sdcera board of retirement investment board meeting minutes

sdcera board of retirement investment board meeting minutes

sdcera board of retirement investment board meeting minutes

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

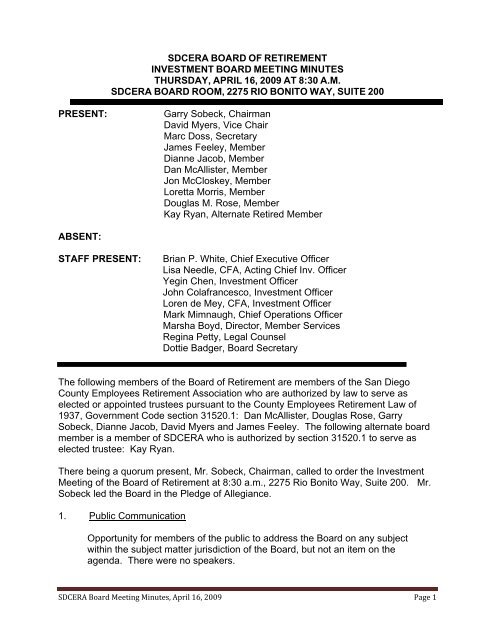

SDCERA BOARD OF RETIREMENT<br />

INVESTMENT BOARD MEETING MINUTES<br />

THURSDAY, APRIL 16, 2009 AT 8:30 A.M.<br />

SDCERA BOARD ROOM, 2275 RIO BONITO WAY, SUITE 200<br />

PRESENT:<br />

Garry Sobeck, Chairman<br />

David Myers, Vice Chair<br />

Marc Doss, Secretary<br />

James Feeley, Member<br />

Dianne Jacob, Member<br />

Dan McAllister, Member<br />

Jon McCloskey, Member<br />

Loretta Morris, Member<br />

Douglas M. Rose, Member<br />

Kay Ryan, Alternate Retired Member<br />

ABSENT:<br />

STAFF PRESENT:<br />

Brian P. White, Chief Executive Officer<br />

Lisa Needle, CFA, Acting Chief Inv. Officer<br />

Yegin Chen, Investment Officer<br />

John Colafrancesco, Investment Officer<br />

Loren de Mey, CFA, Investment Officer<br />

Mark Mimnaugh, Chief Operations Officer<br />

Marsha Boyd, Director, Member Services<br />

Regina Petty, Legal Counsel<br />

Dottie Badger, Board Secretary<br />

The following members <strong>of</strong> the Board <strong>of</strong> Retirement are members <strong>of</strong> the San Diego<br />

County Employees Retirement Association who are authorized by law to serve as<br />

elected or appointed trustees pursuant to the County Employees Retirement Law <strong>of</strong><br />

1937, Government Code section 31520.1: Dan McAllister, Douglas Rose, Garry<br />

Sobeck, Dianne Jacob, David Myers and James Feeley. The following alternate <strong>board</strong><br />

member is a member <strong>of</strong> SDCERA who is authorized by section 31520.1 to serve as<br />

elected trustee: Kay Ryan.<br />

There being a quorum present, Mr. Sobeck, Chairman, called to order the Investment<br />

Meeting <strong>of</strong> the Board <strong>of</strong> Retirement at 8:30 a.m., 2275 Rio Bonito Way, Suite 200. Mr.<br />

Sobeck led the Board in the Pledge <strong>of</strong> Allegiance.<br />

1. Public Communication<br />

Opportunity for members <strong>of</strong> the public to address the Board on any subject<br />

within the subject matter jurisdiction <strong>of</strong> the Board, but not an item on the<br />

agenda. There were no speakers.<br />

SDCERA Board Meeting Minutes, April 16, 2009 Page 1

2. Approval <strong>of</strong> Minutes for the March 19, 2009, Investment Board<br />

Meeting<br />

ACTION:<br />

Motion by Mr. McAllister, seconded by Ms. Morris to approve<br />

the <strong>minutes</strong> for the <strong>meeting</strong> held on March 19, 2009.<br />

The motion was approved by majority vote.<br />

Ayes:<br />

Noes:<br />

Abstain:<br />

Absent:<br />

Doss, Feeley, Jacob, McAllister, McCloskey, Morris, Myers, Rose,<br />

Sobeck<br />

None<br />

None<br />

None<br />

3. CEO Introductory Remarks<br />

Mr. White provided a summary <strong>of</strong> the agenda discussion topics.<br />

4. Discussion/Action on Fund Review and Proposed Alpha Engine Wind-down<br />

Ms. Needle presented an overview <strong>of</strong> the Alpha Engine wind-down. She stated<br />

that Staff recommends a change to the implementation <strong>of</strong> the large cap<br />

domestic equity allocation with a wind-down <strong>of</strong> the Alpha Engine.<br />

