2010 Annual Report - AO Smith

2010 Annual Report - AO Smith

2010 Annual Report - AO Smith

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1. Organization and Significant Accounting Policies (continued)<br />

At December 31, <strong>2010</strong> and 2009, the company had a $13.8 million and $8.0 million receivable, respectively, relating to certain<br />

costs it expects to recover from a vendor under an arrangement which existed prior to entering into litigation with the vendor in<br />

Tennessee State Court. The company believes collection of the receivable and any future amounts to be recovered related to<br />

this litigation is probable. Possible future amounts could reach an additional $6.0 million to $17.0 million.<br />

Environmental costs. The company accrues for losses associated with environmental obligations when such losses are<br />

probable and reasonably estimable. Costs of estimated future expenditures are not discounted to their present value.<br />

Recoveries of environmental costs from other parties are recorded as assets when their receipt is considered probable. The<br />

accruals are adjusted as facts and circumstances change.<br />

Stock-based compensation. The company follows ASC 718, Compensation - Stock Compensation (formerly SFAS 123(R)).<br />

Compensation cost is recognized using the straight-line method over the vesting period of the award. ASC 718 also requires the<br />

benefits of tax deductions in excess of recognized compensation cost to be reported as a financing cash flow, rather than as an<br />

operating cash flow as required under prior literature. Excess tax deductions of $0.7 million, $2.9 million and $1.1 million<br />

were recognized as a financing cash flow in <strong>2010</strong>, 2009 and 2008, respectively.<br />

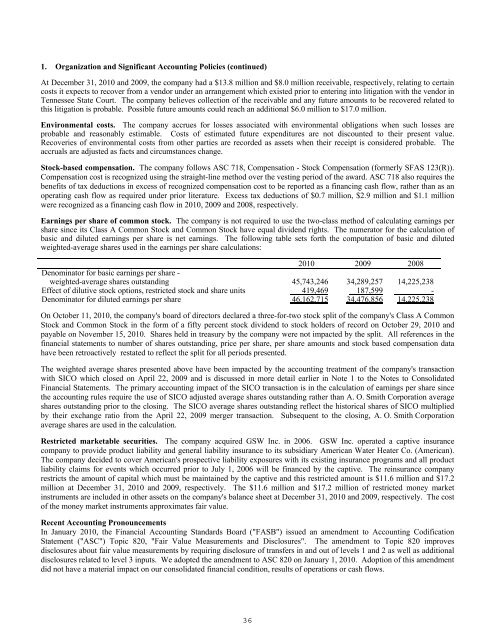

Earnings per share of common stock. The company is not required to use the two-class method of calculating earnings per<br />

share since its Class A Common Stock and Common Stock have equal dividend rights. The numerator for the calculation of<br />

basic and diluted earnings per share is net earnings. The following table sets forth the computation of basic and diluted<br />

weighted-average shares used in the earnings per share calculations:<br />

<strong>2010</strong> 2009 2008<br />

Denominator for basic earnings per share -<br />

weighted-average shares outstanding 45,743,246 34,289,257 14,225,238<br />

Effect of dilutive stock options, restricted stock and share units 419,469 187,599 -<br />

Denominator for diluted earnings per share 46,162,715 34,476,856 14,225,238<br />

On October 11, <strong>2010</strong>, the company's board of directors declared a three-for-two stock split of the company's Class A Common<br />

Stock and Common Stock in the form of a fifty percent stock dividend to stock holders of record on October 29, <strong>2010</strong> and<br />

payable on November 15, <strong>2010</strong>. Shares held in treasury by the company were not impacted by the split. All references in the<br />

financial statements to number of shares outstanding, price per share, per share amounts and stock based compensation data<br />

have been retroactively restated to reflect the split for all periods presented.<br />

The weighted average shares presented above have been impacted by the accounting treatment of the company's transaction<br />

with SICO which closed on April 22, 2009 and is discussed in more detail earlier in Note 1 to the Notes to Consolidated<br />

Financial Statements. The primary accounting impact of the SICO transaction is in the calculation of earnings per share since<br />

the accounting rules require the use of SICO adjusted average shares outstanding rather than A. O. <strong>Smith</strong> Corporation average<br />

shares outstanding prior to the closing. The SICO average shares outstanding reflect the historical shares of SICO multiplied<br />

by their exchange ratio from the April 22, 2009 merger transaction. Subsequent to the closing, A. O. <strong>Smith</strong> Corporation<br />

average shares are used in the calculation.<br />

Restricted marketable securities. The company acquired GSW Inc. in 2006. GSW Inc. operated a captive insurance<br />

company to provide product liability and general liability insurance to its subsidiary American Water Heater Co. (American).<br />

The company decided to cover American's prospective liability exposures with its existing insurance programs and all product<br />

liability claims for events which occurred prior to July 1, 2006 will be financed by the captive. The reinsurance company<br />

restricts the amount of capital which must be maintained by the captive and this restricted amount is $11.6 million and $17.2<br />

million at December 31, <strong>2010</strong> and 2009, respectively. The $11.6 million and $17.2 million of restricted money market<br />

instruments are included in other assets on the company's balance sheet at December 31, <strong>2010</strong> and 2009, respectively. The cost<br />

of the money market instruments approximates fair value.<br />

Recent Accounting Pronouncements<br />

In January <strong>2010</strong>, the Financial Accounting Standards Board ("FASB") issued an amendment to Accounting Codification<br />

Statement ("ASC") Topic 820, "Fair Value Measurements and Disclosures". The amendment to Topic 820 improves<br />

disclosures about fair value measurements by requiring disclosure of transfers in and out of levels 1 and 2 as well as additional<br />

disclosures related to level 3 inputs. We adopted the amendment to ASC 820 on January 1, <strong>2010</strong>. Adoption of this amendment<br />

did not have a material impact on our consolidated financial condition, results of operations or cash flows.<br />

36