Annual Report & Accounts 2009

Annual Report & Accounts 2009

Annual Report & Accounts 2009

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Business review continued<br />

and certain Directors of the Bank who resigned during the<br />

period. Detailed information in respect of the provisions on<br />

these loans is contained in note 55 to the <strong>Annual</strong> <strong>Report</strong>.<br />

In Ireland, the overall economic environment experienced an<br />

unprecedented level of stress during the period under review,<br />

resulting in declining property values, restricted availability of<br />

new credit, and reduced repayment capacities of borrowers.<br />

The current lack of liquidity in the Irish property market has<br />

also made the valuation and realisation of underlying security<br />

more difficult.<br />

UK<br />

In the UK 53% of the 15 month charge relates to<br />

development lending. Commercial and residential<br />

development values have declined significantly in the last<br />

15 months. Losses of €1.0 billion on the UK investment<br />

portfolio, representing 7% of the portfolio, were lower than<br />

those experienced in Ireland. While the UK economy also<br />

suffered a downward adjustment during the period, the<br />

decline in the value of Sterling, low interest rates and<br />

government support in the form of quantitative easing has<br />

helped stabilise the property environment resulting in<br />

reasonable levels of activity.<br />

US<br />

Impairment charges on the Bank’s US loan portfolio totalled<br />

8.6% of closing loan balances, the lowest level of charge<br />

across the three geographies. The US economy benefited<br />

from a large government stimulus package, which impacted<br />

favourably on the residential housing market and general<br />

liquidity in the market during the period. These measures<br />

helped mitigate the decline in values resulting from the global<br />

downturn. Impairment losses on the Bank’s US portfolio were<br />

primarily on development assets and in the hotel sector.<br />

Collective lending impairment provision<br />

A collective provision of €0.6 billion has also been charged in<br />

the period. This reflects an allowance for loan losses existing<br />

in the performing loan book where there is currently no<br />

specific evidence of impairment on individual loans. The<br />

provision has been calculated with reference to historical loss<br />

experience supplemented by observable market evidence and<br />

management’s judgement regarding market conditions at<br />

31 December <strong>2009</strong>. Cumulative collective provisions total<br />

€1.2 billion or 3.2% of total loan balances (excluding<br />

impaired loans).<br />

Treasury<br />

Funding overview<br />

The composition of the Bank’s funding profile has deteriorated<br />

since 30 September 2008. Material declines in customer<br />

funding balances and unsecured deposits from market<br />

counterparts have resulted in an increased reliance on funding<br />

support from central banks and monetary authorities.<br />

Reliance on borrowings from central banks has increased<br />

significantly during the period to total €23.7 billion at<br />

31 December <strong>2009</strong> from €7.5 billion 2 at 30 September 2008.<br />

The decrease in customer and market balances has been<br />

driven by market wide risk aversion towards the banking<br />

sector in general, Bank specific ratings actions and<br />

reputational issues. The Bank successfully issued €7.4 billion<br />

of Government guaranteed Medium Term Notes (‘MTN’)<br />

during the period, including €5.4 billion in the latter half of<br />

<strong>2009</strong>. This issuance more than offset the impact of maturing<br />

term deals.<br />

The Bank is a participating institution in both the Credit<br />

Institutions (Financial Support) (‘CIFS’) and the Credit<br />

Institutions (Eligible Liabilities Guarantee) (‘ELG’) Government<br />

guarantee schemes. The CIFS scheme continues to cover preexisting<br />

deposits and certain other liabilities (senior unsecured<br />

debt, asset covered securities and dated subordinated debt<br />

(Lower Tier 2)) until 29 September 2010. The Group applied to<br />

participate in the ELG scheme on 28 January 2010 and certain<br />

new qualifying deposits and securities issued by the Group<br />

from this date onwards are covered by this scheme. The<br />

presence of these Government guarantees has been a<br />

key factor in ensuring the Bank’s funding capacity.<br />

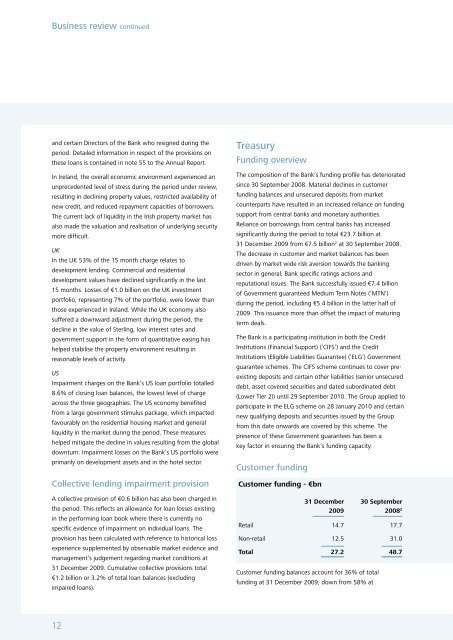

Customer funding<br />

Customer funding - €bn<br />

31 December<br />

<strong>2009</strong><br />

30 September<br />

2008 2<br />

Retail 14.7 17.7<br />

Non-retail 12.5 31.0<br />

Total 27.2 48.7<br />

Customer funding balances account for 36% of total<br />

funding at 31 December <strong>2009</strong>, down from 58% at<br />

12