2010 Annual Report - AO Smith

2010 Annual Report - AO Smith

2010 Annual Report - AO Smith

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

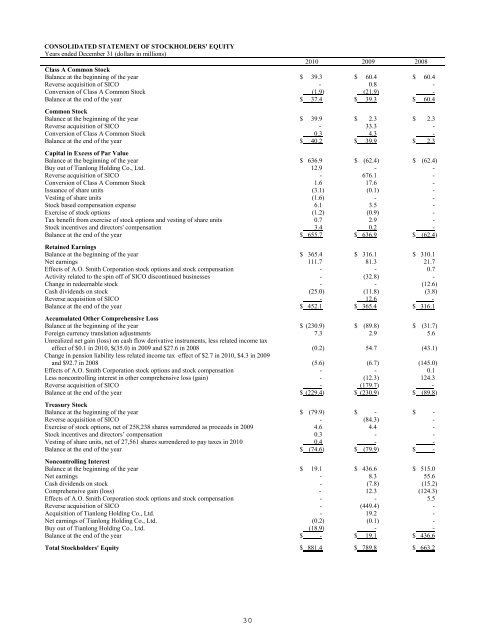

CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY<br />

Years ended December 31 (dollars in millions)<br />

<strong>2010</strong> 2009 2008<br />

Class A Common Stock<br />

Balance at the beginning of the year $ 39.3 $ 60.4 $ 60.4<br />

Reverse acquisition of SICO - 0.8 -<br />

Conversion of Class A Common Stock (1.9) (21.9) -<br />

Balance at the end of the year $ 37.4 $ 39.3 $ 60.4<br />

Common Stock<br />

Balance at the beginning of the year $ 39.9 $ 2.3 $ 2.3<br />

Reverse acquisition of SICO - 33.3 -<br />

Conversion of Class A Common Stock 0.3 4.3 -<br />

Balance at the end of the year $ 40.2 $ 39.9 $ 2.3<br />

Capital in Excess of Par Value<br />

Balance at the beginning of the year $ 636.9 $ (62.4) $ (62.4)<br />

Buy out of Tianlong Holding Co., Ltd. 12.9 - -<br />

Reverse acquisition of SICO - 676.1 -<br />

Conversion of Class A Common Stock 1.6 17.6 -<br />

Issuance of share units (3.1) (0.1) -<br />

Vesting of share units (1.6) - -<br />

Stock based compensation expense 6.1 3.5 -<br />

Exercise of stock options (1.2) (0.9) -<br />

Tax benefit from exercise of stock options and vesting of share units 0.7 2.9 -<br />

Stock incentives and directors' compensation 3.4 0.2 -<br />

Balance at the end of the year $ 655.7 $ 636.9 $ (62.4)<br />

Retained Earnings<br />

Balance at the beginning of the year $ 365.4 $ 316.1 $ 310.1<br />

Net earnings 111.7 81.3 21.7<br />

Effects of A.O. <strong>Smith</strong> Corporation stock options and stock compensation - - 0.7<br />

Activity related to the spin off of SICO discontinued businesses - (32.8) -<br />

Change in redeemable stock - - (12.6)<br />

Cash dividends on stock (25.0) (11.8) (3.8)<br />

Reverse acquisition of SICO - 12.6 -<br />

Balance at the end of the year $ 452.1 $ 365.4 $ 316.1<br />

Accumulated Other Comprehensive Loss<br />

Balance at the beginning of the year $ (230.9) $ (89.8) $ (31.7)<br />

Foreign currency translation adjustments 7.3 2.9 5.6<br />

Unrealized net gain (loss) on cash flow derivative instruments, less related income tax<br />

effect of $0.1 in <strong>2010</strong>, $(35.0) in 2009 and $27.6 in 2008 (0.2) 54.7 (43.1)<br />

Change in pension liability less related income tax effect of $2.7 in <strong>2010</strong>, $4.3 in 2009<br />

and $92.7 in 2008 (5.6) (6.7) (145.0)<br />

Effects of A.O. <strong>Smith</strong> Corporation stock options and stock compensation - - 0.1<br />

Less noncontrolling interest in other comprehensive loss (gain) - (12.3) 124.3<br />

Reverse acquisition of SICO - (179.7) -<br />

Balance at the end of the year $ (229.4) $ (230.9) $ (89.8)<br />

Treasury Stock<br />

Balance at the beginning of the year $ (79.9) $ - $ -<br />

Reverse acquisition of SICO - (84.3) -<br />

Exercise of stock options, net of 258,238 shares surrendered as proceeds in 2009 4.6 4.4 -<br />

Stock incentives and directors’ compensation 0.3 - -<br />

Vesting of share units, net of 27,561 shares surrendered to pay taxes in <strong>2010</strong> 0.4 - -<br />

Balance at the end of the year $ (74.6) $ (79.9) $ -<br />

Noncontrolling Interest<br />

Balance at the beginning of the year $ 19.1 $ 436.6 $ 515.0<br />

Net earnings - 8.3 55.6<br />

Cash dividends on stock - (7.8) (15.2)<br />

Comprehensive gain (loss) - 12.3 (124.3)<br />

Effects of A.O. <strong>Smith</strong> Corporation stock options and stock compensation - - 5.5<br />

Reverse acquisition of SICO - (449.4) -<br />

Acquisition of Tianlong Holding Co., Ltd. - 19.2 -<br />

Net earnings of Tianlong Holding Co., Ltd. (0.2) (0.1) -<br />

Buy out of Tianlong Holding Co., Ltd. (18.9) - -<br />

Balance at the end of the year $ - $ 19.1 $ 436.6<br />

Total Stockholders' Equity $ 881.4 $ 789.8 $ 663.2<br />

30