2010 Annual Report - AO Smith

2010 Annual Report - AO Smith

2010 Annual Report - AO Smith

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

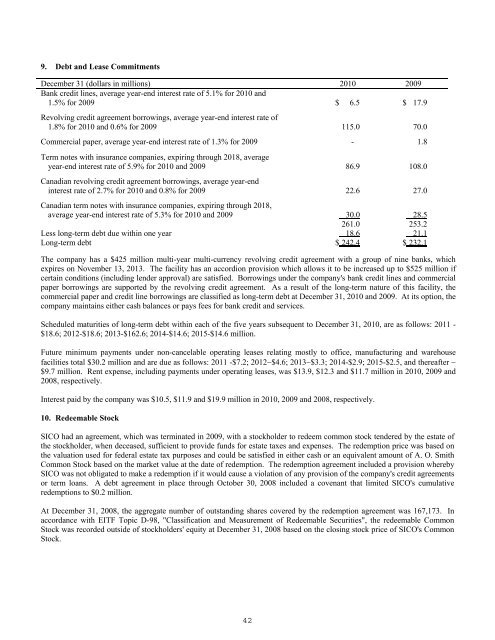

9. Debt and Lease Commitments<br />

December 31 (dollars in millions) <strong>2010</strong> 2009<br />

Bank credit lines, average year-end interest rate of 5.1% for <strong>2010</strong> and<br />

1.5% for 2009 $ 6.5 $ 17.9<br />

Revolving credit agreement borrowings, average year-end interest rate of<br />

1.8% for <strong>2010</strong> and 0.6% for 2009 115.0 70.0<br />

Commercial paper, average year-end interest rate of 1.3% for 2009 - 1.8<br />

Term notes with insurance companies, expiring through 2018, average<br />

year-end interest rate of 5.9% for <strong>2010</strong> and 2009 86.9 108.0<br />

Canadian revolving credit agreement borrowings, average year-end<br />

interest rate of 2.7% for <strong>2010</strong> and 0.8% for 2009 22.6 27.0<br />

Canadian term notes with insurance companies, expiring through 2018,<br />

average year-end interest rate of 5.3% for <strong>2010</strong> and 2009 30.0 28.5<br />

261.0 253.2<br />

Less long-term debt due within one year 18.6 21.1<br />

Long-term debt $ 242.4 $ 232.1<br />

The company has a $425 million multi-year multi-currency revolving credit agreement with a group of nine banks, which<br />

expires on November 13, 2013. The facility has an accordion provision which allows it to be increased up to $525 million if<br />

certain conditions (including lender approval) are satisfied. Borrowings under the company's bank credit lines and commercial<br />

paper borrowings are supported by the revolving credit agreement. As a result of the long-term nature of this facility, the<br />

commercial paper and credit line borrowings are classified as long-term debt at December 31, <strong>2010</strong> and 2009. At its option, the<br />

company maintains either cash balances or pays fees for bank credit and services.<br />

Scheduled maturities of long-term debt within each of the five years subsequent to December 31, <strong>2010</strong>, are as follows: 2011 -<br />

$18.6; 2012-$18.6; 2013-$162.6; 2014-$14.6; 2015-$14.6 million.<br />

Future minimum payments under non-cancelable operating leases relating mostly to office, manufacturing and warehouse<br />

facilities total $30.2 million and are due as follows: 2011 -$7.2; 2012$4.6; 2013$3.3; 2014-$2.9; 2015-$2.5, and thereafter <br />

$9.7 million. Rent expense, including payments under operating leases, was $13.9, $12.3 and $11.7 million in <strong>2010</strong>, 2009 and<br />

2008, respectively.<br />

Interest paid by the company was $10.5, $11.9 and $19.9 million in <strong>2010</strong>, 2009 and 2008, respectively.<br />

10. Redeemable Stock<br />

SICO had an agreement, which was terminated in 2009, with a stockholder to redeem common stock tendered by the estate of<br />

the stockholder, when deceased, sufficient to provide funds for estate taxes and expenses. The redemption price was based on<br />

the valuation used for federal estate tax purposes and could be satisfied in either cash or an equivalent amount of A. O. <strong>Smith</strong><br />

Common Stock based on the market value at the date of redemption. The redemption agreement included a provision whereby<br />

SICO was not obligated to make a redemption if it would cause a violation of any provision of the company's credit agreements<br />

or term loans. A debt agreement in place through October 30, 2008 included a covenant that limited SICO's cumulative<br />

redemptions to $0.2 million.<br />

At December 31, 2008, the aggregate number of outstanding shares covered by the redemption agreement was 167,173. In<br />

accordance with EITF Topic D-98, "Classification and Measurement of Redeemable Securities", the redeemable Common<br />

Stock was recorded outside of stockholders' equity at December 31, 2008 based on the closing stock price of SICO's Common<br />

Stock.<br />

42