Download the interactive SABMiller plc 2011 Annual report PDF

Download the interactive SABMiller plc 2011 Annual report PDF

Download the interactive SABMiller plc 2011 Annual report PDF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>SABMiller</strong> <strong>plc</strong> <strong>Annual</strong> Report <strong>2011</strong> 143<br />

32. Pensions and post-retirement benefits continued<br />

Grolsch pension scheme<br />

The Grolsch pension plan, named Stichting Pensioenfonds van de Grolsche Bierbrouwerij, is a funded scheme of <strong>the</strong> defined benefit type,<br />

based on average salary with assets held in separately administered funds. The latest valuation of <strong>the</strong> Grolsch pension fund was carried out at<br />

31 March <strong>2011</strong> by an independent actuary using <strong>the</strong> projected unit credit method.<br />

South Africa pension schemes<br />

The group operates a number of pension schemes throughout South Africa. Details of <strong>the</strong> major schemes are provided below.<br />

The ABI Pension Fund, Suncrush Pension Fund and Suncrush Retirement Fund are funded schemes of <strong>the</strong> defined benefit type based on<br />

average salary with assets held in separately administered funds. The surplus apportionment schemes for <strong>the</strong> ABI Pension Fund, <strong>the</strong> Suncrush<br />

Pension Fund and Suncrush Retirement Fund have been approved by <strong>the</strong> Financial Services Board.<br />

The active and pensioner liabilities in respect of <strong>the</strong> ABI Pension Fund and <strong>the</strong> Suncrush Retirement Fund have been settled. The only liabilities<br />

are in respect of <strong>the</strong> surplus apportionment scheme and unclaimed benefits. Once <strong>the</strong> surplus liabilities have been settled, <strong>the</strong> Funds will be<br />

deregistered and liquidated. The trustees have resolved that any surplus remaining in <strong>the</strong> Suncrush Retirement Fund should be transferred to<br />

<strong>the</strong> Suncrush Pension Fund, although this has not yet been approved.<br />

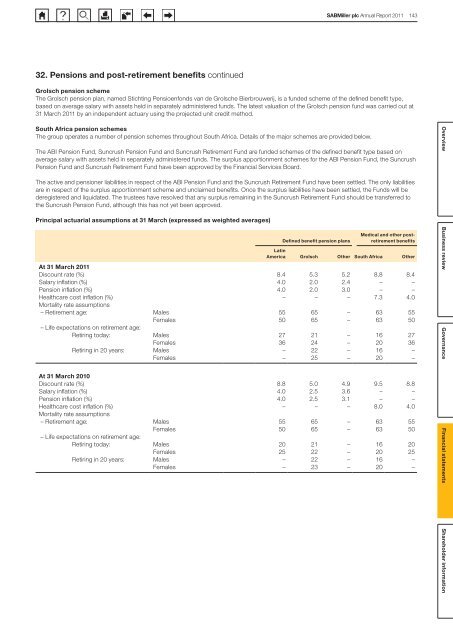

Principal actuarial assumptions at 31 March (expressed as weighted averages)<br />

Medical and o<strong>the</strong>r post-<br />

Defined benefit pension plans<br />

<br />

retirement benefits<br />

Latin<br />

America Grolsch O<strong>the</strong>r South Africa O<strong>the</strong>r<br />

At 31 March <strong>2011</strong><br />

Discount rate (%) 8.4 5.3 5.2 8.8 8.4<br />

Salary inflation (%) 4.0 2.0 2.4 – –<br />

Pension inflation (%) 4.0 2.0 3.0 – –<br />

Healthcare cost inflation (%) – – – 7.3 4.0<br />

Mortality rate assumptions<br />

– Retirement age: Males 55 65 – 63 55<br />

Females 50 65 – 63 50<br />

– Life expectations on retirement age:<br />

Retiring today: Males 27 21 – 16 27<br />

Females 36 24 – 20 36<br />

Retiring in 20 years: Males – 22 – 16 –<br />

Females – 25 – 20 –<br />

At 31 March 2010<br />

Discount rate (%) 8.8 5.0 4.9 9.5 8.8<br />

Salary inflation (%) 4.0 2.5 3.6 – –<br />

Pension inflation (%) 4.0 2.5 3.1 – –<br />

Healthcare cost inflation (%) – – – 8.0 4.0<br />

Mortality rate assumptions<br />

– Retirement age: Males 55 65 – 63 55<br />

Females 50 65 – 63 50<br />

– Life expectations on retirement age:<br />

Retiring today: Males 20 21 – 16 20<br />

Females 25 22 – 20 25<br />

Retiring in 20 years: Males – 22 – 16 –<br />

Females – 23 – 20 –<br />

Overview Business review Governance Financial statements Shareholder information