European Private Equity Outlook 2012 (PDF, 1293 ... - Roland Berger

European Private Equity Outlook 2012 (PDF, 1293 ... - Roland Berger

European Private Equity Outlook 2012 (PDF, 1293 ... - Roland Berger

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Source: <strong>Roland</strong> <strong>Berger</strong><br />

<strong>European</strong>_<strong>Private</strong>_<strong>Equity</strong>_<strong>Outlook</strong>_<strong>2012</strong>_final.pptx<br />

19<br />

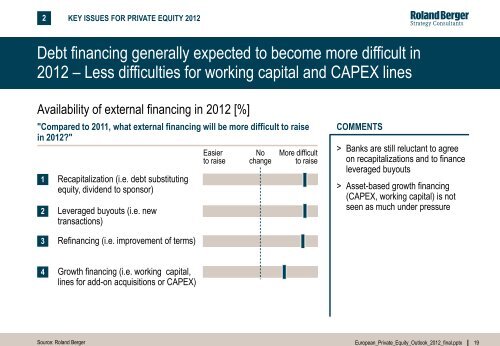

2 KEY ISSUES FOR PRIVATE EQUITY <strong>2012</strong><br />

Debt financing generally expected to become more difficult in<br />

<strong>2012</strong> – Less difficulties for working capital and CAPEX lines<br />

Availability of external financing in <strong>2012</strong> [%]<br />

"Compared to 2011, what external financing will be more difficult to raise<br />

in <strong>2012</strong>?"<br />

1<br />

2<br />

Recapitalization (i.e. debt substituting<br />

equity, dividend to sponsor)<br />

Leveraged buyouts (i.e. new<br />

transactions)<br />

Easier<br />

to raise<br />

No<br />

change<br />

More difficult<br />

to raise<br />

COMMENTS<br />

> Banks are still reluctant to agree<br />

on recapitalizations and to finance<br />

leveraged buyouts<br />

> Asset-based growth financing<br />

(CAPEX, working capital) is not<br />

seen as much under pressure<br />

3<br />

Refinancing (i.e. improvement of terms)<br />

4<br />

Growth financing (i.e. working capital,<br />

lines for add-on acquisitions or CAPEX)