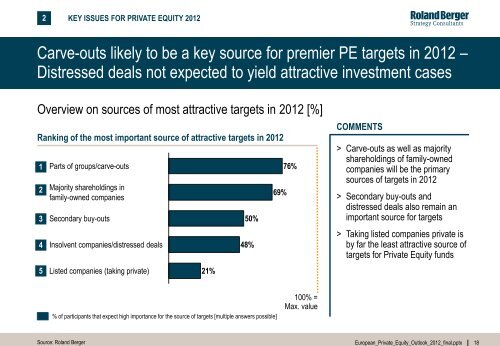

2 KEY ISSUES FOR PRIVATE EQUITY <strong>2012</strong><br />

Carve-outs likely to be a key source for premier PE targets in <strong>2012</strong> –<br />

Distressed deals not expected to yield attractive investment cases<br />

Overview on sources of most attractive targets in <strong>2012</strong> [%]<br />

Ranking of the most important source of attractive targets in <strong>2012</strong><br />

1<br />

2<br />

3<br />

4<br />

5<br />

Parts of groups/carve-outs 76%<br />

Majority shareholdings in<br />

family-owned companies<br />

Secondary buy-outs 50%<br />

Insolvent companies/distressed deals 48%<br />

Listed companies (taking private) 21%<br />

69%<br />

COMMENTS<br />

> Carve-outs as well as majority<br />

shareholdings of family-owned<br />

companies will be the primary<br />

sources of targets in <strong>2012</strong><br />

> Secondary buy-outs and<br />

distressed deals also remain an<br />

important source for targets<br />

> Taking listed companies private is<br />

by far the least attractive source of<br />

targets for <strong>Private</strong> <strong>Equity</strong> funds<br />

% of participants that expect high importance for the source of targets [multiple answers possible]<br />

100% =<br />

Max. value