Annual Report & Accounts 2009

Annual Report & Accounts 2009

Annual Report & Accounts 2009

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Anglo Irish Bank<br />

<strong>Annual</strong> <strong>Report</strong> & <strong>Accounts</strong> <strong>2009</strong><br />

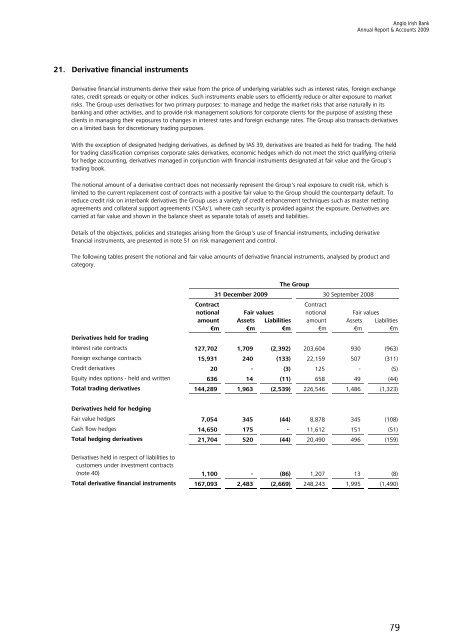

21. Derivative financial instruments<br />

Derivative financial instruments derive their value from the price of underlying variables such as interest rates, foreign exchange<br />

rates, credit spreads or equity or other indices. Such instruments enable users to efficiently reduce or alter exposure to market<br />

risks. The Group uses derivatives for two primary purposes: to manage and hedge the market risks that arise naturally in its<br />

banking and other activities, and to provide risk management solutions for corporate clients for the purpose of assisting these<br />

clients in managing their exposures to changes in interest rates and foreign exchange rates. The Group also transacts derivatives<br />

on a limited basis for discretionary trading purposes.<br />

With the exception of designated hedging derivatives, as defined by IAS 39, derivatives are treated as held for trading. The held<br />

for trading classification comprises corporate sales derivatives, economic hedges which do not meet the strict qualifying criteria<br />

for hedge accounting, derivatives managed in conjunction with financial instruments designated at fair value and the Group's<br />

trading book.<br />

The notional amount of a derivative contract does not necessarily represent the Group's real exposure to credit risk, which is<br />

limited to the current replacement cost of contracts with a positive fair value to the Group should the counterparty default. To<br />

reduce credit risk on interbank derivatives the Group uses a variety of credit enhancement techniques such as master netting<br />

agreements and collateral support agreements ('CSAs'), where cash security is provided against the exposure. Derivatives are<br />

carried at fair value and shown in the balance sheet as separate totals of assets and liabilities.<br />

Details of the objectives, policies and strategies arising from the Group's use of financial instruments, including derivative<br />

financial instruments, are presented in note 51 on risk management and control.<br />

The following tables present the notional and fair value amounts of derivative financial instruments, analysed by product and<br />

category.<br />

Derivatives held for trading<br />

31 December <strong>2009</strong><br />

The Group<br />

30 September 2008<br />

Contract<br />

Contract<br />

notional Fair values notional Fair values<br />

amount Assets Liabilities amount Assets Liabilities<br />

€m €m €m €m €m €m<br />

Interest rate contracts 127,702 1,709 (2,392) 203,604 930 (963)<br />

Foreign exchange contracts 15,931 240 (133) 22,159 507 (311)<br />

Credit derivatives 20 - (3) 125 - (5)<br />

Equity index options - held and written 636 14 (11) 658 49 (44)<br />

Total trading derivatives 144,289 1,963 (2,539) 226,546 1,486 (1,323)<br />

Derivatives held for hedging<br />

Fair value hedges 7,054 345 (44) 8,878 345 (108)<br />

Cash flow hedges 14,650 175 - 11,612 151 (51)<br />

Total hedging derivatives 21,704 520 (44) 20,490 496 (159)<br />

Derivatives held in respect of liabilities to<br />

customers under investment contracts<br />

(note 40) 1,100 - (86) 1,207 13 (8)<br />

Total derivative financial instruments 167,093 2,483 (2,669) 248,243 1,995 (1,490)<br />

79