The necessary steps to achieve the wind-down include:<br />

a. Move the following managers to the opportunistic bucket: Brevan<br />

Howard, Bridgewater, Moon Capital and UBS O’Connor<br />

b. Move Davidson Kempner to the high yield segment <strong>of</strong> the Fund<br />

c. Reduce the hedge fund managers within the opportunistic bucket to the<br />

proposed target size<br />

d. Potentially terminate an additional manager pending final assessment<br />

Mr. John Shearman, Albourne America, LLC, reviewed the process for<br />

eliminating the Alpha Engine. He stated that many <strong>of</strong> the hedge funds may be<br />

identified as standalone candidates for the Opportunistic bucket. Alternatively,<br />

if SDCERA decides that it would like to use the hedge funds in aggregate to<br />

mimic a policy asset class (or mix <strong>of</strong> policy asset classes) this is also an option.<br />

Mr. Steve Voss, Ennis Knupp + Associates, stated that Ennis Knupp supports<br />

the changes proposed by Staff and has reviewed the process to phase out the<br />

Alpha Engine portfolio. He stated that the proposed reallocation <strong>of</strong> hedge fund<br />

strategies to Opportunistic Investment allocation is appropriate and the active<br />

risk budget remains in line with the target and reverts to December 2008 levels<br />

SDCERA Board Meeting Minutes, April 16, 2009 Page 2

under the final structure.<br />

Mr. Doss suggested that an Asset Allocation Study be conducted.<br />

Mr. Voss stated that it would be ideal to complete an Asset Allocation Study in<br />

conjunction with an Actuarial Study.<br />

Mr. White stated that an Actuarial Study will be conducted as <strong>of</strong> June 30, 2009<br />

and the report will be available in the Fall.<br />

ACTION: Motion by Mr. Doss, seconded by Mr. McAllister to approve<br />

Staff’s recommendation to wind-down the Alpha Engine using the<br />

steps listed below and to include a separate category for Hedge<br />

Funds.<br />

The necessary steps to achieve the wind-down include:<br />

a. Move the following managers to the opportunistic bucket: Brevan<br />

Howard, Bridgewater, Moon Capital and UBS O’Connor<br />

b. Move Davidson Kempner to the high yield segment <strong>of</strong> the Fund<br />

c. Reduce the hedge fund managers within the opportunistic bucket to the<br />

proposed target size<br />

d. Potentially terminate an additional manager pending final assessment<br />

The motion was approved by majority vote.<br />

Ayes:<br />

Noes:<br />

Abstain:<br />

Absent:<br />

Doss, Feeley, Jacob, McAllister, McCloskey, Morris, Myers, Rose,<br />

Sobeck<br />

None<br />

None<br />

None<br />

ACTION: Motion by Mr. Doss, seconded by Mr. McAllister to request Staff to<br />

conduct an Asset Allocation Study after the Actuarial Experience<br />

Study is conducted in the Fall.<br />

The motion was approved by majority vote.<br />

Ayes:<br />

Noes:<br />

Abstain:<br />

Absent:<br />

Doss, Feeley, Jacob, McAllister, McCloskey, Morris, Myers, Rose,<br />

Sobeck<br />

None<br />

None<br />

None<br />

SDCERA Board Meeting Minutes, April 16, 2009 Page 3

5. Presentation on Manager Due Diligence Deliverables<br />

Mr. Voss, Ennis Knupp + Associates, outlined additional information that will be<br />

included in the quarterly and annual reports going forward. On a quarterly<br />

basis, Ennis Knupp will provide updates on managers based on <strong>meeting</strong>s that<br />

occurred during the quarter and/or any critical items to be brought to the<br />

Board’s attention. The annual report will provide a comprehensive due<br />

diligence packet on all <strong>of</strong> SDCERA’s managers that Ennis Knupp is responsible<br />

for monitoring.<br />

6. Presentation on Manager Diversification<br />

Ms. Needle provided a presentation on Asset Class Manager Diversification.<br />

She stated that SDCERA has a diverse asset allocation and the level <strong>of</strong><br />

manager diversification is driven by asset class. She stated that the number <strong>of</strong><br />

managers is consistent with the structure <strong>of</strong> the Fund and the asset classes that<br />

require more manager diversification are resourced accordingly with designated<br />

Staff and Consultants.<br />

7. Fourth Quarter 2008 Real Estate Performance Review – The Townsend Group<br />

Mr. Colafrancesco presented a brief overview <strong>of</strong> SDCERA’s Fourth Quarter<br />

2008 Real Estate Quarterly Performance review.<br />

Ms. Jennifer Young, The Townsend Group, provided additional detail for the<br />

Fourth Quarter 2008 Real Estate Performance Review for SDCERA’s portfolio.<br />

Several Trustees expressed concern in regard to SDCERA’s overexposure to<br />

RREEF. They requested a report outlining a transition in the REIT account.<br />

8. Presentation on Legal Review <strong>of</strong> Investment Transactions<br />

Ms. Petty, Legal Counsel, stated that Ice Miller, LLP and Waller Landsden<br />

Dortch & Davis, LLP, legal counsel for SDCERA will together present an<br />

overview <strong>of</strong> the processes both firms follow to assist SDCERA with <strong>investment</strong><br />

transactions.<br />

Ms. Rhodes, Ice Miller, LLP, presented an overview <strong>of</strong> Ice Miller’s capabilities<br />

and the procedures they follow to assist SDCERA with Real Estate,<br />

International Practice, Tax, Public Securities and Private Equity legal due<br />

diligence. She stated that the legal teams from both Ice Miller and Waller, have<br />

worked together to create uniform processes and standardized terms to assist<br />

