2010 Annual Report - AO Smith

2010 Annual Report - AO Smith

2010 Annual Report - AO Smith

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

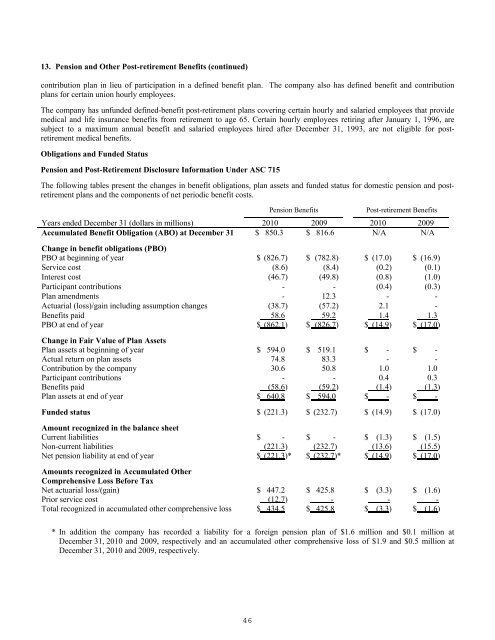

13. Pension and Other Post-retirement Benefits (continued)<br />

contribution plan in lieu of participation in a defined benefit plan. The company also has defined benefit and contribution<br />

plans for certain union hourly employees.<br />

The company has unfunded defined-benefit post-retirement plans covering certain hourly and salaried employees that provide<br />

medical and life insurance benefits from retirement to age 65. Certain hourly employees retiring after January 1, 1996, are<br />

subject to a maximum annual benefit and salaried employees hired after December 31, 1993, are not eligible for postretirement<br />

medical benefits.<br />

Obligations and Funded Status<br />

Pension and Post-Retirement Disclosure Information Under ASC 715<br />

The following tables present the changes in benefit obligations, plan assets and funded status for domestic pension and postretirement<br />

plans and the components of net periodic benefit costs.<br />

Pension Benefits<br />

Post-retirement Benefits<br />

Years ended December 31 (dollars in millions) <strong>2010</strong> 2009 <strong>2010</strong> 2009<br />

Accumulated Benefit Obligation (ABO) at December 31 $ 850.3 $ 816.6 N/A N/A<br />

Change in benefit obligations (PBO)<br />

PBO at beginning of year $ (826.7) $ (782.8) $ (17.0) $ (16.9)<br />

Service cost (8.6) (8.4) (0.2) (0.1)<br />

Interest cost (46.7) (49.8) (0.8) (1.0)<br />

Participant contributions - - (0.4) (0.3)<br />

Plan amendments - 12.3 - -<br />

Actuarial (loss)/gain including assumption changes (38.7) (57.2) 2.1 -<br />

Benefits paid 58.6 59.2 1.4 1.3<br />

PBO at end of year $ (862.1) $ (826.7) $ (14.9) $ (17.0)<br />

Change in Fair Value of Plan Assets<br />

Plan assets at beginning of year $ 594.0 $ 519.1 $ - $ -<br />

Actual return on plan assets 74.8 83.3 - -<br />

Contribution by the company 30.6 50.8 1.0 1.0<br />

Participant contributions - - 0.4 0.3<br />

Benefits paid (58.6) (59.2) (1.4) (1.3)<br />

Plan assets at end of year $ 640.8 $ 594.0 $ - $ -<br />

Funded status $ (221.3) $ (232.7) $ (14.9) $ (17.0)<br />

Amount recognized in the balance sheet<br />

Current liabilities $ - $ - $ (1.3) $ (1.5)<br />

Non-current liabilities (221.3) (232.7) (13.6) (15.5)<br />

Net pension liability at end of year $ (221.3)* $ (232.7)* $ (14.9) $ (17.0)<br />

Amounts recognized in Accumulated Other<br />

Comprehensive Loss Before Tax<br />

Net actuarial loss/(gain) $ 447.2 $ 425.8 $ (3.3) $ (1.6)<br />

Prior service cost (12.7) - - -<br />

Total recognized in accumulated other comprehensive loss $ 434.5 $ 425.8 $ (3.3) $ (1.6)<br />

* In addition the company has recorded a liability for a foreign pension plan of $1.6 million and $0.1 million at<br />

December 31, <strong>2010</strong> and 2009, respectively and an accumulated other comprehensive loss of $1.9 and $0.5 million at<br />

December 31, <strong>2010</strong> and 2009, respectively.<br />

46