SDCERA with <strong>investment</strong> counsel services.<br />

SDCERA Board Meeting Minutes, April 16, 2009 Page 4

Beth Guest, Waller Landsden Dortch & Davis, LLP, presented an overview <strong>of</strong><br />

the firm and the procedures they follow to assist SDCERA with Hedge Fund,<br />

Real Estate, Private Equity, Venture Capital legal reviews. Ms. Guest stated<br />

that her firm has been working closely with Ice Miller to come up with a<br />

systematized approach to <strong>investment</strong> analysis.<br />

Ms. Jacob and Mr. Sobeck requested that an update on the progress <strong>of</strong> Staff’s<br />

review <strong>of</strong> all redemption and gate terms be provided to the Board at the June<br />

Investment <strong>meeting</strong>.<br />

9. Report on Prior Closed Session Investment Transaction Decisions<br />

Ms. Needle stated that in accordance with SDCERA’s policy to report out and<br />

provide information on transactions that occur during Closed Session, a report<br />

has been provided that summarizes the terminations <strong>of</strong> the BlackRock Galaxite<br />

Fund, the Zazove Convertible Arbitrage, and Lots<strong>of</strong>f Capital Management.<br />

10. CIO’s Report<br />

Ms. Needle provided an update on firm changes for Stark Investments, Western<br />

Asset Management, and the Russell Investment Group.<br />

11. Request for Closed Session Item for Consideration <strong>of</strong> Investment Transactions,<br />

Purchases, Sales<br />

Ms. Needle stated that Staff requests approval to discuss an Investment<br />

transaction during Closed Session.<br />

ACTION: Motion by Ms Jacob, seconded by Mr. Sobeck to place this item in<br />

Closed Session based on the fact that the disclosure <strong>of</strong> the<br />

information relating to the decision can potentially have an adverse<br />

impact on the financial interest <strong>of</strong> the fund.<br />

The motion was approved by majority vote.<br />

Ayes:<br />

Noes:<br />

Abstain:<br />

Absent:<br />

Doss, Feeley, Jacob, McAllister, McCloskey, Morris, Myers, Rose,<br />

Sobeck<br />

None<br />

None<br />

None<br />

12. Closed Session<br />

Ms. Ryan recused herself from Agenda Item 12.3 <strong>of</strong> the Closed Session.<br />

SDCERA Board Meeting Minutes, April 16, 2009 Page 5

13. Report Out, if Required, Decision Made on Closed Session Items<br />

For Agenda Item 12.4, Ms. Petty stated that the action taken by the Board in<br />

Closed Session will be reported out in accordance with the Policy on Closed<br />

Session for Investment transactions and decisions in the future.<br />

For Agenda Item 12.6, the action taken by the Board on a motion by Mr.<br />

Sobeck, seconded by Mr. McAllister was to unanimously authorize counsel for<br />

SDCERA to appeal the order denying SDCERA’s motion to intervene in the<br />

litigation.<br />

14. Seminars and Conferences<br />

ACTION: Motion by Mr. Myers, seconded by Mr. McAllister to approve<br />

Staff travel at the various seminars and conferences as follows:<br />

Forward Ventures, Private Equity Fund Annual Meeting, San Diego, CA<br />

April 29, 2009<br />

Yegin Chen<br />

Carlson Capital Annual Meeting, Dallas, TX<br />

May 4-5, 2009<br />

Loren deMey<br />

Hellman & Friedman LLC, Private Equity Fund Annual Meeting,<br />

San Francisco, CA<br />

May 6, 2009<br />

Yegin Chen<br />

Blackstone Group Private Equity Fund Annual Meeting, New York<br />

May 14-15, 2009<br />

Yegin Chen<br />

TA Associates Private Equity Fund Annual Meeting, Boston, MA<br />

May 19, 2009<br />

Yegin Chen<br />

Bain Capital Partners Private Equity Fund Annual Meeting, Boston, MA<br />

May 20-21, 2009<br />

Yegin Chen<br />

Plan Sponsor “Only” Emerging Manager Educational Forum,<br />

Beverly Hills, CA<br />

June 17, 2009<br />

Lisa Needle<br />

SDCERA Board Meeting Minutes, April 16, 2009 Page 6

The motion was approved by majority vote.<br />

Ayes:<br />

Noes:<br />

Abstain:<br />

Absent:<br />

Doss, Feeley, McAllister, McCloskey, Morris, Myers, Rose, Sobeck<br />

None<br />

None<br />

Jacob<br />

15. Information Items<br />

No information items.<br />

16. Last Item(s) <strong>of</strong> Business<br />

None<br />

The <strong>meeting</strong> concluded at 1:10 p.m.<br />

____________________________<br />

Garry Sobeck, Chairman<br />

____________________________<br />

Marc Doss, Secretary<br />

SDCERA Board Meeting Minutes, April 16, 2009 Page 7